|

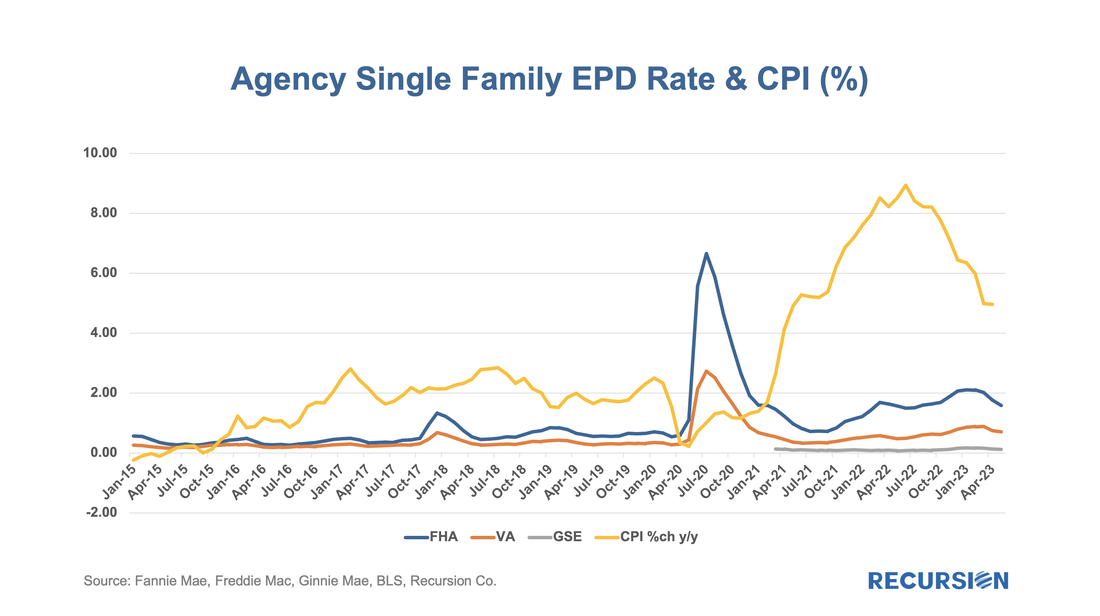

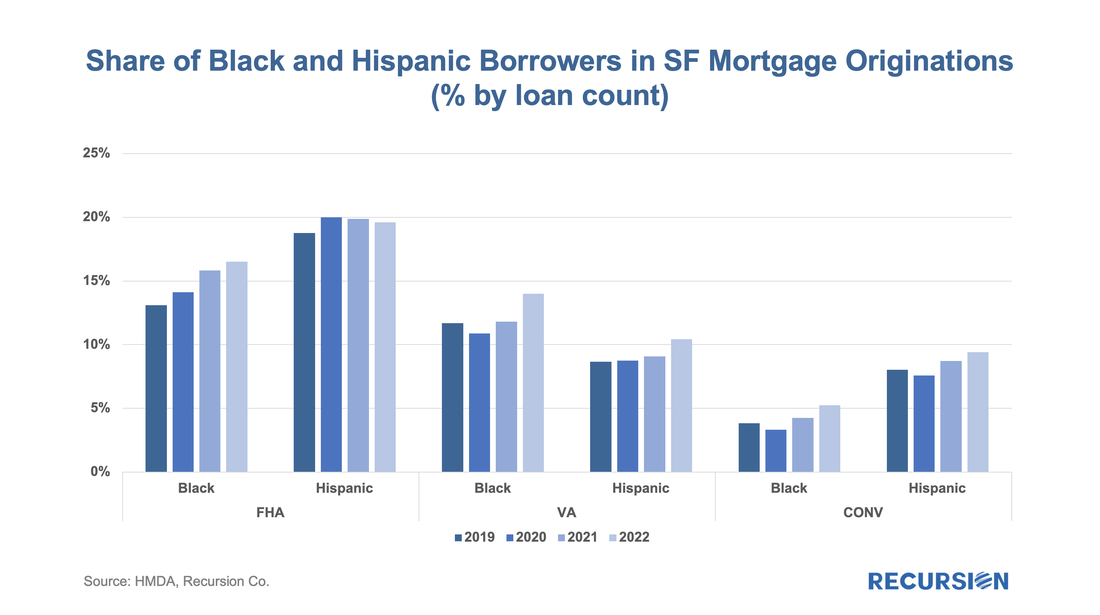

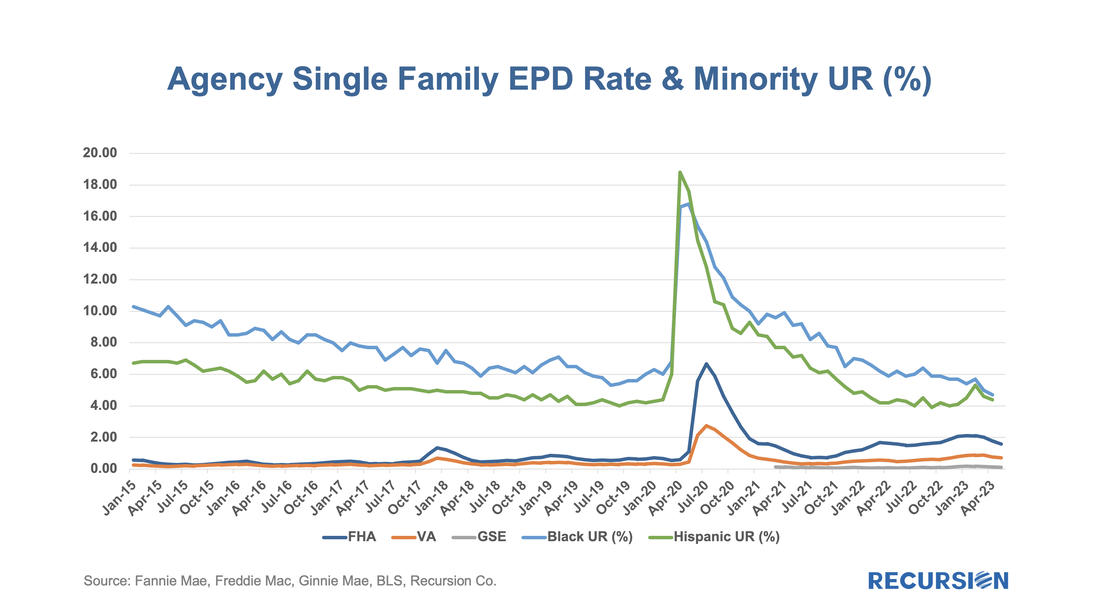

The release of the Agency performance data in early May provided confirmation that the dip in Early Payment Defaults[1] we have witnessed over the last three months ended a 16-month long uptrend in this statistic for FHA loans. A similar but far more muted pattern can be seen for VA and conventional mortgages. In a previous post, we speculated that the uptrend was correlated with the higher inflationary trend observed since early 2021[2]. Below please find an update of the chart: Considering the appropriate lags, it is plausible to imagine that the correlation is more than a coincidence. The traditional fundamental driver of mortgage distress is labor market conditions. Overall, the national unemployment rate has been near a 50-year low for the past two years. However, the path has been very different depending on the race of the worker. Insofar as the loans delivered to different agencies have varied racial compositions, we can expect DQ rates to vary accordingly. The chart below shows the racial composition of loans by agency over the 2019-2022 period from the HMDA data: In each case, FHA has a higher share of originations made to black and Hispanic households than VA, which is in turn higher than conventional mortgages. The next chart looks at the EPDs vs. the unemployment rates of these groups: Interestingly, the sizable drop in the EPD rate for FHA loans in the last two months corresponds with a similar decline in minority unemployment rates, particularly for black households[3]. Given delinquency rates are a lagging indicator of economic conditions, it’s notable that market distress is easing at this stage. This is a positive in terms of the assessment of the financial environment, particularly servicing, but a challenge for improvement in the business situation as measured by transaction volumes. The status quo persists. Of course, life is more complicated than a one-factor model can describe. There is always more in-depth research that can be applied using Recursion data. [1] A loan that has two or more missed payments within six months of issuance.

[2]https://www.recursionco.com/blog/a-quick-note-on-the-gnm-gse-early-delinquency-gap [3] The white unemployment rate has been in a narrow band near 3% since December 2021. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed