|

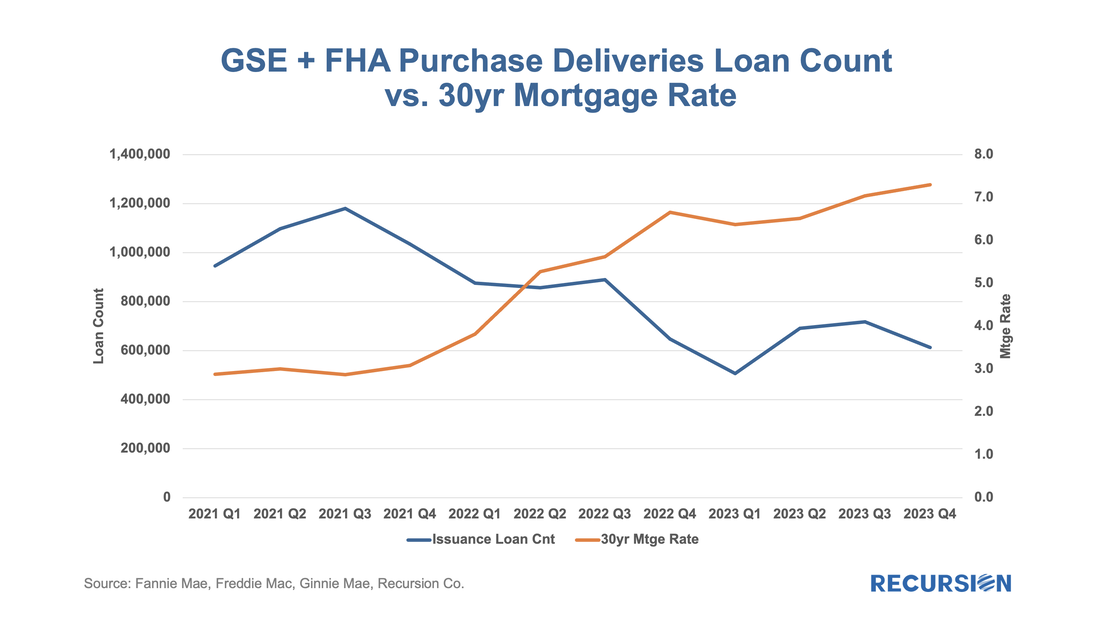

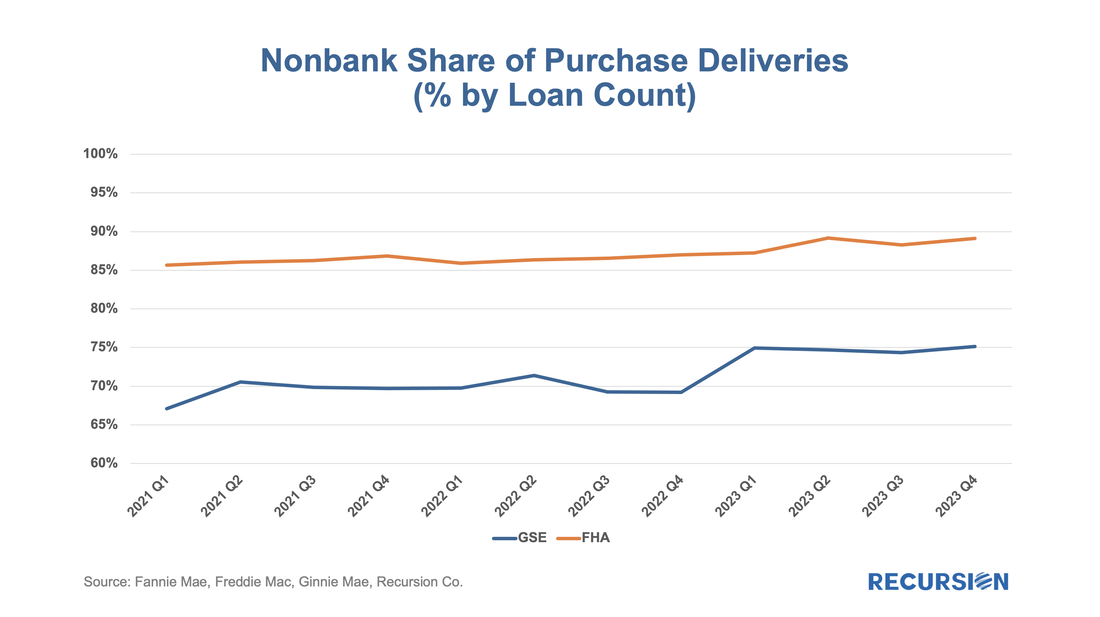

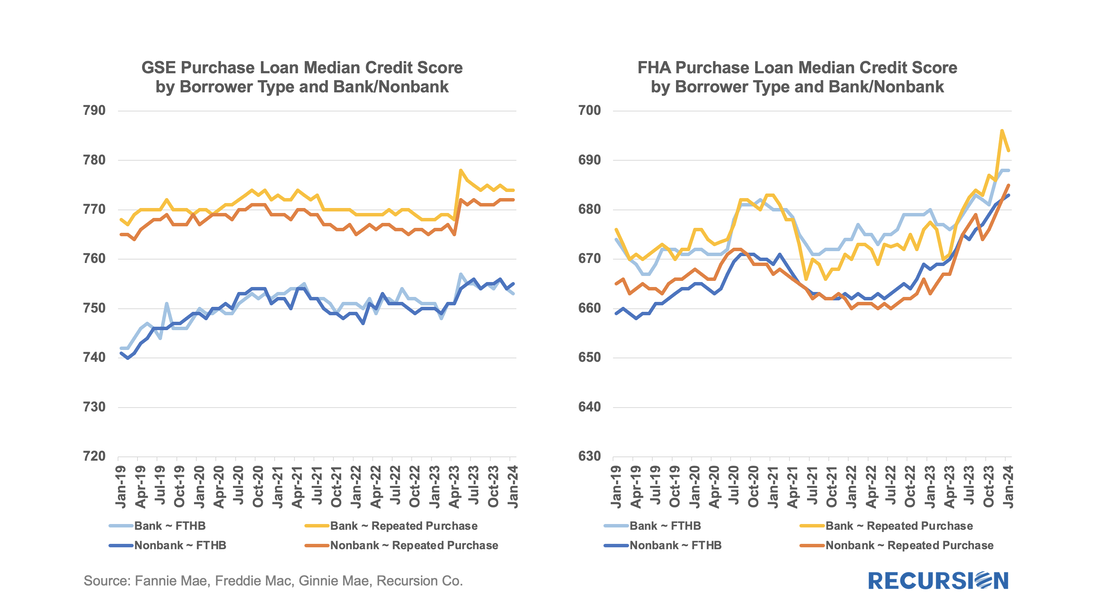

On March 8, 2023, Silicon Valley Bank (SVB) announced a loss of $1.8 billion in a sale of assets and collapsed two days later. The ensuing market turmoil resulted in a string of bank failures and a temporary surge in Federal Reserve lending to the banking sector. What impact has this event had on the mortgage market? To answer this question, we need to be able to distinguish the impact of the SVB collapse from other factors that can impact bank lending. The economy in general and labor markets in particular have posted robust performance statistics over the past year. Mortgage rates, which were about 6.75% in early March last year, surged to a 23-year peak of 7.75% in November and currently stand nearly unchanged from a year ago at about 6.75%. The negative correlation between deliveries and the mortgage rate is clear. However, there is a distinct drop in deliveries in Q1 2023, followed by a modest recovery, implying that the turmoil in the banking sector in that period can also be a factor in the pattern we see here. Another perspective can be obtained by looking at the bank/nonbank share over this period: Here, we see a sharp jump in the share for both conforming and FHA deliveries, which has persisted since the collapse of SVB. While this event has likely had some impact on aggregate deliveries, it seems that the more interesting ramifications are felt in the market structure. There is also the question of the mechanism through which this event had the observed consequences. A likely vehicle is changes in the underwriting standards of different categories of lenders: A recent CFPB analysis found that the distribution of credit scores shifted upward during the pandemic, “suggesting that pandemic-era mortgage forbearances, the federal student loan repayment pauses, and federal cash transfers that improved some consumers’ financial wellbeing drove the overall increases in credit scores.[1]” And in fact, for both FHA and GSE deliveries we see an increase in credit scores that has persisted. It’s interesting to note that, for conventional loans, while bank tightening was initially greater than that for nonbanks, the credit score spreads between banks and nonbanks have reverted to pre-bank crisis levels for both loan categories. However, there is a jump in credit scores in Q1 2023 (most evident with conforming borrowers) that can’t be accounted for by this factor. This period corresponds to the period of volatility associated with the collapse of some medium-sized banks, notably SVB. The SVB crisis has triggered a sequence of regulatory actions. In July of 2023, the Federal Reserve proposed revised rules that would apply to a wider set of banks that would increase bank minimum capital requirements. A recent report by Fitch ratings states that: “New proposals enacting the final Basel III standard for US banks were unveiled in a speech by the Federal Reserve’s vice-chair for supervision, Michael S. Barr. The revised rules would apply to a wider set of banks, starting from those with USD100 billion in assets, and would increase bank minimum capital requirements by 2pp.[2]” Bank supervision remains a hot topic for both regulators and market participants a year after the SVB collapse, renewed perhaps by recent turmoil at New York Community Bank[3]. This conversation occurs at the individual lender level, based on their balance sheet characteristics. Recursion’s new tool, Bank Call Report Analyzer, will allow us to combine our detailed mortgage data with financial information by bank lender. Stay tuned. There is more to come. [1]https://www.consumerfinance.gov/about-us/blog/office-of-research-blog-credit-score-transitions-during-the-covid-19-pandemic/

[2]https://www.fitchratings.com/research/banks/bank-regulation-monitor-highlights-new-us-capital-rules-reflections-on-resolution-12-07-2023#:~:text=New%20proposals%20enacting%20the%20final%20Basel%20III%20standard,would%20increase%20bank%20minimum%20capital%20requirements%20by%202pp. [3]https://www.reuters.com/markets/us/new-york-community-bancorps-latest-troubles-2024-02-07/ |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed