|

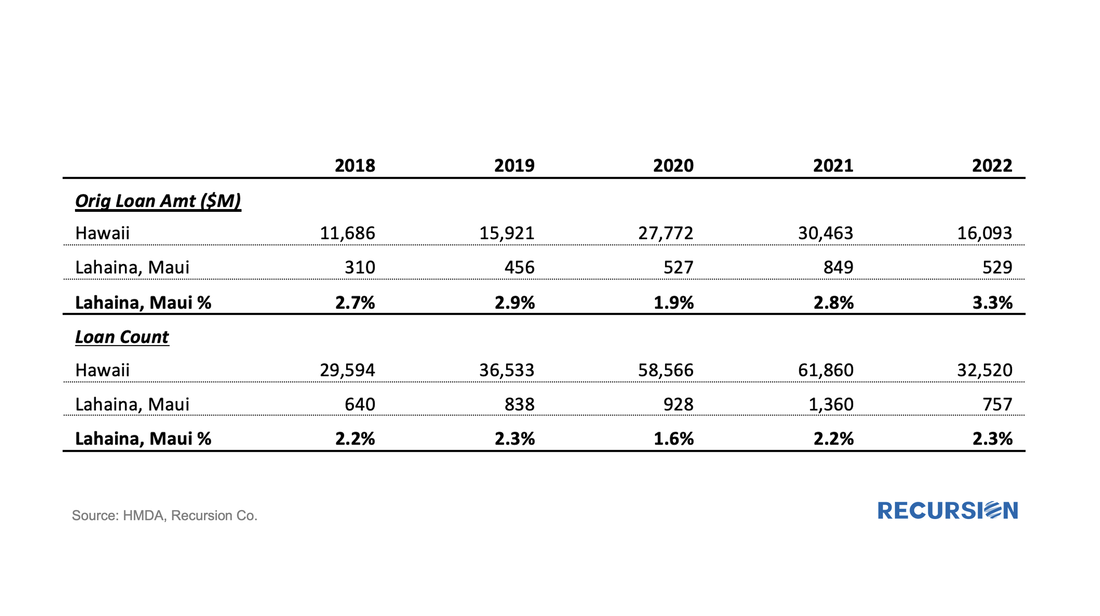

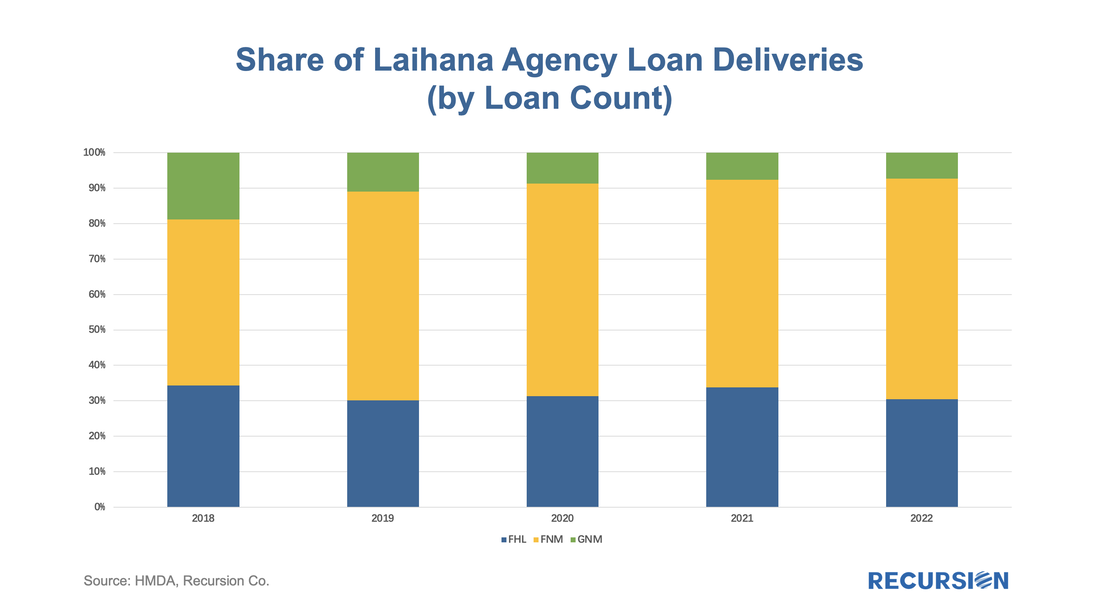

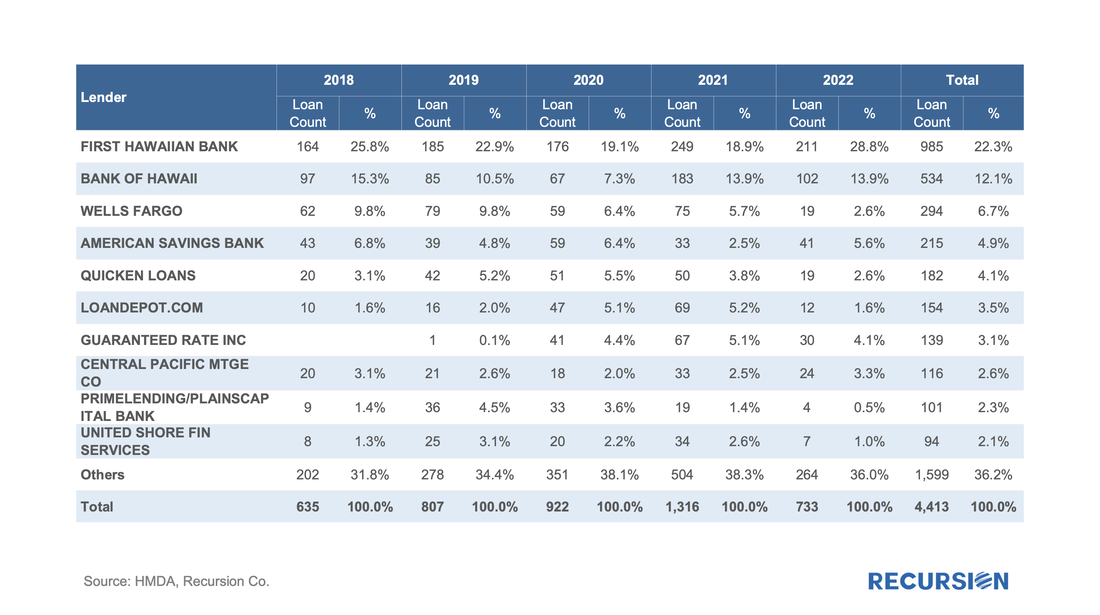

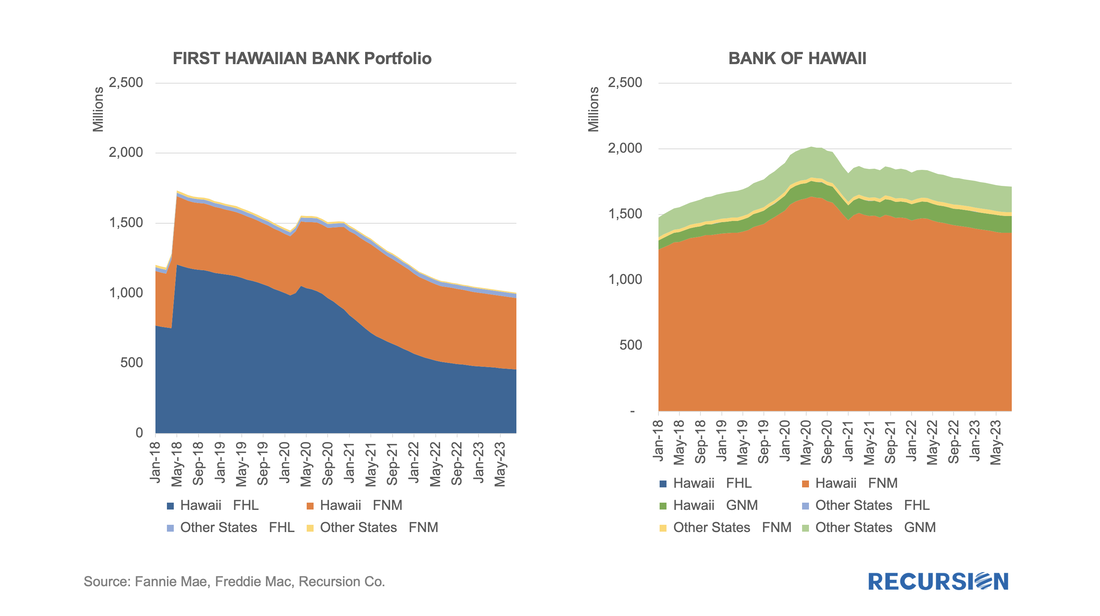

We get a lot of requests at Recursion, the bulk of which never make it to these posts, but one that struck home recently was from a regulator who asked what we know about Lahaina. Given the scope of this tragedy, we thought it worth the effort to talk about what we do and don’t have. Specific to that location, the answer is relatively limited. The Agency disclosure data is provided at the state level. The population of Lahaina was 12,700 as of the 2020 Census, out of a population of the Island (County) of Maui of 164,000 and 1.4 million for the state of Hawaii overall. So, this level of detail seems unlikely to be sufficiently granular to provide a basis for analysis. However, it seems we can take a bottom-up approach that may yield something of value. This would be based on the HMDA data. HMDA data has the advantage of granularity down to the census tract level. Out of over 84,000 Census Tracts, we can identify 6 for Lahaina. We can then pull-down originations from HMDA: So, the share of Lahaina’s mortgage market for all of Hawaii stands about 3% by original loan amount and 2¼% by loan count. This implies a somewhat higher median loan size in Lahaina than the state overall. We have some information for Agency deliveries: The notable takeaway here is that the share of loan sales by count to GNM out of total Agency shares has fallen sharply from 19% in 2018 to 7% in 2022. The Freddie Mac share also posted a decline (from 34% to 30%), while Fannie Mae’s share jumped from 47% to 62%. Then, there is the question of bank exposure to this market. Below find a table of the top 10 lenders by loan count in the Lahaina census tracts: The top two banks, First Hawaiian Bank and Bank of Hawaii have accounted for more than 30% of originations in recent years. To get a sense of what their book of business looks like, we turn to Cohort Analyzer to pull down their servicing distributions. We can only do this at the state level, but this provides a big-picture view of their overall strategies: For both lenders, conforming loans in Hawaii comprise most of their business, although First Hawaiian balances its GSE deliveries between Fannie Mae and Freddie Mac, while Bank of Hawaii delivers the lion’s share of its production in this category to Freddie Mac. First Hawaiian services virtually no loans in GNM programs while they comprise about 19% of Bank of Hawaii’s book.

In the coming months, we will get loan performance by Agency for loans in Hawaii by servicer. Insofar as the devastation is concentrated in the Lahaina area, we should be able to estimate the impact of the disaster, down to the servicer level. As we look around the globe, we see the impact of climate change as the key risk facing the housing market, and likely to stay that way for the indefinite future. A key question facing policymakers is whether they and the key market constituencies, borrowers, lenders, and investors have the information they need to make informed decisions. Looking at this exercise, it is clear that the current data disclosures fall far short of meeting this standard. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed