|

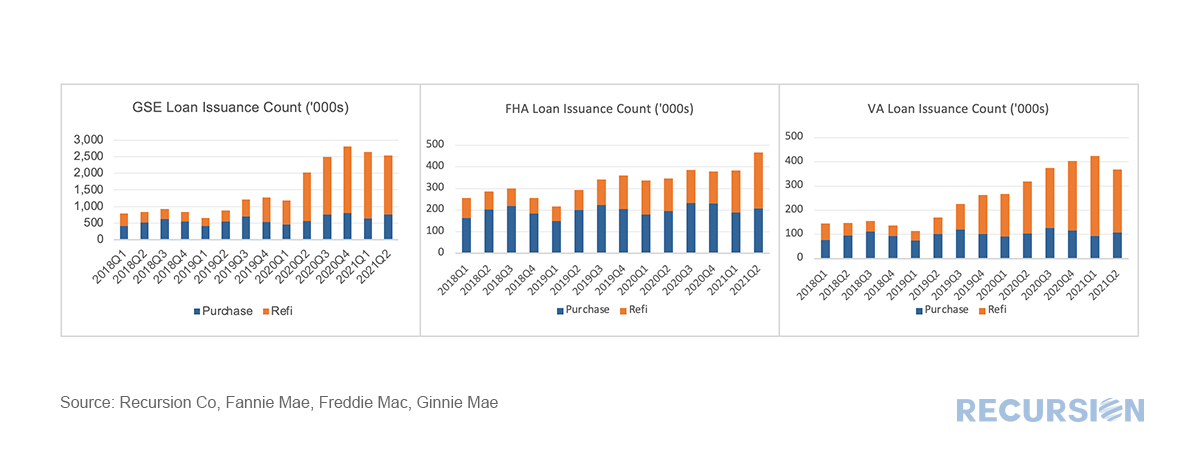

Credit provision is one of the great areas of concern addressed by the New Housing Policy. In a previous post[1], we mentioned that we have integrated HUD LMI Neighborhood information with our tools. We can view aggregate credit creation through Cohort Analyzer, and its composition through HMDA Analyzer. 2020 marked an unprecedented year for mortgage production as the pandemic sparked aggressive moves by the Federal Reserve driving mortgage rates to record lows, coupled with a flight of households away from density towards more sparsely populated areas. Trends in the major programs by loan count can be seen here: *This chart can be duplicated using the above two queries

The matched dataset continues to pay dividends (sorry no buy-backs). This time we take a look at appraisal waivers. The very straightforward question based on the new data is to ask if there are differences in the rate of PIW take-up among eligible loans between areas with a higher share of low to moderate income people and those with a lower share. Our breakpoint is areas with LMI>=51(Low-or Moderate-Income Areas) and LMI<51 (Not Low-or Moderate-Income Areas), and we look here at just purchase loans.

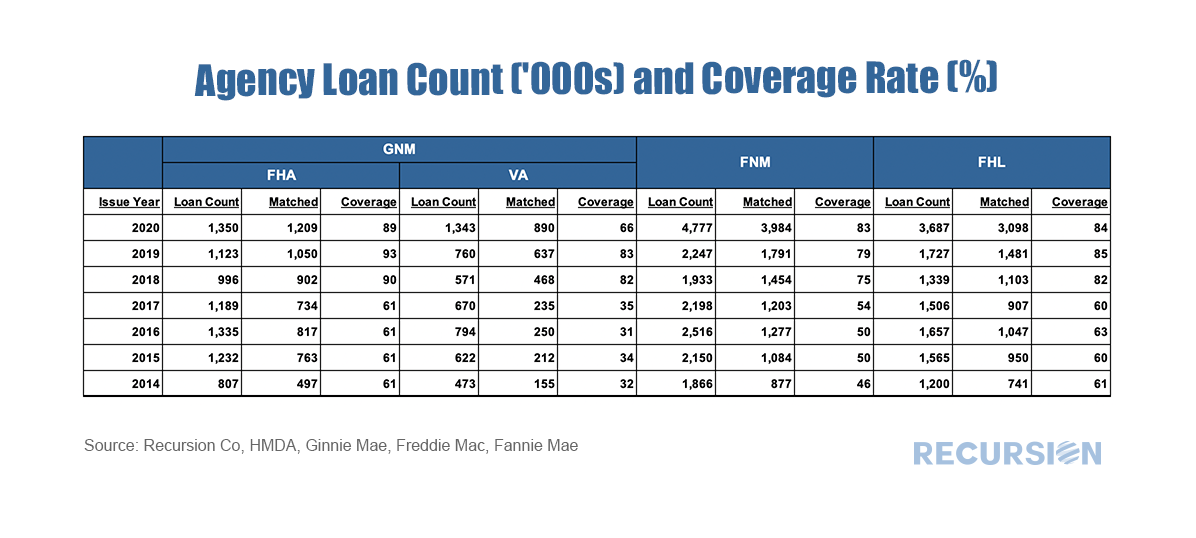

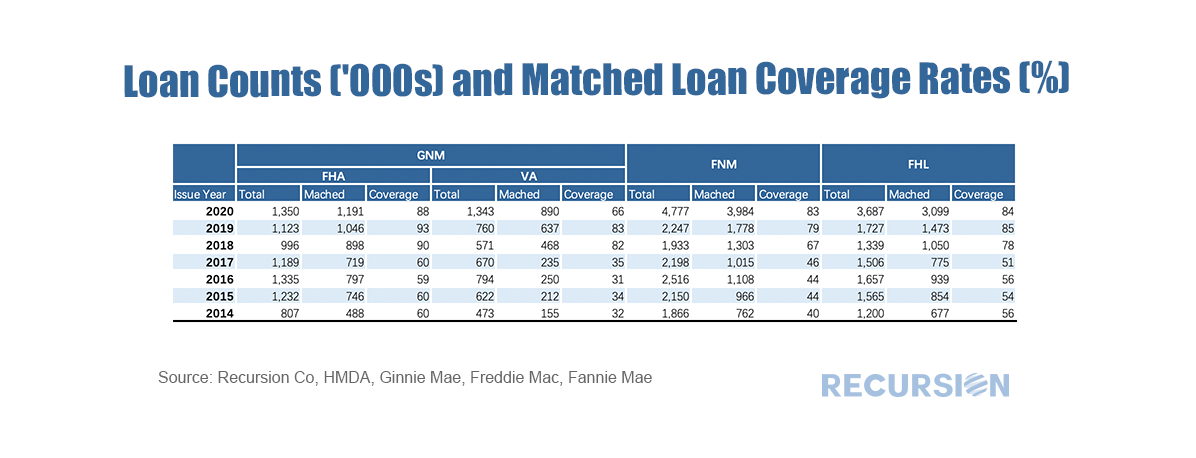

Before we begin, as this query is focused entirely on GSE loans, we felt it necessary to put the bots into overdrive to improve the match rate between HMDA and the GSE loan tapes and for those keeping track the updated match rate is: Our proprietary matching algorithm continues to chug along and our match rates between the Agency loan tapes and HMDA continue to improve. Here is an up-to-date summary table:

As we accumulate more data at a fine local level, the opportunities to evaluate policies derived from insights into lender, borrower and supervisor behavior grow massively. Our recent post looking at the potential impact of FHFA’s new rate mod policy[1] is our most recent example of the application of digital tools in the policy space, but as noted previously[2], the new policy framework is designed to focus on wealth creation and housing sustainability at the local level.

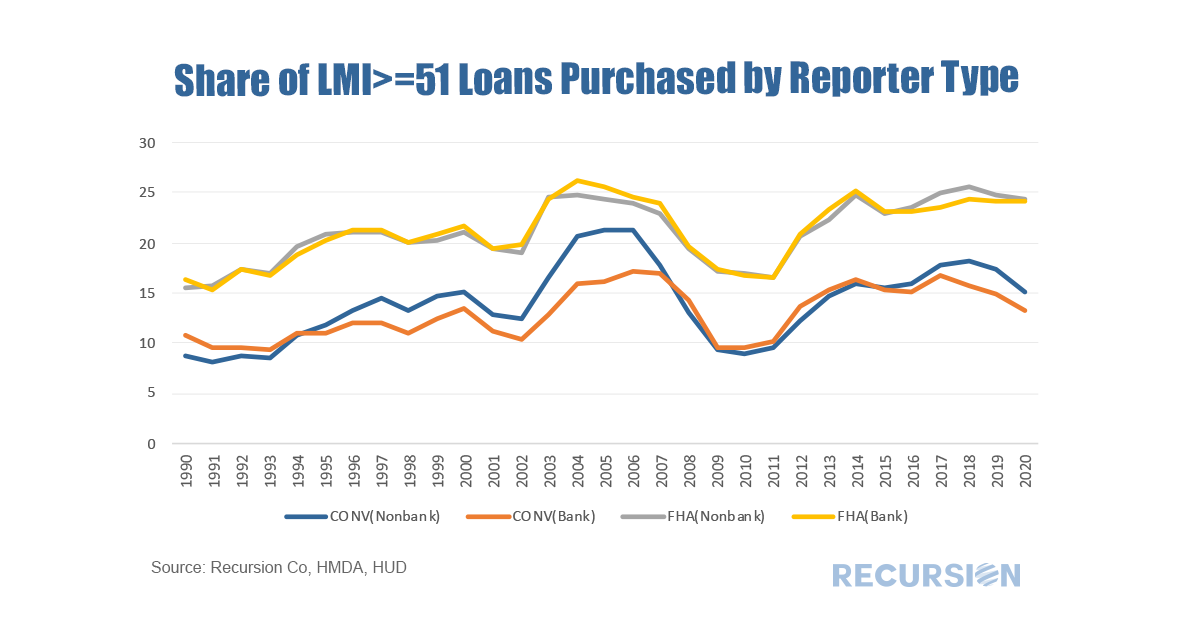

To look at this issue, we need to have data at hand that tells us which local areas have a preponderance of low-income borrowers on which we can overlay the HMDA data set, which reports census tract level indicators related to the policy issue at hand. It turns out that the income data can be found in the American Community Survey (ACS)[3]. A key facet of this survey is information regarding the share of every census tract where low and moderate income (LMI) people comprise less than or equal to 51% of the total population. This data is available through the HUD Exchange[4]. With that, we now have a robust tool for analysis. An immediate challenge in this regard is to come up with specific queries out of the myriad of possibilities that demonstrate their power. Below finds a chart that provides a big-picture view of lender behavior in LMI neighborhoods broken down between banks and nonbanks[5]. Specifically, we look at the trend in purchases from third-party originators of both FHA and conventional loans: Recursion Partners with Clear Capital to provide intelligence for valuation model accuracy7/12/2021

We are delighted to announce our partnership with Clear Capital, a national real estate valuation and analytics fintech leader.

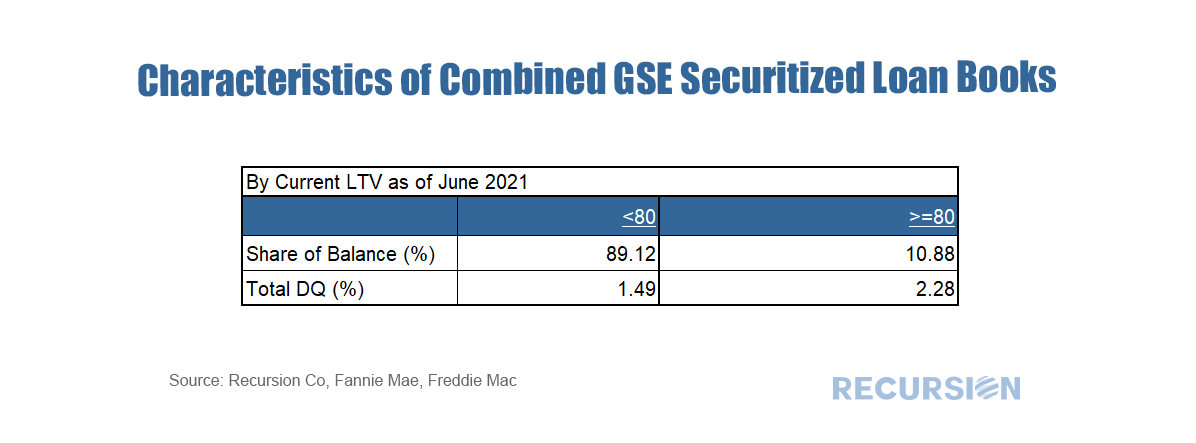

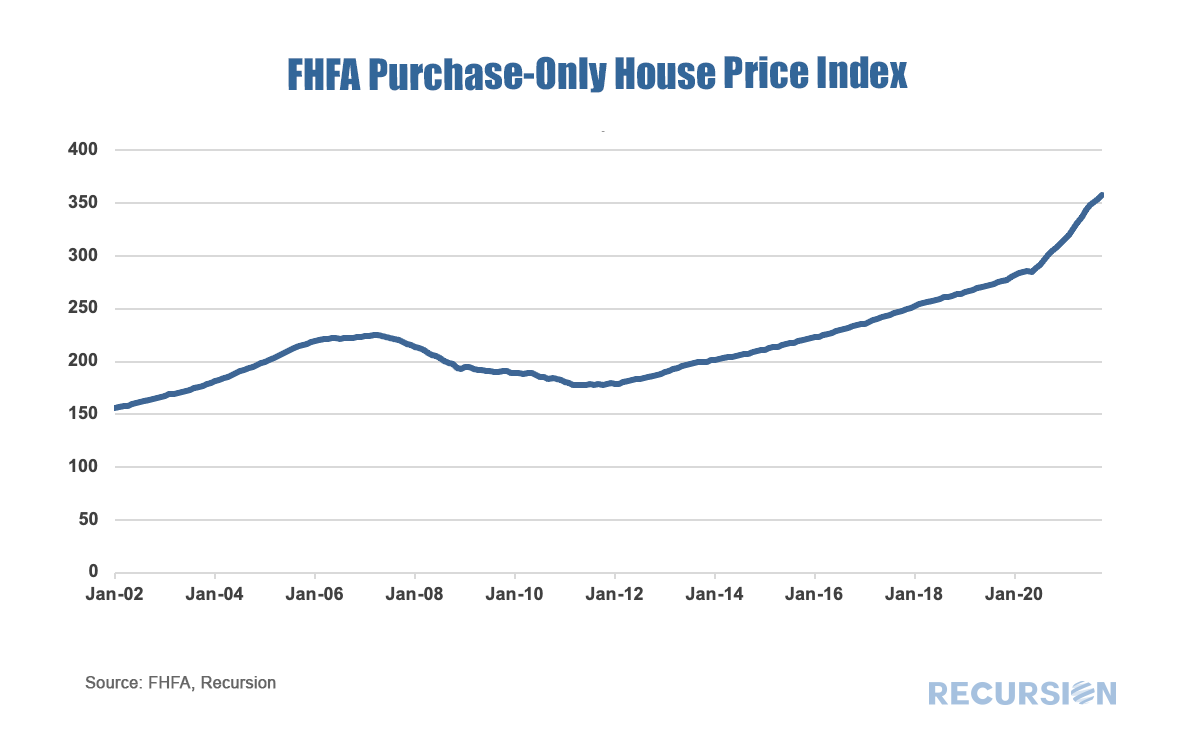

Founded in Truckee, California, Clear Capital provides automated valuation and underwriting solutions for the real estate market, as well as portfolio valuations for mortgage servicers. Recursion‘s over 30 million loan-level mortgage records across hundreds of data points will help Clear Capital produce even more accurate valuation models and timely solutions. We are excited to work with Clear Capital to apply the most advanced fintech tools to address the mortgage and real estate industry’s most pressing challenges. Read More - Press Release by Clear Capital The new FHFA Acting Director Sandra Thompson has lost no time in implementing new policies designed to support homeownership with the aim of creating greater wealth equality. This is the basis of the New Housing Policy we described in a recent post[1]. At first, this involved extending foreclosure moratoriums for distressed families until the end of the year[2]. Then recently, the GSE regulator announced a change in its modification policy to broaden the eligibility for rate mods to any qualifying household that were previously only available to those with a mortgage greater than or equal to 80% of the current home valuation (Current LTV>=80)[3]. This program is designed to allow as many credit-worthy borrowers to stay in their homes as possible.

The LTV limit is significant because the surge in house prices we have witnessed over the past year has meant that a relatively small share of loans should have Current LTVs greater than or equal to 80. Our loan-level data set allows us to examine this question by looking at over 25 million GSE loans. Below finds a snapshot of the total combined June books of the GSEs broken down in this manner: |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed