|

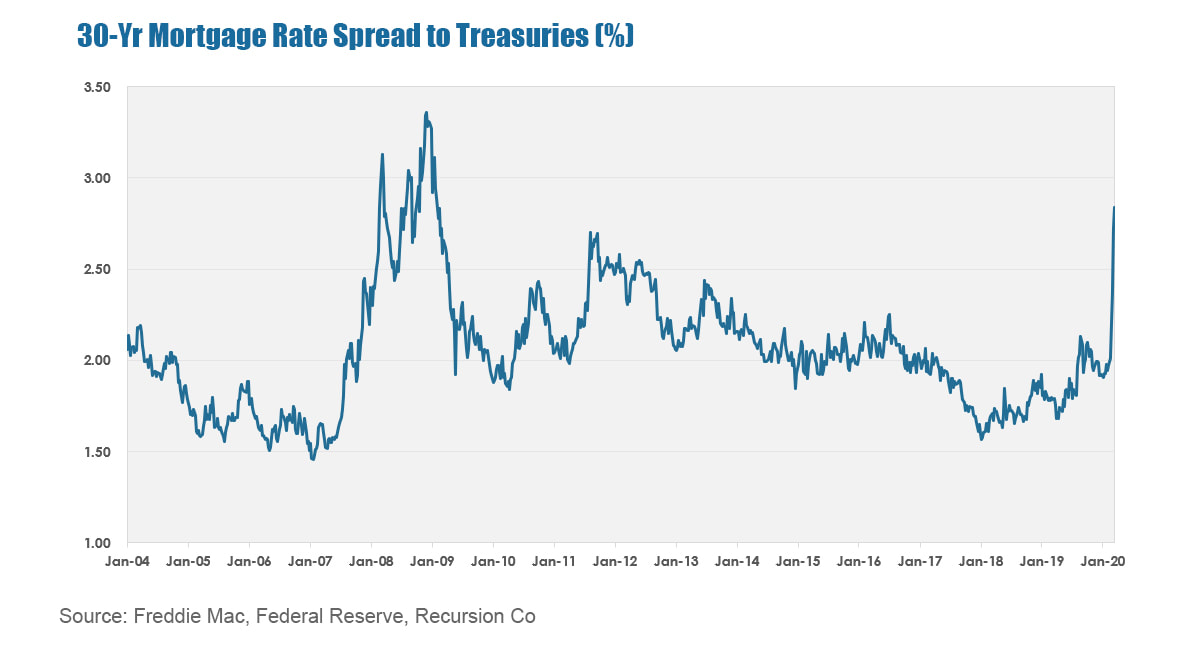

The onset of the COVID-19 virus has resulted in tremendous volatility in financial markets. The 10-year Treasury yield plunged from 1.9% at the beginning of 2020 to a record low near 0.5% in early March but has since rebounded to near 1.1% at present. The drop in Treasury yields has not been matched by a similar decline in mortgage rates. The 30-year fixed mortgage rate released by Freddie Mac on March 19 came in at 3.65%, just 0.07% below the level attained at the beginning of the year. Chart 1* Chart 1 shows the spread of the 30-year mortgage rate over the Treasury yield (as measured by the average of the 5-year and 10-year yields), revealing a spike up to levels not seen since the Global Financial Crisis (GFC) of 2007 – 2009. At that time, the Government took extraordinary measures such as putting the GSE’s into conservatorship and the Fed introduced large-scale asset purchases, including mortgages, and spreads fell rapidly. Now, uncertainty remains elevated and the market path dependent on the strength and duration of a pandemic that no one can predict. The Fed’s decision to restart its mortgage purchases on March 15 can push against the tide but cannot resolve the underlying issues.

The antidote to uncertainty is information, and market participants and policymakers will need to access the most advanced data tools to effectively monitor market behavior to inform their decision-making. *30-yr Mortgage Rate minus average (5-year & 10-year Treasury yield) |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed