|

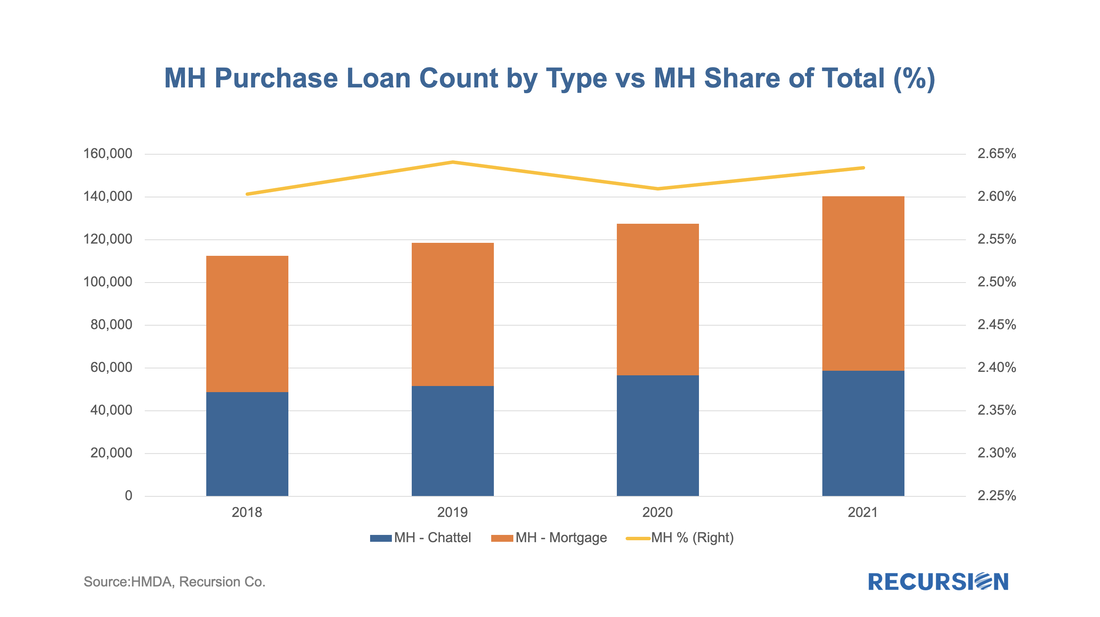

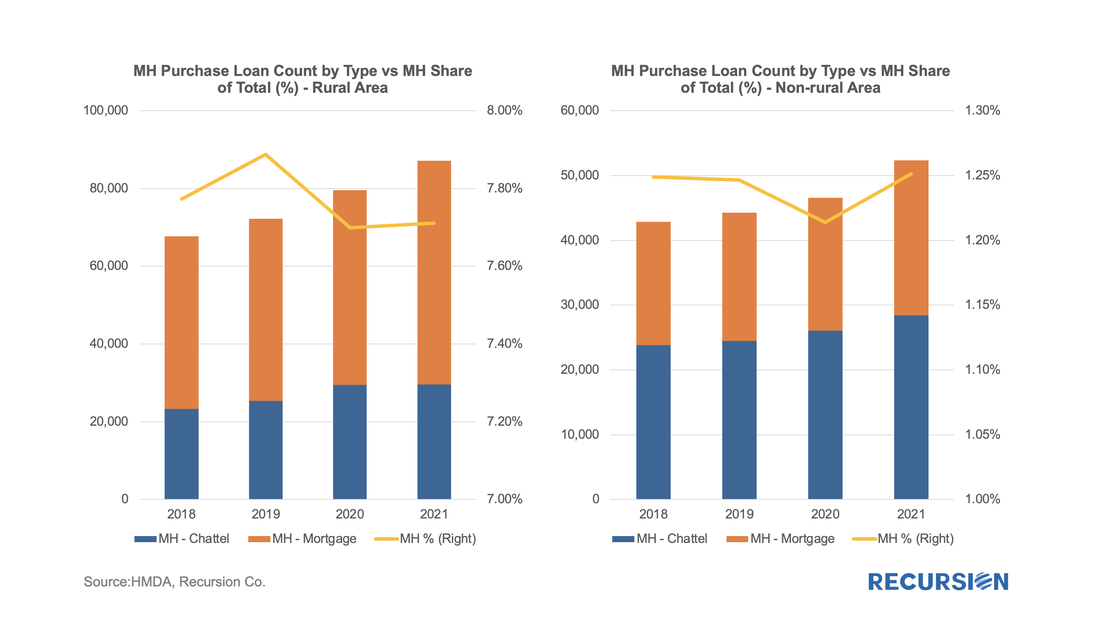

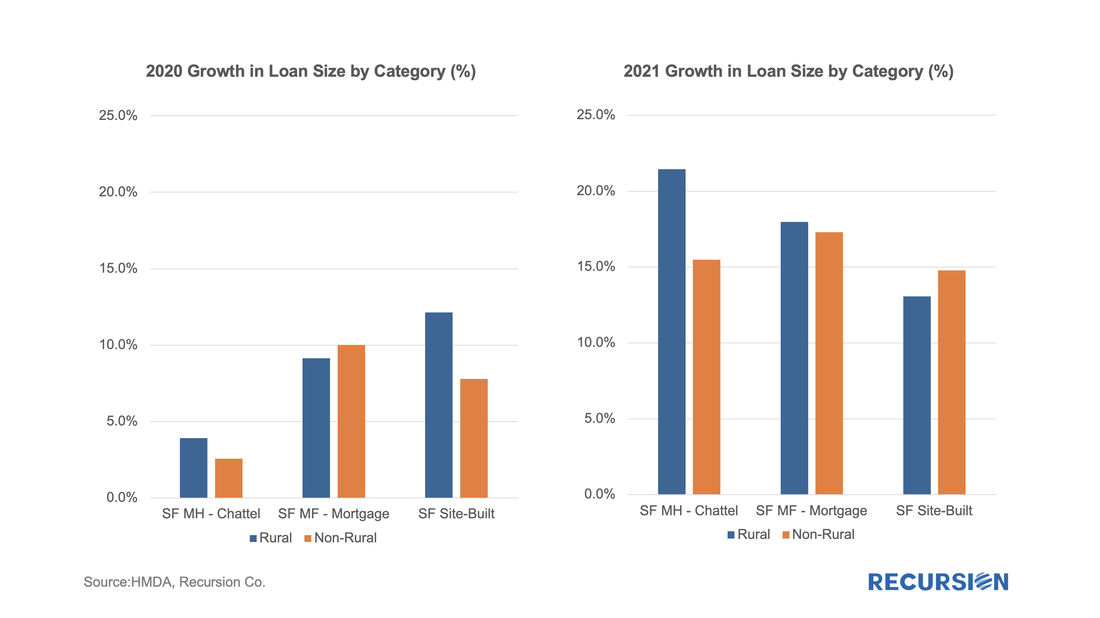

The release of 2021 HMDA data in March set off a familiar round of impactful analysis[1]. However, there are components that cannot be obtained unit the final release in July, including the important category of manufactured housing, a key piece of the policy discussion around affordable housing. Last year we dug into this topic[2] and it would be a good time to update this analysis with new information from the final 2021 release. First of all, manufactured housing experienced a resurgence in 2021: Manufactured housing regained most of the small loss in share experienced in 2020. Interestingly this was mostly due to a 15% increase in the total number of MH mortgage loans vs. 4% for chattel. As before, we then break this down between rural and non-rural MSAs: So the recovery in overall MH share in 2021 was due to an increase in non-rural areas while the share in rural areas held steady. Turning to loan size, it is well known that overall house prices surged in 2021, and it is notable that this held for each category of manufactured housing: Most striking is the surge in chattel loan sizes. It appears that the overall increase in prices drove demand for the cheapest category within the group. It will be interesting to see the impact of higher interest rates when 2022 data is released next year. [1] https://www.recursionco.com/blog/2021-hmda-takeaways [2] https://www.recursionco.com/blog/manufactured-housing-during-covid Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed