|

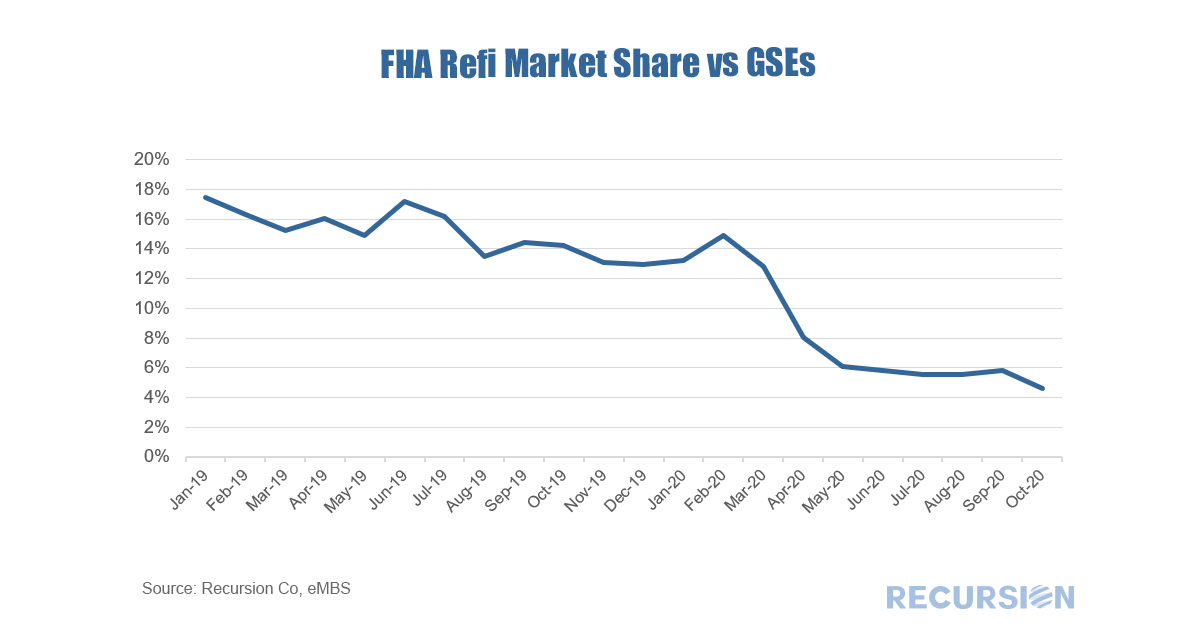

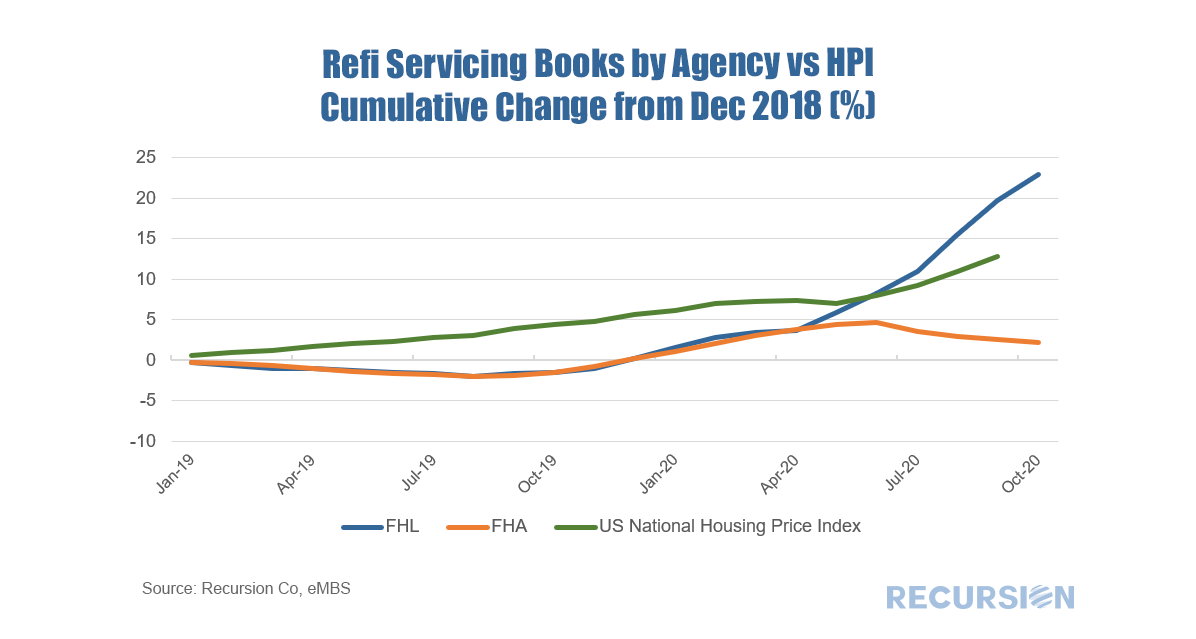

In a recent post we noted the recent striking rise in the GSE refinance share and commented that the rate of this activity in GNM programs, while still rising, has lagged[1]. This seems to be related to the tendency of capacity constrained lenders to provide credit to the highest quality borrowers, and to a looming 0.5% fee hike on GSE refinance deliveries scheduled for December 1. Focusing on FHA alone, the share of refinance loans compared to those delivered to the GSE’s has plummeted in recent months: This dramatic decline underscores an immediate question: Are fewer borrowers with an FHA loan refinancing compared to those with a conforming loan, or are FHA borrowers refinancing into mortgages suitable for sale to Fannie Mae and Freddie Mac? Unfortunately, our data on refinance deliveries does not include any information on what sort of loan borrowers are refinancing out of so we cannot address this question directly. One of the recurring themes of this blog, however, is how Big Data opens doors to more nuanced analysis. In this situation, besides deliveries, we also have information on the composition of the books of the various agencies. Imagine that 5% of an agency’s book refinances in a given month and the new loans are delivered to the same agency. Barring cashouts and paydowns, the size of the agency’s book will remain unaffected from this activity. The composition of the book between purchase and refi loans will change, however, insofar as loans that started out as purchase loans refinance. All else being equal, more refis should be reflected in a growing book of refinance mortgages. Of course, a borrower can refinance into a different program than that the one where they obtained their original loan. In practice, more borrowers with FHA loans refinance into conforming loans than vice versa due to flexibilities about Mortgage Insurance (MI) for loans delivered to the GSEs. These flexibilities are most pronounced for high-LTV borrowers[2]. So the question about FHA share can be recast by looking at the trend in the size of the refinance books between FHA and the GSE’s, specifically Freddie Mac[3]. If FHA is losing share, their book of refinance loans should be growing slower than that of the Freddie Mac’s. In fact, the difference is striking: Not only is the gap in the size of the FHA book of business of refinance mortgages growing vs that of the Freddie Mac, since the onset of the Covid-19 crisis, The FHA refi book has been shrinking in absolute terms! This is strong evidence of significant share loss for FHA. In terms of a fundamental driver of this dramatic shift, we look at home prices. Since the initial “freeze” in March and April, HPI growth has accelerated due to record low interest rates and a powerful trend of households moving away from the densest locations. The spike in home prices serves in turn to reduce CLTVs, making it easier for borrowers with an FHA loan to refinance into a conventional mortgage. More can be done to investigate this phenomenon in more detail, and this will form the basis of future posts. [1] https://www.recursionco.com/blog/policy-primacy

[2] https://www.fha.com/fha_requirements_mortgage_insurance [3] In this blog, we look at the refi servicing book shares for FHA comparing with Freddie Mac to avoid survival bias in Fannie Mae loan data. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed