|

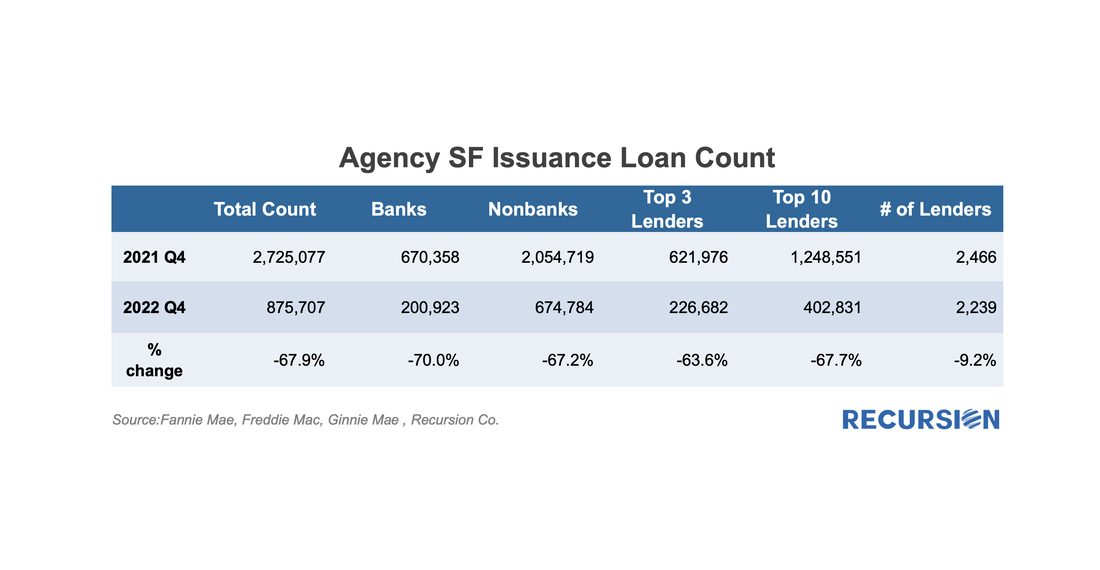

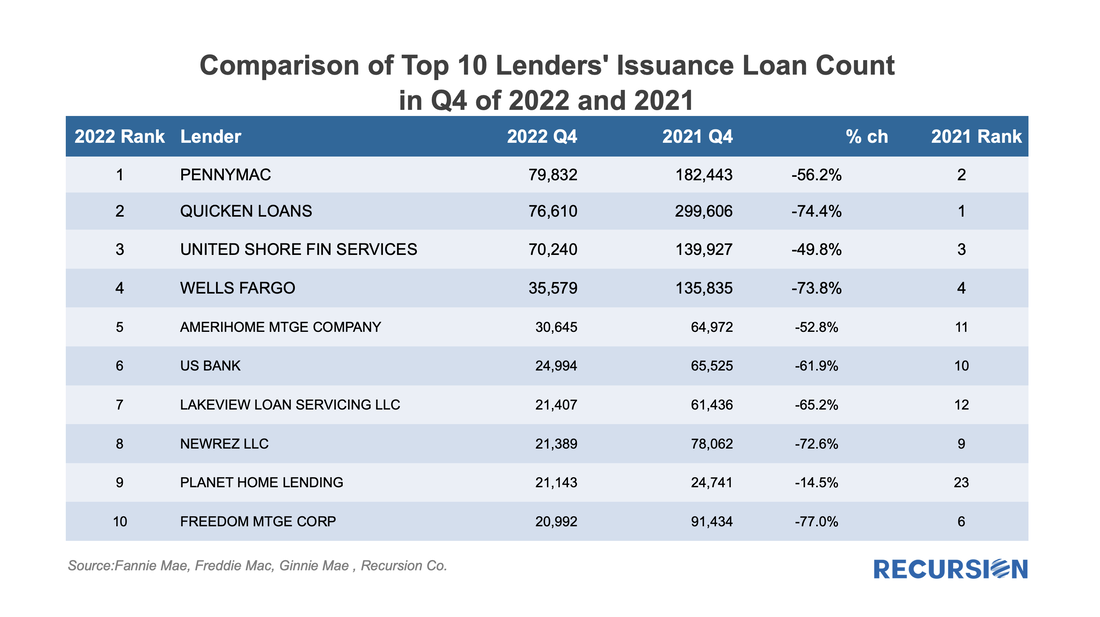

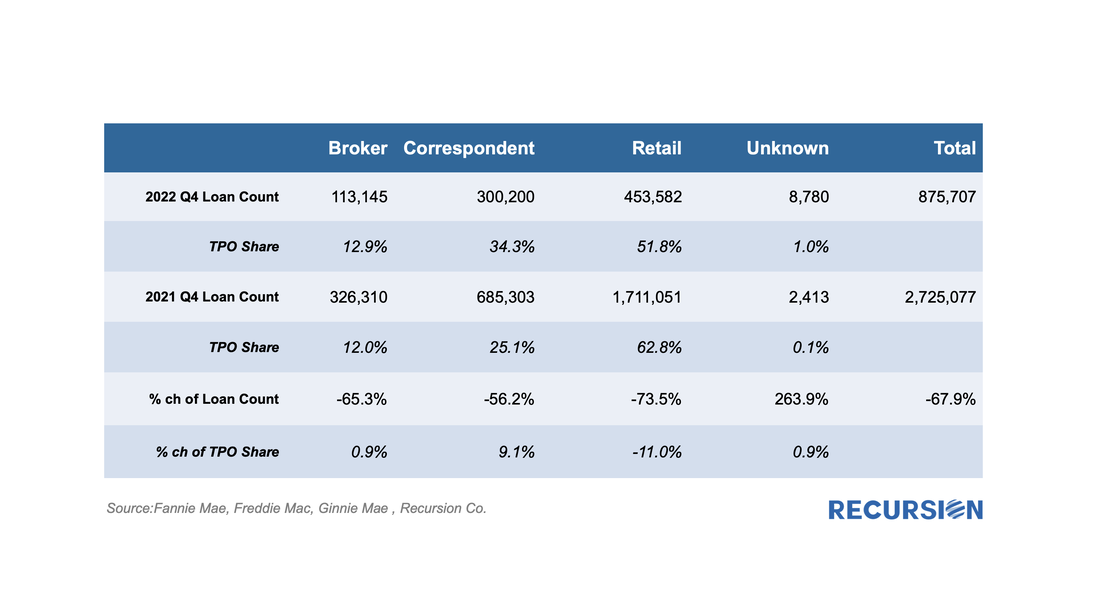

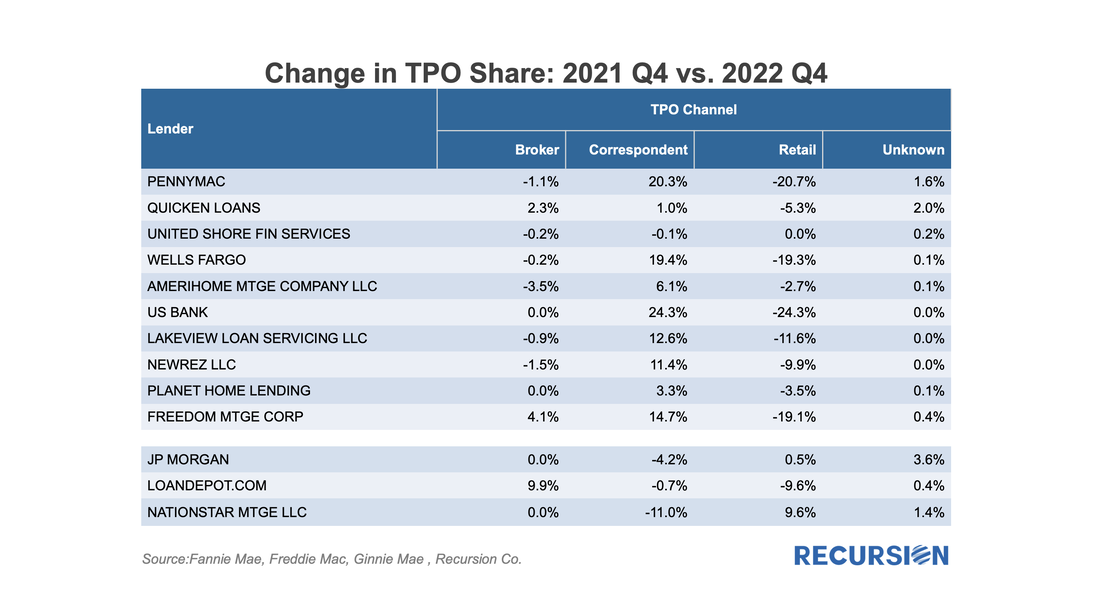

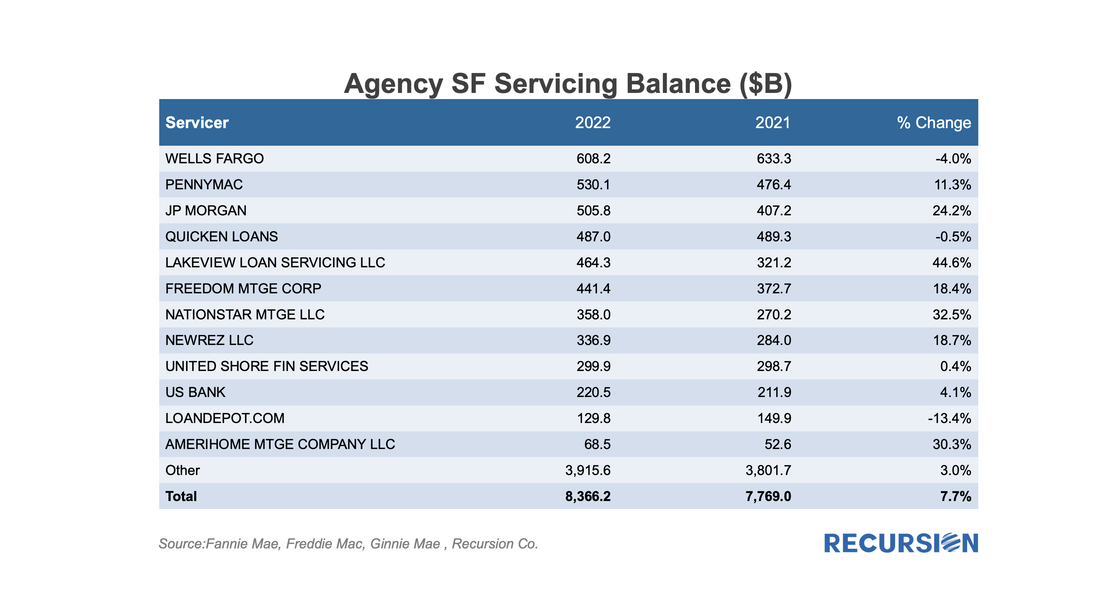

In a recent post[1], we spoke about how the current market environment of high interest and home prices is leading to downward pressure on both supply and demand in the housing market, a situation we call "Mortgage Winter". While this environment is unlikely to result in a severe recession such as the Global Financial Crisis, there is the potential for broad fallout associated with distress in the lender and broker markets. First, we look at the originations. The count of loans that were delivered to the three agencies dropped by 68% from Q4 2021 to Q4 2022: There were 9% fewer lenders that delivered to agency programs in Q4 2022 compared to Q4 2021. Bank deliveries modestly underperformed nonbanks. The top ten institutions performed in line with the overall market, although the top three institutions outperformed the market. We can also focus on the top 10 lenders: PennyMac replaced Quicken in the #1 slot at the end of 2022, as measured by the loan count of deliveries. The firm with the best overall performance in this group was Planet Home Lending (-14.5%), which jumped from 23rd to 9th place at the end of 2022. The three lenders in the top 10 at the end of 2021 with the biggest drop in deliveries were JP Morgan (-77.8%), Nation Star (-80.4%, and Loan Depot (-79.5%). Each fell out of the top 10 in 2022, from #5 to #11 for JP Morgan, #7 to #14 for Nation Star, and #8 to #13 for Loan Depot. The three lenders that jumped into the top 10 in 2022 were AmeriHome (#11 to #5), Lakeview (#12 to #7), and Planet Home Lending (#23 to #9). There are many possible reasons for these changes in rankings, ranging from business structure to corporate strategy. A notable shift that occurred in the market during 2022 was a distinct shift away from the retail channel to the correspondent channel: This breakdown provides powerful insights into the differences in strategies applied across firms: A shift away from the retail channel would tend to be associated with slashing costs in the short run but may also make it more difficult for the lender to respond quickly to any significant rebound that may occur. Firms with above-average drops in this channel might be buying into the idea of a persistent "mortgage winter". So far, the mortgage market can be said to be bent, but not broken. Firms are making adjustments in their business models in order to optimize their structures around their views of how large any future recovery in the market will be and when it might occur. But the question arises: What if the recovery takes longer than the market expects? At some point, could liquidity start to dry up? These are complex issues beyond the scope of what can be reasonably addressed in this note. On the servicing side, we saw elevated MSR transfer activity in 2022, causing sudden changes in the holdings on the part of individual servicers. Here is a table of these holdings across our dozen large servicers at year-end 2022 and year-end 2021, along with the change: Setting aside Wells Fargo as a specific case, the three large nonbanks with below-average growth (or contraction) in their servicing books last year were Quicken, United Shore, and Loan Depot. Changes in holdings of MSRs can occur for many reasons, including views on the fundamentals of loan performance. But they are also potential sources of liquidity should a firm find the credit markets difficult or expensive to access. Monitoring the MSR holdings of individual firms, particularly nonbanks without regulatory backstops, can be a useful sign of impending financial issues. A situation in which the number of firms exhibiting this behavior grows could be a leading indicator of rising systemic risk. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed