Preparing for the Delinquency Storm — Using Big Data to Track Portfolio Risk in the Mortgage Market3/27/2020

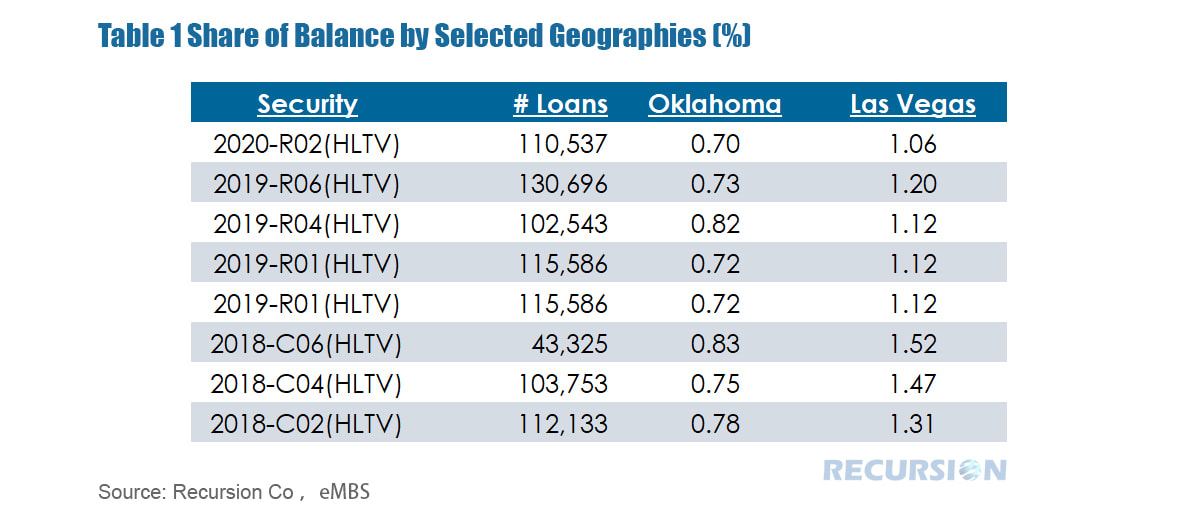

As US society goes deeper into “Shelter in Place” and “Social Distancing” to protect itself from the COVID-19 virus, jobs are being lost at a rapid pace. Jobless claims in the United States for the week ending March 21 came in at a record high 3.28 million. In turn, household finances are being stretched around the country. Fiscal stimulus and various debt forbearance plans can help to mitigate the damage, but families will have to make decisions about how to allocate scarce resources based on their own priorities. In the securitized mortgage backed securities (MBS) market, traditionally the two mortgage Government Sponsored Enterprises (GSE’s), Fannie Mae and Freddie Mac insure investors from “credit loss”, i.e. late payments from borrowers with conforming loans. Beginning in 2013, the GSE’s launched a new category of investment products called Credit Risk Transfer (CRT) that were designed to share credit losses with private investors. There are two similar programs, one for each GSE, Connecticut Avenue Securities (CAS) for Fannie Mae and Structured Agency Credit Risk (STACR) for Freddie Mac. Both programs issue notes whose return depends on the performance of a reference pool of loans in MBS. The notes are tranched so that investors can choose how much risk they are willing to take in the hope of generating returns. Tail risk, i.e. extreme losses is held by the GSE’s. The program has been quite successful, with outstanding balances at the end of 2019 standing at over $2 trillion and the notes are broadly held by a wide variety of investors, including mutual funds. As the economic landscape has thus far been quite pristine since the start of the CRT program, investors have largely experienced positive performance in this asset class. This record will be tested as the impact of the COVID-19 virus begins to pass through to these notes. In order to make informed investment decisions, Investors need to be able to parse the risks in these notes in various ways, using the information contained in the reference pool of loans. There are generally hundreds of thousands of individual loans involved, across a wide variety of characteristics. As a result, the parsing of this information is most efficiently accomplished using big data techniques. This note looks at examples of exposure by geography. First, we look at two geographies that may be suffering from severe economic shocks: Oklahoma with its dependence on the oil industry, and Nevada with its large tourism sector, particularly the Las Vegas MSA. Table 1 outlines the exposures of the high LTV collateral groups of eight recently issued notes in the CAS program to these two geographies based on percentage of total balance in the reference loans contained in each group. A second approach is to look at the geographic distribution of the loans referenced in a single group: Of course, a decision to invest depends on a myriad of factors, but in an environment of extreme uncertainty advanced tools are needed to identify risks and locate opportunity in financial markets.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed