|

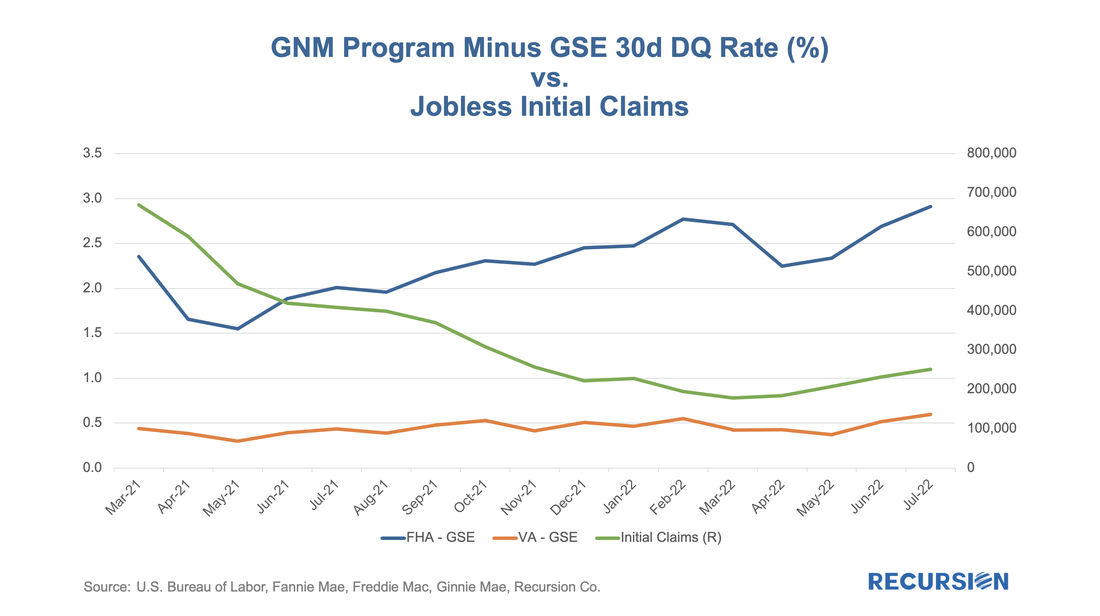

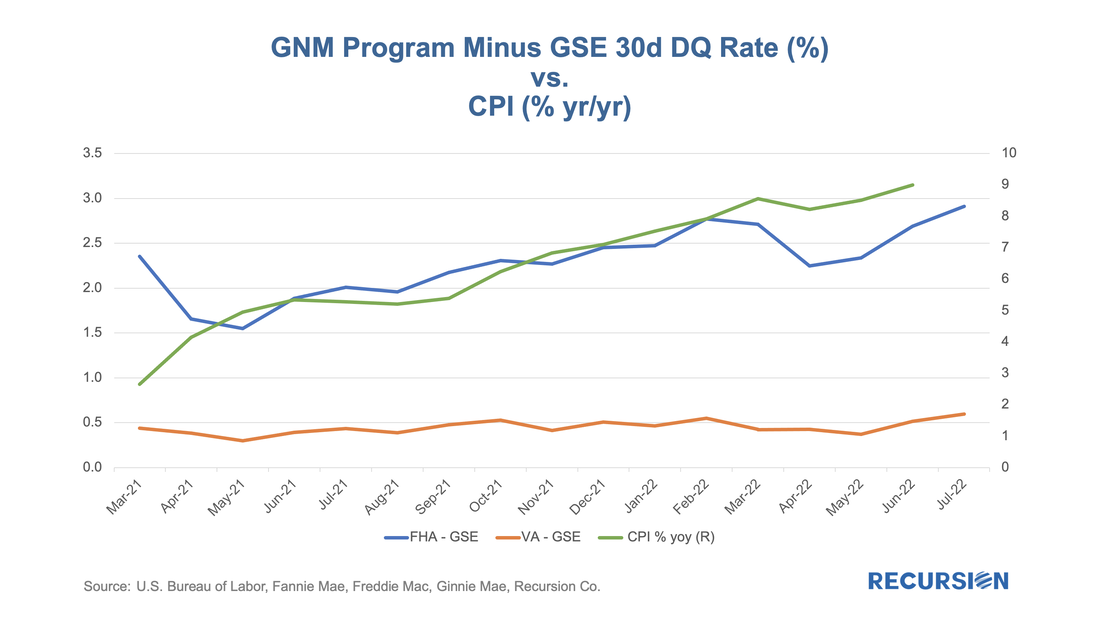

There has been a modest but persistent widening of the gap in 1-month DQ rates between the Ginnie Mae programs and the GSEs over the past couple of years. Previously, our experience was that these are mostly driven by developments in the labor market[1]. In fact, there has been a recent small but persistent rise in the number of initial jobless claims that correlates with this widening: The theory worked until about one year ago, but the widening in the DQ spread has preceded the rising trend in claims. An alternative explanation comes from a different part of the macro scene: inflation. In a report earlier this year, Shernette McLeod at TD bank looked at the impact of higher inflation on different income categories[2]. While the direct impact is felt most heavily on middle-income households, lower-income families have very limited ability to adjust to this shock, particularly as their savings tend to be low and their budgets are already stretched. As a result, the overall impact of higher inflation can be severe for this group. According to the 2021 HMDA data, the median income of FHA borrowers is $65k per year compared to $85k for VA and $105k for conventional borrowers. Consequently, when we looked at the spreads vs. the inflation rate, the correlation is striking: So far, the overall impact is relatively small, with the 30-day DQ rate as of August 1 for FHA at 3.76% vs. 0.59% for the GSEs, but the trend is clear. Even with only 18 months of observations, the graph is in line with the conclusions drawn in the TD paper. The balance between growth and inflation facing the Fed is very complex and rife with possibilities of unintended consequences. [1] Unemployment and the Coming Wave of Delinquencies - RECURSION CO [2] A Look at Inflation’s Impact by Income and Age in the U.S. (td.com) Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed