|

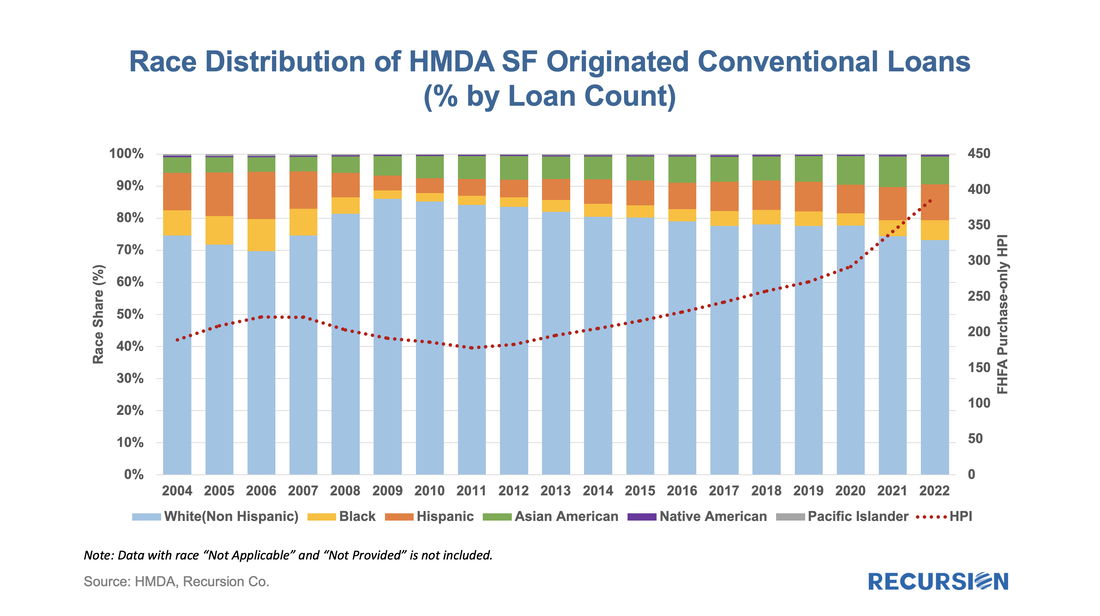

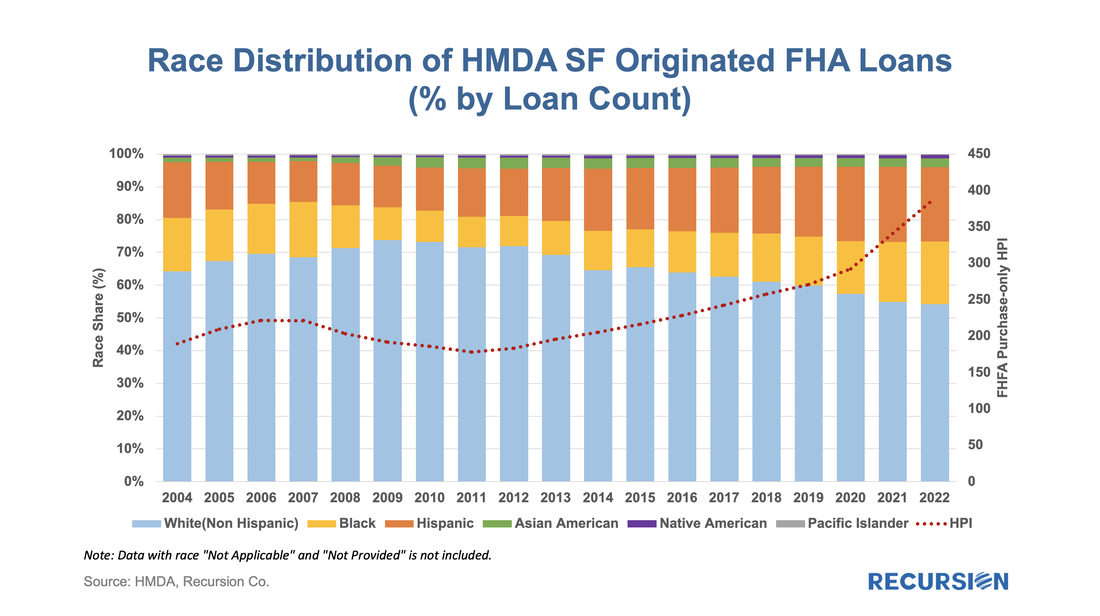

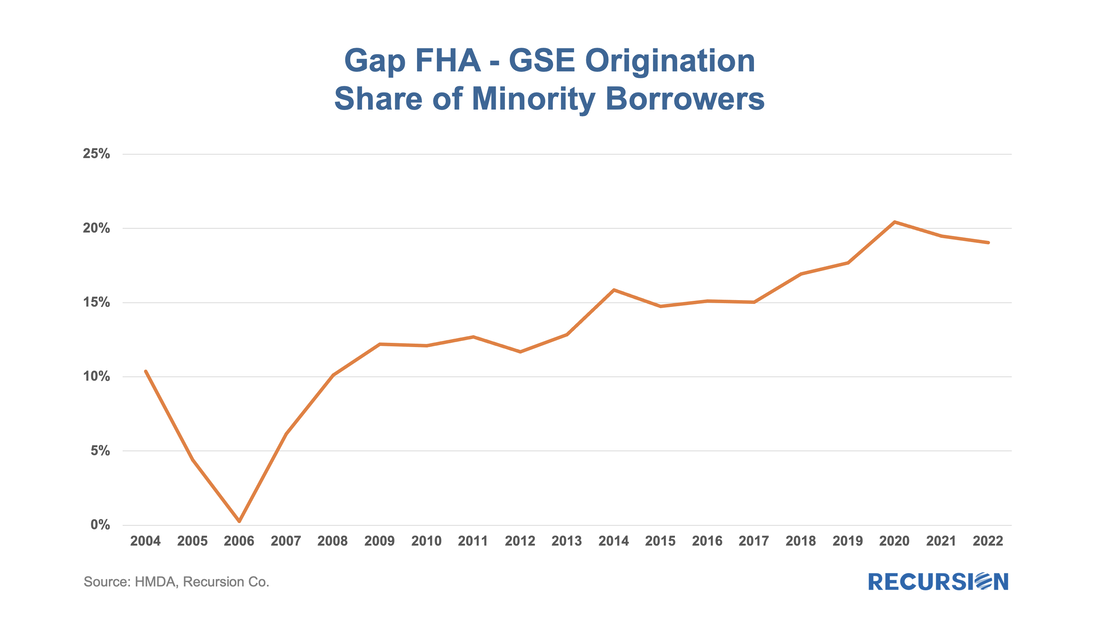

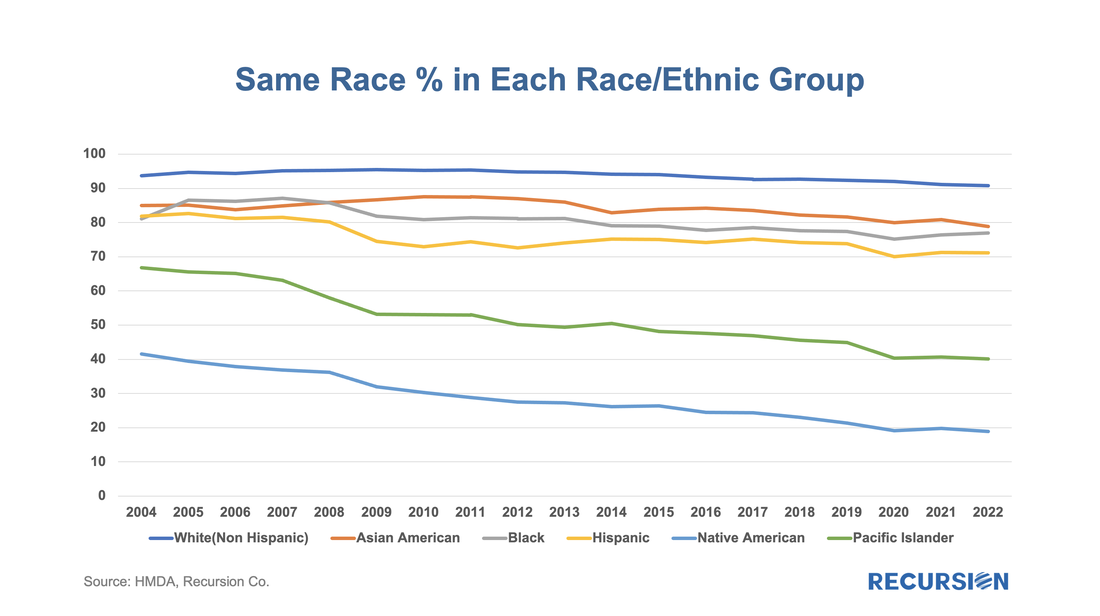

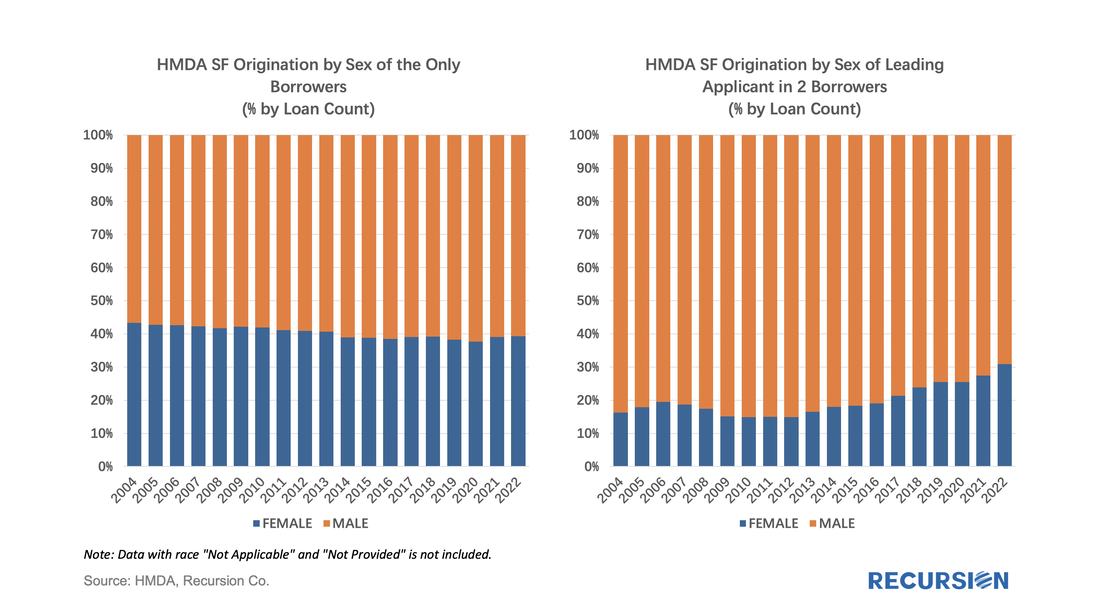

In a previous note, we looked at mortgage trends derived from the recent release of 2022 HMDA data[1]. Of course, HMDA is a prime data source for analysts and policymakers who seek to understand how social and economic trends interact. The most discussed issue is the distribution of originations by race. Below find a bar chart for the share of originations by race annually from 2004-2022 by loan count: And here for FHA: In both cases, we note the trend increase in the minority share over the last decade, with that for conventional loans rising by 1.2% to 26.8% in 2022, the highest level attained since 30.2% was reached in 2006. The same statistic for FHA last year was up 0.7% to 45.8%. The key question here is what is driving the trend increase in share. It is tempting to ascribe it to policy actions, but over time one can see a distinct negative correlation with home prices and the minority lending share. As prices rise, are minority households stepping up, or are white households stepping back? The answer to this question is of considerable interest to future policy designs. As the FHA share of mortgage given to miniroties reaches towards an unprecedented 50%, it’s also interesting to note that the gap in the minority share between FHA’s and the GSE’s has narrowed modestly in the past couple of years after surging at the start of the pandemic. We believe the shift to higher minority share in mortgage lending is not only related to policies, but also to the fact that the population is more diversified. Here is some evidence from HMDA data itself. Below find a chart of the share of loan provided to two borrowers with the same race, out of all two-borrower mortgages by race: A broad but not uniform trend of the racial composition of households can be seen. Unlike race distribution of the population, gender distribution is stable over time. We conclude with a couple of gender charts. Below find two charts, one on the gender of borrowers in single-person households and another on the share of the gender listed first in two-person households: The share of women in single-person borrower households has been quite steady, near 40% for the past two decades, while the trend of women leading two-person households in 2022 continues on the upward trend in place over the past ten years, over which time the share has more than doubled. Much more can be accomplished with this rich and robust dataset. Feel free to reach out with specific questions. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed