|

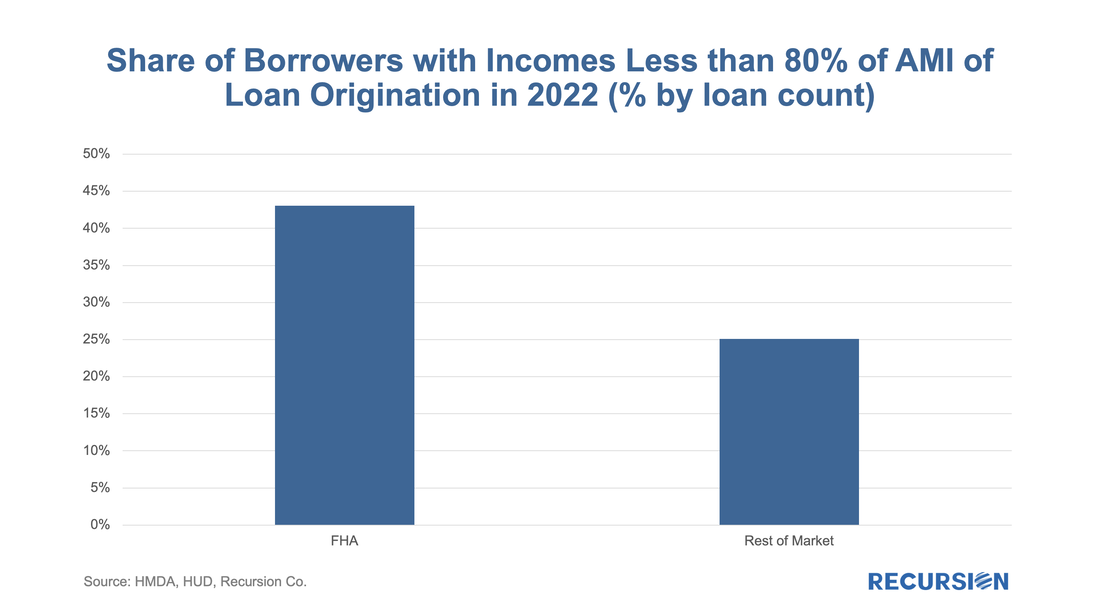

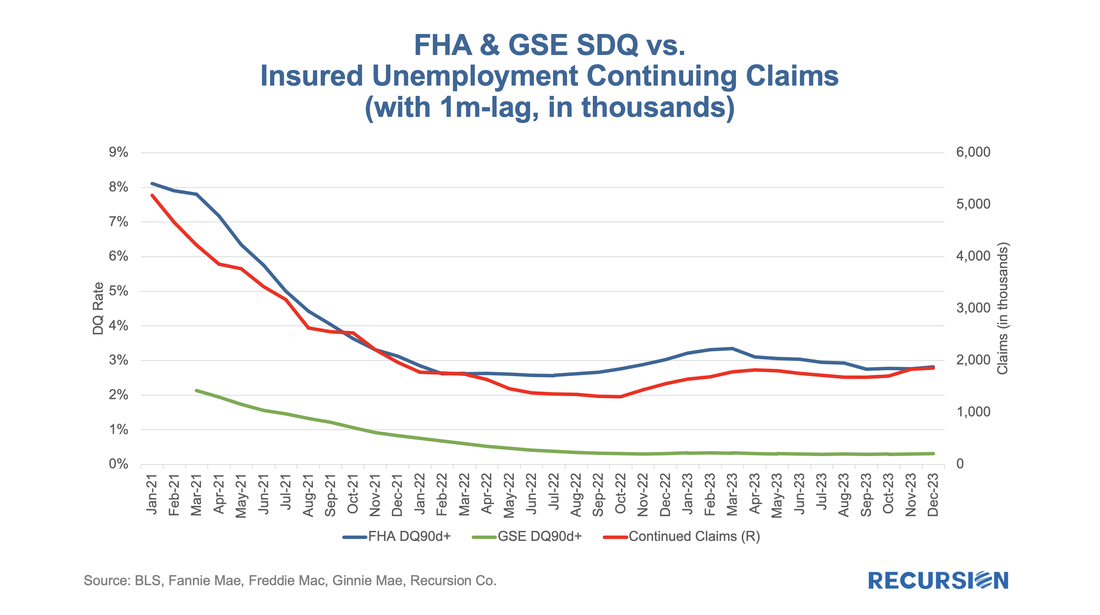

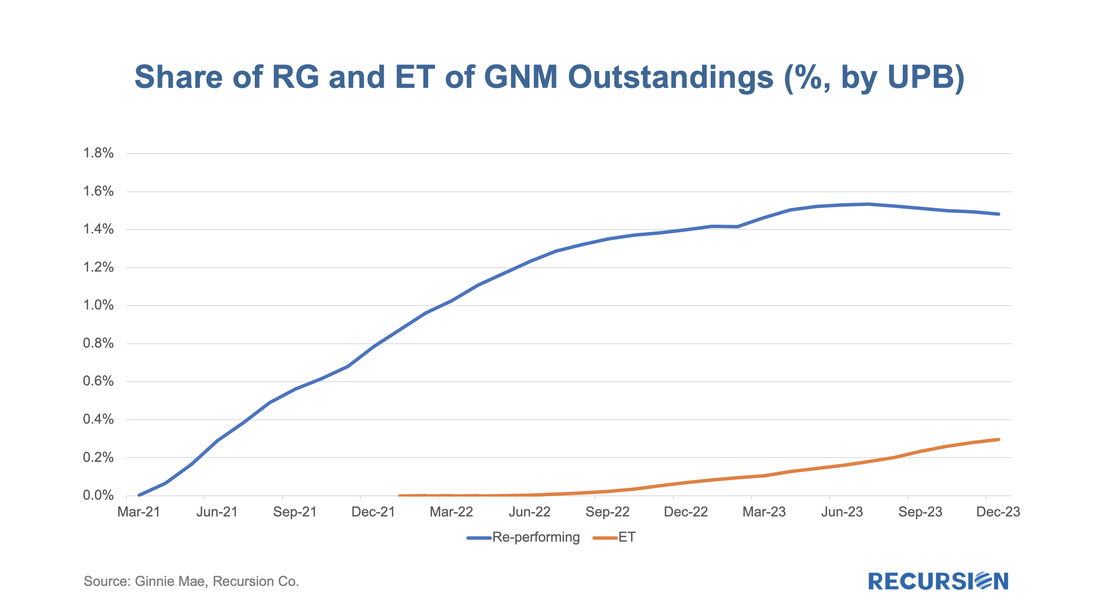

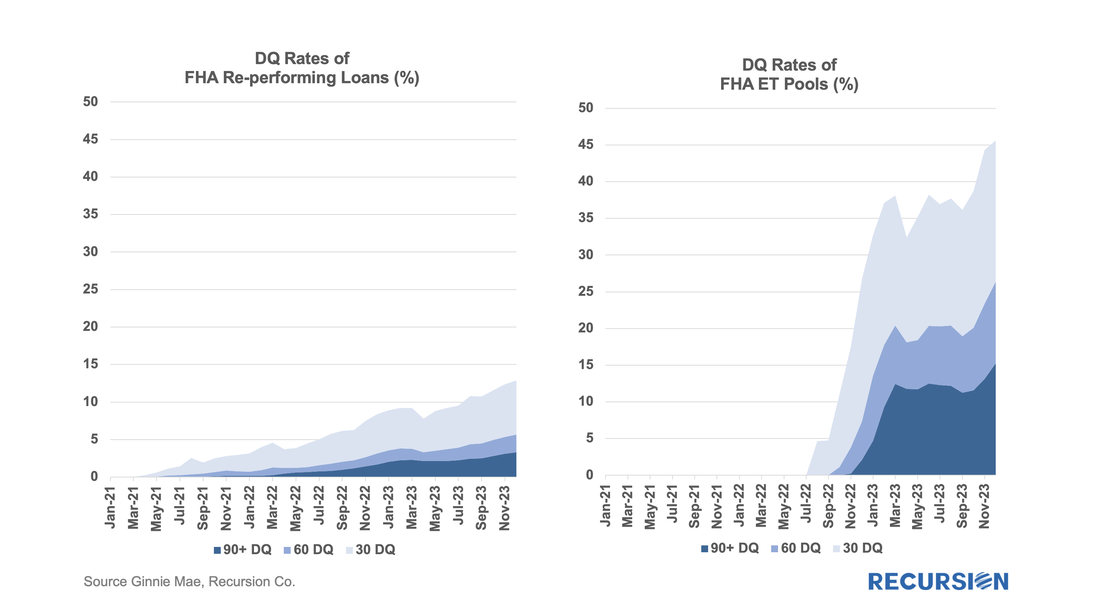

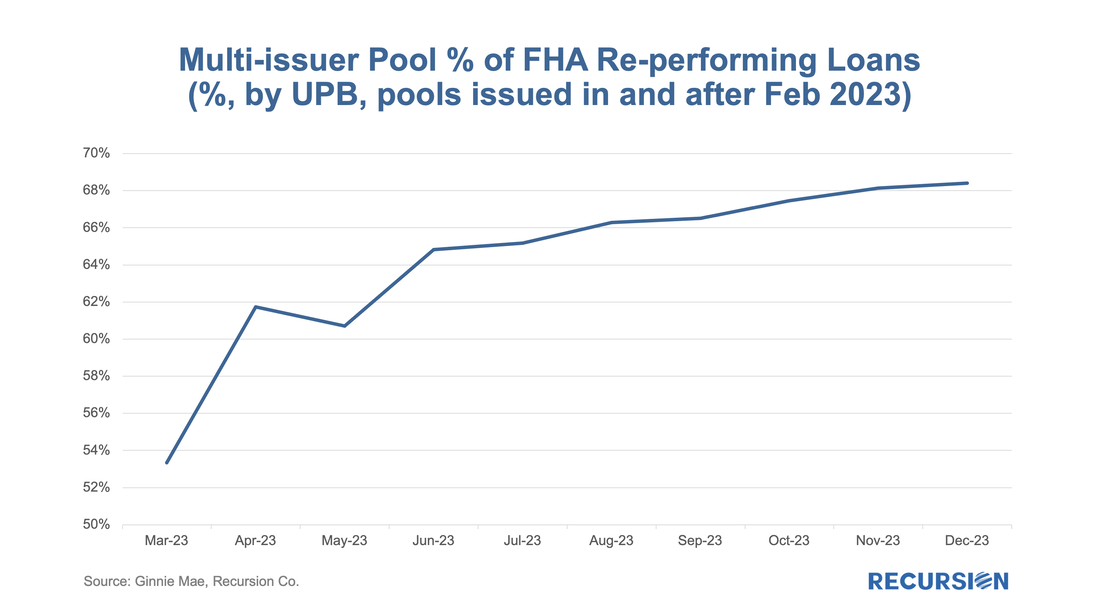

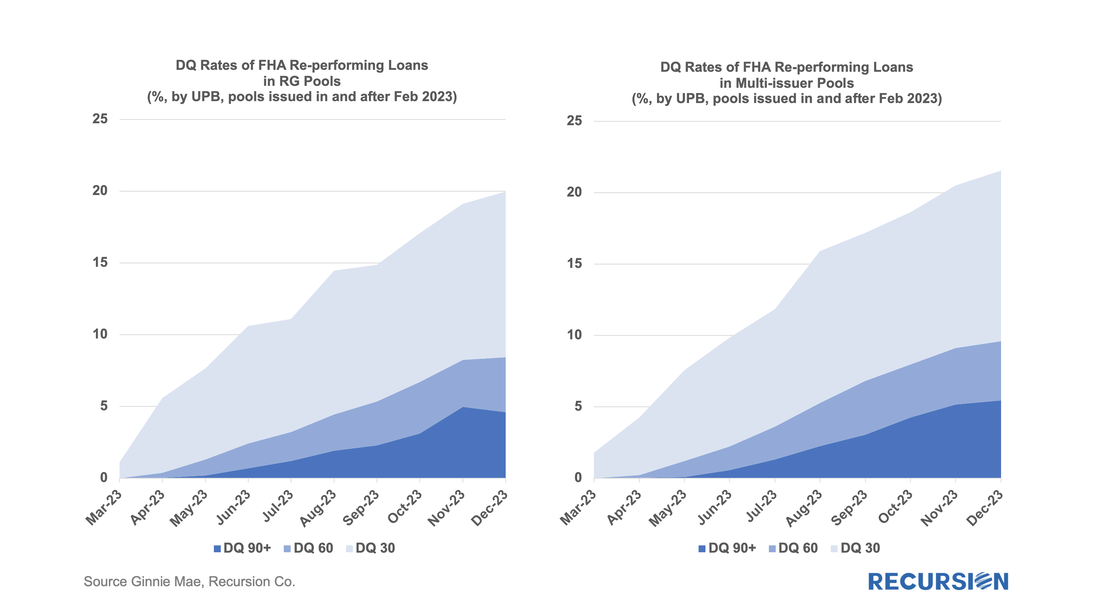

The year 2023 was remarkable in many ways, but a key characteristic was the resilience of the economy and labor markets to high and rising interest rates. At the start of the year, the consensus forecast called for sharply slower growth and rising unemployment. In reality, growth accelerated, and unemployment remained near historic lows. This has left analysts in a state of chaos regarding the outlook for 2024[1]. We leave forecasting to others, pausing to note that we find a high correlation between the confidence of forecasters, and forecast error. Instead, we pose a hypothetical question. What if the economy slows down and even experiences a modest recession? What would that mean for borrowers, particularly for those in low-income households? Our core Agency disclosure data is of somewhat limited usefulness here as we do not have borrower income as a disclosed characteristic. However, we can break the universe up by Agency, notably comparing FHA to conforming loans, as we know FHA borrowers are lower-income borrowers, as demonstrated by 2022 HMDA data: The distinction reported here allows us to perform a natural experiment whereby we compare the performance of FHA loans to those of other programs, in this case, the GSEs. To accomplish this, we look at the SDQ (90D+) rate for FHA and GSE loans vs a key fundamental: continuing jobless claims: Both FHA and conforming loans are sensitive to the state of the labor market, but the connection is much tighter for low-income FHA borrowers. It seems reasonable to think that the same relationship would hold should the labor market deteriorate, and continuing claims rise. But there is more. FHA, in recent years, has implemented programs for highly vulnerable borrowers to keep them in their homes. The first of these is “reperforming mortgages,” where borrowers who have fallen behind on their payments after leaving forbearance but have subsequently made payments for six consecutive months may take the missed payments as a “partial claim” due when the mortgage is extinguished[2]. This has superior credit considerations for the borrower compared with a modification. When the program was launched in January 2021 these loans could only be securitized in new “RG pools”. Since February 2023, the seasoning repooling requirement was shortened to three months from six months, and these loans are eligible for issuance in Ginnie Mae multi-issuer pools[3]. Another program is “Extended Term Mortgages”. These are loans with a modification that extends their maturity to at least 361 months and not more than 480 months. This program was launched in February 2023, and these loans are securitized only into “ET pools”. It is natural to ask about the performance of these categories of loans as they relate to particularly vulnerable borrowers. While these are not particularly large programs, it’s interesting to note that the share of RG loans out of total outstandings peaked earlier this year while the ET share continued to rise. And below find the performance statistics for these categories of loans: The DQs for the RG loans are modestly higher than those for the overall FHA program, while those for the ET pools are dramatically higher. Given the current strong state of the economy, we conclude that there are market segments that will experience distress should labor market conditions become less tight. Many questions remain. First, we have the issue of the performance of RG loans by pool type since these can now be securitized into either RG or GNM multi-issuer pools. Interestingly, over the last nine months, the split has grown from just over 50/50 multis/RG pools to about 68/32. Here are the performance statistics for each type: It is noticed that DQs for loans distributed to multi-issuer pools have recently been performing somewhat worse than those in RG pools. There is a temptation to think that the loans in multi-issuer pools can only be tracked at the loan level with advanced data technologies. A natural question would be whether issuers have different strategies for allocating re-performance mortgages in RG prefix pools or multi-issuer pools. And then there is the issue of the large spike in DQs for ET pools. Again, further work on the issuer level will shed light on the driver of the deteriorating performance. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed