|

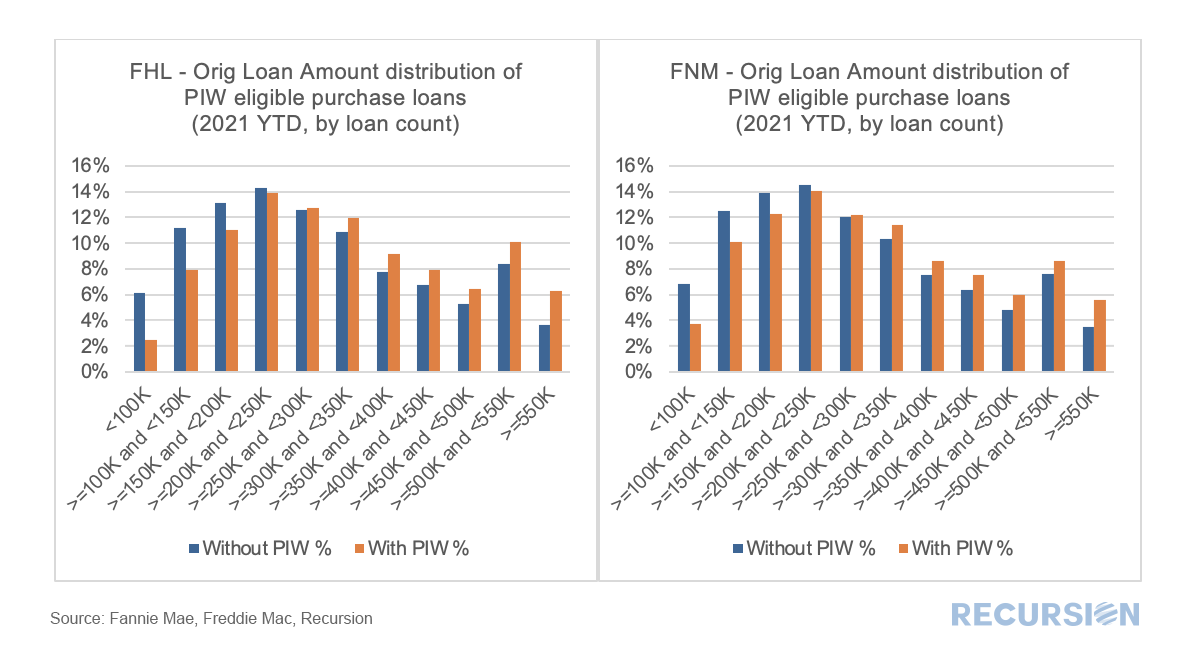

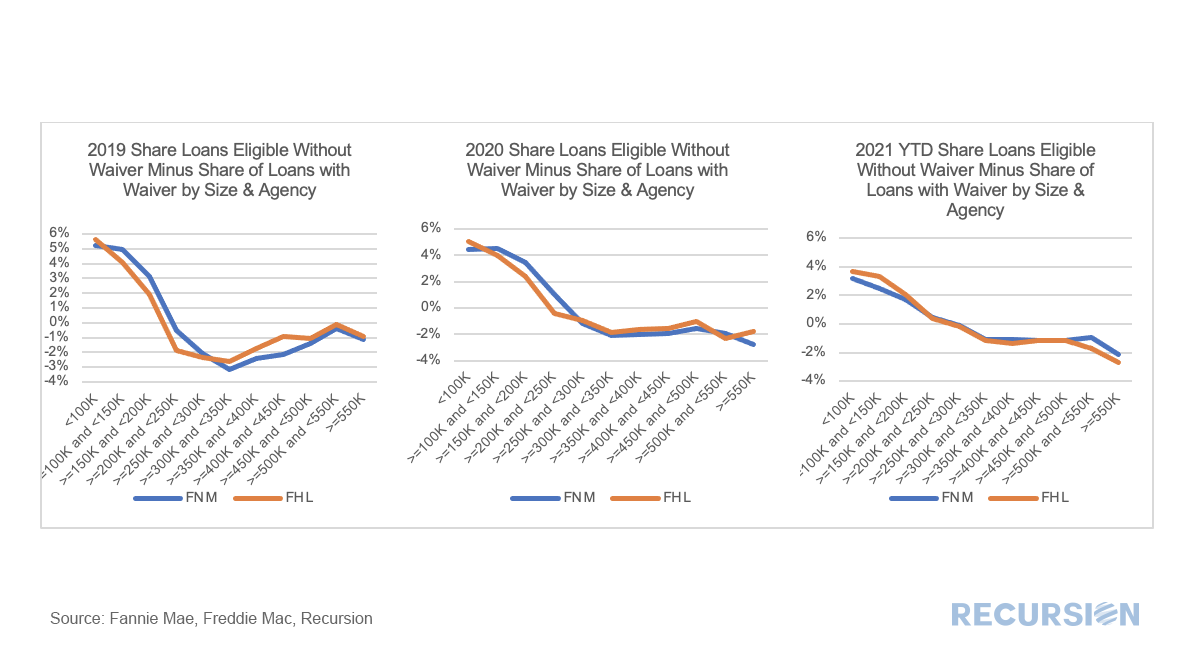

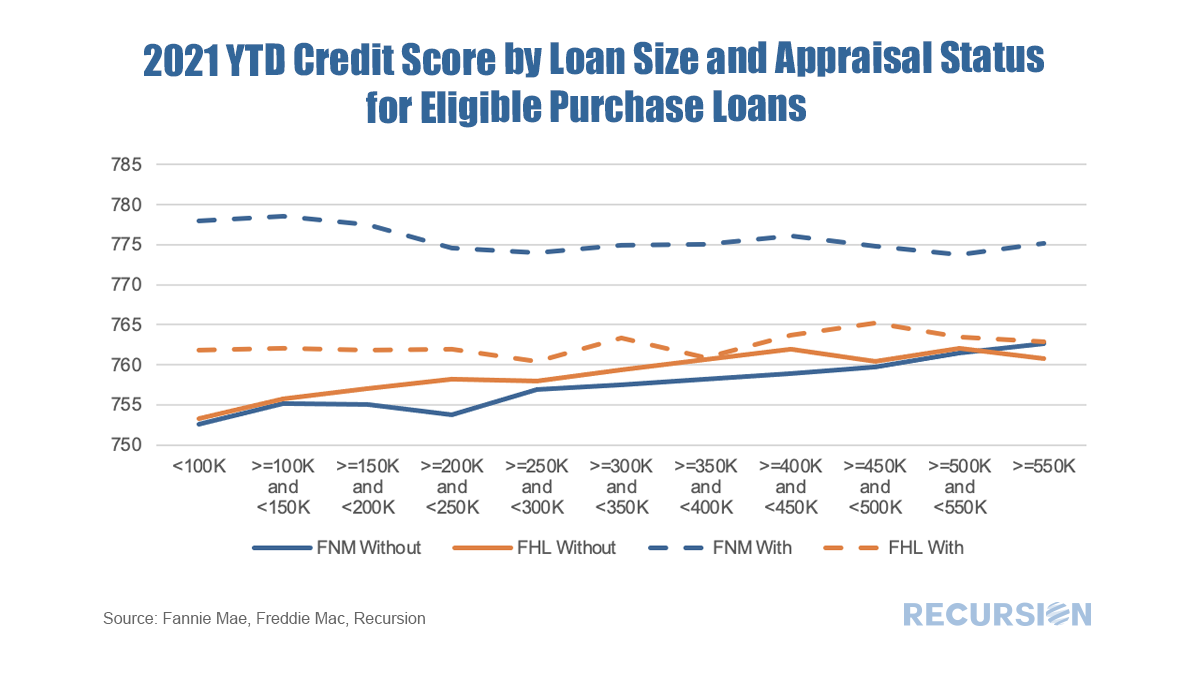

As we have noted many times, one of the best features of loan-level analysis is the ability to segment the mortgage market into components that allow for a deepening of understanding of the behavior of the various market players. In this note we look at two groups: borrowers who get an appraisal and those who are eligible to get one but do not. In previous posts we pointed out that analysis of the performance characteristics of mortgages with and without appraisal waivers cannot be accomplished by looking at loans with waives vs those without as many loans without waives are ineligible to obtain them. A robust analysis can only be conducted by looking at loans with waivers against loans that are qualified to get one. The qualification characteristics can be complex, but the main factor is LTV, which differs by loan purpose.[1] The question that naturally arises is why do some eligible borrowers not obtain a waiver when doing so would save money on the transaction? To address this issue, we look at the distribution of loan sizes for purchase loans with waivers vs those without them that are eligible. Here is the pattern of loans delivered to the GSEs YTD October 2021 by Agency: There is a clear pattern for the size distribution of eligible loans without waivers to be weighted towards smaller sizes, while large sizes comprise a bigger share of the distribution for mortgages with waivers. It turns out that this holds over time and is consistent between the two agencies. The next and harder question is what drives this pattern? It all comes down to supply and demand. One way to think about this is to look at a breakdown of the categories utilized above by credit score for 2021 YTD. The credit scores for eligible loans that do not have waivers is modestly upward sloping in loan size, and are very similar across the two Enterprises, while the same curves are very flat for loans with waivers. The rather large gap between the Fannie Mae and Freddie Mac curves for loans with waivers likely reflects differences between the two programs. These observations would indicate that the use of a waiver among eligible borrowers is more likely a demand side consideration rather than an allocation decision by lenders. Why would anyone turn down a waiver if one were offered as it would reduce transaction costs? It can only be that the information provided by a waiver is valuable, and it appears that this this is more the case for lower income borrowers looking for leverage in their negotiations with the seller than it is in more upscale markets, particularly in a time of rapidly rising house prices. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed