|

On March 8, 2023, Silicon Valley Bank (SVB) announced a loss of $1.8 billion in a sale of assets and collapsed two days later. The ensuing market turmoil resulted in a string of bank failures and a temporary surge in Federal Reserve lending to the banking sector. What impact has this event had on the mortgage market?

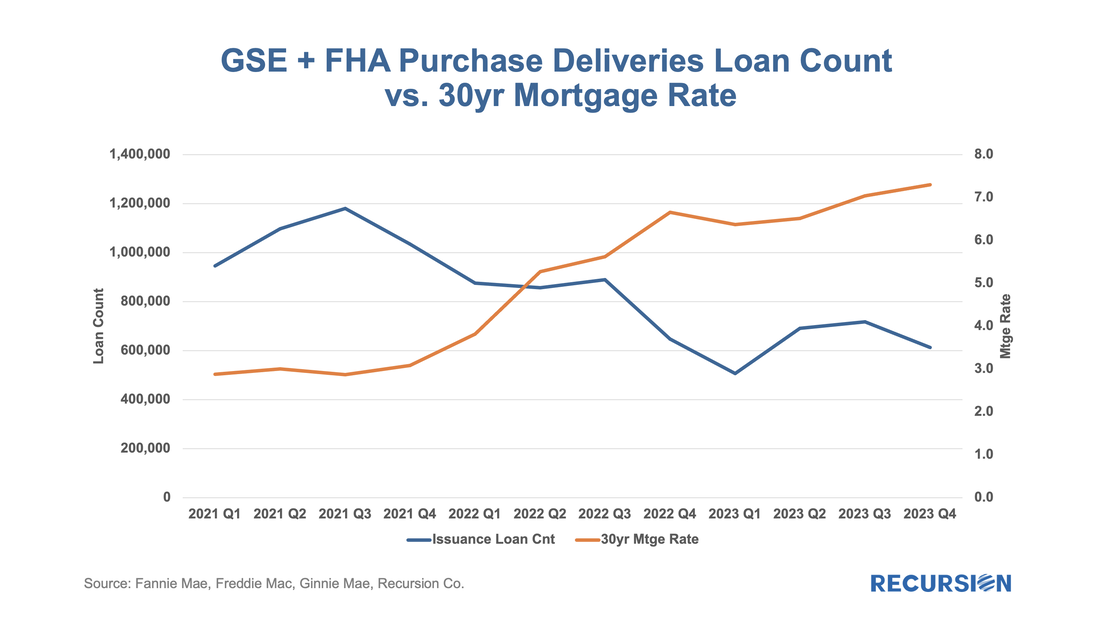

To answer this question, we need to be able to distinguish the impact of the SVB collapse from other factors that can impact bank lending. The economy in general and labor markets in particular have posted robust performance statistics over the past year. Mortgage rates, which were about 6.75% in early March last year, surged to a 23-year peak of 7.75% in November and currently stand nearly unchanged from a year ago at about 6.75%. On February 16 Commercial Mortgage Alert published an article entitled “Fannie Focusing on Affordable Market”. In this article, they stated that “Fannie purchased $4.04 billion of multifamily mortgages in January, according to data from Recursion Co.” They go on to mention that “Of the loans Fannie purchased last month, 81% of the units financed were affordable to renters earning no more than 80% of area median income. Over the last couple of years, that figure generally has ranged from 70% to 75% of units financed, according to Recursion.” We are proud that our data is widely cited in issues of importance to the housing policy and finance communities.

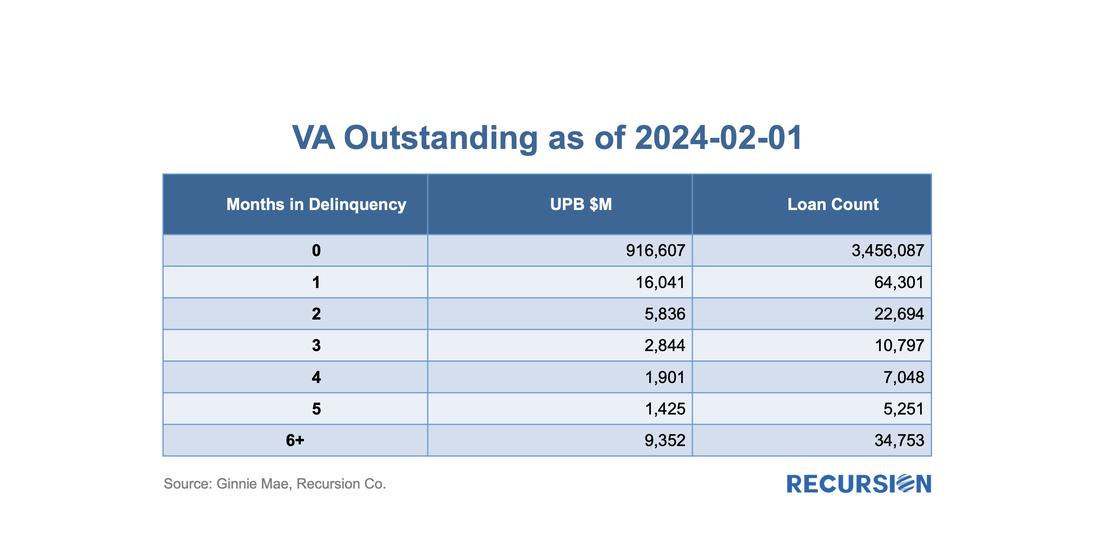

Please reach out to [email protected] if you would like a copy of the article On November 30, 2023, the Veterans Administration (VA) announced a new home retention program called the VA Servicing Purchase (VASP) program as an option for borrowers who cannot be assisted through other home retention options[1]. As the program will not be rolled out until March 2024, VA has strongly encouraged a foreclosure moratorium on all VA-guaranteed loans through May 31, 2024. Under this program, VA will exercise its statutory option to purchase the loan from the servicer and VA will hold the loan in VA's own loan portfolio[2]. The servicer will prepare a modification of the loan to increase affordability for the Veteran.

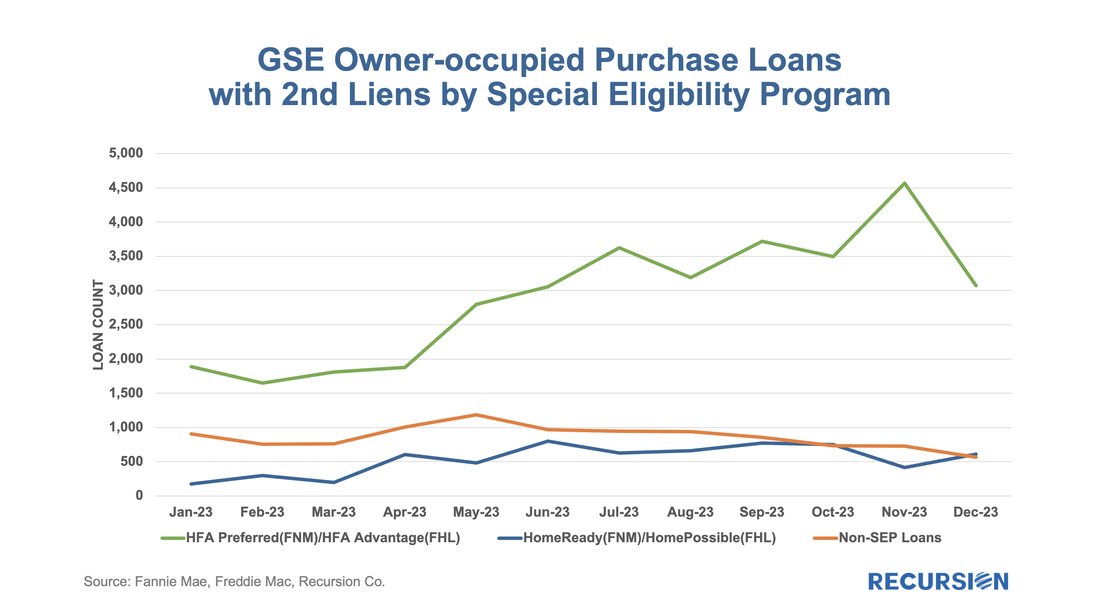

As the vast majority of VA mortgages are securitized in Ginnie Mae pools, let’s first take a look at the outstanding balance and loan count of VA loans using data disclosed by Ginnie Mae: In Mortgage Winter, affordability is job one for housing policy. In our most recent quarterly macro report, we noted that the share of loans with buydowns posted significant increases across all three agencies in the second half of 2023[1]. To see how widespread these sorts of supportive actions are, we look at down payment assistance (DPA) programs.

To start, the GSEs only allow downpayment assistance through specified second lien programs: “Community Seconds” for Fannie Mae[2] and “Affordable Seconds” for Freddie Mac[3]. While there are technical differences between programs, they are second liens funded by an approved list of government agencies, nonprofits, and private sector lenders. The liens are subordinate to the first mortgage and face various limits on combined LTV (CLTV) and note rates. These liens are neither securitized by the Enterprises nor directly reported in the data disclosures. However, we could identify those (we call it “piggyback”) by looking for loans with the original combined LTV higher than its original LTV. Below find the number of owner-occupied loans containing “piggyback” liens for the HFA programs, the low-income programs (FNM “Home Ready” and FHL “Home Possible”), and other[4]: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed