|

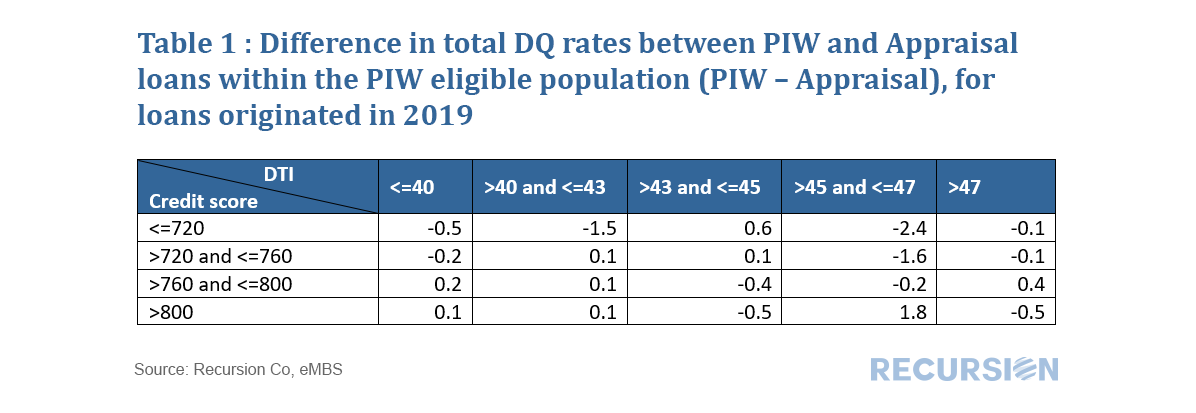

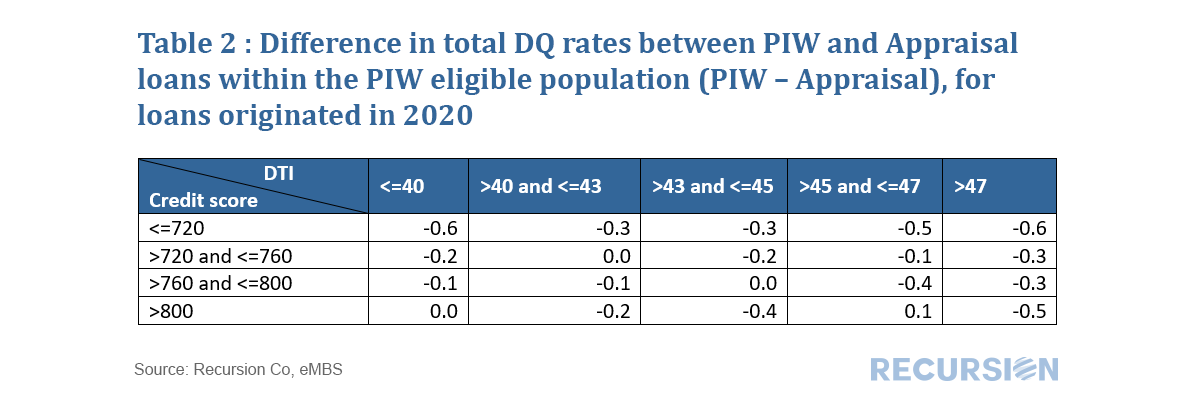

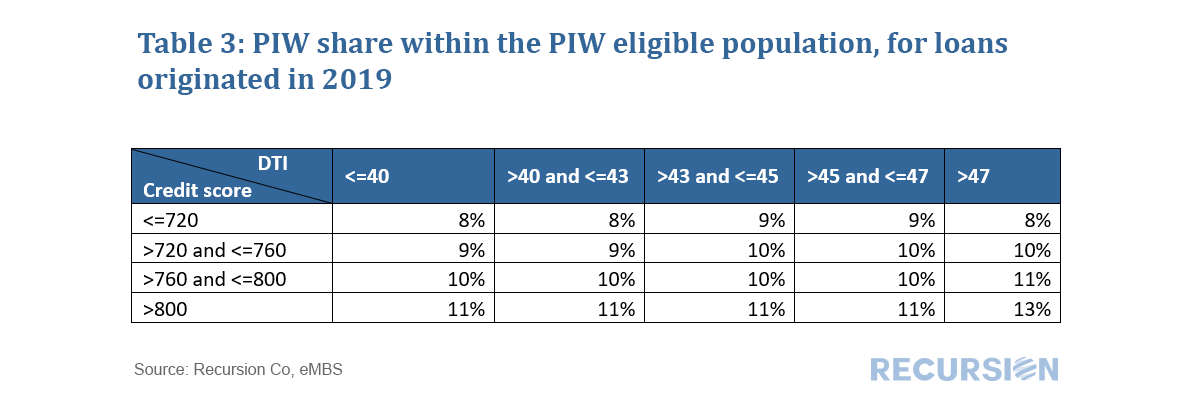

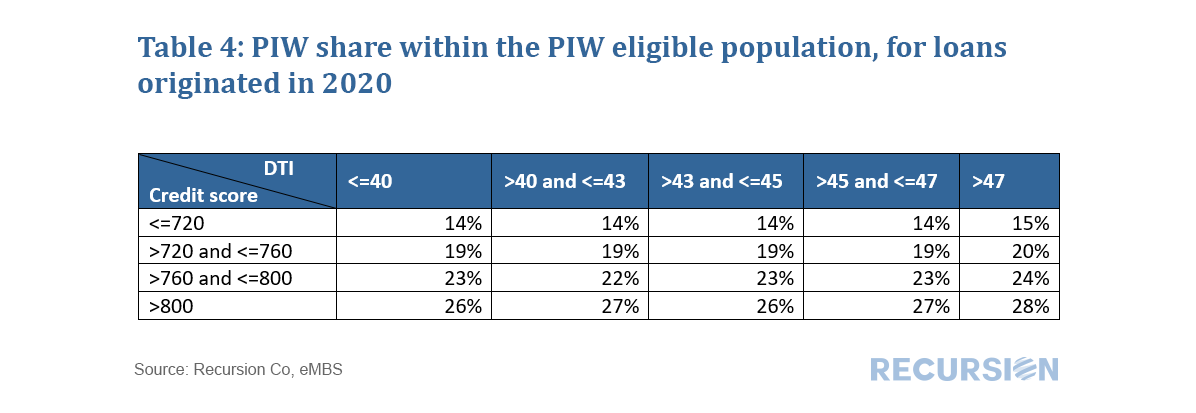

In a recent post, we discussed the relative performance of loans with property inspection waivers vs those with traditional appraisals that qualified for a waiver[1]. We commented that the observed out-performance of loans with waivers as measured by lower total delinquency rates (DQs) was likely influenced by relatively tighter lending standards (eg higher credit scores, lower DTI) for these loans compared to eligible loans that received a traditional waiver. A fully rigorous examination of this issue would be an extensive undertaking outside the scope of these brief posts. But let’s do a quick example as a demonstration of what our tools can produce along these lines. To make for an apple-to-apple comparison, below find two grids containing the difference between the total delinquency rates for purchase loans with PIWs compared to those that are eligible but obtain a traditional appraisal. The first is for loans originated in 2019 and the second is for those originated in 2020: We find that PIW’s are more extensively used in 2020 than in 2019. In addition, in 2019 the range of PIW takeup across cells was 8%-13%, while for 2020 it was 14%-28%. In both cases, takeup tends to rise with credit score. Lenders appear to be more willing to allow a waiver for borrowers with better credit. For 2019, there are a number of outliers, but there is no clear pattern across the grid. Many lenders were just beginning to implement their waiver programs that year. By 2020, PIWs became a standard part of the toolkit. For most of the center of the grid, loans with waivers very slightly outperform those eligible loans using appraisals. Bigger outperformance can be seen, however, along the edges, i.e. loans with credit scores less than 720, and DTIs greater than 47. It appears it is not the waiver itself that leads to outperformance, but likely that underwriters are more careful and pay more attention in general to these riskier classes of loans. Further work would look at performance across the largest servicers, and by state. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed