|

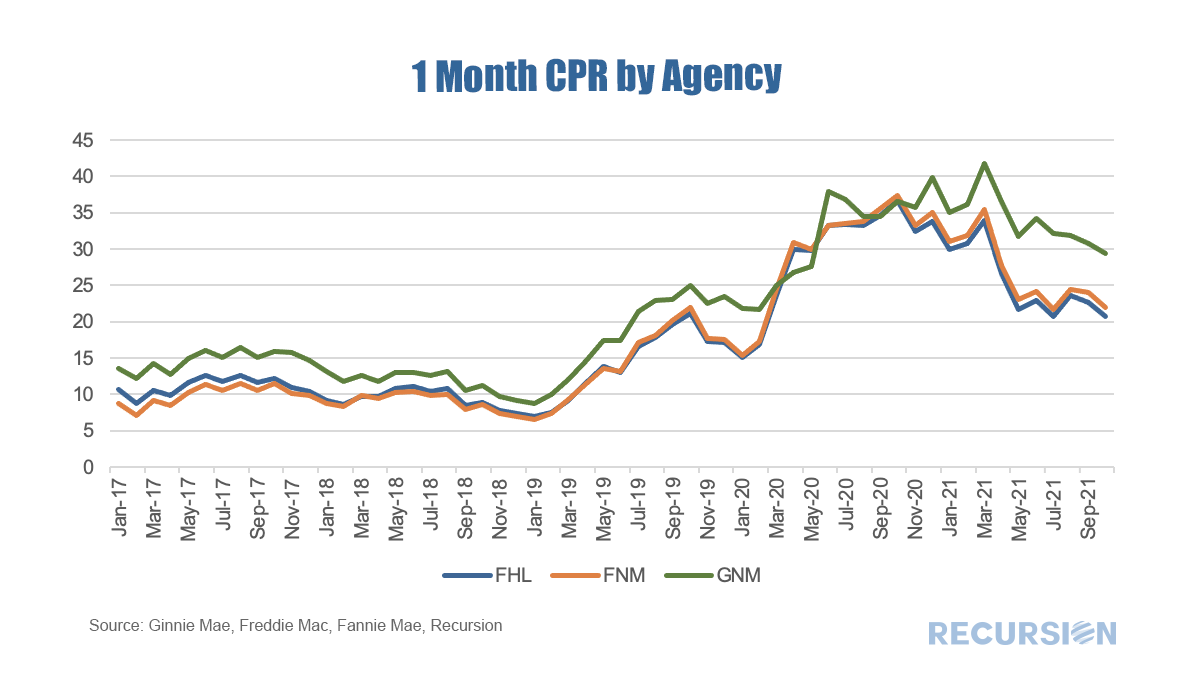

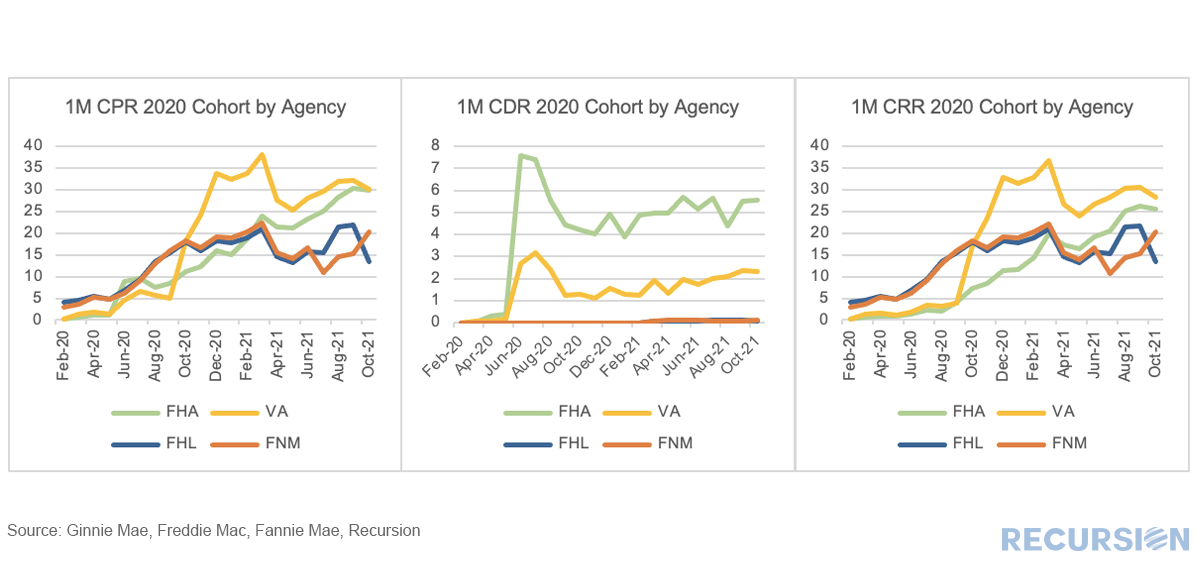

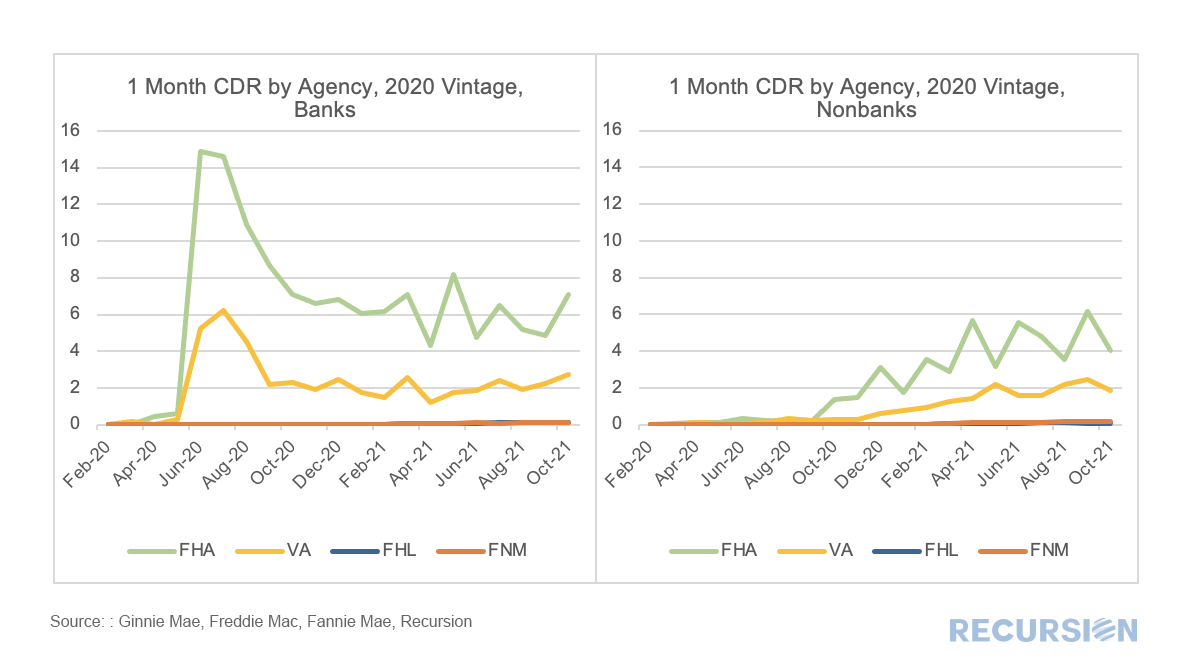

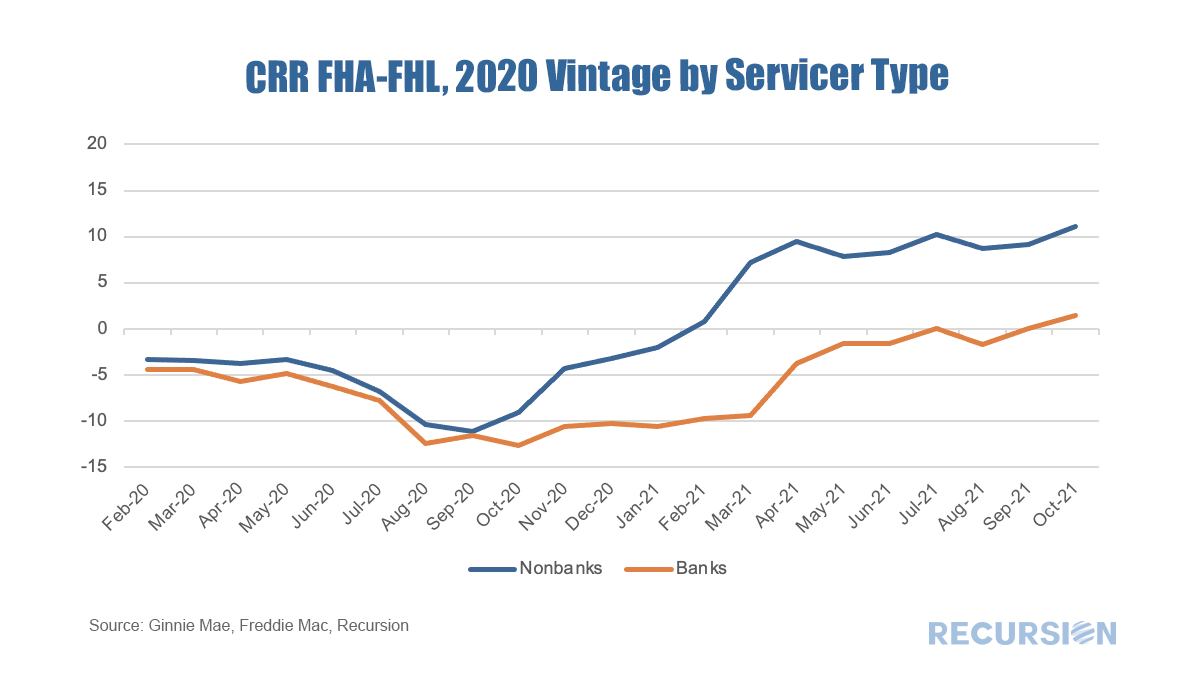

Over the past six months, prepayment speeds of Ginnie Mae securities have notably widened against those of the GSEs. Loan performance is a complex subject, but in the era of Covid-19, it’s complicated further by activity associated with the purchase of delinquent loans in forbearance out of pools. The way to see this is to distinguish prepayment speeds between those that are voluntary (CRR) and that are involuntary (CDR), i.e. where the loans are purchased out of pools. The overall prepayment speed CPR is a combination of CRR and CDR. The distinction is sometimes made between loans that leave pools with losses (CDR) as these are normally associated with a period of delinquency and those without losses (CRR) that are standard refinancings. Another key distinction is that most GNM loans are in two programs, FHA and VA, that have quite different borrower bases. Below find charts of the CPR, CDR, and CRR for the 2020 vintage for the four major loan programs. A few notable points drop out. First, so far in 2021, the prepayment rates (CPR) of FHA and VA loans have been widening relative to the GSEs. This year Ginnie Mae servicers have had a financial incentive to buy loans in forbearance programs out of pools and resecuritize borrowers’ loans that have been cured while the GSEs face a different set of incentives. So involuntary prepays (CDR) are higher in the Ginnie programs. Consequently, a comparison of voluntary prepayments excluding this factor (CRR) shows a significant narrowing (but not elimination) in the gap in speeds between agencies. A natural extension of this analysis is to further break down the data between banks and nonbanks. This is particularly interesting for Ginnie programs as the two categories of servicers have very different capital structures. The well-capitalized banks had considerably higher CDRs than those of the nonbanks for FHA and VA programs shortly after the onset of the pandemic, but this difference has narrowed significantly recently as all lenders are facing the need to work through their inventories of loans in forbearance programs. The implications of the differences in capital structure between servicer types can clearly be seen by looking at the gap in the voluntary prepayment speeds between the FHA and Freddie Mac programs: Both have risen considerably over the past year, but at present voluntary prepayments in FHA relative to FHL for nonbanks are very wide, while banks are experiencing similar speeds across programs. Going forward, the question is, what will happen with buyouts? Nonbank servicers of FHA loans have made a start on workouts with borrowers in forbearance but have a way to go before the process is complete. Bank servicers, on the other hand, have likely completed the process for a larger share of their books. A significant uncertainty is what actions the GSEs will take. In September 2020, the Agencies extended the timelines for this activity to 24 months, implying that the Agencies may not begin dealing with this issue until the second quarter of 2022[1]. At this point, the involuntary prepay gap between the Ginnie Mae programs and those of the GSEs may start to narrow. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed