|

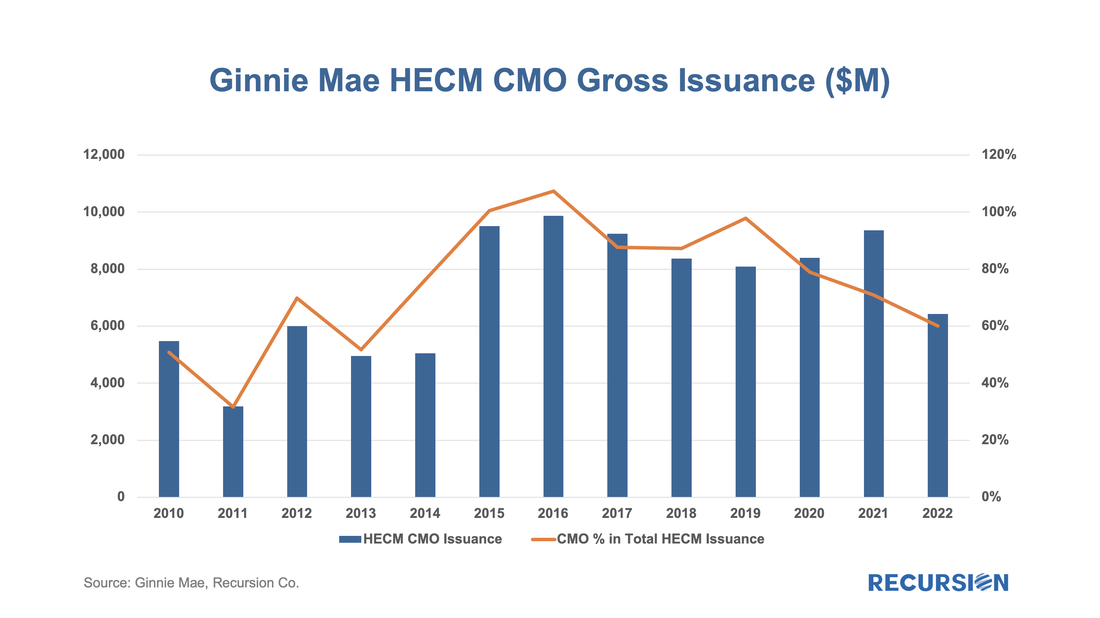

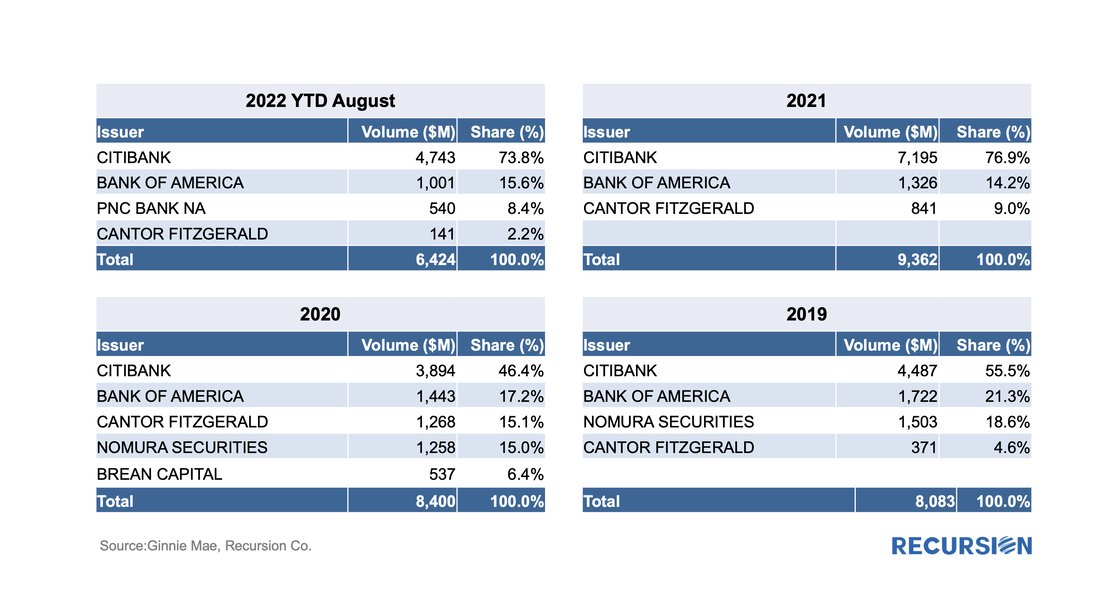

Following the recent publication report of our CMO league tables[1], our next look at the structured mortgage product market is with HECMs. This is a very specialized product, but it offers distinct investment opportunities for investors to benefit from fundamental analysis of the unique characteristics of these "reverse mortgages". As the number of outstanding loans in this class is very much less than that of "forward" mortgages, it stands to reason that many HECMs would be packaged into CMOs to enhance diversification, and indeed that is the case: There have been periods when the issuance of HECM CMOs has actually slightly surpassed the total new issuance of pools, as the CMOs can contain seasoned pools. In the last few years, the share has been declining, and stands at just over 60% of the first 8 months of 2022. Using the collateral files provided by FHA, we can build League Tables for HECM CMOs. It is not surprising that a few institutions dominate this business. Citibank is known for collaborating with other banks in securitizing HECM CMOs and thus has dominated this market with over 50% share since 2019 Only BofA has had a share greater than 20% during this period, and that was in 2019. Once again, these calculations demonstrate the ability our clients' ability perform complex calculations using our tools, boosting their competitiveness in the marketplace. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed