|

Recently, the GSE’s Fannie Mae and Freddie Mac released loan-level data associated with their “Special Eligibility Programs” that look to extend credit to low-income borrowers. As housing policy is increasingly focused on providing this market segment access to this market segment, this data will prove useful to housing analysts looking to assess the effectiveness of these programs as well as to traders looking to understand the impact on the performance of MBS containing these loans. Briefly, each agency has three programs. There are many differences in details between the programs.

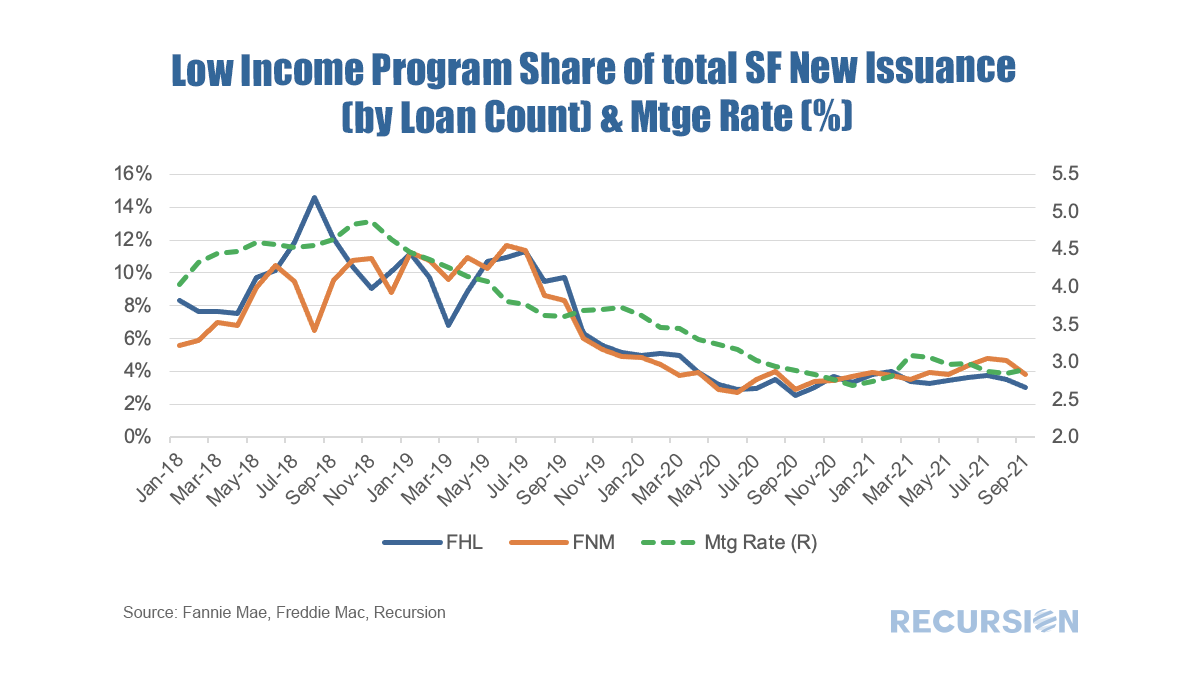

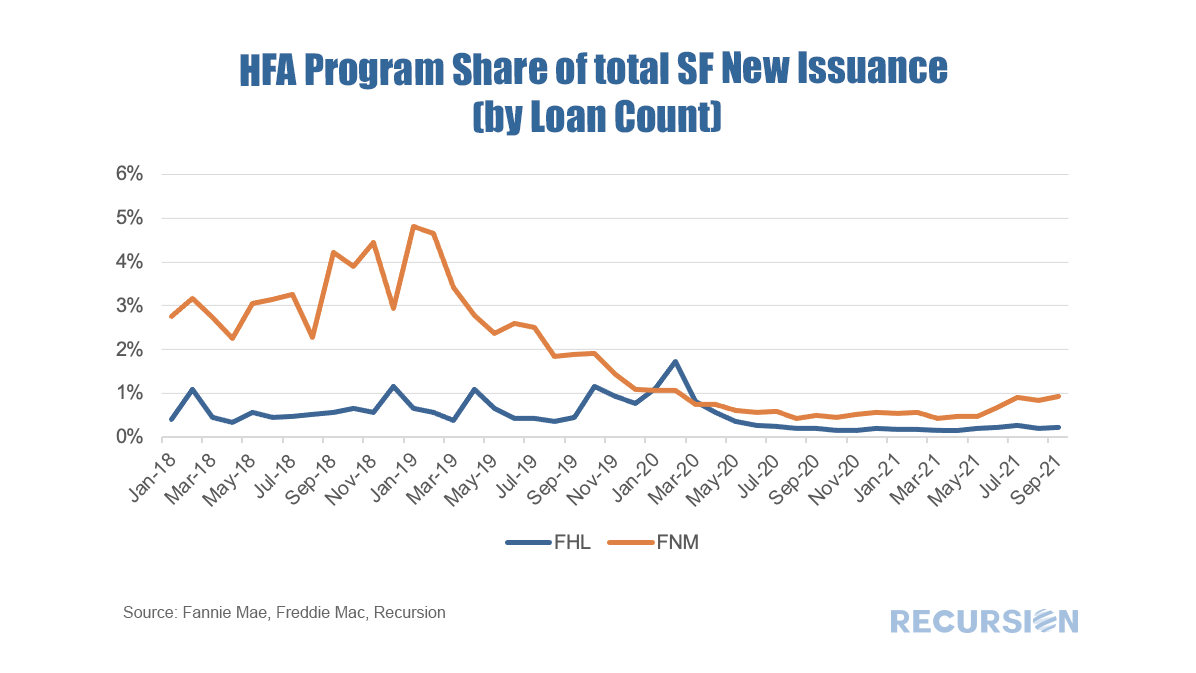

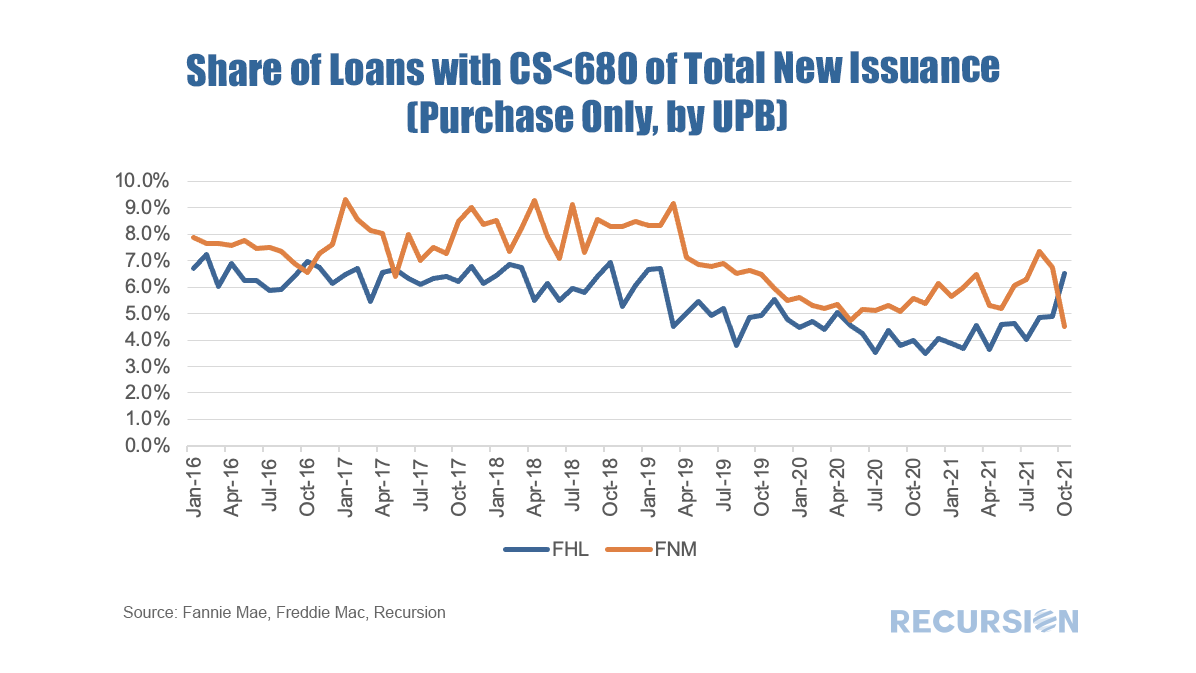

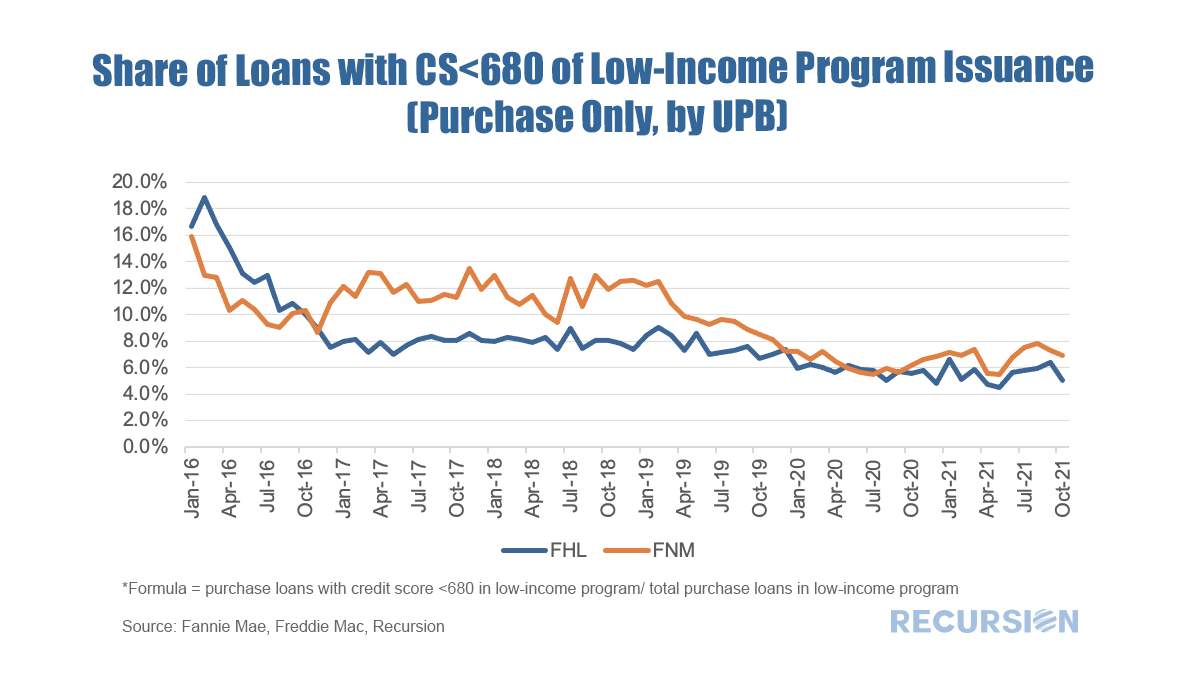

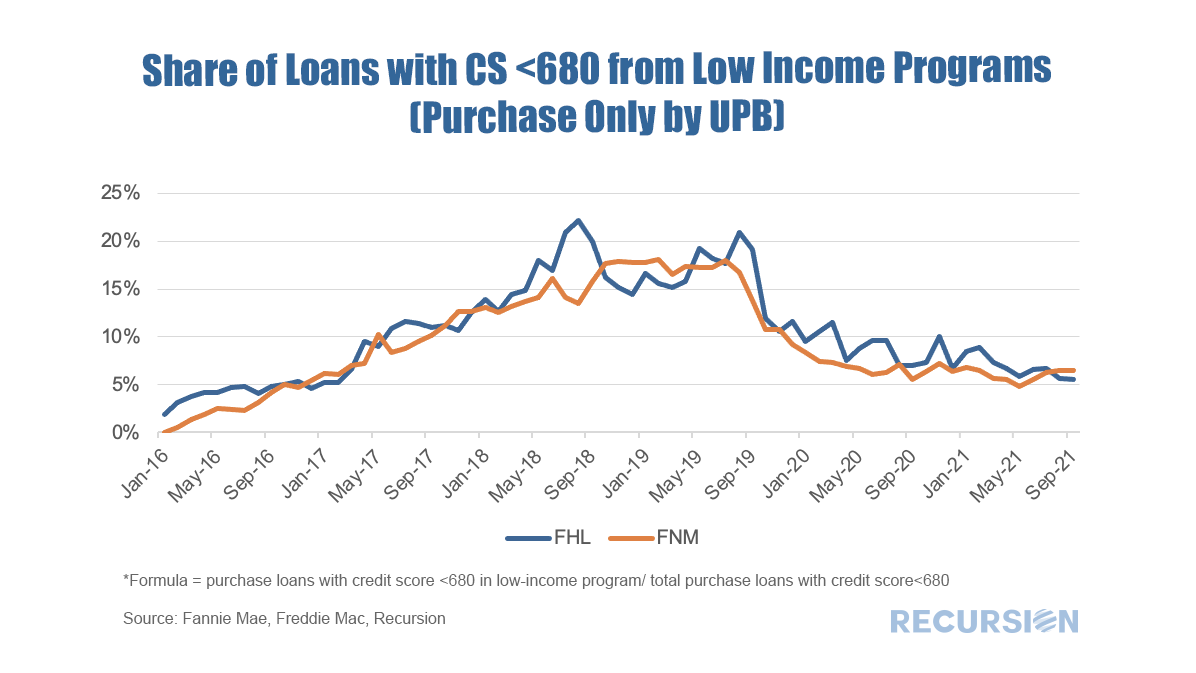

As the refi programs are relatively new and volumes are small, in this post we focus on the first two. For convenience, we refer to the first as the “Low-Income Programs” and the second the “HFA Programs”. Below find the market share of Home Ready and Home Possible out of total volumes for their respective Agencies by loan count: These programs got into the low double-digit shares of the total in 2018 and 2019 but fell off sharply as interest rates fell. More analysis will have to be conducted to get to the bottom of such a tight correlation, but one possibility is that low interest rates sparked home price increases that took valuations out of each for this population. Another is servicer capacity constraints as the refinance market boomed, leaving less space for more complicated credits. While the pattern for Fannie Mae HFA loans is similar to the low income programs, Freddie Mac’s never utilized its HFA program to a significant degree. Regular recipients of our Recursion Monthly Credit Report will recall that in 2018 and 2019 that Fannie Mae’s appetite for providing credit to lower-credit score borrowers was greater than that of Freddie Mac. It seems that the same patten can be observed in the low-income special programs. Interestingly, the share of all purchase loans with credit scores less than 680 that come from the special low-income programs is very similar across the Enterprises. The great challenge for policymakers is to come up with innovative techniques to bring low- income families onto the path of homeownership in a rising home price environment. Given widespread supply constraints this is more likely to occur with a focus on local market conditions than national ones, and the HFAs are well situated to fill an important role in this regard [1] https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/homeready-mortgage

[2] https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/home-possible [3] For background on HFA’s see https://www.ncsha.org/about-us/about-hfas/ [4] https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/hfas-public-entities [5] https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/hfa-advantage [6] https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/refinow-expanding-refinance-eligibility-qualifying-homeowners [7] https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/refi-possible |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed