|

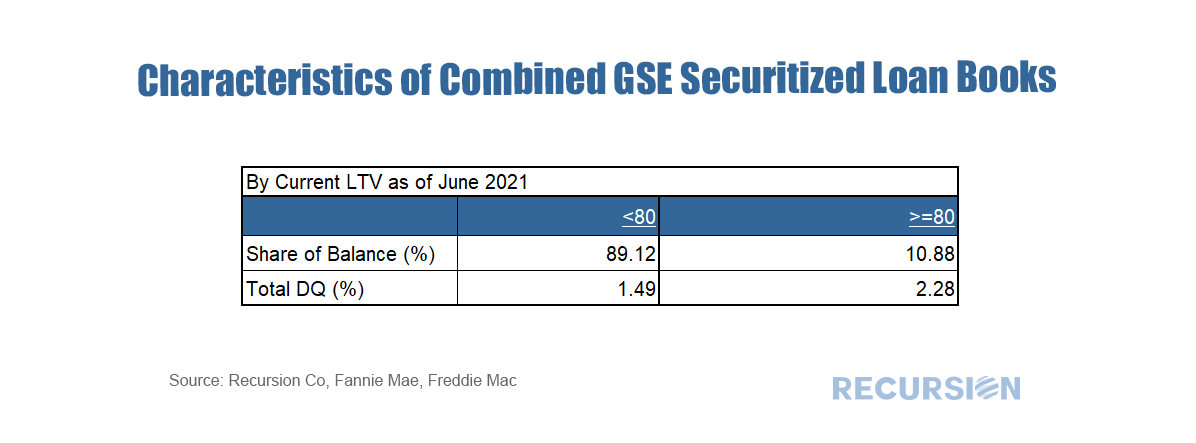

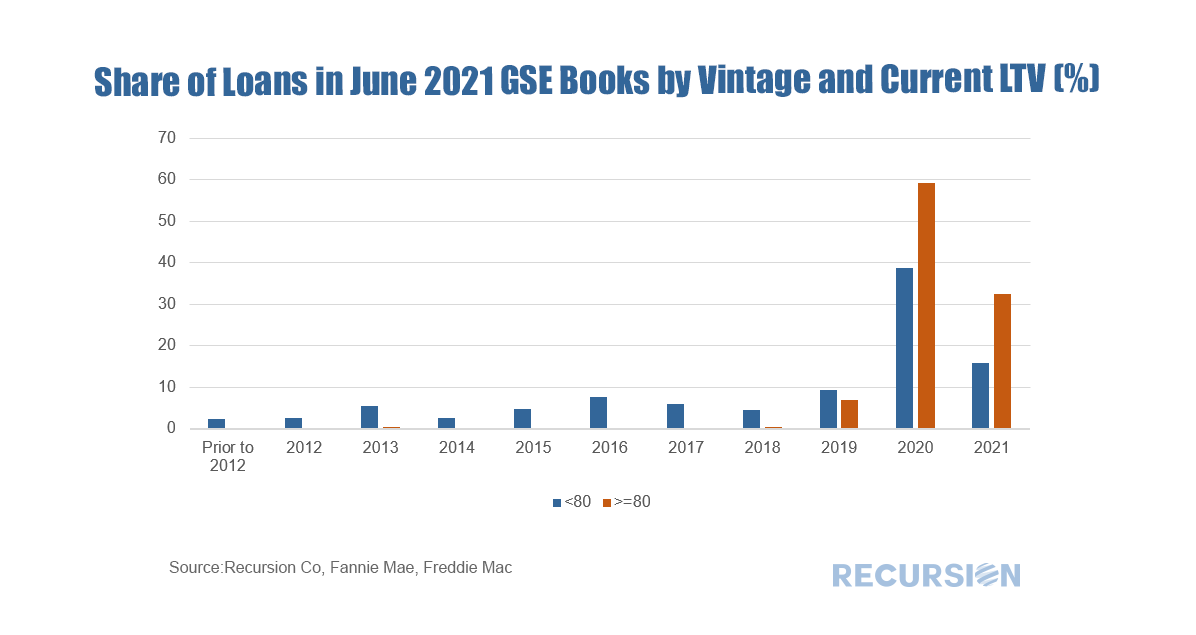

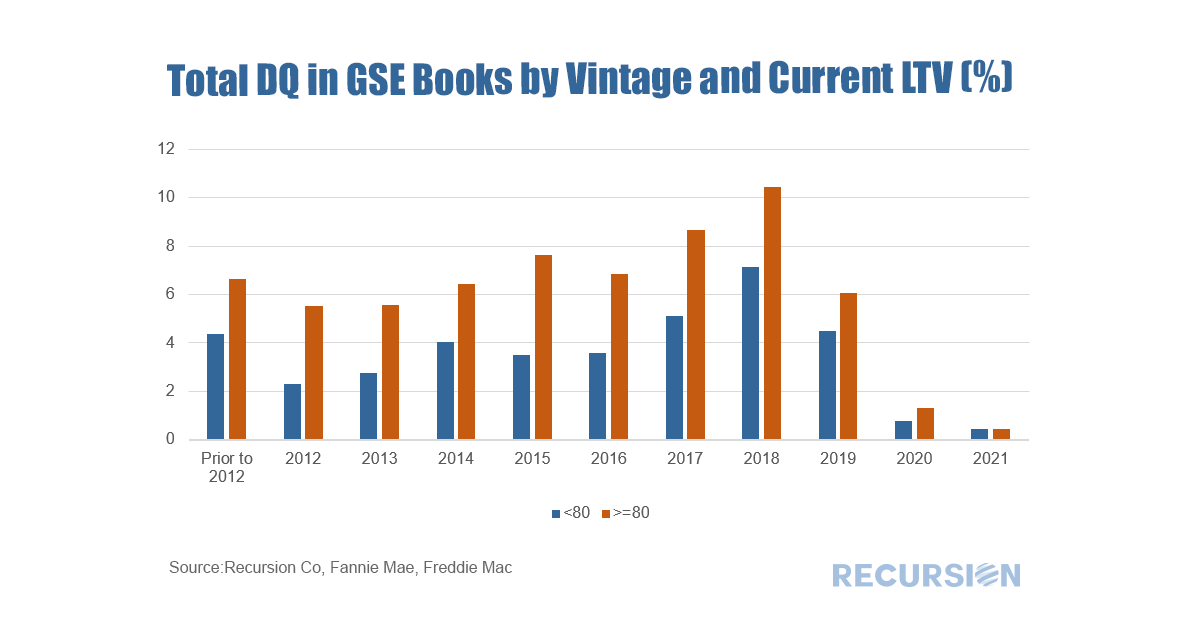

The new FHFA Acting Director Sandra Thompson has lost no time in implementing new policies designed to support homeownership with the aim of creating greater wealth equality. This is the basis of the New Housing Policy we described in a recent post[1]. At first, this involved extending foreclosure moratoriums for distressed families until the end of the year[2]. Then recently, the GSE regulator announced a change in its modification policy to broaden the eligibility for rate mods to any qualifying household that were previously only available to those with a mortgage greater than or equal to 80% of the current home valuation (Current LTV>=80)[3]. This program is designed to allow as many credit-worthy borrowers to stay in their homes as possible. The LTV limit is significant because the surge in house prices we have witnessed over the past year has meant that a relatively small share of loans should have Current LTVs greater than or equal to 80. Our loan-level data set allows us to examine this question by looking at over 25 million GSE loans. Below finds a snapshot of the total combined June books of the GSEs broken down in this manner: In fact, almost 90% of the loans in this sample have Current LTV’s <80. There are several caveats that should be considered regarding this calculation. First, this is for loans in securities and does not include loans held on the books of the Enterprises. Second, our mark-to-market calculation is rather rough as we apply the FHFA House Price Index at the state level to the price of the loan at origination to obtain the Current LTV. The most recent observation is April data released in late June. Nonetheless, this serves as a robust “back of the envelope” showing that the extent of the potential number of households that can be helped in this manner is material. Of course, additional mods means additional prepayments as loans are purchased out of pools. An interesting follow-up question along this line is to look at the distribution of these loans by vintage. Given the sharp rise in house prices, it’s not surprising that mortgages with Current LTVs >=80 are concentrated in the most recent vintages. Expanding the size of the population eligible to receive a mod without any LTV restrictions creates the opportunity to more seasoned loans. In order to capture the sense of how significant this impact is, we can view the total DQ rate by vintage: The elevated DQ rates for older vintages imply that prepayments will likely be felt in pools with seasoned loans. Of course, we are just getting started with new policies, this looks to be just the leading edge of a wave of new measures to come. Fortunately, the market has at its disposal innovative digital tools to assess the new policies. [1] https://www.recursionco.com/blog/the-dfa-the-scf-and-the-new-housing-policy

[2] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Protects-Borrowers-After-COVID-19-Foreclosure-and-REO-Eviction-Moratoriums-End.aspx [3] https://www.fhfa.gov/Media/PublicAffairs/Pages/FHFA-Expands-Use-of-IRR-to-Help-Borrowers.aspx |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed