WHO WE SERVE

Our mission is to democratize financial big data and bring transparency to the financial market. Find out how we can help you if you are:

Policy Maker/regulatorUse our tools and services to monitor market trends at both a macro and firm level. Keep on top of emerging risks and mortgage market performance. Design targeted policies and monitor the effectiveness of these using our services. Mortgage ServicerBenchmark your portfolio performance, find out about the likely impact of the most recent government policy changes that will reshape the servicing landscape and assess your competitive position in delinquent loan work out strategies.

|

Mortgage Trading DeskQuery billions of mortgage loan records covering decades of history with unlimited combination of slicing using our Analyzers. Prepay, Delinquency, Forbearance, S-curves, ramp, EBO, issuance at the loan level is only minutes away.

Mortgage Lender Service ProviderGain access to Recursion’s mortgage lender/servicer database, tailor your solution to your targeted clients and increase your market presence. |

Mortgage LenderFind out how to ride the refi and EBO waves, boost your lending business across multiple lines and geographic areas, assess your competitive strengths and weaknesses, develop data-based strategies to gain market share and revenue. Mortgage Company Equity AnalystUse our mortgage company alternative data to track the activity of the companies you follow in the mortgage space compiled from individual loans, whether the company is public or private, bank or non-bank.

|

Join the group of leading institutions who have chosen Recursion, including:

Recursion Data Citations

Recursion's high quality data is trusted and cited by industry leaders. Check out the Recursion Data citation list.

SOLUTIONS

Let our team of analysts, quants and IT professionals help tackle your most challenging mortgage analytical issues.

Recursion AnalyzersA set of GUI based tools used for querying meticulously cleansed and standardized big mortgage data tables.

|

Mortgage Company DataCompany level information compiled by Recursion from different data sources such as Agency mortgage data, HMDA data, call reports and others.

|

Recursion DataCloudWe provide a copy of selected tables from our Recursion Cloud Database to those clients who need direct access to mortgage big data using SQL and/or a program language.

|

Customized SolutionsWe provide customized projects, including subject research and periodically customized reporting in the mortgage space.

|

BLOG

Enhance your knowledge of mortgage market developments with insights from the Recursion.

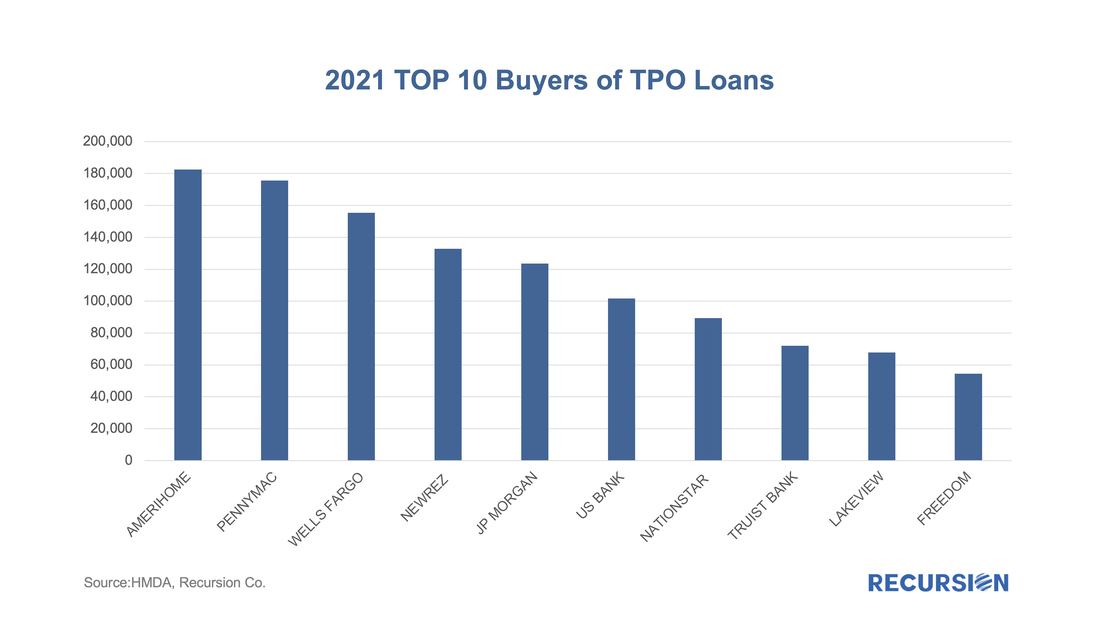

Discovering Third-Party Mortgage Originators6/28/2022

Usually, when we talk about financial institutions in our posts, we focus on sellers and/or servicers as we have a clear view from the Agency disclosures. An interesting distinction in this regard is to break down originations between those sourced through a retail channel within the lending institutions and those purchased from other lenders, known as third-party originations (TPOs). Read More Vertical Divider

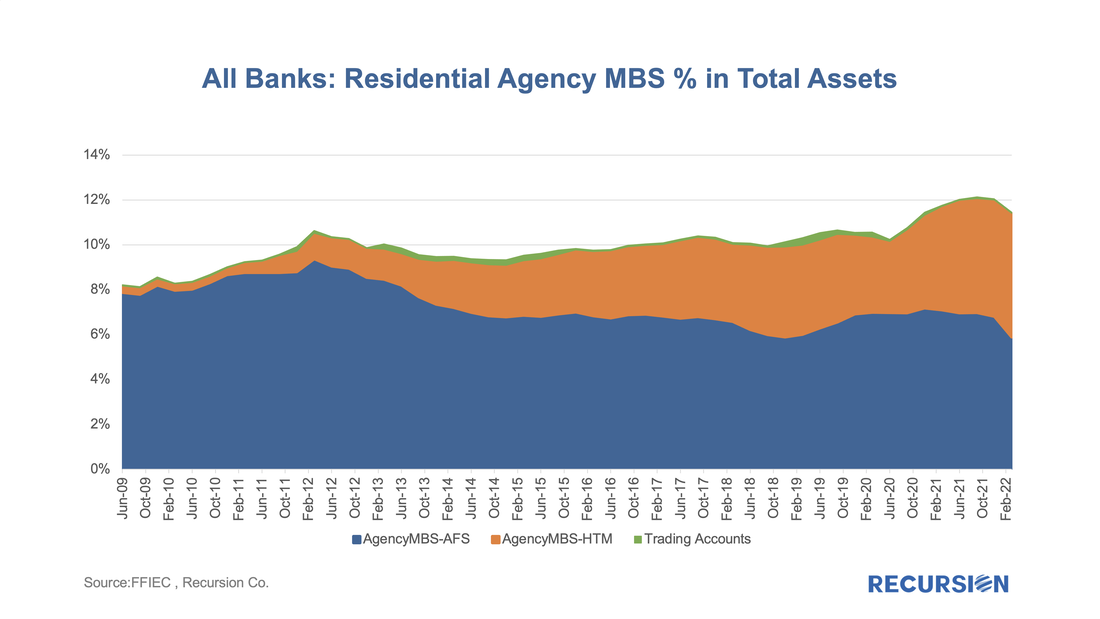

Recent Developments in Bank’s MBS Ownership from the Call Reports6/16/2022

While the Fed has clearly been the dominant player in the MBS market for the last 13 ½ years, the consistent biggest holders of MBS have been the banks. When the Federal Reserve launched its QE program in late 2008, banks held about 16% of the outstanding balance at the time, and that share has more than doubled as of Q1 2022 to stand at about one-third of the total. Read More |

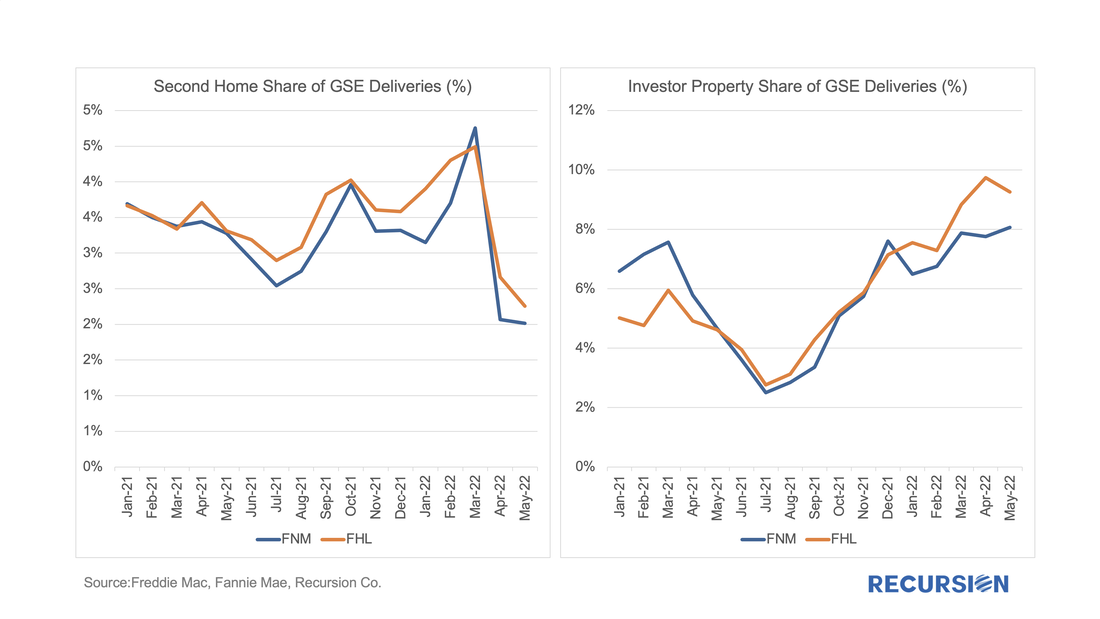

Policy Matters --- Impact of FHFA’s fee change for mortgages by Occupancy6/15/2022

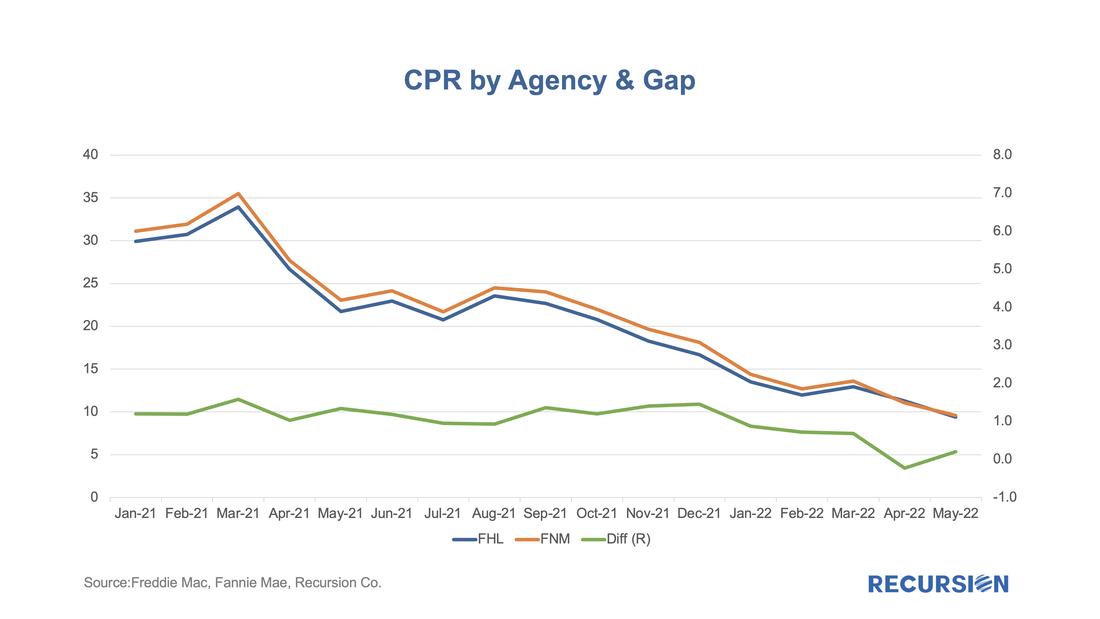

Over the past couple of years, we’ve witnessed some volatility with regards to FHFA’s approach to mortgages on second homes and investor properties (sometimes referred to non-owner occupied housing or NOO). In January 2021, FHFA announced that caps would be imposed to limit the acquisitions of loans backed by second homes and investment properties to 7% of the total on a rolling 52-week basis[1]. These caps were then suspended in September of that year. Read More Introducing the Constant Curtailment Rate (CCR) in the low prepay era6/13/2022

On May 5, 2022, Freddie Mac announced "that certain principal curtailments were previously not passed through on a timely basis to MBS securities holders[1]. The outstanding principal curtailments will be reflected in the May 2022 factors and passed through to the affected MBS securities with the May 2022 payment. Read More Vertical Divider

|

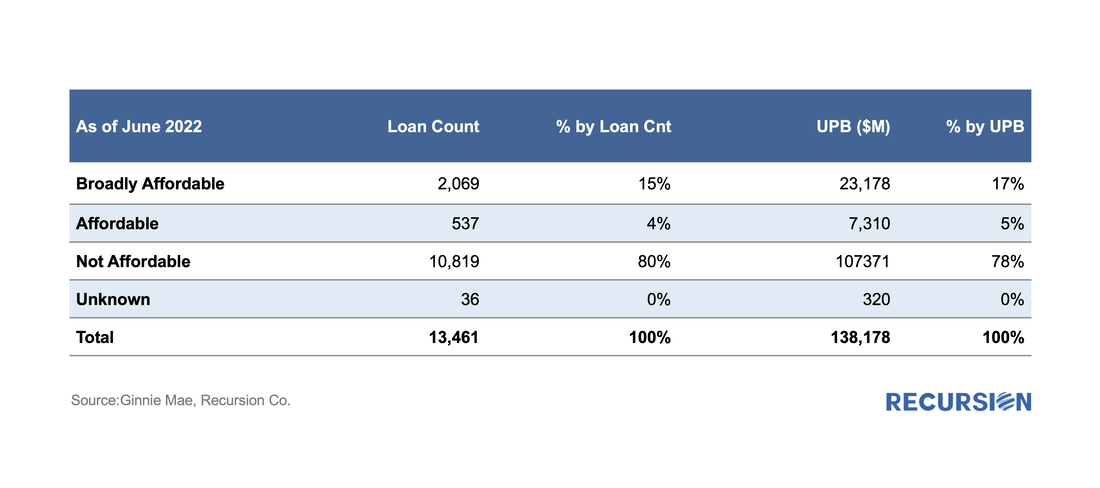

First Glance at the New Ginnie Mae Multifamily Affordable Status Flag6/10/2022

On May 25, 2022, Ginnie Mae announced that starting on June 8 it would enhance its pool and loan-level multifamily disclosures through the addition of an Affordable Status Field[1]. This field marks every FHA loan in pools with a Ginnie Mae guarantee as:

Read More |