|

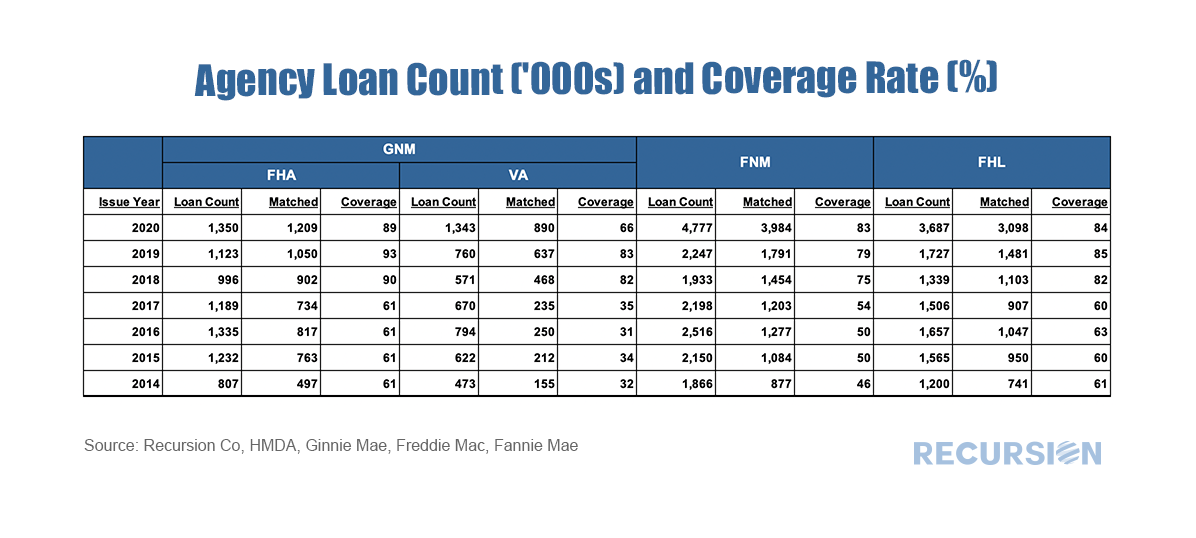

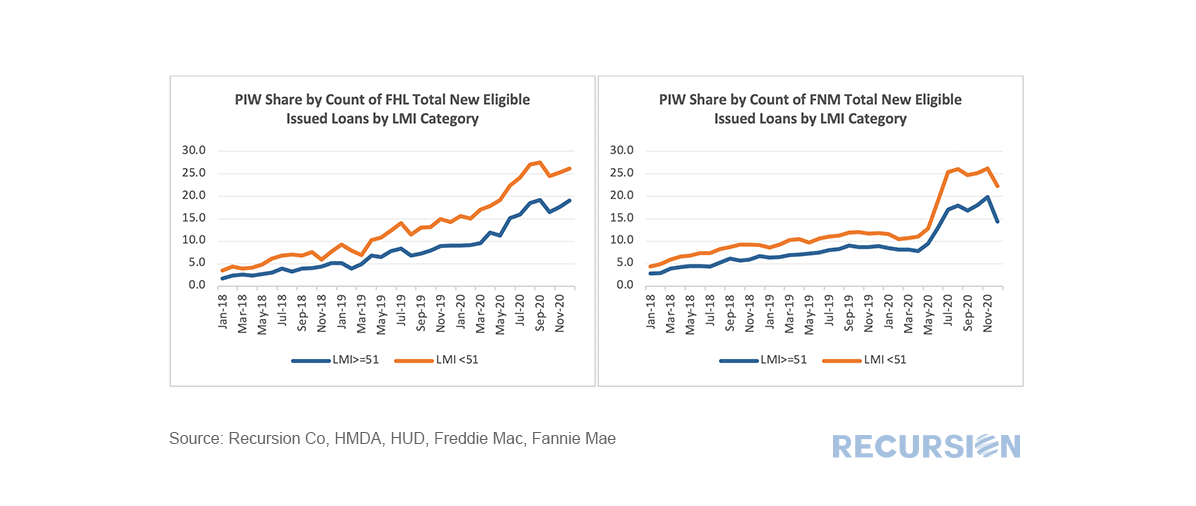

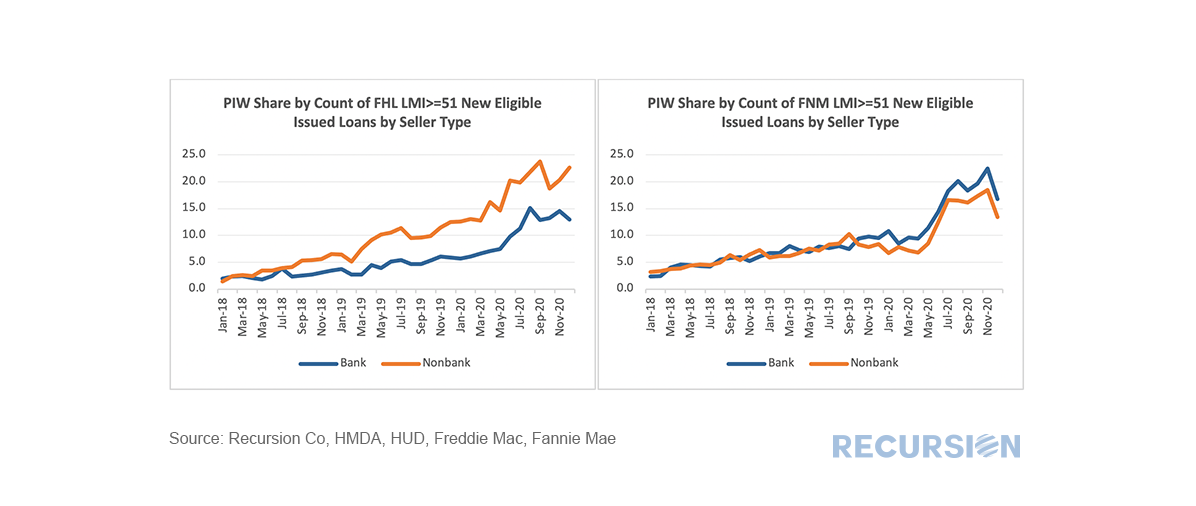

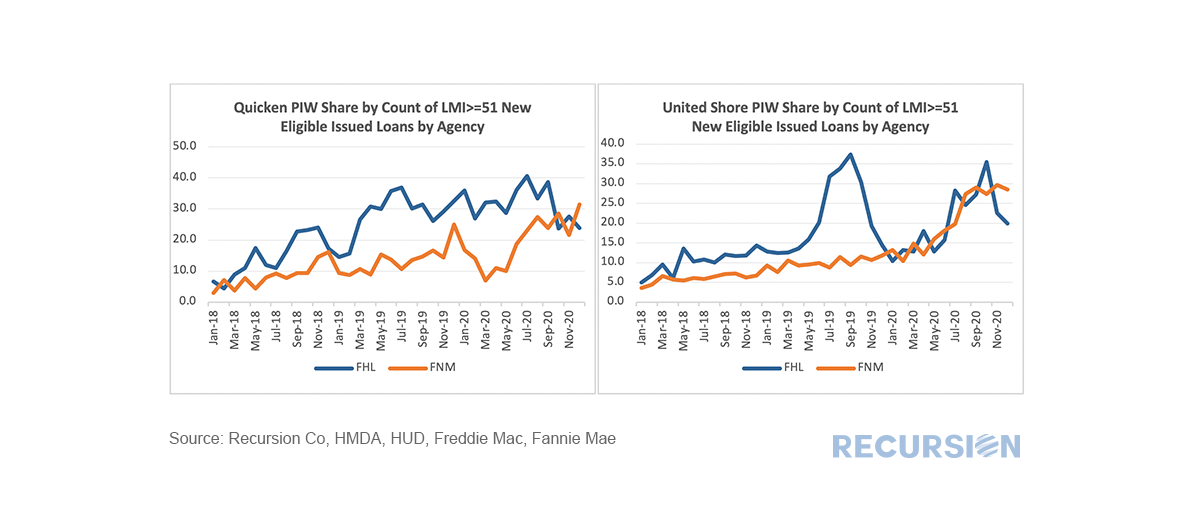

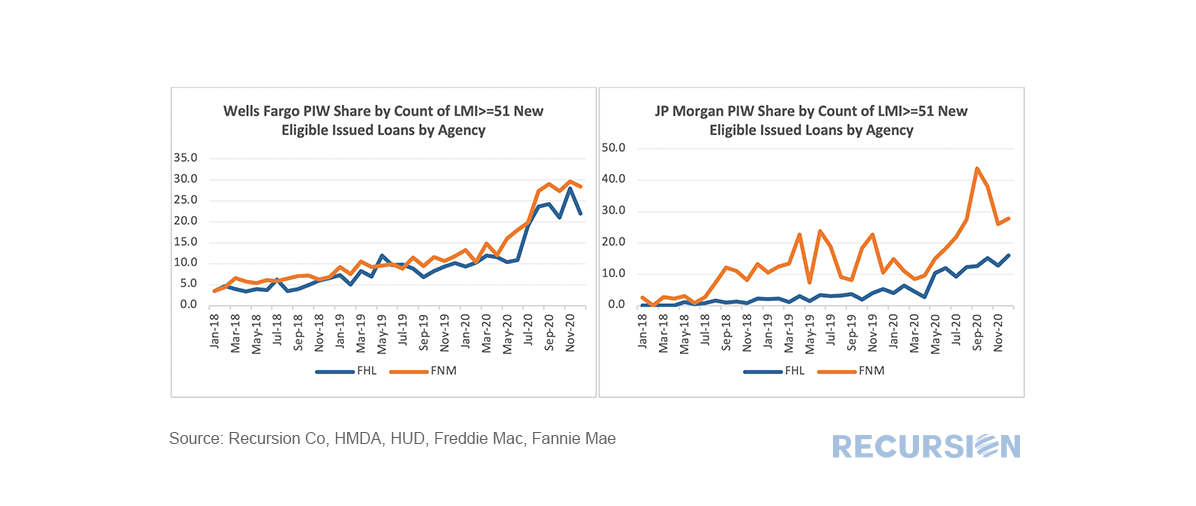

The matched dataset continues to pay dividends (sorry no buy-backs). This time we take a look at appraisal waivers. The very straightforward question based on the new data is to ask if there are differences in the rate of PIW take-up among eligible loans between areas with a higher share of low to moderate income people and those with a lower share. Our breakpoint is areas with LMI>=51(Low-or Moderate-Income Areas) and LMI<51 (Not Low-or Moderate-Income Areas), and we look here at just purchase loans. Before we begin, as this query is focused entirely on GSE loans, we felt it necessary to put the bots into overdrive to improve the match rate between HMDA and the GSE loan tapes and for those keeping track the updated match rate is: With the following results: It seems so. For both Fannie Mae and Freddie Mac, lenders use waivers for property valuations in areas with less than 51% LMI individuals at a higher rate than for those greater to or less than that share. Of course, much more investigation is necessary before ascribing this distinction to any particular driving factor. So, the number of paths forward here are about endless, but a natural extension is to ask if there is a distinction between bank and nonbank sellers. Below we look at this for the lower (LMI>=51) areas: The answer here is, sometimes. Nonbank sellers use PIW’s in lower income areas at a greater rate than banks for loans delivered to Freddie Mac, while they are much closer together for those delivered to Fannie Mae. In fact, recently banks have been modestly exceeding nonbanks in this regard for loans delivered to Fannie Mae. This is something of a surprise. Once again, there are countless possibilities to examine, but one path is to look at the same results for individual large lenders: Nonbanks: Banks: This is somewhat noisy data but based on this rather small sample it seems that both individual firm strategies and the particular policies of the GSE’s play a role here[1]. In any case, as we have previously demonstrated that prepayment speeds vary between higher and lower income areas[2] these kinds of distinctions might prove useful in both the policy and investment arenas. [1] For Freddie Mac, the Automated Collateral Evaluation ACE system guides appraisal decisions, https://sf.freddiemac.com/content/_assets/resources/pdf/requirements/ace.pdf

While for Fannie Mae it is the Collateral Underwriter (CU) https://singlefamily.fanniemae.com/applications-technology/collateral-underwriter [2] https://www.recursionco.com/blog/insights-on-prepayment-speeds-from-the-matched-dataset |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed