|

On January 27 2022, HousingWire published an article called “GSEs’ cash window loses some luster” that talks about how large nonbanks have increasingly moved to using swap transactions with the Enterprises. Recursion data is used throughout and Recursion’s Chief Research Officer Richard Koss is quoted regarding the fact that only Freddie Mac provides full disclosure of the loans delivered through the cash window while Fannie Mae’s data in this regard is incomplete.

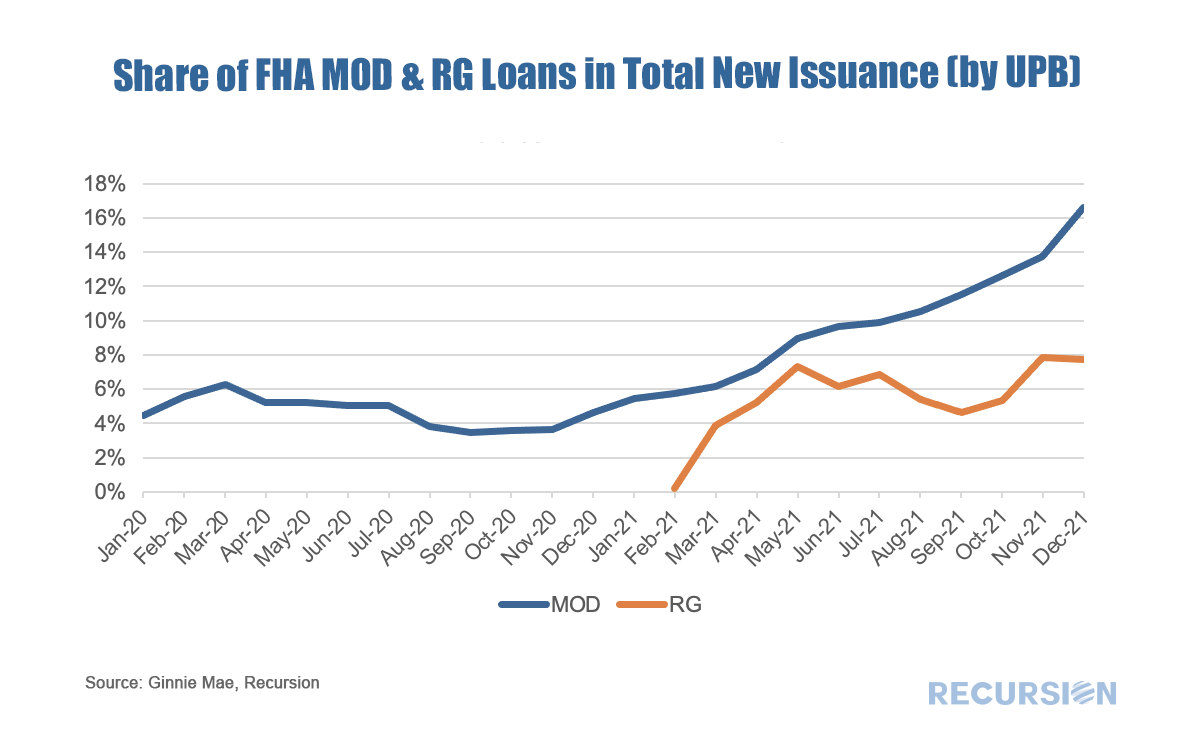

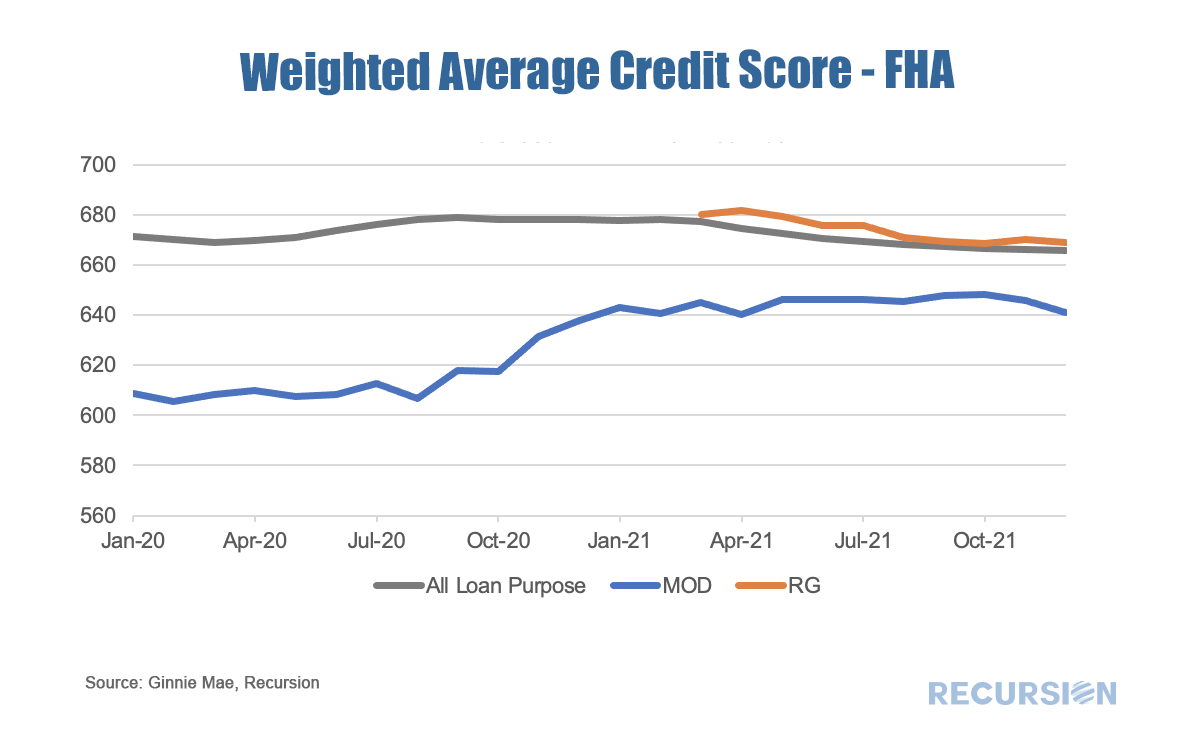

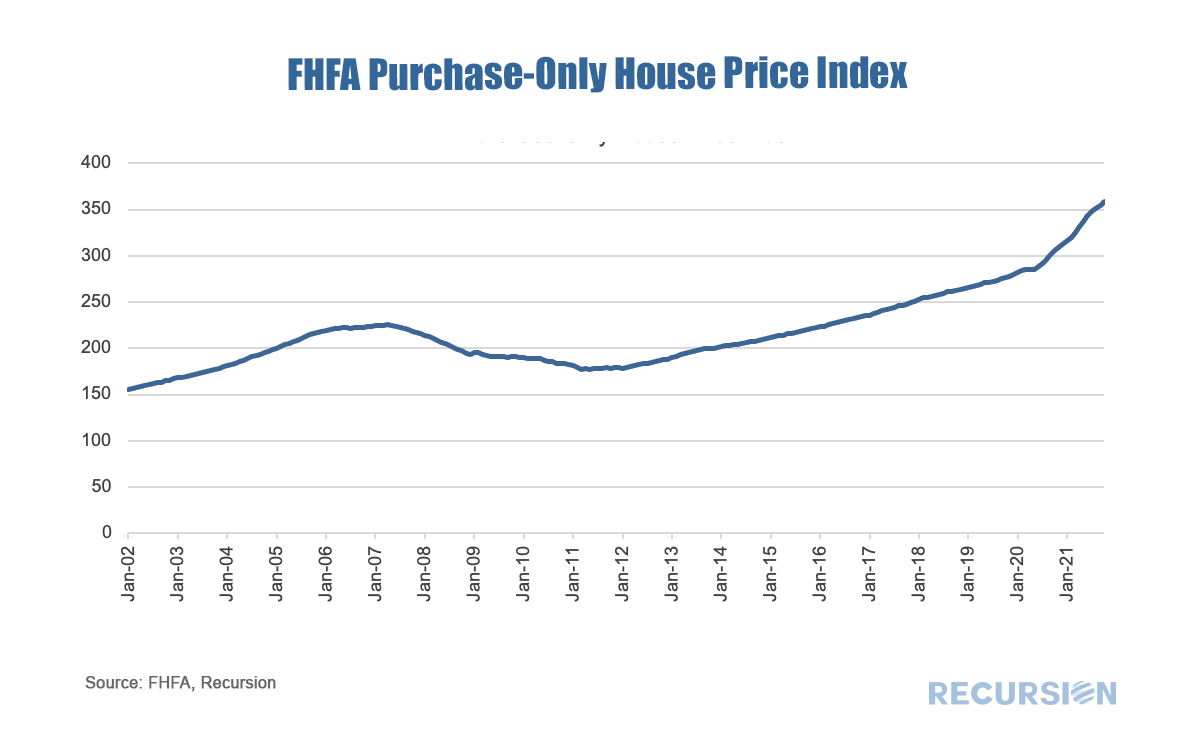

Mortgage market analysis in 2022 is setting up to be very much focused on the impact of expiring forbearance programs. In this post, we look at the FHA program from this perspective. With the onset of the pandemic, FHA began to apply “Partial Claim”s, a seldom-used loss mitigation method to help its mortgage borrowers cope with financial difficulties stemming from the pandemic.[1] A Partial Claim is a no-interest junior claim consisting of missed P&I payments secured by the property that comes due when the first lien is extinguished. Ginnie Mae created a new pool type, the RG pool, mainly to take delivery of the loans received via a partial claim, after they successfully made six6 consecutive payments. Another FHA innovation is the availability of an automatic modification that allows borrowers exiting forbearance to have access to a program that reduces monthly payments by up to 25%[2] without impacting their credit. The result has been a sharp change in the composition of FHA loans delivered to Ginnie Mae program over the past year. This changing composition will likely have a measurable impact on pool performance. In this regard, it’s interesting to look at the credit scores of borrowers across loan types. Original Credit scores for RG loans look very much like those in the overall pool. And while credit scores for modified loans remain below those overall, the gap has narrowed since the new waterfall was made available. As a result, we are once again in the situation where we can’t confidently extrapolate historical trends about the relationship of loan performance and economic factors like interest rates and unemployment as a basis for decision-making. Instead, it is the details in the policy changes designed to keep borrowers in their homes that provide the clearest view on market performance. An ongoing theme of these posts has been the way that the Covid-19 pandemic and the policy response it has engendered have served to upend traditional relationships in the system of housing and housing finance. During the Global Financial Crisis, the unemployment rate surged to 10%, and housing prices collapsed by 35% causing widespread devastation in global financial markets. Shortly after the onset of the health crisis, the unemployment rate shot up close to 10% again, but this time, house prices soared, rising over 25% from May 2020 to October 2021.

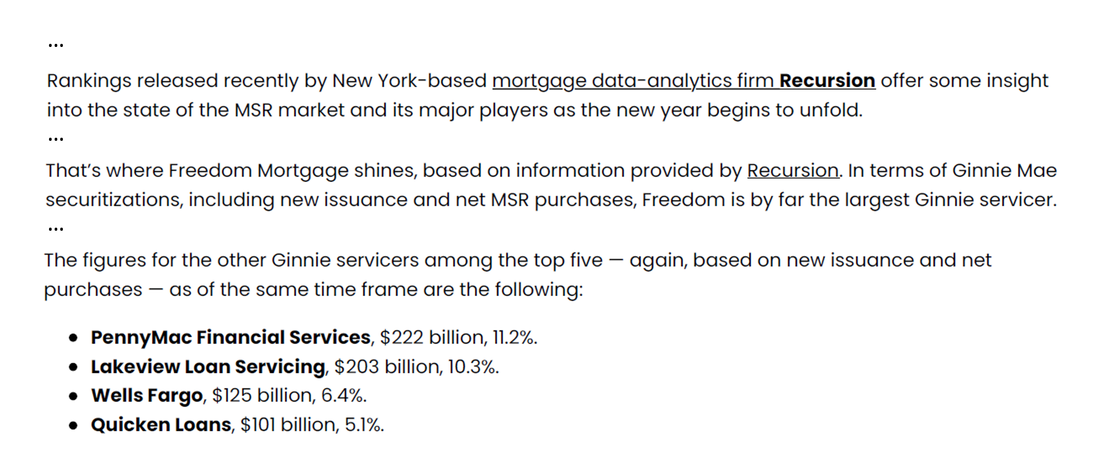

On January 13, Housing Wire posted an article titled “Freedom Mortgage dominates the MSR market” in which they reported that, among other top servicers, Freedom is leading the MSR marketing. They cited Recursion data on the ranking of the Ginnie Mae top servicers/buyers as well as their loan delinquency rates to provide perspective on the MSR market.

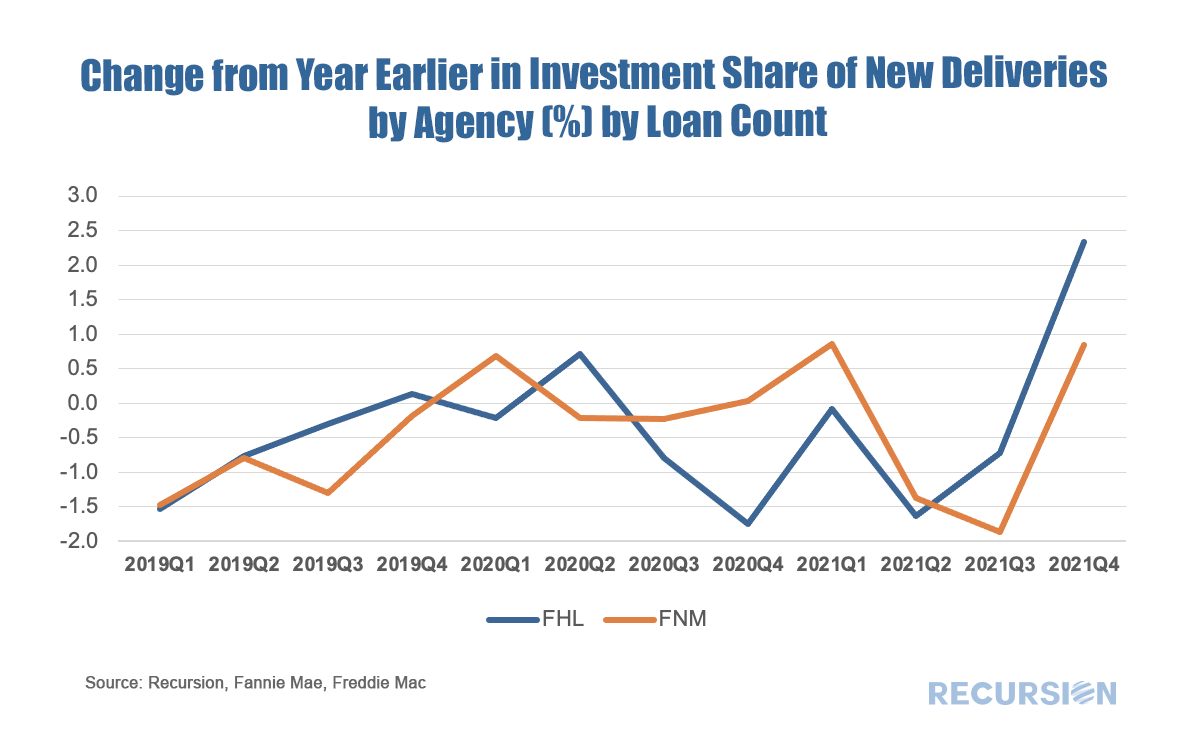

In a recent post, we discussed the market impact that arose from the imposition, and subsequent reversal, of limits on deliveries of NOO (non owner-occupied) residences, as well as on deliveries via the cash window, to the GSEs[1]. In summary, it discussed how the imposition of limits resulted in declines in the share of the NOO categories in the summer, with some rebound in evidence in Q3 when these were rescinded.

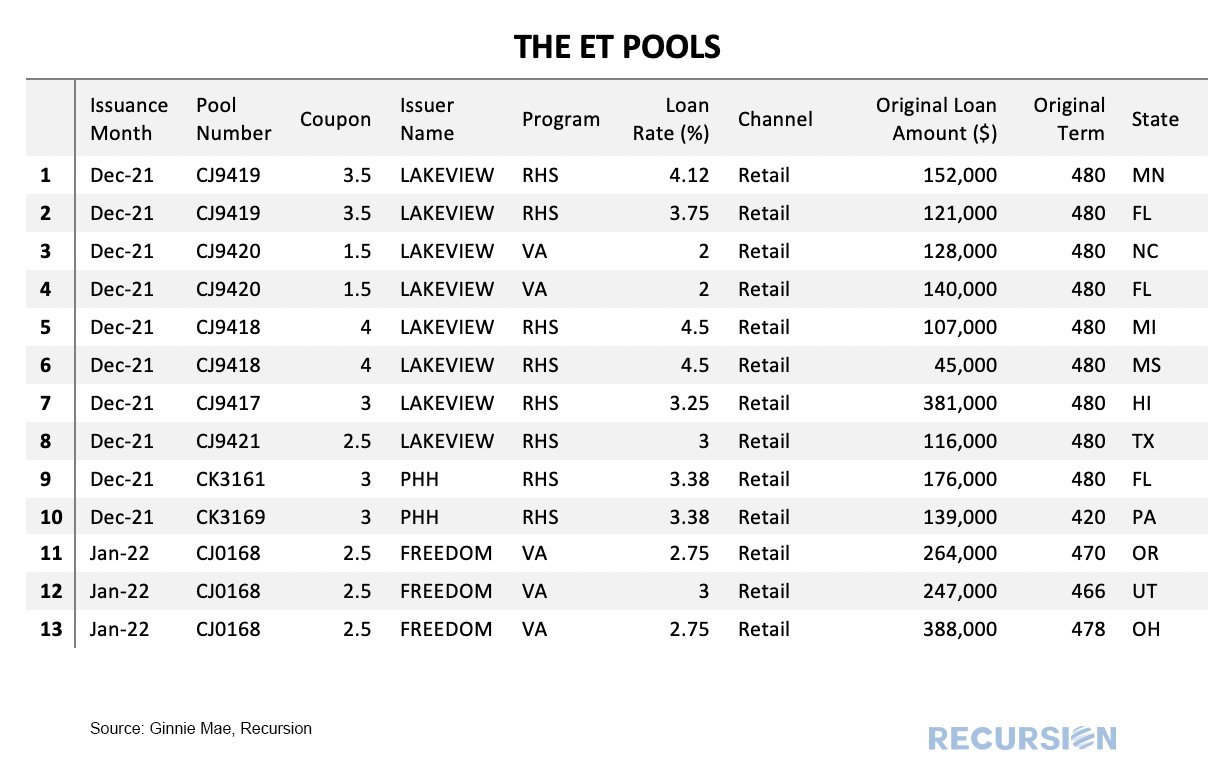

In this exercise, we look at the change in the share of purchase mortgage deliveries to both Enterprises from the same quarter in the prior year. This is done to eliminate the seasonal pattern that is in evidence in these shares that derive from the fact that owner-occupied purchases tend to have a strong seasonal pattern (peak in the spring) while the NOO categories do not. If the suspension of the constraints in September 2021 were binding, we would expect to see a jump in the share in the NOO categories in Q4. This is certainly the case for investment properties: On June 25, 2021, Ginnie Mae announced the creation of a new pool type C-ET that consists of modified loans with original terms greater than 361 months and less than or equal to 480 months[1]. The Custom pool design implies that each pool is created by a single issuer. Other custom pools are limited to 360-month maturities, so this structure is designed to enhance liquidity for these borrowers. 7 such pools were issued in December 2021, and 1 in January 2022 so far. The 8 pools have only 13 loans, from 3 issuers. 8 out the 13 loans are Rural loans, 5 are VA. Once again, Ginnie Mae has provided the market with new investment opportunities, and analysts with the opportunity to learn about how markets behave under long-term timeframes. On January 6, Housing Wire ran an article titled “2022 opens with a big MSR bulk-sale

offering” in which they report that large volumes of sales activity at the start of 2022 point to a robust deal year ahead. They cite Recursion data on the growth in total Agency MSR transactions in 2021 compared to the previous year to provide perspective on the strong momentum in deal flow. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed