|

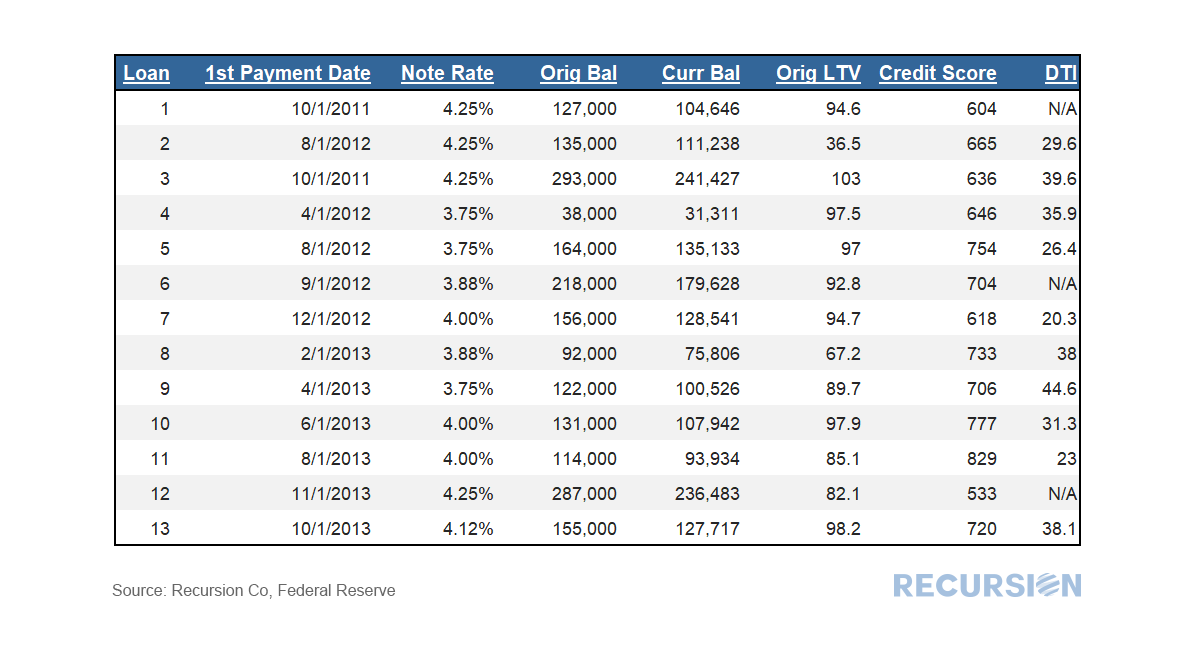

Sometimes, future trends can be seen in the weeds. In this case it’s the 12 FHA and 1 VA mortgages (out of tens of millions) that were securitized this month in Ginnie Mae pool G2 CA8080, the very first RG pool, issued by PNC Bank, delivered to the GNMII20C program. This pool type was first announced by Ginnie Mae last December 4[1], and consists entirely of loans that were bought out of pools and cured with partial claims. These are eligible for resecuritization after 6 months without a missed payment. A previous announcement was made by Ginnie Mae last June that prohibited loans in forbearance from being bought out of pools and resecuritized into any existing pool type[2]. This rule was enacted after large banks purchased a massive number of loans in forbearance and resecuritized them immediately, leading to concerns on the part of investors[3]. Is there anything interesting about these loans? The loans were all originated in 2011-2013, so they are pretty seasoned. Note rates range from 3.75% - 4.25%. Underwriting characteristics vary considerably, with credit scores ranging from 533 to 829, for example. While original LTV’s are generally high (8/13 greater than 90) home price appreciation over the last 8-10 years likely implies that borrowers have considerable equity. More of this to come as forbearance programs begin to run out later this year. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed