|

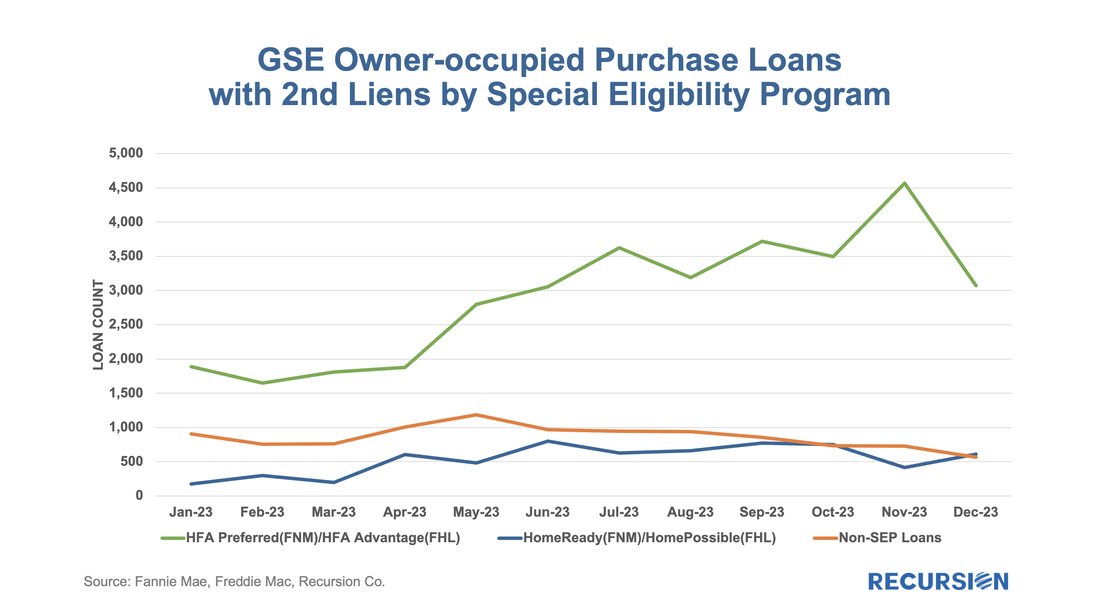

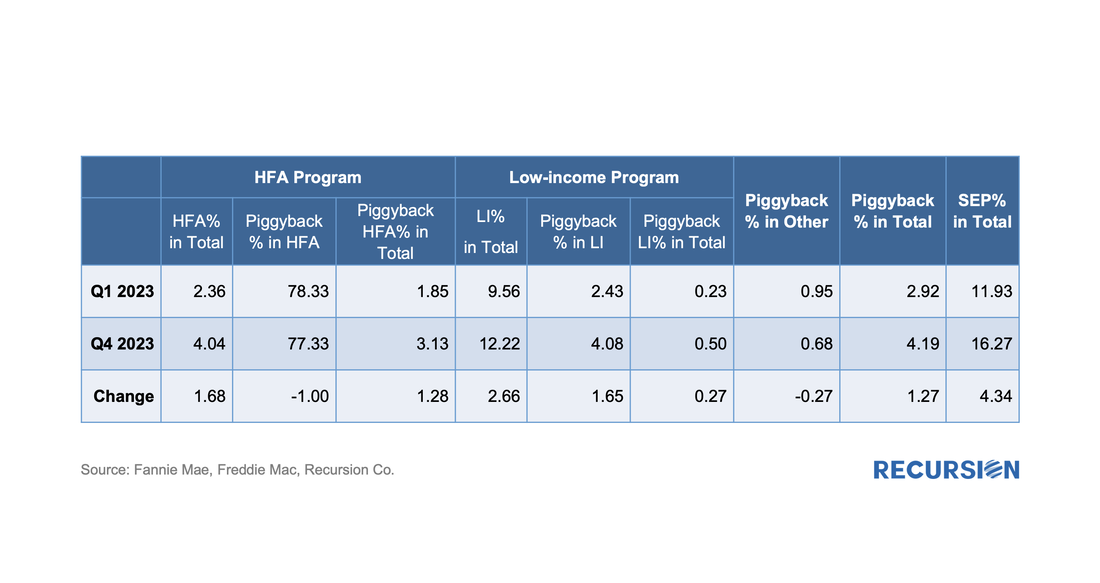

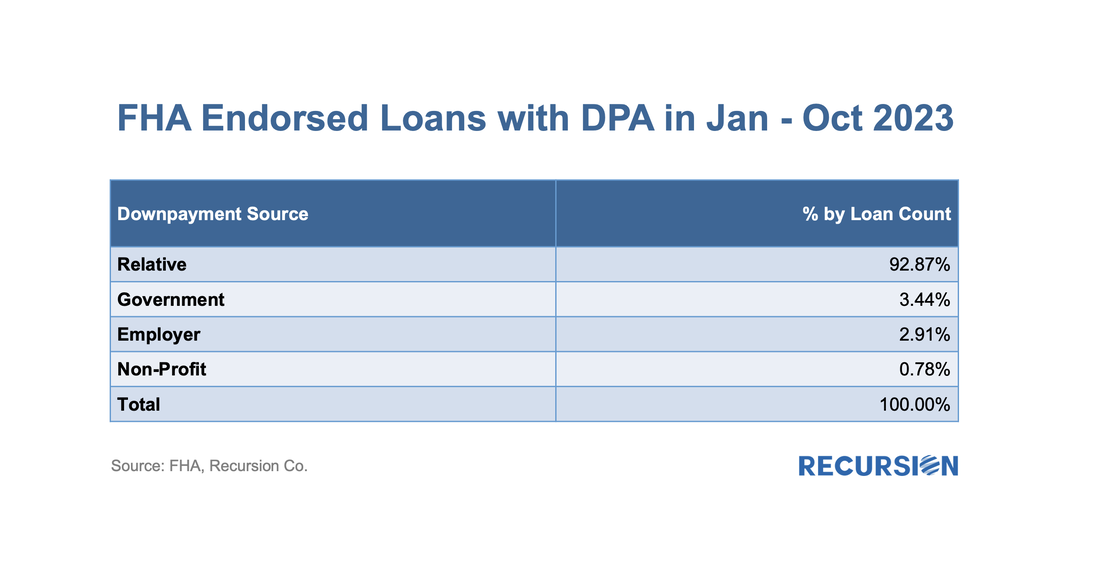

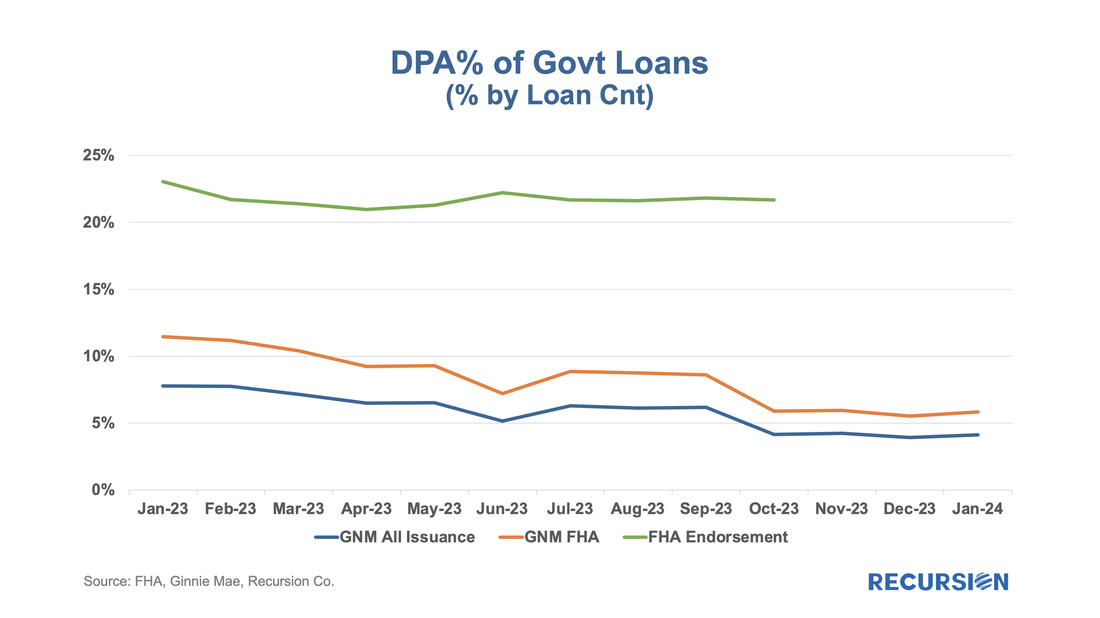

In Mortgage Winter, affordability is job one for housing policy. In our most recent quarterly macro report, we noted that the share of loans with buydowns posted significant increases across all three agencies in the second half of 2023[1]. To see how widespread these sorts of supportive actions are, we look at down payment assistance (DPA) programs. To start, the GSEs only allow downpayment assistance through specified second lien programs: “Community Seconds” for Fannie Mae[2] and “Affordable Seconds” for Freddie Mac[3]. While there are technical differences between programs, they are second liens funded by an approved list of government agencies, nonprofits, and private sector lenders. The liens are subordinate to the first mortgage and face various limits on combined LTV (CLTV) and note rates. These liens are neither securitized by the Enterprises nor directly reported in the data disclosures. However, we could identify those (we call it “piggyback”) by looking for loans with the original combined LTV higher than its original LTV. Below find the number of owner-occupied loans containing “piggyback” liens for the HFA programs, the low-income programs (FNM “Home Ready” and FHL “Home Possible”), and other[4]: Looking into the details, there has been an increase in the share of owner-occupied purchase deliveries with second liens to the GSEs over the course of 2023, but these mostly reflect an increased share of loans from HFA programs that have a high utilization rate of piggybacked loans. There has also been a small increase in second lien usage for the low-income programs which have posted an increase in market share through the course of 2023. While not dramatic, growth in the usage of special programs is partially responsible for the modest increase in the share of second liens we observe in the deliveries of owner-occupied purchase loans to the GSEs. The situation is somewhat different with respect to the FHA program. In this case, we benefit from the presence of a “DPA” flag in the GNM disclosures. But there is a complicating factor with regards to the issue of what the definition of “DPA” means here. According to the GNM data dictionary, the DPA flag is “An indicator of whether the borrower received gift funds for the Loan Down Payment”. But we have another data set—HUD’s monthly “FHA Portfolio Snapshot” dataset that contains data on all loans endorsed by the agency[5]. Here, the DPA definition is quite different: Pulling down the DPA share from all available sources we see this: There are some interesting observations to be made here. First, the monthly Agency disclosure data shows a declining trend in DPA usage during the course of 2023, both for FHA and all GNM loans (implying that usage for VA is declining at a similar clip to that of FHA). However, the FHA endorsement data shows a much flatter curve at over 20% of new endorsements. Apparently, differences in the definition of “DPA” between datasets imply significant differences in the measurement of DPA usage. More work remains to be done here. [1] Recursion Macro Housing Analytics January 2024

[2] https://singlefamily.fanniemae.com/media/5641/display [3]https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/affordable-seconds [4]https://www.recursionco.com/blog/a-first-look-at-the-special-eligibility-programs [5]https://www.hud.gov/program_offices/housing/rmra/oe/rpts/sfsnap/sfsnap |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed