|

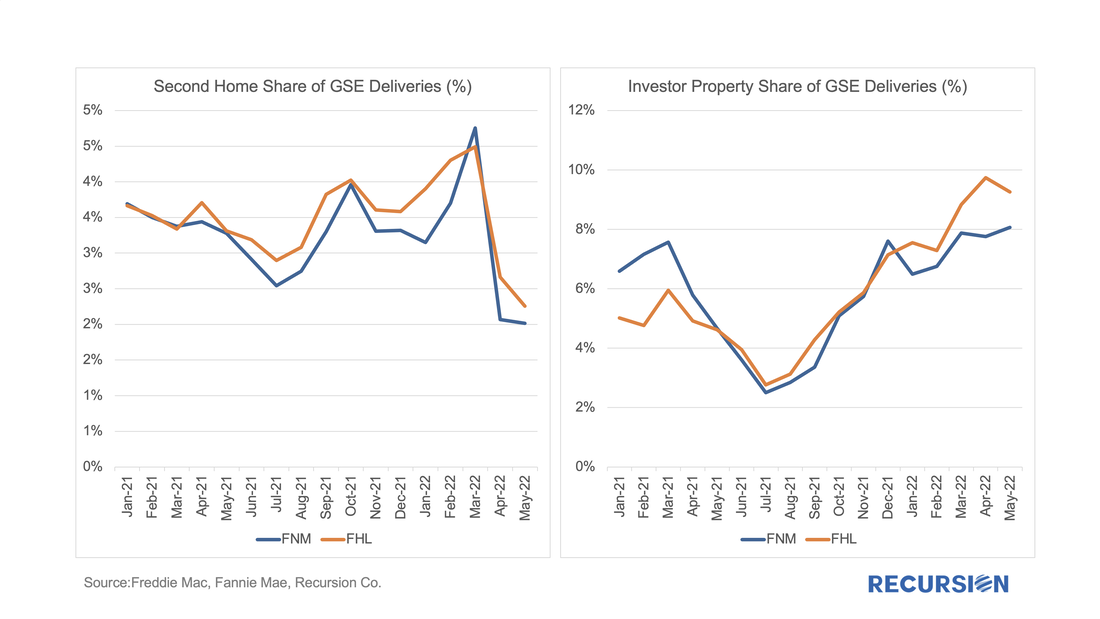

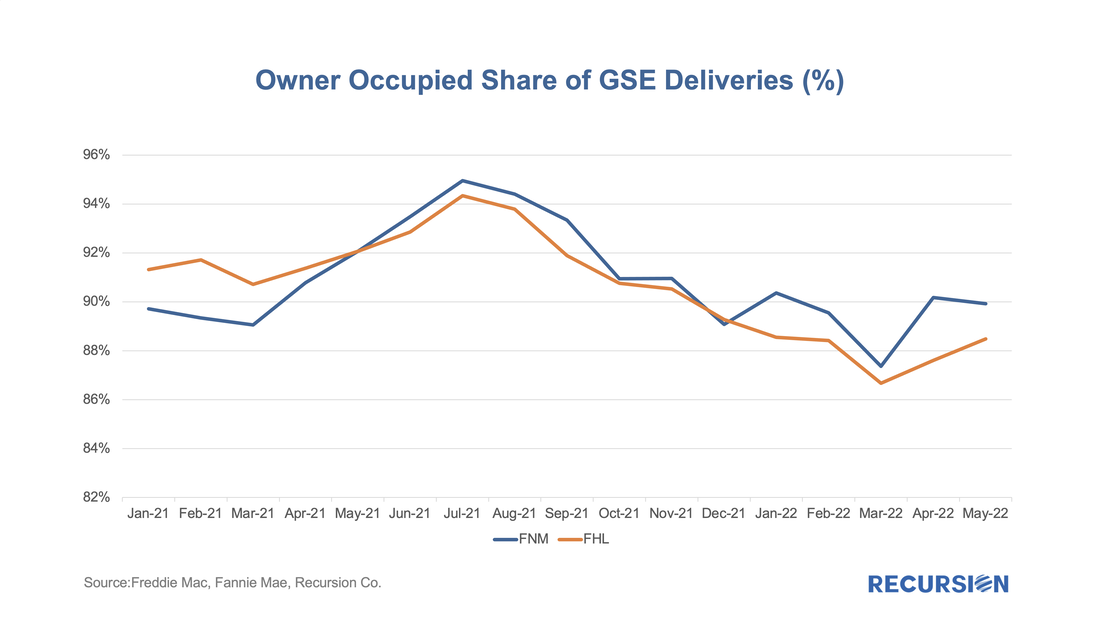

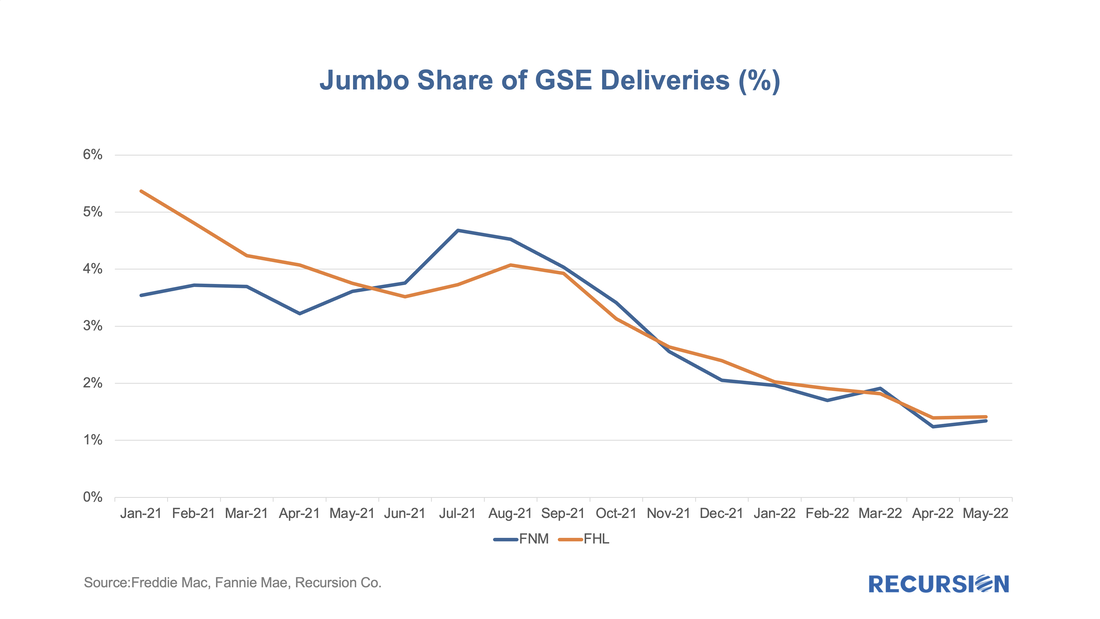

Over the past couple of years, we’ve witnessed some volatility with regards to FHFA’s approach to mortgages on second homes and investor properties (sometimes referred to non-owner occupied housing or NOO). In January 2021, FHFA announced that caps would be imposed to limit the acquisitions of loans backed by second homes and investment properties to 7% of the total on a rolling 52-week basis[1]. These caps were then suspended in September of that year. Then, on January 5, 2022, FHFA announced targeted fee hikes on second home mortgages and jumbo mortgages on loans delivered to Fannie Mae and Freddie Mac, to be implemented on April 1, 2022[2]. These up-front fees are tiered by LTV and for second home mortgages range from 1.125% and 3.875% and for high balance loans range from 0.25% and 0.75%. Borrowers in special affordability programs[3] are excluded from these fees, as are first-time homebuyers in high-cost areas whose incomes fall below 100% of the area median income. To see what if any impact these fee hikes have had on the targeted market segments, we look first at the share of conventional loans broken into second homes, investment homes and others, as measured by loan count. As might be expected, there was a run-up early in 2022 in the share of mortgages backed by second mortgages, followed by a sharp downward correction. The Investor share picked up in Q2 however. To get a somewhat different perspective, we look at the owner-occupied share: Which, for all the policy noise, doesn’t look like it’s changed much since early last year when all this started, raising the question as to how much of the loss in the share of second home collateral was a reclassification into the investor bucket. The long-term downtrend in jumbo deliveries to the GSEs is well-documented, as banks have a distinct preference to carry these loans on their balance sheets to support efforts to market other products to these borrowers. There was a small bump prior to the imposition of the new fees, but the downtrend immediately was reinstated. Effective financial market analysis involves an understanding of the behavior of the economic agents that demand and provide products in this space. And, a thorough understanding of institutional market arrangements, particularly policies. There is no approach that comes close to supporting this effort as loan-level big data tools in the cloud. [1] Non-Owner-Occupied (NOO) Mortgage Unbound - RECURSION CO [2] FHFA Announces Targeted Increases to Enterprise Pricing Framework | Federal Housing Finance Agency [3] A First Look at the Special Eligibility Programs - RECURSION CO Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed