|

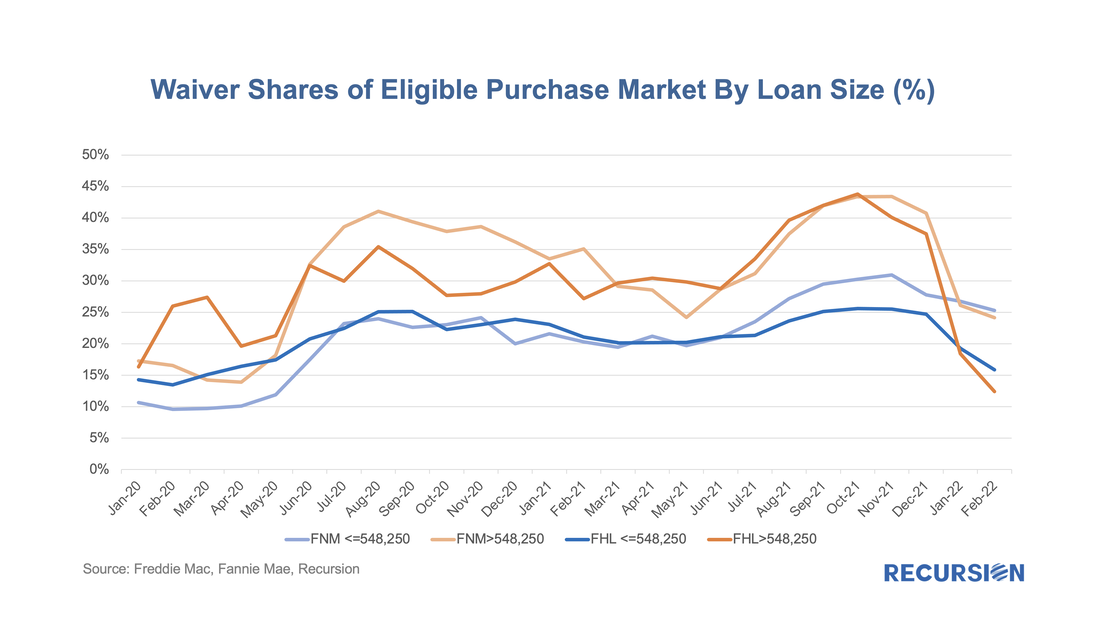

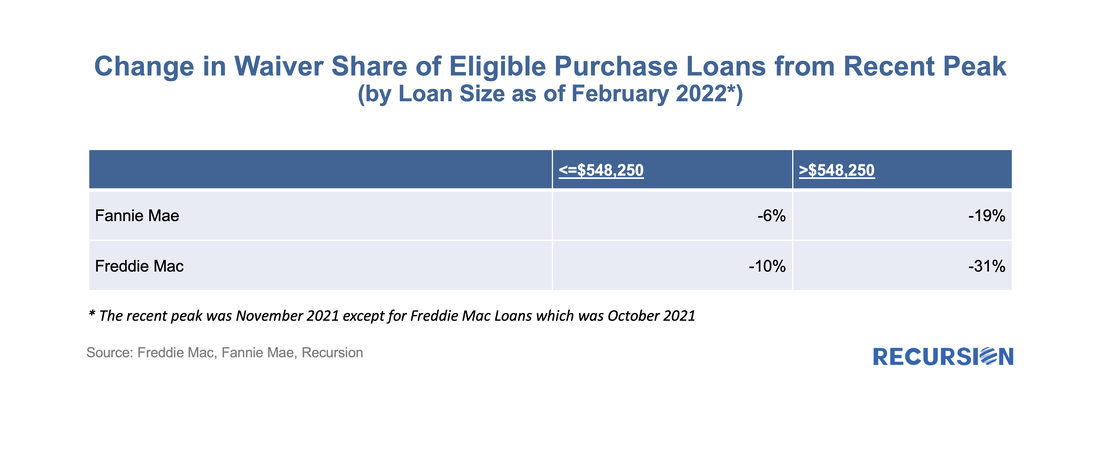

We’ve noticed that the prevalence of appraisal waivers for purchase mortgages within the eligible population peaked in Q4 last year, and recently has gone into steep decline. Our working thesis as to what is behind this trend is that lenders are getting concerned about the rapid pace of home price increases and want the additional security associated with an on-site appraisal. If this is indeed the case, we should see a greater decline in this share for larger mortgages than for smaller ones. So we break up the universe by GSE, and by loans above and below 2021’s conforming loan limit of $548,250: There are two major results. First, the decline in the use of waivers in February compared to the recent peak was considerably greater for larger loans than smaller loans. Second, the decline for Freddie Mac is materially greater than for Fannie Mae. This last point about the drop in valuation risk for Freddie Mac being greater than that for Fannie Mae is parallel to the greater increase in DTI risk we observe in the blog we published last week[1] for Fannie Mae relative to that for Freddie Mac. It seems that competitive pressures, perhaps stemming from the introduction of the UMBS, are leading to a broader tendency for risk-taking in loans delivered to Fannie Mae. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed