|

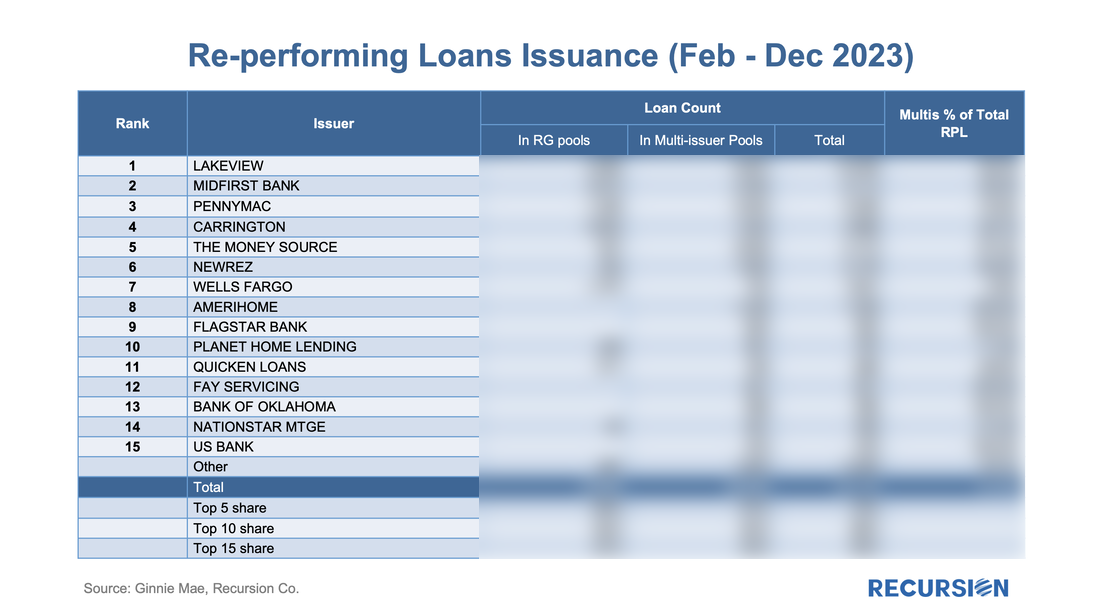

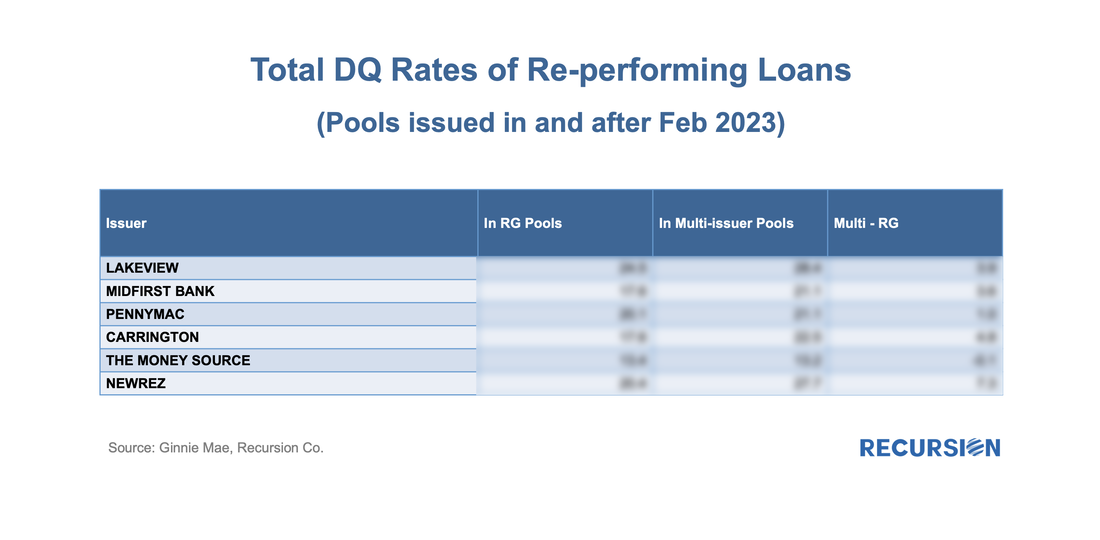

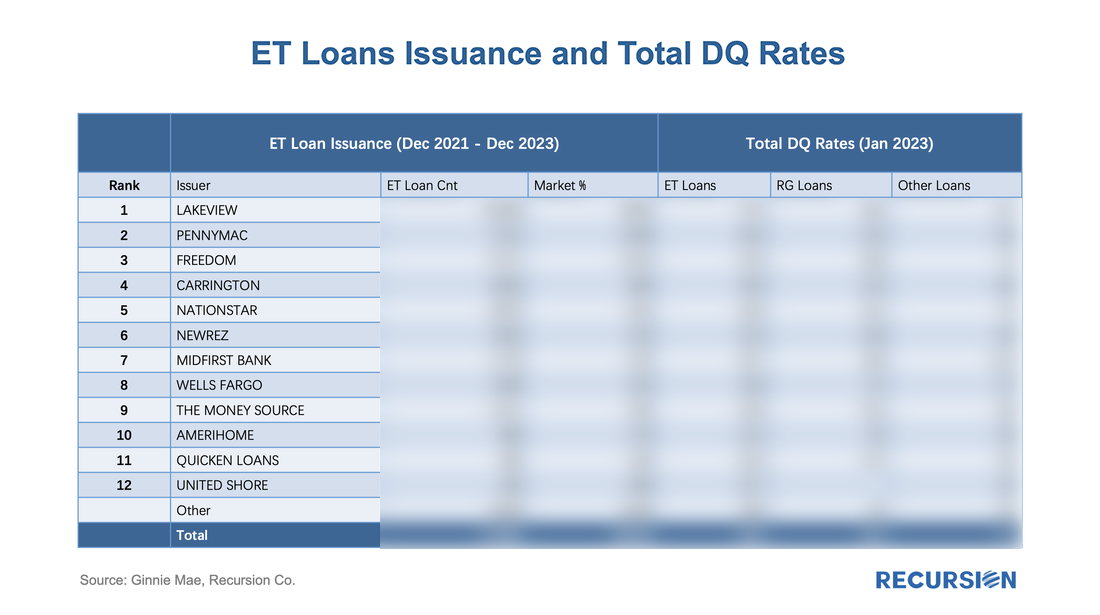

In a recent post, we noted that delinquency rates for two classes of FHA modified loans were rising faster than for the general population, namely reperforming (RG) and extended term (ET) loans[1]. In this post, we dig down into details to get a closer view of the behavior of lenders in these categories. We start with RG loans. As noted in the previous blog, the program was launched in January 2021, allowing borrowers who had outstanding unpaid balances from the Covid period but six consecutive months of payments to roll the balances into a “partial claim” due when the loan is extinguished. At that time, a new “RG” custom pool category was formed to issue these mortgages. Starting in February 2023, the seasoning period was reduced from six to three months and these loans became eligible to be issued in Ginnie Mae multi-issuer pools. The share of these loans in multi-issuer pools reached over 2/3 at the end of 2023. Delinquency rates are modestly higher for RG loans in multi-issuer pools relative to RG pools even though they are relatively new. One topic that comes up is which servicers are most involved in this loan type and how much variation in behavior can be seen across these institutions. Below find the list of the top 15 institutions issuing RG loans and the distribution of each by pool type The quick conclusion is that this market is very concentrated with the top 15 banks accounting for 95% of the total. Issuance into RG pools is more concentrated than in multi-issuer pools as the top 5 consist of 80% of issuance, while the same figure for multi-pools is 67%. There is a considerable deviation in this distribution by the lender. Five out of the top 15 deliver all of their loans into multi-issuer pools, while Wells Fargo and Quicken only deliver 5.6% and 26.6% in that category, respectively. In terms of performance, we see below the total DQ by pool type for RG loans for the top six issuers: Next, we look into ET loans. This is a much smaller cohort compared to RG loans, and the only outlet is custom pools with prefix “ET”. The top 12 issuers account for almost 90% of the total. But the headline is that 45.8% of all ET loans are behind in their payments. Within the top twelve, Quicken has the highest DQ rate at 50.2% for ET loans, while Wells Fargo’s figure stands at just 12%. The numbers of mortgages here are not high, but the increasing trend indicates that there are borrower cohorts struggling to make ends meet. The policy issue is what, if anything more, can be done to keep them in their homes. Please reach out to [email protected] if you would like read the full article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed