|

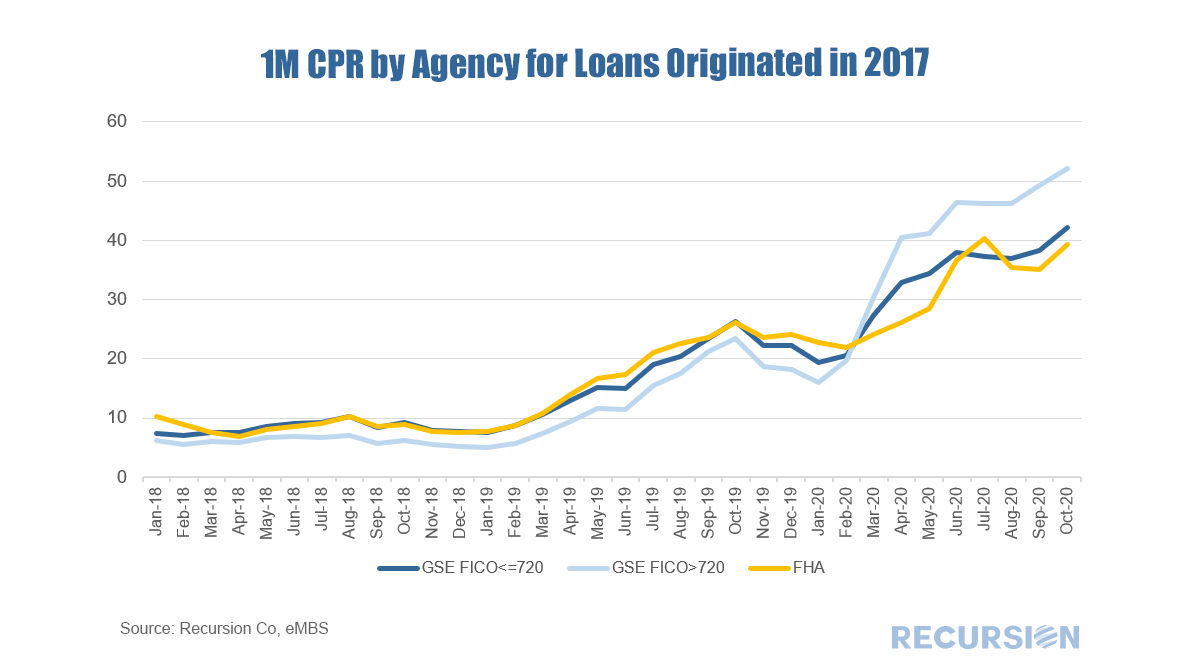

Unlike the situation during the Global Financial Crisis, imbalances in the housing market are not the root cause of the Covid-19 economic downturn. Instead, housing is helping to pull the economy out of its pandemic-induced swoon. House price rises have accelerated, due both to low interest rates, as well as to household relocations away from high-density areas. This is leading to increased construction, and improved household balance sheets. Moreover, a surge in refinances improves household cash flow. How long can this trend continue? The answer to this question depends crucially on many varied policy settings that influence lender and borrower behavior. The chart below shows 1-month CPR for 30-yr MBS securities broken down between the 30-Year GSEs and 30-Year FHA for the 2017cohort. A number of fundamental and policy factors come into play. Fundamental Factors

Policy Factors

Looking forward, 2021 promises to be a year of intense focus on the policy landscape. Assuming that mortgage rates remain conducive to a robust refi market, key factors include:

Once again, the availability of big data tools to analyze emerging trends in market activity is essential to decision making by investors, lenders, servicers and regulators. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed