|

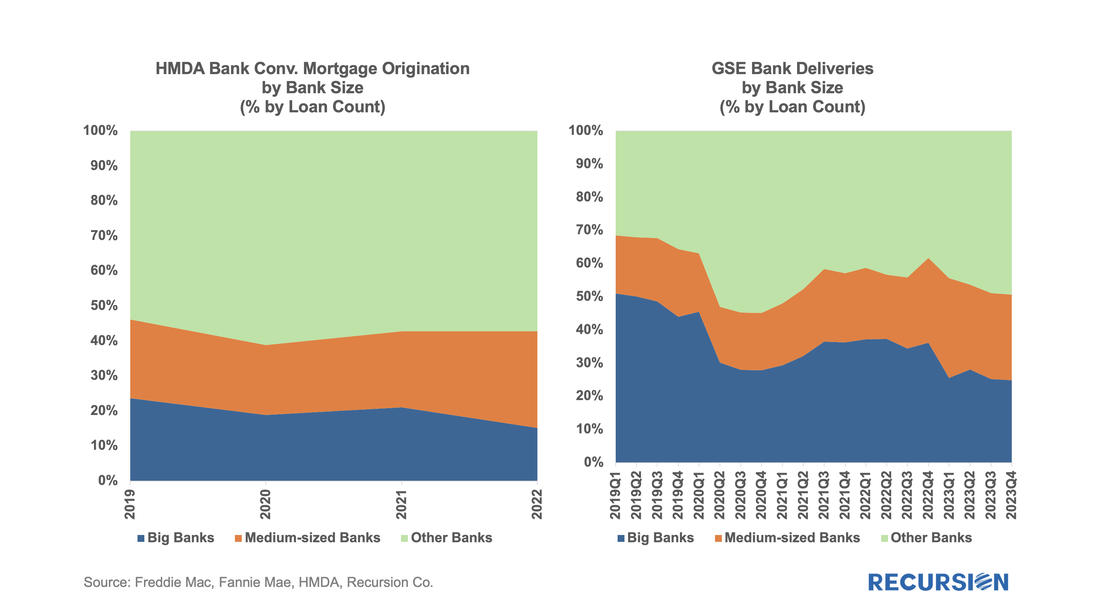

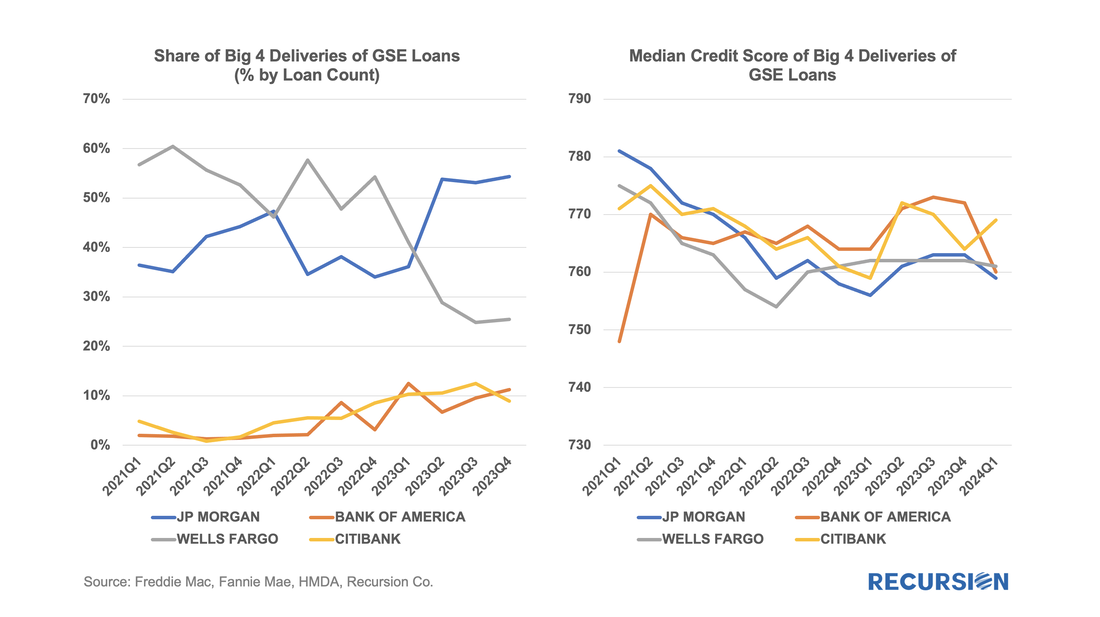

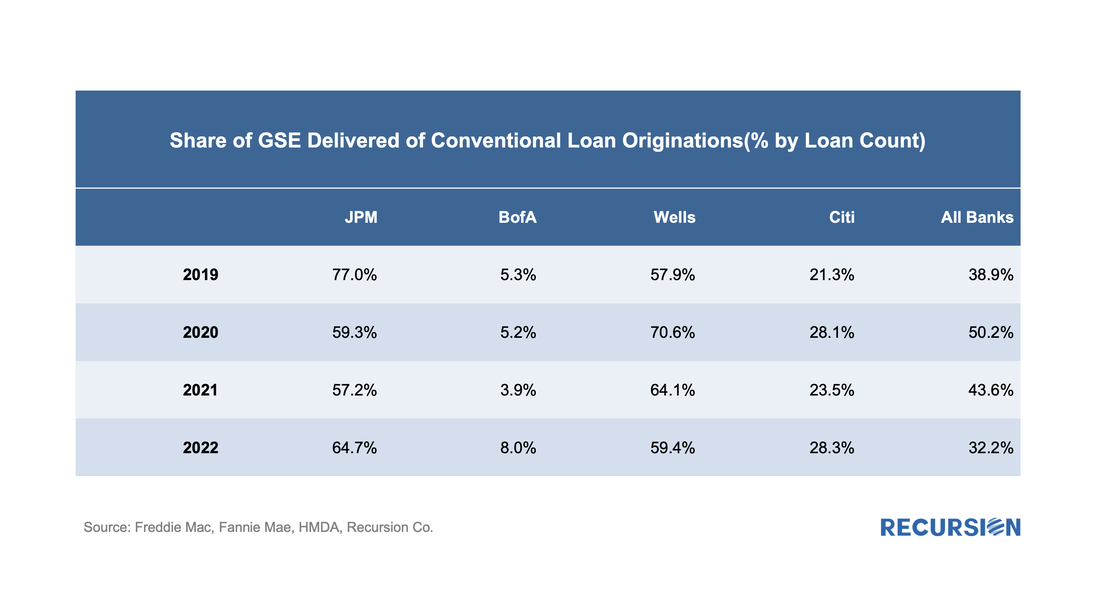

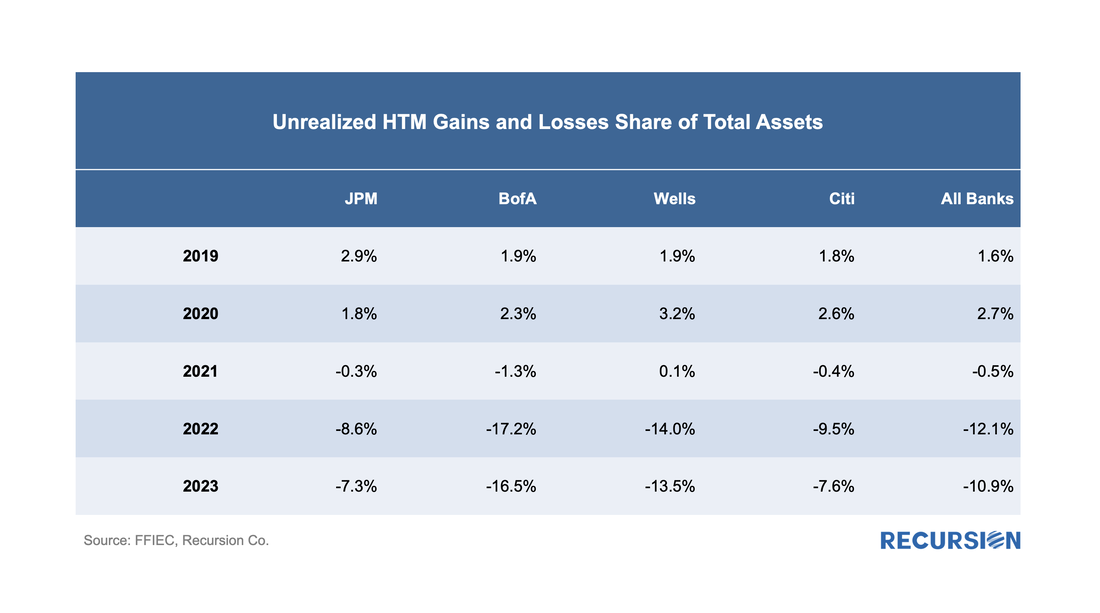

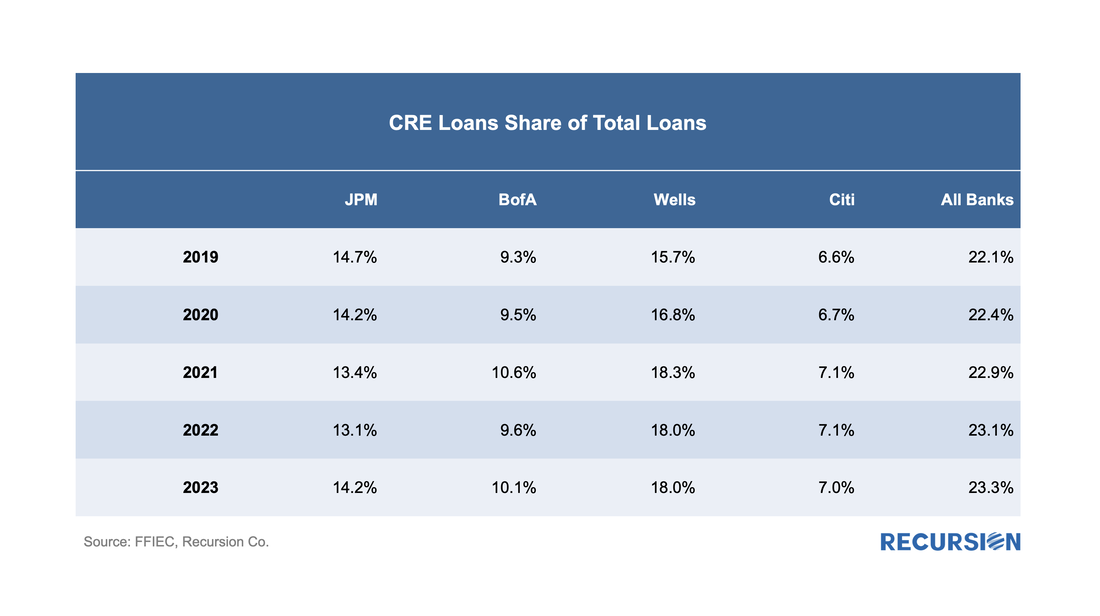

In a recent post, we discussed the impact of the COVID-19 pandemic on the mortgage market[1]. We noted that there has been a trend toward higher median credit scores in Agency mortgage deliveries since 2020 due to policy stimulus and asset price appreciation. In addition, there was a jump in median bank credit scores in early 2022, accompanied by a drop in the bank share relative to nonbanks of about 5%. This is not negligible, and the share decline has persisted over the past year. We attribute this to the shock of the collapse of four banks, notably Silicon Valley Bank (SVB), during this time. A more thorough assessment of the impact the bank shock had on the mortgage market requires access to the financial statements of a range of banks. This data is available via the Bank Call Reports. Data are released quarterly by the FDIC and made available through the FFIEC[2] with trends discussed in the FDIC Quarterly[3]. This note is meant to be a technical description of the data infrastructure we have built to support this sort of analysis by tying together mortgage production data with bank financial information from the Call Reports. The Recursion Call Report Analyzer The Call Report data is readily accessible, and we like many others have for some time pulled data down for individual institutions for use in various studies. If you want to look at the whole system, however, we are looking at well over 3,800 datapoints covering some 4,600 institutions. This is not big data like the Agency loan level disclosures or HMDA data, however, normalization of the dataset takes considerable subject expertise, as banks report different forms with different datapoints. Since we are interested in applications to the mortgage market, we start by linking institution names to the consistent naming database we have built in the Agency mortgage space. That allows us to make quick inferences into the mortgage world from bank shocks. In next step, we designed a front-end system (the Analyzer) that allows users to pull down data for designated characteristics for subsets of banks using a graphic interface without programming. To demonstrate the application of this tool, we look at some aggregate figures with a breakdown for the Big 4 Banks: JP Morgan, Wells Fargo, Citi and Bank of America. These banks were not the source of the turmoil last Spring but are of general interest. The Overall Bank Picture First, we break down the banks into three buckets: large (assets over $1 trillion), medium ($100 billion to $1 trillion), and small (under $100 billion) using the total assets of them obtained from Bank Call Reports. Then we analyze them through the origination data from two traditional Recursion tools, HMDA Analyzer and Cohort Analyzer (for agency loan level disclosure). Below find charts of the distributions from each source for conforming mortgages by loan count back to 2019: Note that the HMDA data ends in 2022 as 2023 HMDA has not been released yet. In both cases, we see a trend decline in the share of the Big 4 banks. There are a couple of observations that are notable here. First, the share of mortgage activity of the Big 4 institutions with regard to mortgage activity is in decline. (Originations by 9% from 2019 to 2022, deliveries by 22% from 2019 to 2023). It seems that the bulk of declines in the bank share of deliveries in 2023, cited in the earlier note, was concentrated in bigger banks. Below find a table of the share of deliveries of the Big 4 Banks along with the median credit score quarterly since 2021: The basic trend is a sharp decline in Wells Fargo's activity, with gains posted by the other three, notably JPMorgan. We note that the banks with the highest share of loans held-on-book reported increases in their median credit scores, following the collapse of SVB. Second, the share of the larger banks is larger for deliveries than originations, despite the fact that two of the Big 4 banks, Bank of America and Citi, have been holding most of their production on their balance sheet. The big banks are likely delivering loans they purchase from smaller institutions. Digging into Big 4 Fundamentals Our last section is a demonstration of how Bank Call Report Data can shed light on observed patterns of activity in the mortgage market. There are many possible variables that may prove useful in this regard, but here we look at three: 1.Deposits Note that the trend in declining bank reserves last year was broken by only one of the Big 4 Banks: JP Morgan. This is a trend that might be explained by the fact that this institution is deemed to be the safest by depositors. 2.Unrealized losses: While losses are widespread, the best performer by this measure was once again JP Morgan, followed by Citi. 3.CRE Loans Share of Total Loans: Here, the lowest exposure by far out of this group is held at Citi. It must be noted, however, that this is a very rough measure as the CRE space is composed of a wide variety of assets with different levels of associated risk. Finally, the exposures here are below those of all banks overall, implying that this risk is greater in the smaller bank cohort. This will be the subject of our next note on proposed bank policy changes. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed