|

On May 25, 2022, Ginnie Mae announced that starting on June 8 it would enhance its pool and loan-level multifamily disclosures through the addition of an Affordable Status Field[1]. This field marks every FHA loan in pools with a Ginnie Mae guarantee as:

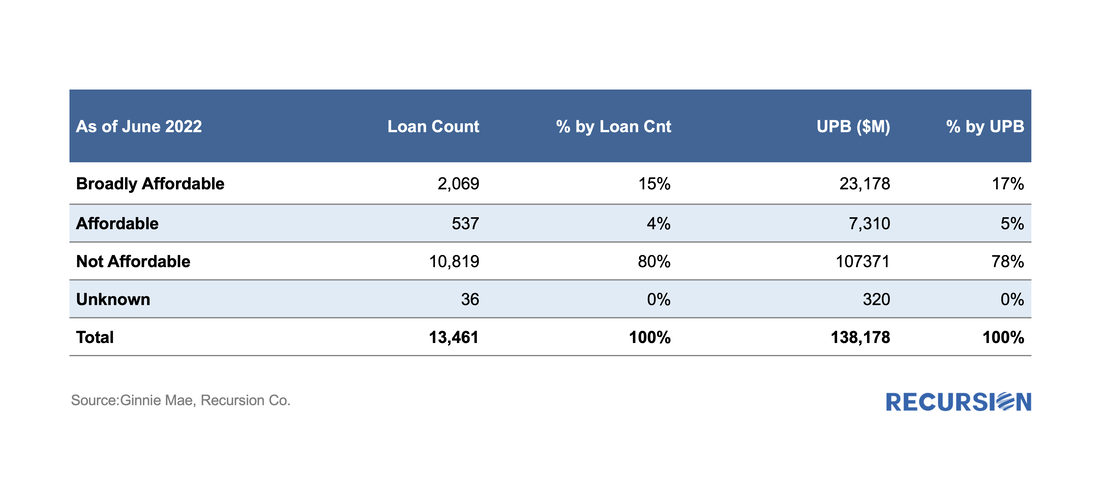

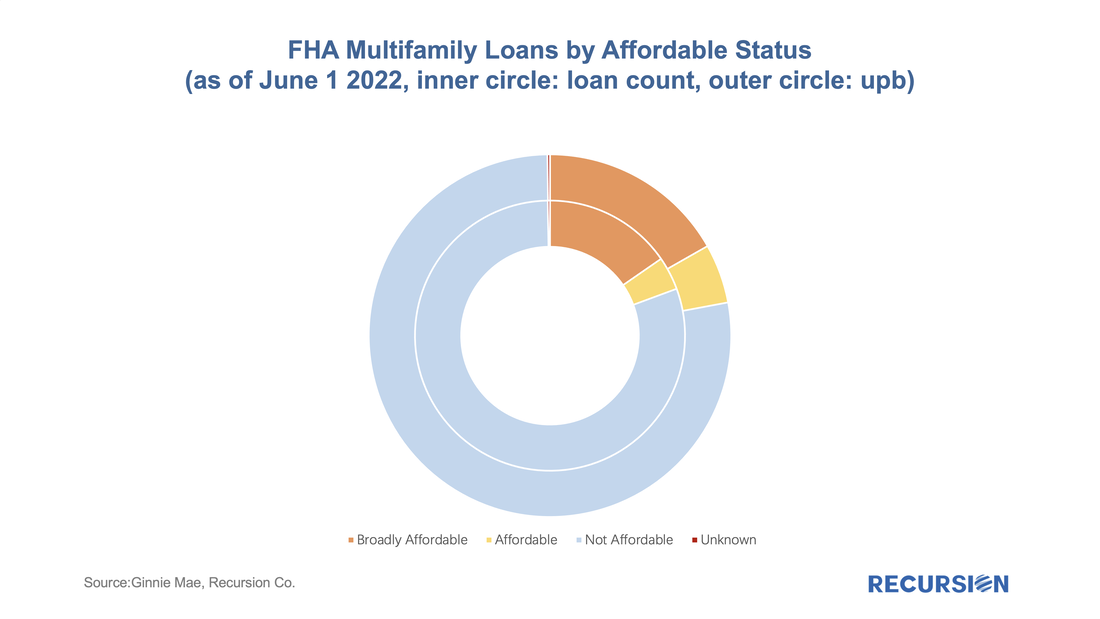

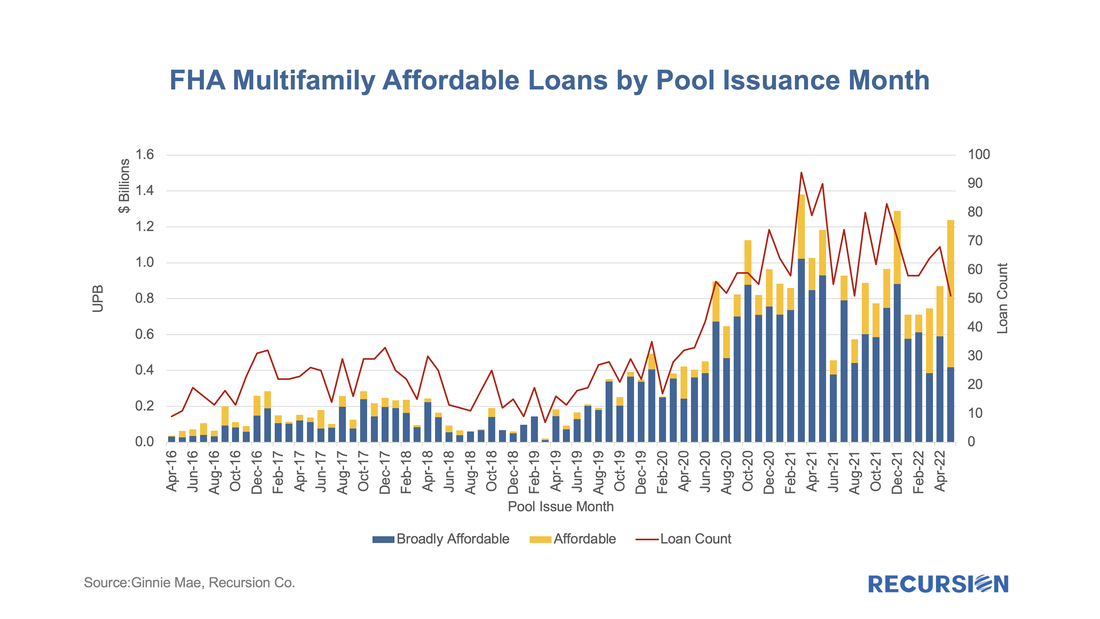

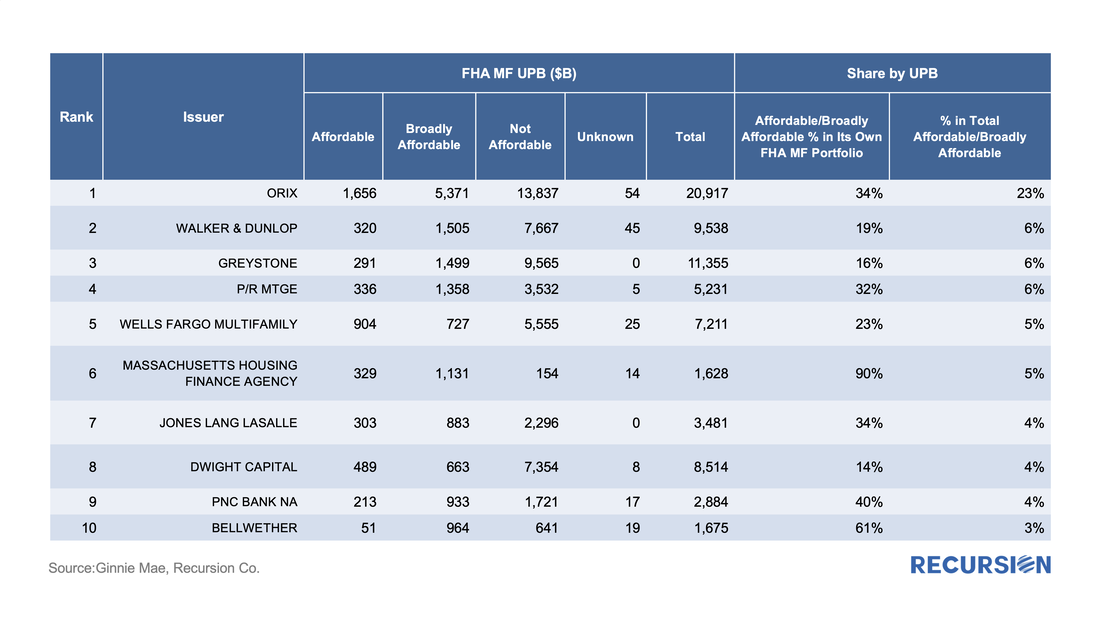

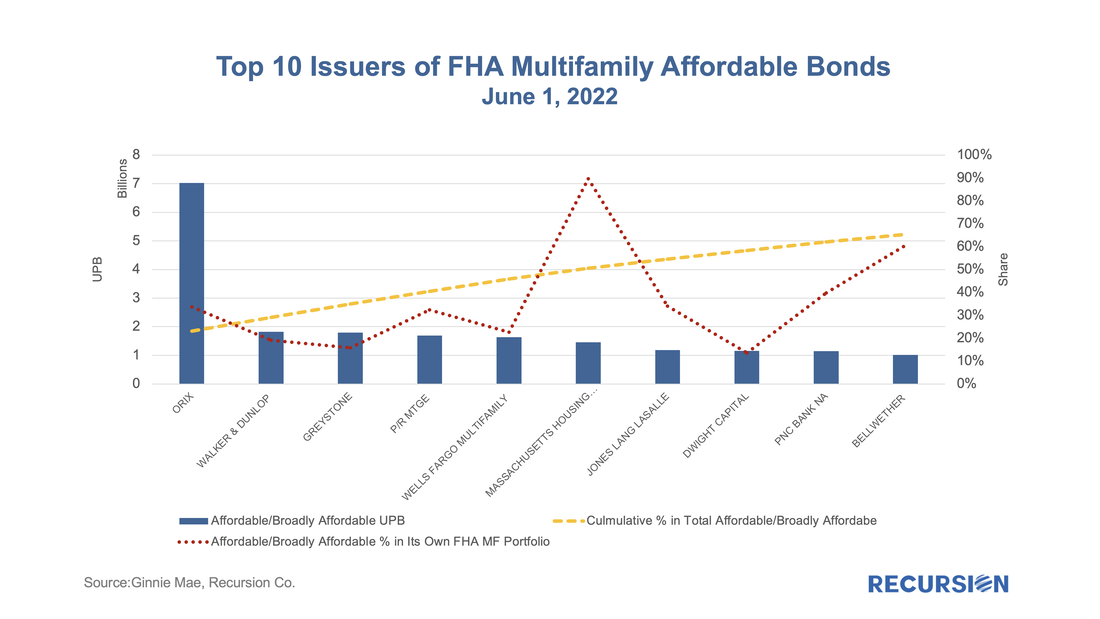

We received this data on the 6th business evening, and below find some summary descriptions: As of June 2022, the total loan count of FHA multifamily loans was 13,494 (UPB $138.6 billion). Of these loans to "Broadly Affordable" Projects amounted to 15% of the total by loan count and 17% by UPB. For "Affordable" Projects, the shares were 4% and 5%, respectively. Here is the volume (measured by UPB) of affordable loans by pool issuance month, along with affordable loan count: Finally, here are some breakdowns for the top 10 issuers: The release of "Affordable" status for Ginnie Mae MF loans, in addition to the recently disclosed "Green" flag, is one of the government agency's efforts to promote ESG. [1] Bulletins (ginniemae.gov) [2] The term definitions are rather complex but key features include that “Broadly Affordable” refers to projects that ‘‘have at least 90 percent of its units covered by an affordability use restriction under the LIHTC program or a similar State or locally sponsored program, with achievable and underwritten tax credit rents at least 10 percent below comparable market rents.” “Affordable” projects are those for which “a minimum of 10 percent of the units must be affordable to, at most, a family at 80 percent Area Median Income (AMI), with rents sized to be affordable at 30 percent of the income at that level” and other program restrictions. See sections B and C 2016-07405.pdf (govinfo.gov) Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed