|

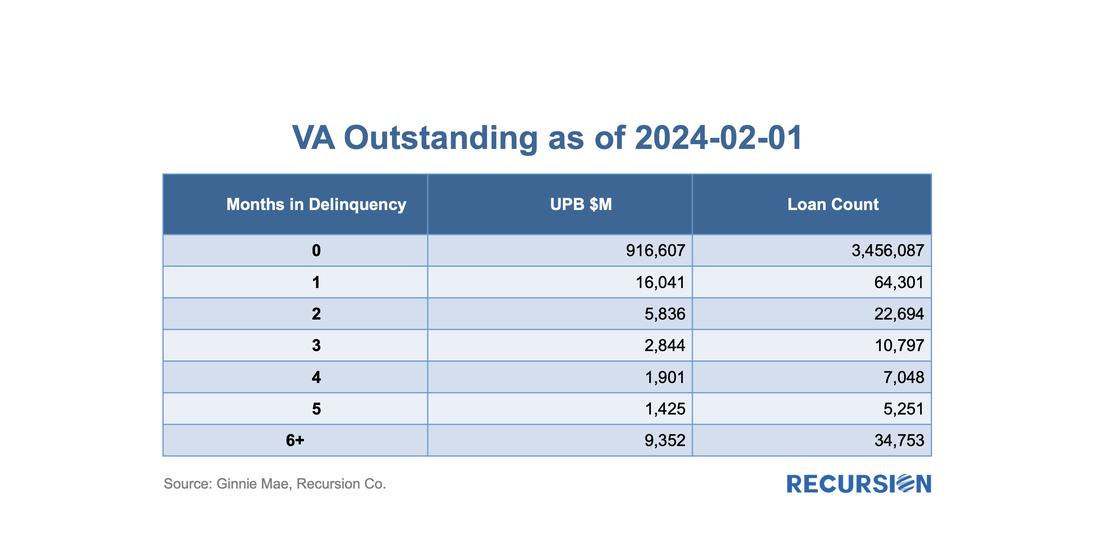

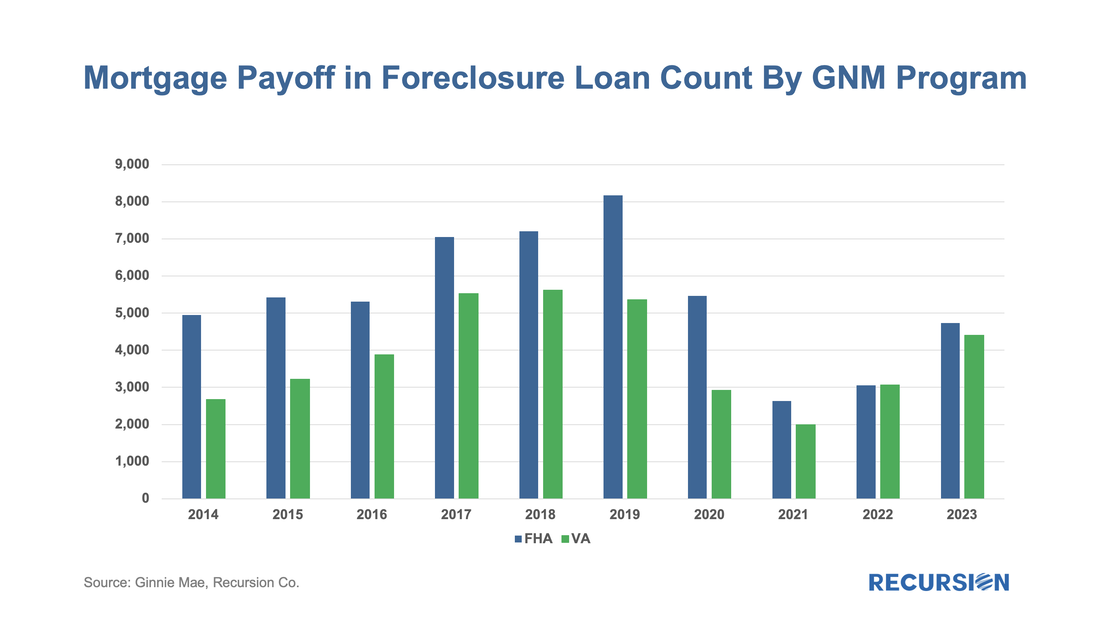

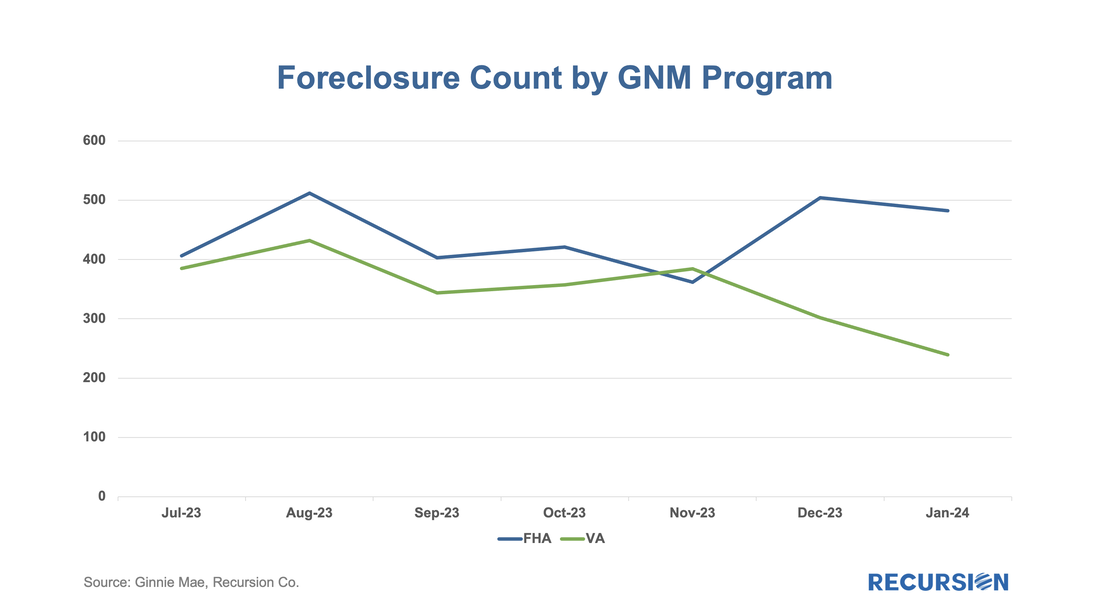

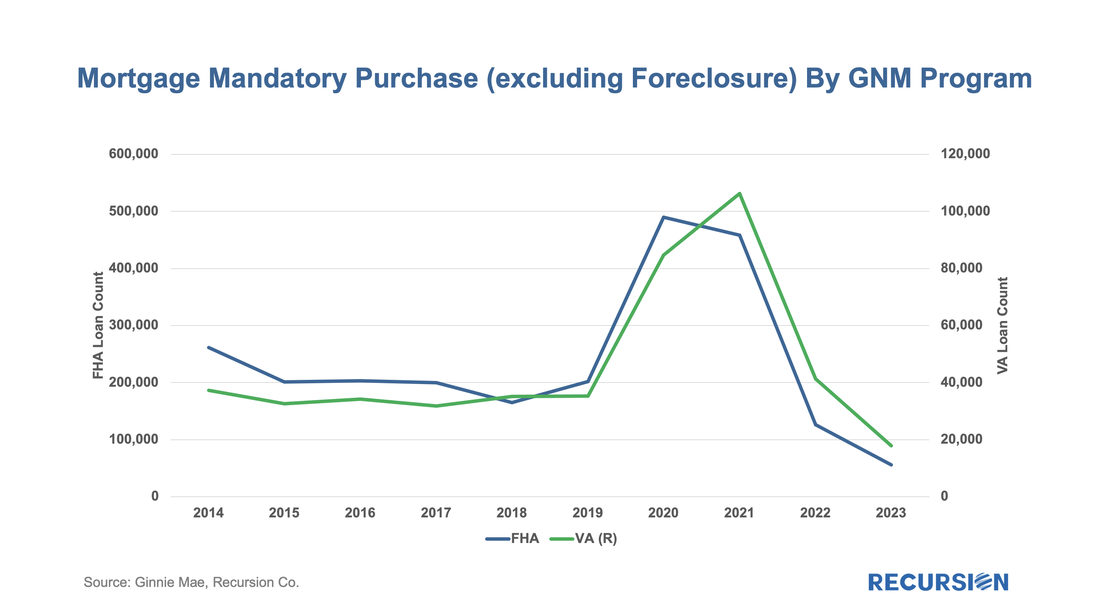

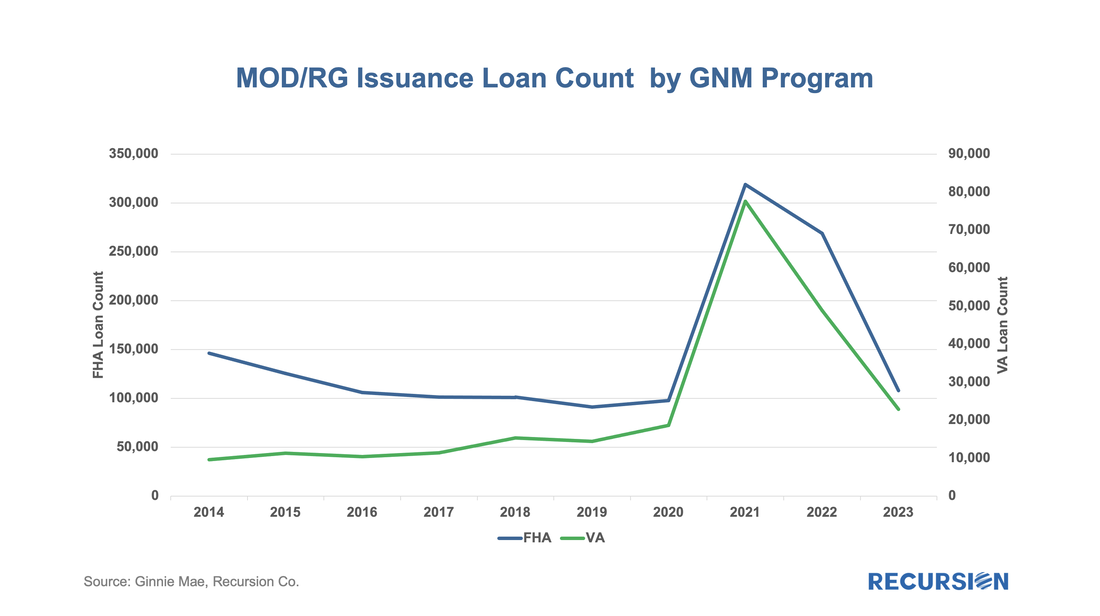

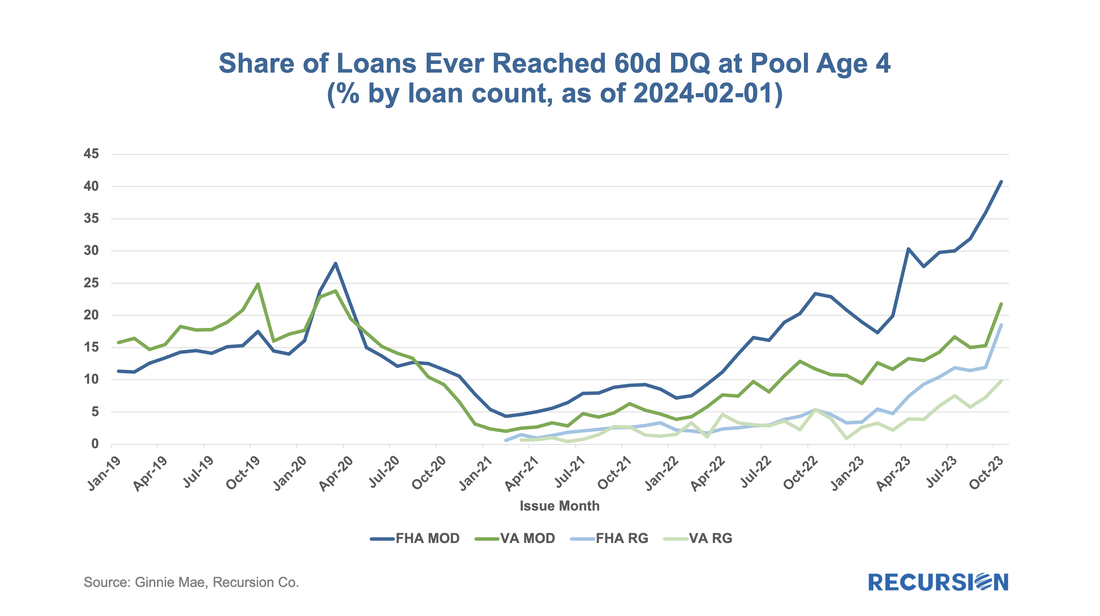

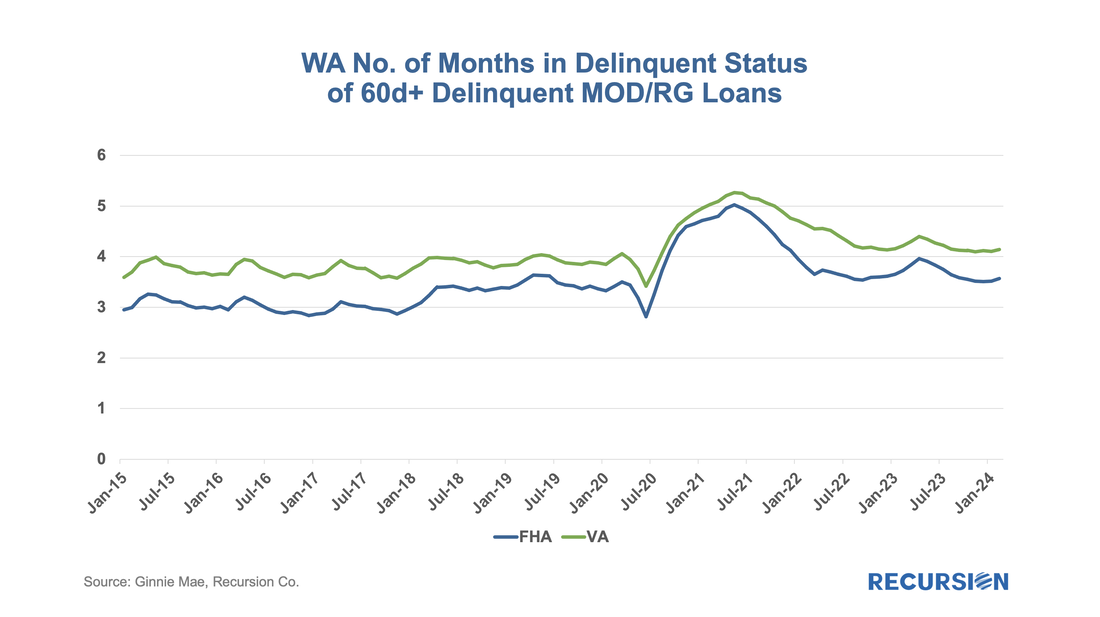

On November 30, 2023, the Veterans Administration (VA) announced a new home retention program called the VA Servicing Purchase (VASP) program as an option for borrowers who cannot be assisted through other home retention options[1]. As the program will not be rolled out until March 2024, VA has strongly encouraged a foreclosure moratorium on all VA-guaranteed loans through May 31, 2024. Under this program, VA will exercise its statutory option to purchase the loan from the servicer and VA will hold the loan in VA's own loan portfolio[2]. The servicer will prepare a modification of the loan to increase affordability for the Veteran. As the vast majority of VA mortgages are securitized in Ginnie Mae pools, let’s first take a look at the outstanding balance and loan count of VA loans using data disclosed by Ginnie Mae: Note there are about 3.6mm VA mortgages with an outstanding balance of almost 1 trillion dollars. The average VA mortgage outstanding balance is $265K, which is higher than people would expect, as Ginnie Mae imposes no size limit on VA mortgages, and there are quite a few million-dollar mortgages securitized in the pools. It currently has 64.3k loans that are 30 days delinquent, 22.6k in 60 days delinquency, and 57.8k in 90 days plus delinquency. It's worth noting that the number of the 90-day plus delinquent loans is lower than the 95k figure provided by the VA, as some of the seriously delinquent mortgages have already been removed from the pools. While we wait for the program details it seems worthwhile to look at recent trends in data, and here are a few takeaways: 1. VA mortgages are more likely to be subject to foreclosures than FHA: In 2023, the number of loans repurchased in foreclosure from FHA and VA are almost identical. However, we know there are nearly twice as many FHA loans securitized in Ginnie Mae pools. We can see a rising trend from 2014-2019, then a drop presumably due to forbearance, then an increase as these programs have run out. The interesting thing is that the VA count is very close to that of FHA in 2022 and 2023, whereas previously, FHA’s count was always bigger. It seems, therefore, that foreclosure prevention has recently been more active for FHA borrowers compared to those in the VA program. Such results might have prompted a move to a more aggressive tack for VA borrowers in this regard. In fact, the VA moratorium announcement already seems to be having an impact: 2. The mandatory purchase exit of FHA loans by loan count in general is five times that of VA. Again, considering the difference in loan count between FHA and VA, we conclude that FHA mortgages are ten times more likely to be repurchased via other loss mitigation programs than foreclosure. 3. The VA modification/RG issuance loan count remains proportionally lower compared to FHA due to its relatively smaller repurchase loan count. 4. VA Modified/RG loans have lower re-default rates than those of FHA. Here we look at the share of such program’s re-default rates four months after they are re-delivered to the Ginnie Mae pools. As we can see, both FHA/VA performance deteriorated; however, FHA is in much worse shape than VA. The most recent data shows that over 40% of FHA MOD loans have become seriously delinquent again, while for VA the figure is about 20%. 5. Issuers tend to let VA re-defaulted mortgages stay in the pools for a longer period, compared to those of FHA loans. This causes the serious delinquency rate of the VA MOD/RG program to be higher than that of FHA, despite the outperformance of the VA MOD/RG loans versus the comparable FHA program. Addendum This note would not have been possible without the help of our friend and client Mike Gill at the Housing Policy Council who died tragically earlier this month[3]. We mourn Mike’s passing but remain inspired by his professionalism and devotion to his community. [1] https://www.benefits.va.gov/HOMELOANS/documents/circulars/26-23-25.pdf

[2] https://www.federalregister.gov/documents/2023/11/27/2023-26083/agency-information-collection-activity-department-of-veterans-affairs-servicing-purchase-vasp#:~:text=This%20option%20will%20assist%20Veterans,in%20VA's%20own%20loan%20portfolio. [3] https://www.housingpolicycouncil.org/_files/ugd/d315af_743db840759541b996f45bc6249cb99e.pdf |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed