|

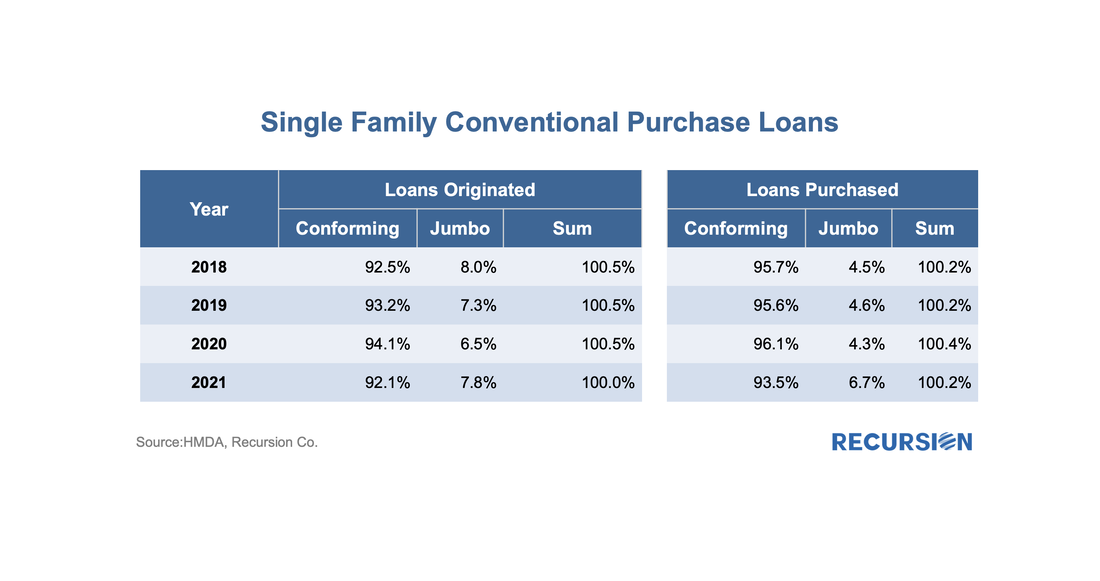

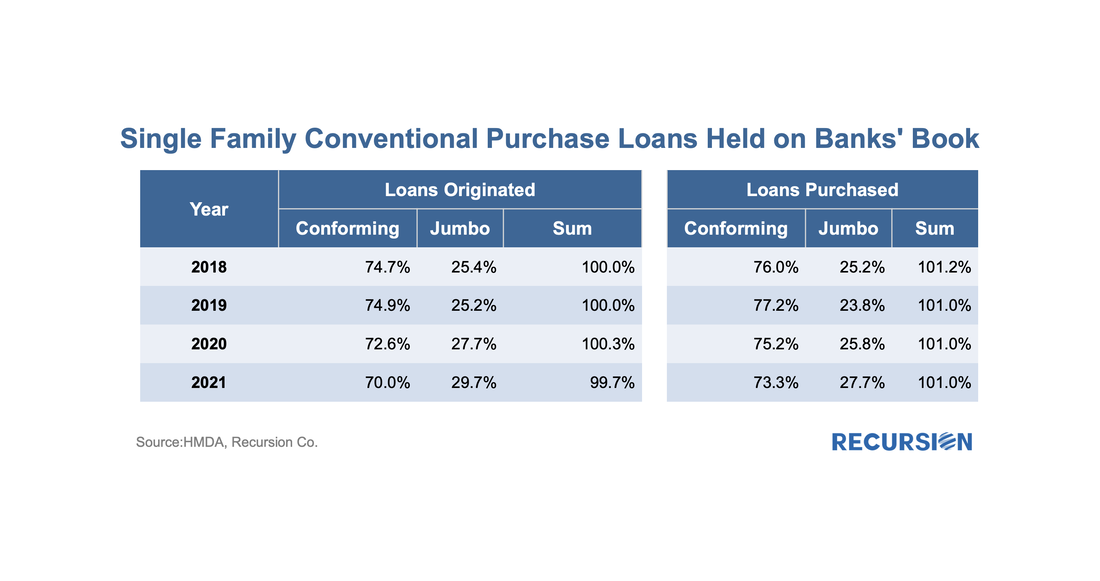

In a recent post, we discussed the attributes of manufactured housing data that came with the final 2021 HMDA release in July[1], which were not available in the preliminary release. Another important data point from this final release is the conforming flag, identifying which loans satisfy the requirements for delivery to Fannie Mae and Freddie Mac. Obviously, any loan sold to a GSE is conforming, so its main use is to enable analysts to examine these loans which are held on bank balance sheets. The lag between the preliminary and final releases of HMDA data can be four months or longer, so it would be useful to be able to identify these loans right after the preliminary release. One way to approach this is to flag non-government loans with balances above the conforming limits as “jumbo”. How does Recursion’s “Jumbo” flag compared with HMDA’s Conforming flag? If the information is perfect, “Jumbo” loans should be all the loans that are not “Conforming”. However, the exact original balance of a mortgage is not provided by HMDA to protect privacy. For those loans close to the conforming boundary, our program can misjudge which category to assign. Given all that, going back to 2018, there is still a very strong negative connection between the two measures: The quite small amount of double counting between the two measures, as we discussed, comes from the blurry boundary area of the conforming loan limit. We get similar results by looking only at loans held on book: The two flags provide almost the same information, particularly for originated loans held on book. One trend reflected by the data is that since 2019 and 2021, banks are holding more Jumbo loans on their books. Our “Jumbo” flag is available to clients who use the Recursion HMDA Analyzer, one of the many value-added enhancements that we provide in addition to the raw data. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed