|

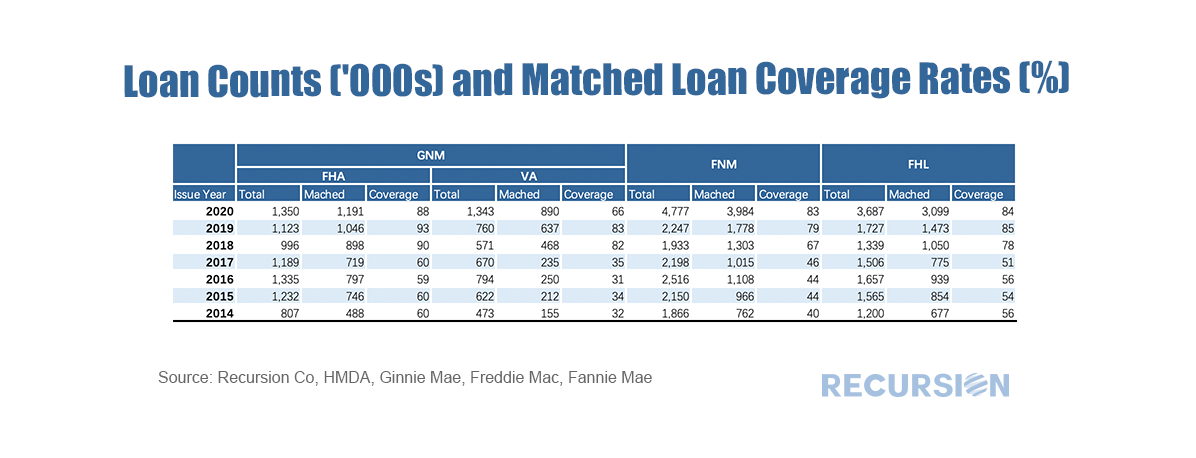

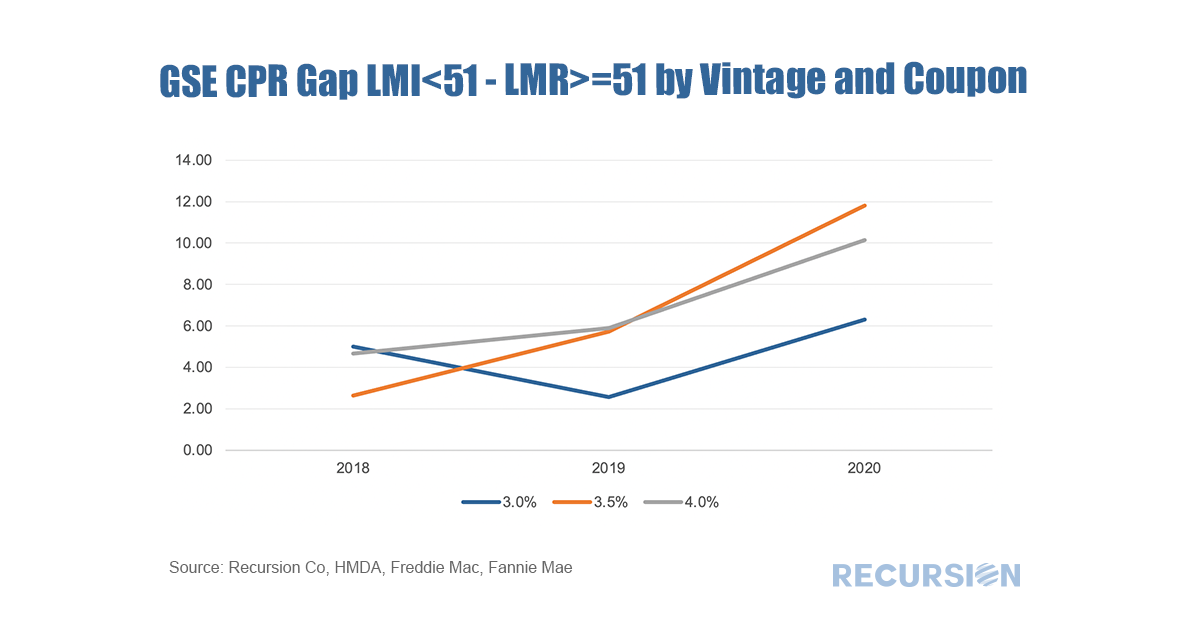

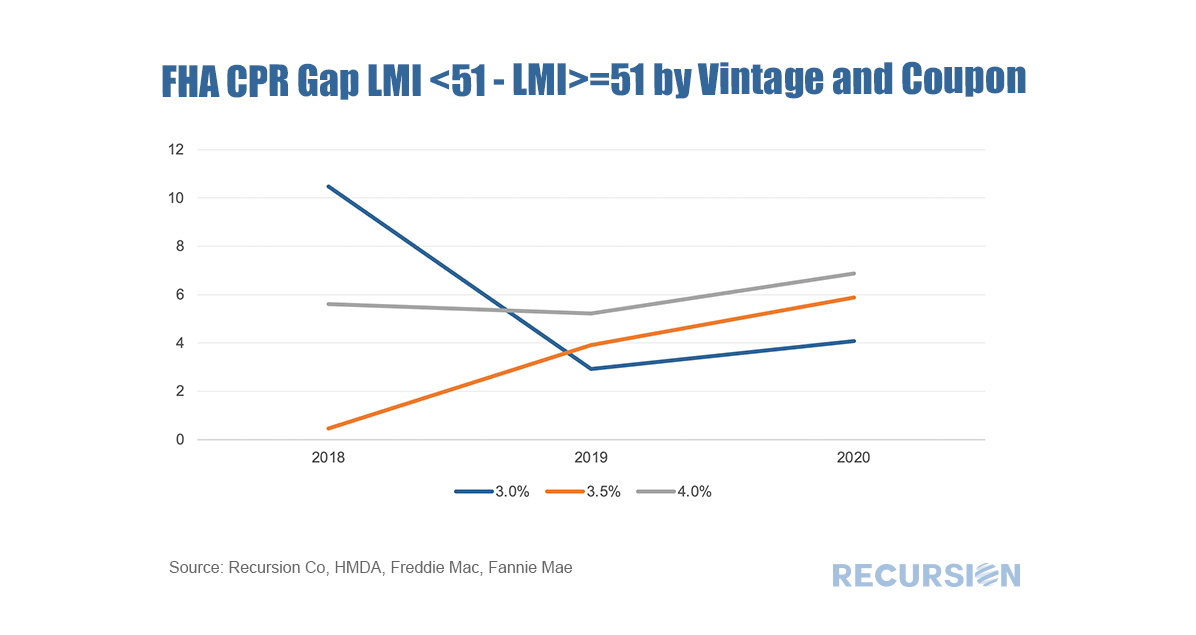

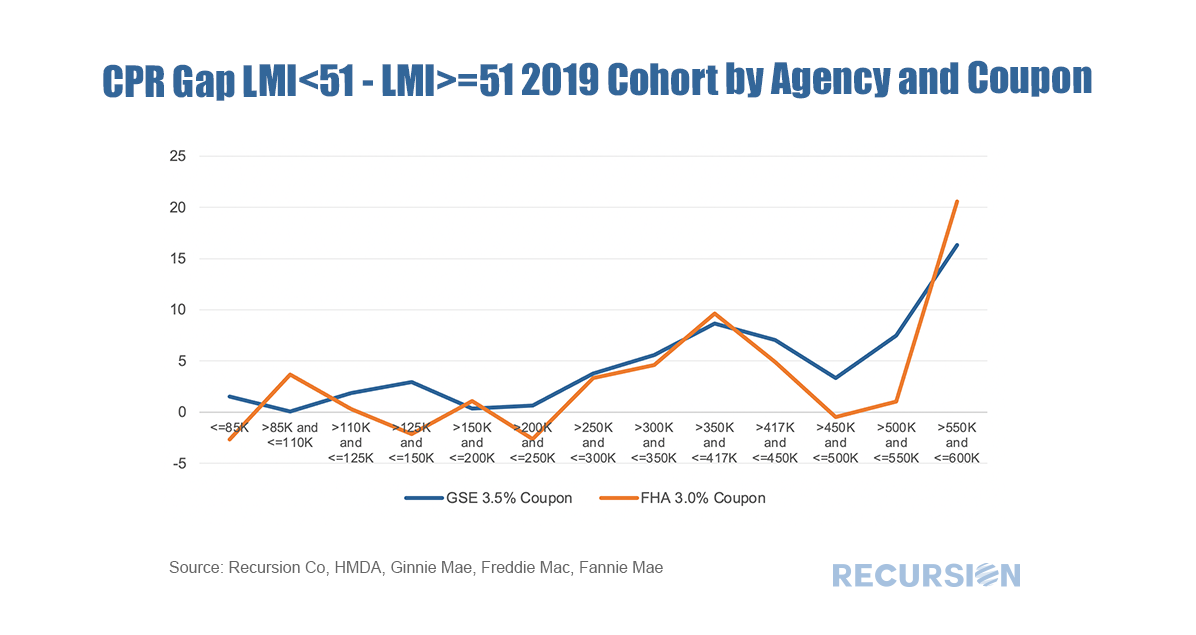

Our proprietary matching algorithm continues to chug along and our match rates between the Agency loan tapes and HMDA continue to improve. Here is an up-to-date summary table: The improvement posted the last few years compared to the prior period is largely due to the broadening of reported characteristics in HMDA since 2018. There is room for improvement, particularly for the GSEs. Fortunately, the bots never stop. So it’s time to dive into what this all means for prepayment speeds. Recall that the matched dataset provides a robust sample of millions of loans with the underwriting and performance statistics from the Agency loan tapes combined with the social and demographic data contained in HMDA. A key advancement is that HMDA reports down to the census tract level. This in turn allows us to integrate local Census data into our analysis[1]. A question that seems of broad interest is: are prepayment speeds slower in areas with a preponderance of low-income people? To look at this we tile the country into two segments, those areas with a majority of people with Low and Moderate Incomes (LMIs >=51%) and all other areas. We can then look at the difference in speeds between the two zones (the “gaps”) by coupon and origination year and program. In this case we look at the 1-month CPR for June 2021, first for the GSEs: And then for FHA: So, at first, the answer seems to be yes. In most cases, prepayments are faster in areas with fewer than half LMI people. Of course, there are many other factors that can be driving this result. One that pops into mind is original loan size. The smaller the loan, the less incentive there is to refi. It seems natural then to try to adjust these charts for this factor. This is a complicated task as it adds an extra dimension to what we have above so what we do is to just look at a narrow slice of the whole picture by looking at the 1-month CPR in June for specific coupons for the GSEs and FHA for the 2019 vintage by loan size bucket: *This chart can be duplicated using the above two queries While the data are noisy (sample sizes are declining) the trend to relatively faster prepayment speeds in areas with a lower share of LMI population for loan sizes greater than $250k is pretty clear. Readers of these comments will recall that we are an analytics and not a policy or modeling shop. But we believe that our analysis is useful to both. Nothing here is definitive, but with regards to the question posed at the top we can say that you can’t rule it out. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed