|

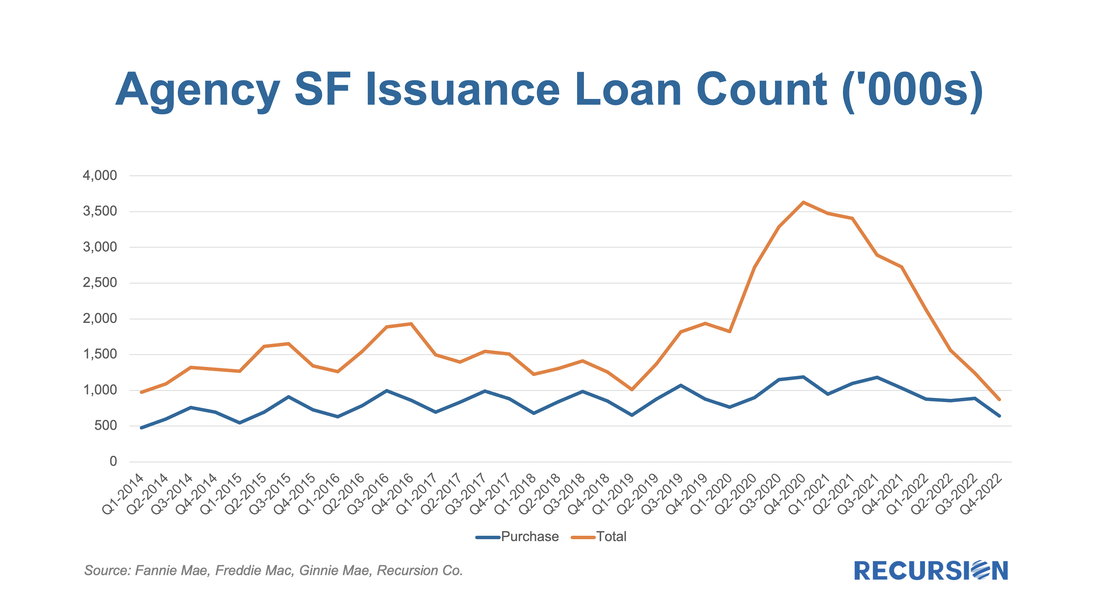

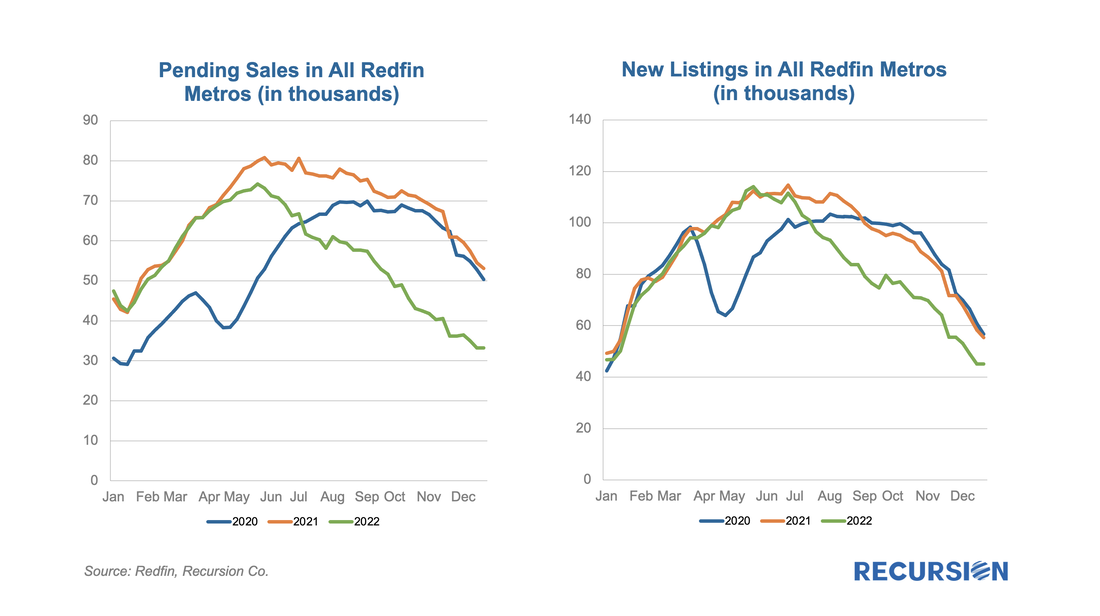

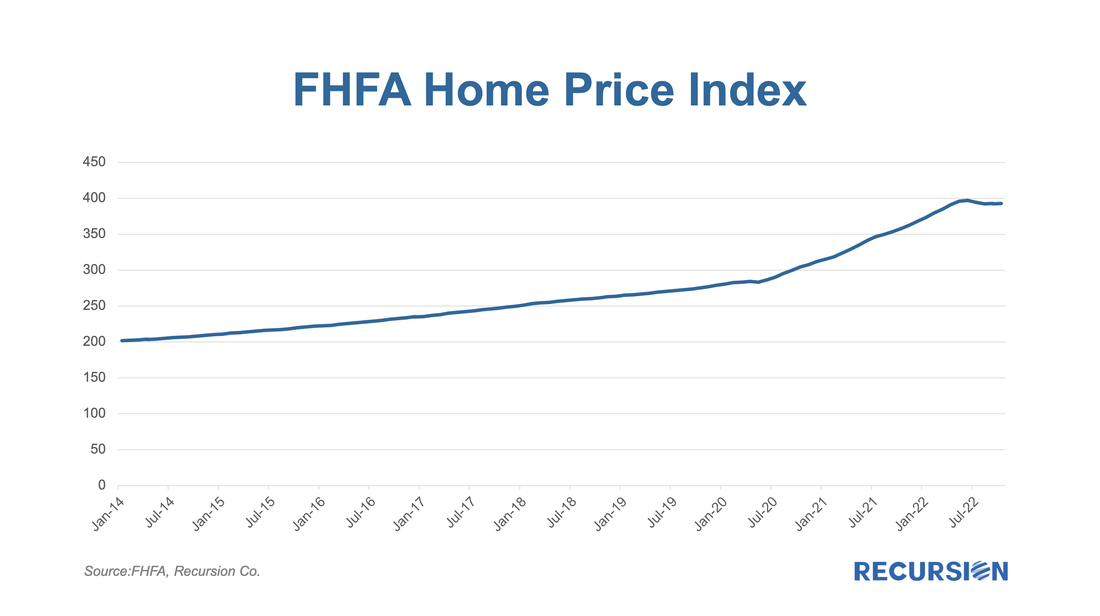

With 2022 at a close, we can begin to assess the impact of the extraordinary shocks of the past few years on the mortgage market landscape. The boom-bust nature of the housing market since the onset of the Covid-19 pandemic has resulted in an unprecedented degree of uncertainty about the outlook. Most commentary in this regard is understandably focused on home prices, but in the end, real estate is a transactional business, and we focus on that market aspect here: The number of loans delivered to the three agencies in Q4 2022 was 872,500, down 76% from the peak of 3,631,100 two years earlier and at least an 8-year low. Of course, the bulk of this decline took place in the refinance markets as we see the spread between total deliveries and purchase deliveries has reached to negligible levels. The ramifications of this plunge will be felt for years to come. With more than 60% of all mortgages issued in coupons less than 3.0%, a huge refinance surge seems unlikely in the short-medium term. While the drop in the purchase market is more muted, the decline has been significant, with Q4 deliveries at 644,200, down 46% from the Q4 2020 peak at 1,187,200. The next question that arises here is whether the decline in purchase transactions is a precursor to a sharp fall in home prices. In brief, this doesn’t have to be the case. The reason for this is that a drop in home sales is not necessarily a reflection of weak demand. Changes in transaction volumes are the result of changes in supply as well as demand. Often we think that price formation in the housing market occurs along the demand curve as aggregate supply changes resulting from the production of new homes occur slowly. But most home sales occur in the existing home market, and owners can decide whether to sell or not with few restrictions. The issue now is that the sharply higher interest rates we are experiencing are constraints on both supply and demand. Demand because of affordability, and supply because an owner with an existing mortgage is reluctant to move because the prevailing interest rate is likely to be much higher than that on their existing loan. The charts below track the seasonal patterns of demand (pending sales) and supply (new listings) over the past several years. Both are weaker than those experienced from prior years’ activity. As demand is falling faster than supply, the upward trend in house prices has stalled, but while supply remains soft, prices seem unlikely to suffer a rapid correction. “Mortgage Winter” is a market of persistent weakness in both supply and demand, where prices exhibit a degree of inflexibility. It’s a troubling equilibrium not because of a wealth effect of the sort that we witnessed in the Global Financial Crisis of 2008-2009, but because a dynamic housing market is essential for overall economic vibrancy and resiliency. Growth is impacted as well, as the housing services sector of the economy (particularly brokers and lenders) bears the full brunt of collapsing transaction activity. Lower interest rates and easing price pressures will ultimately work to thaw the market, but perhaps not for a considerable period. The remaining macro risk is focused on mortgage finance. Lender consolidation has been underway for much of 2022, and the lack of a quick rebound in new borrowing seems likely to present challenges to these firms. We will look at this risk in future comments.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed