|

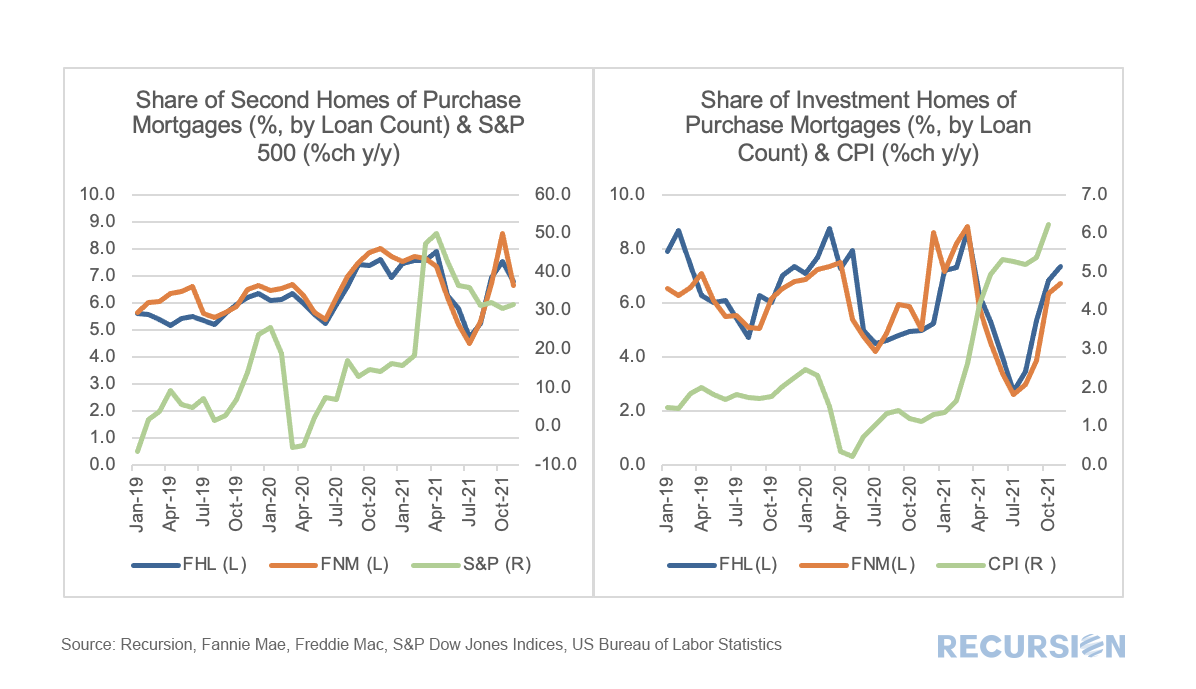

Episode 10 of Ginnie Mae’s “Capital Markets Live” podcast is titled “Using Data to Understand the First-Time Home Buyer” and featured Recursion’s Founder and CEO Li Chang explaining how the company’s advanced data and tools can be leveraged to demonstrate Ginnie Mae’s important role in serving this important borrower segment. Chief Research Officer Richard Koss further discussed how fundamental factors such as a shortage of supply are supporting the housing market and how Ginnie Mae’s modification programs designed to help families stay in their homes are minimizing disruptions associated with the expiration of forbearance. A curious policy development this year has been the stop-start approach towards the imposition of caps on the GSE’s regarding their purchases of loans backed by non-owner occupied (NOO) residences. In January the Treasury and FHFA amended the Enterprise’s Preferred Stock Purchase Agreements (PSPAs) to limit their acquisitions of single-family mortgage loans secured by second homes and investment properties to 7% of single-family acquisitions over the preceding 52-week period[1]. In September these caps were suspended[2]. Below find charts of the shares of second homes and investment properties out of all purchase mortgage deliveries to Fannie Mae and Freddie Mac, along with supporting fundamental factors. In both cases, there was a drop in the shares in the NOO categories after the initial policy announcement this year followed by a rebound in recent months. With regards to the fundamental factors, in the case of second homes, the share of purchase mortgages rose from about 6% to 8% following the onset of the pandemic as households sought refuge from densely populated areas. According to the National Association of Realtors, more than 50% of second homes are all-cash transactions, suggesting that the equity market is more important than earned income in driving these buying decisions[3]. Of course, the data used here come from loans in Agency pools, but the performance of the equity market likely has a significant influence on buyer sentiment in this market segment. The recent acceleration of consumer prices is likely supporting the sales of homes purchased for investment purposes, as real estate is widely seen as a hedge against inflation, in part because mortgage payments will not rise if the purchase is financed with a fixed-rate mortgage. Once again, we have a case where optimal investment decisions are driven by detailed knowledge of a combination of policy and fundamental factors. Loan-level digital tools are essential in drilling down to the level needed to formulate successful strategies. Recursion’s Chief Executive Officer Dr. Li Chang and Chief Research Officer Dr. Richard Koss will attend the 27th ABS East Conference in Miami from Dec 13-15, 2021. Dr. Chang will serve as a panelist in the session entitled “ESG Hub: Applications to MBS”. Other panelists include senior executives from Angel Oak Capital, MSCI, Selendy & Gay, PLLC and Fixed Income Investor Network (FIIN). If you would like to schedule a meeting during the conference with Recursion executives, please contact: [email protected]

In a recent post[1], we discussed the various factors behind the elevated pace of prepayments in Ginnie Mae securitized pools relative to those in conventional pools. A key driver of the difference in speeds is the different incentives facing Ginnie Mae program servicers regarding loan buyouts on one hand and those facing the GSE’s on the other. In the first case, the economics of the transaction are often favorable for servicers with cash available to purchase loans out of pools while the GSE’s take a more balanced view of the interests of servicers and investors.

The key regulation driving GSE behavior in this regard is the September 30, 2020 statements by the Enterprises extending the timeframe for delinquent loan buyouts from four consecutive months to twenty four consecutive months[2]. While forbearance was not explicitly mentioned in these announcements, there is clearly a connection between this timeframe and that of the duration of the forbearance programs. For conventional loans that entered a plan prior to February 28 2021, borrowers have a maximum 18 months of forbearance available to them[3]. Since the biggest share of loans in forbearance took place in Q2 2020, that 18 month period is running out for many. As borrowers work with their servicers to consider their options, loan buyouts should start to pick up in coming months as distressed borrowers pursue loan modifications or enter into foreclosure proceedings. In addition, distressed borrowers with equity in their homes may choose to sell their properties, leading to a pickup in voluntary prepayments. In its issue on December 3, 2021, Commercial Mortgage Alert highlighted Recursion’s recent attainment of approved data distributor status by Fannie Mae and Freddie Mac.

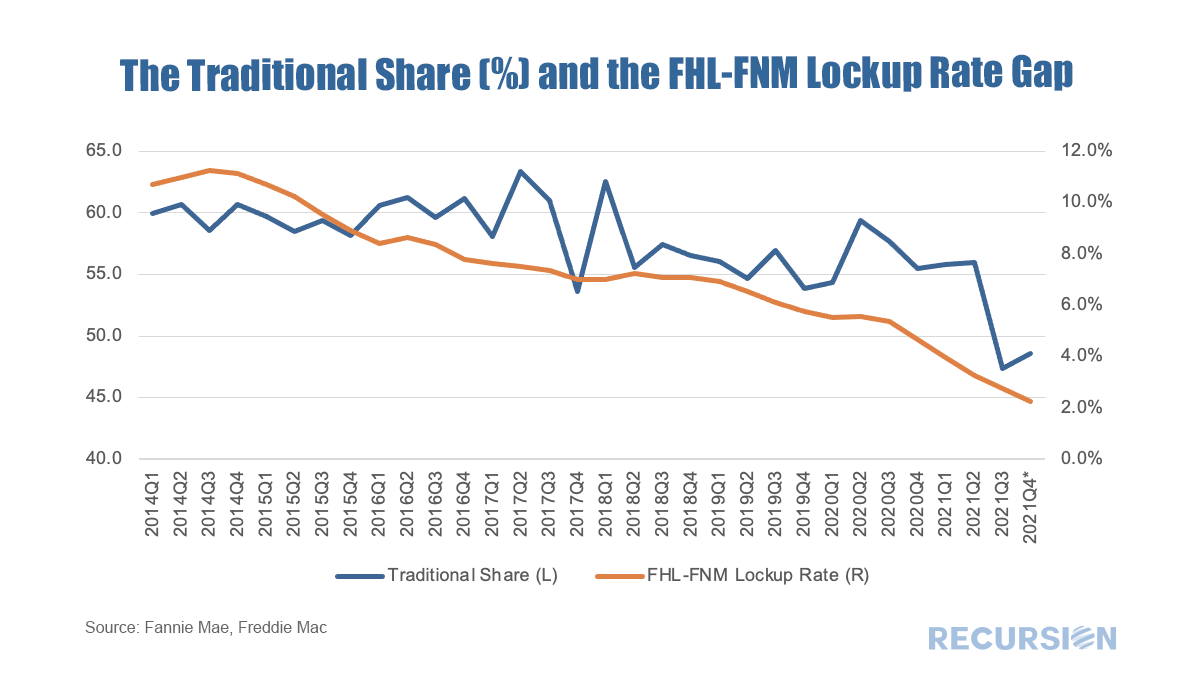

Along with our set of powerful digital querying tools Recursion offers its clients a unique suite of top to bottom solutions to meet their goals. We look to develop long-term relationships through a strong culture of customer service and fair pricing. If you would like to hear more, please reach out to [email protected]. In a recent note, we pointed out how a measure of the success of the Unified Mortgage Backed Securities (UMBS) project was the narrowing in the CMO Lockup Rate between Freddie Mac and Fannie Mae[1]. For many years, Fannie Mae benefitted from the liquidity advantage its security maintained compared to that of Freddie Mac, based on its long-standing market leadership position. To compensate, Freddie Mac locked up more of its securities in CMO’s, in an effort to create a supply-constrained premium in its own securities. The degree of success achieved using this strategy could be measured in terms of changes in the “Traditional Share”.

“Traditional Share” is a terminology widely used within Fannie and Freddie, that measures the market share held by Fannie Mae compared to its smaller rival. For example, the Traditional Share of 60, means loans guaranteed by Fannie Mae contribute to 60% of the GSE book, while those guaranteed by Freddie Mac contribute 40%. For the purposes of this note we will measure this in terms of loan count for purchase mortgages only. In 2014, FHFA announced the establishment of a new securitization infrastructure[2] for all mortgage loans backed by single family residences into a new common security. Historically, the Traditional Share had stood at about 60%, but at that time it had risen to over 70%, putting Freddie Mac into a dire situation. With that announcement, the share started to decline, and by the time the UMBS was launched in 2019 the share had eased back towards the 60% level. As a result, Freddie Mac faced reduced pressure to lock its securities up in CMOs, and the gap between this activity and that of Fannie Mae was about halved over the 2014-2019 time frame. Subsequently, the question was whether investors would maintain an indifferent posture between the delivery of Fannie Mae and Freddie Mac UMBS. Lingering fears about the possibility of so-called specified trades faded along with narrowing performance differences between the two agencies, and in recent months the Lockup Gap has almost disappeared. This was recently met with a significant plunge of 8.6% in the Traditional Share in Q3 2021 to a record-low 47.4%. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed