|

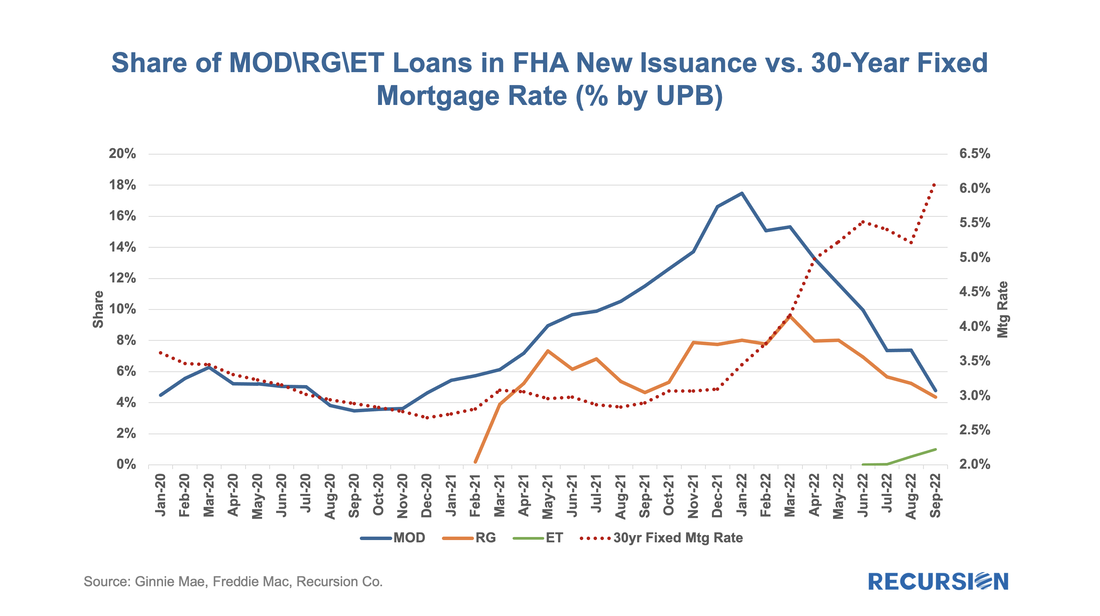

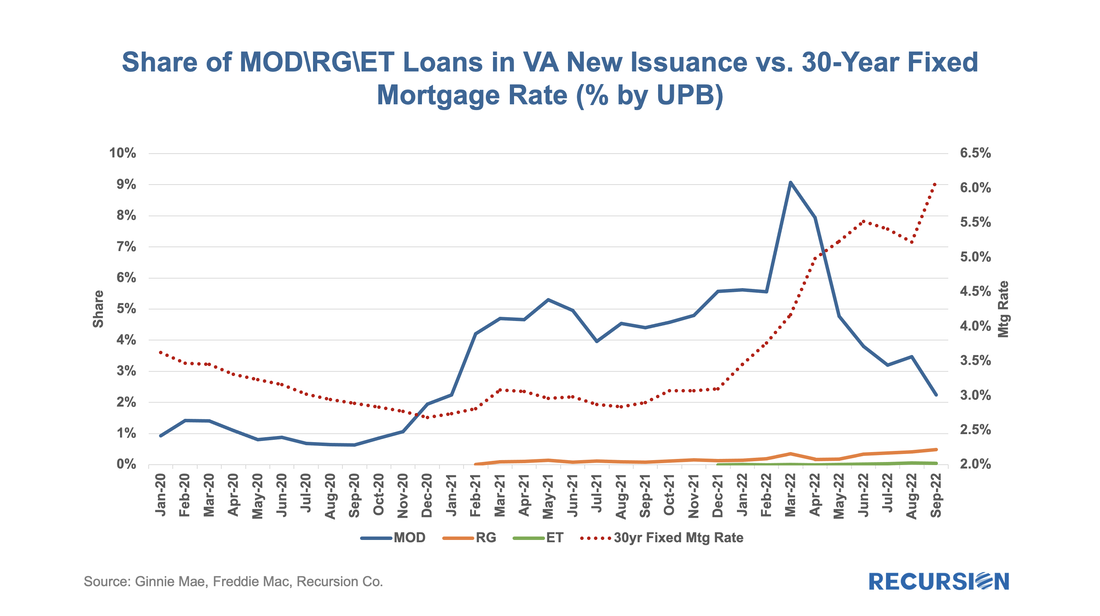

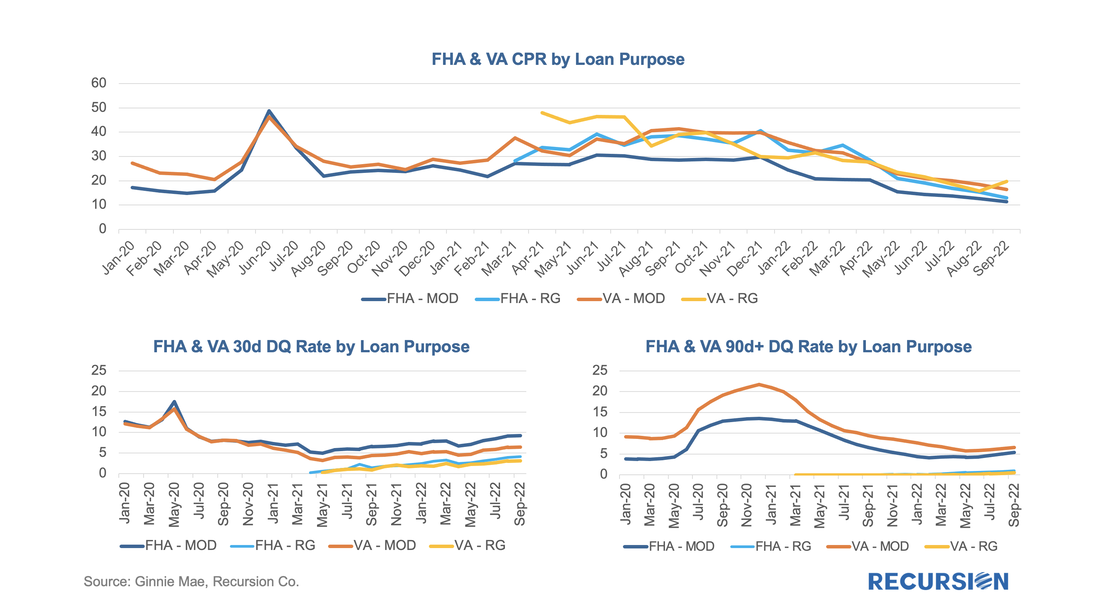

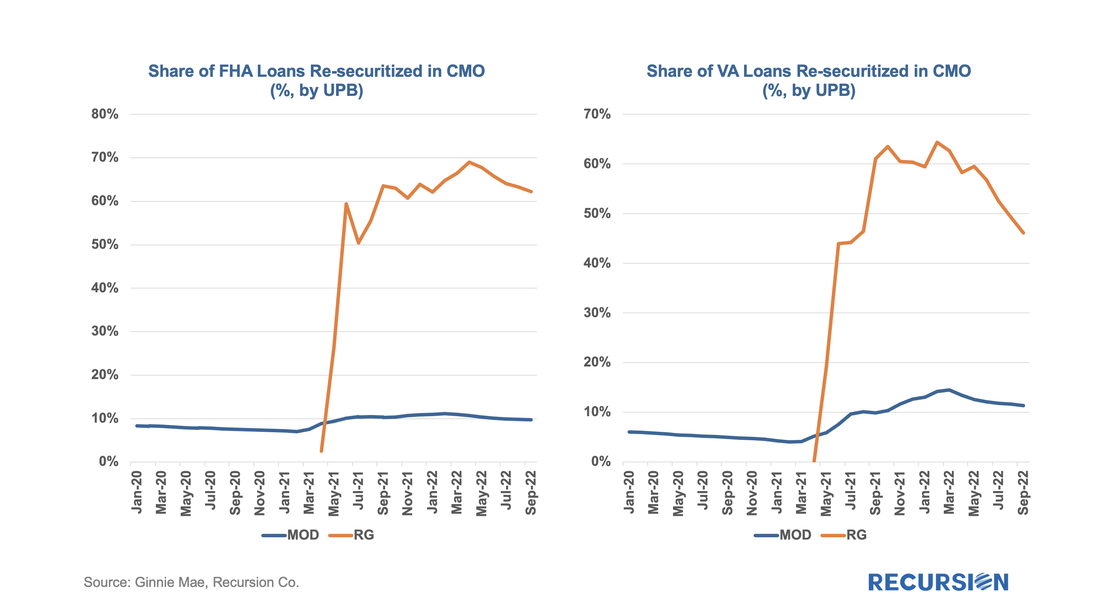

In previous posts, we discussed the trends in Ginnie Mae MBS issuance by loan purpose.[1] Recall that the decision to buy a loan out of a Ginnie pool rests with the servicer. As such, this decision is dependent in part on environmental factors that impact the profitability of this action, notably the interest rate. As loans get bought out at par, there is a greater incentive to purchase loans out of pools and get them into reperforming status when rates are low than when they are high. This relationship can be clearly seen in the following graphs: As mortgage rates fell in 2021 and then surged this year to 13-year highs, the share of modified loans of total issuance has plummeted. A more modest decline can be seen for FHA RG loans, while the very small share of RG VA loans has recently crept slightly higher. The new ET loan type is starting to be visible for FHA, but is almost nonexistent yet in VA. Given the performance trends we see in GNM program RG loans, it appears that servicers are securitizing these loans into structured products instead of GNM pools, particularly for the FHA program: Remember that we saw the first RG pool in Feb. 2021[2]. The RG CMO re-securitization rate shot up from close to 0 in April to 60% in June of that year. That is how long it took the pool investors to decide they did not want RG pools and to let CMO investors deal with them instead. [1] https://www.recursionco.com/blog/agency-mbs-issuance-trends-in-an-environment-of-rising-mortgage-rates-and-house-prices and https://www.recursionco.com/blog/agency-rpl-market-structure-and-performance [2] https://www.recursionco.com/blog/the-rg-pool-arrives Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed