|

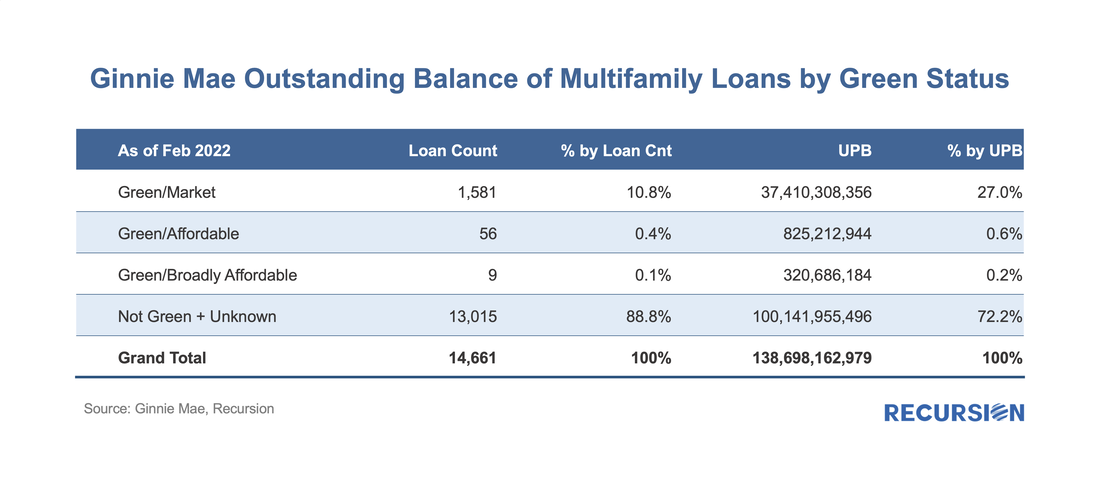

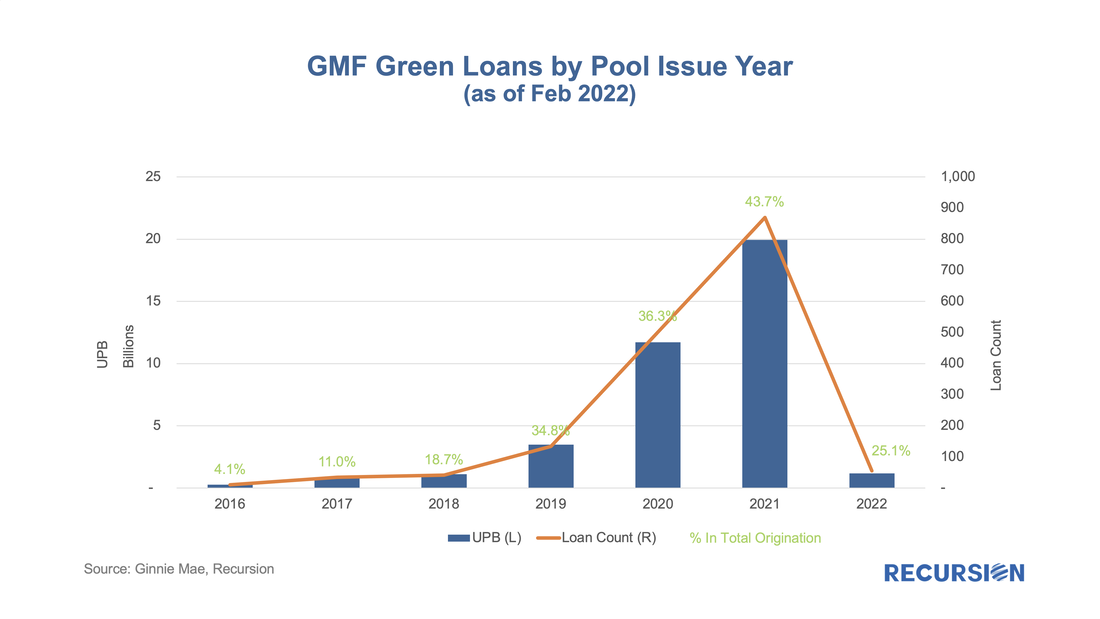

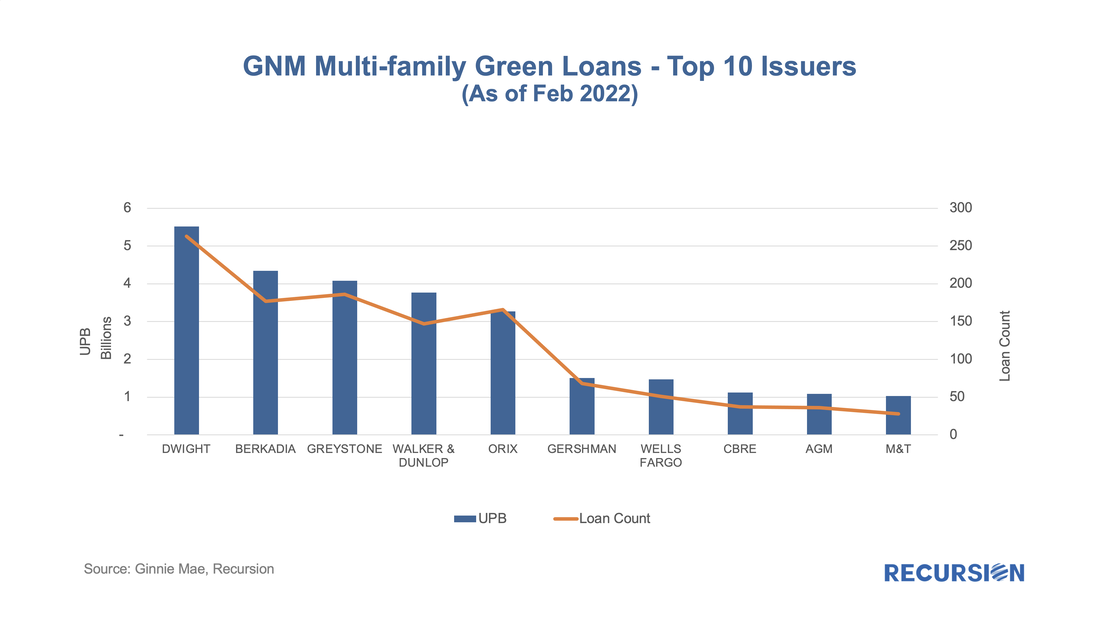

On February 15, 2022, Ginnie Mae announced it was adding a “Green Status” field to its multifamily disclosures, “giving investors information that supports their sustainable investing decisions and solutions.”[1] Specifically, “The new securities disclosure allows investors to easily identify multifamily mortgage-backed securities whose collateral meets the requirements of FHA’s Multifamily “Green” Environmental Product Programs. This will assist investors in acquiring suitable investments to meet their ESG mandates and improve the liquidity of the securities in the secondary trading to other ESG investors.” There are several broad observations that can be immediately taken from the new disclosure. First, Green loans tend to be larger than others. As of February 2022, over 12% of loans in Ginnie Mae multi-family pools by loan count contain the green flag, accounting for almost 28% of UPB. As a result, green loans stand about twice as big as those which do not fall in this category. The bulk of these units are market rate apartments meeting the Green building requirements or loans in the affordability categories accounting for less than 1% of both total outstanding loan count and UPB. Second, the trend in the share of total issuance derived from the Green space has risen rapidly, with the 2021 vintage standing more than ten times higher than that in place five years earlier, considering most of those loans should still be outstanding. Finally, the market for green loans is quite concentrated, with the top five issuers accounting for over 70% of volumes as measured by UPB. With the Green loan share of the multifamily market on a sharp uptrend, understanding the performance dynamics in this sector becomes increasingly important to investors in the Agency space. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed