|

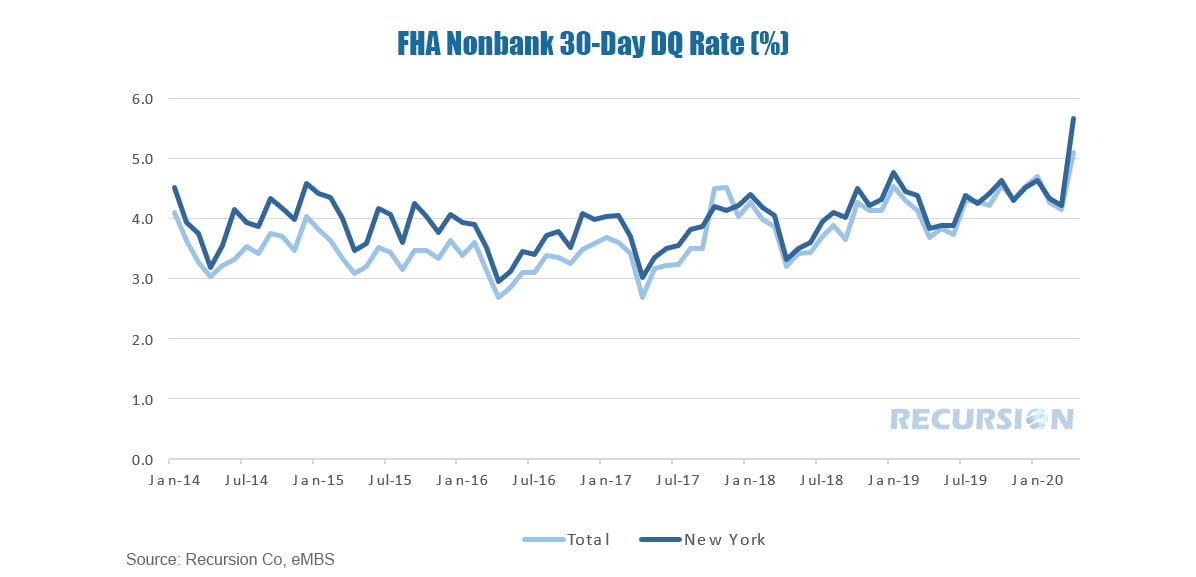

Late on the sixth business-day of every month, Ginnie Mae releases its updated loan tape that allows us to calculate the delinquency rates for its book of mortgages. We received the most recent tape this week, reflecting the mortgage payment activities in March. As most payments are due in the first half of the month, we did not expect to see a very large impact as the scale of the crisis was not fully recognized until the second half of the month. To check for traces of such an impact, we looked at short-term (30day) delinquencies (DQ’s) for loans serviced by nonbanks in the FHA program. We chose FHA because this program tends to support lower-income households, which are more likely to be impacted by the virus. We chose nonbanks because they tend to have somewhat looser lending standards than banks, and consequently higher delinquency rates. For the country as a whole, the 30-day DQ rate for nonbanks in FHA programs jumped by 0.95% to 5.10%, the highest obtained in more than six years. Such a modest increase might be due to several factors. To test for the virus cause, we looked at the same statistic for New York State, which has led the nation in infections. For NY State, the DQ rate on the same measure jumped by 1.46% to 5.67%, greater than the national average, after tracking closely for the previous several years. Of course, basing a conclusion on a single observation is always tenuous, but this observation tees up a framework for analysis for the wave of delinquencies that is sure to come. Access to enormous loan-level data sets across many characteristics will be essential for risk managers, investors and policymakers to make informed decisions regarding the management of the financial pressures that are just now being observed.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed