|

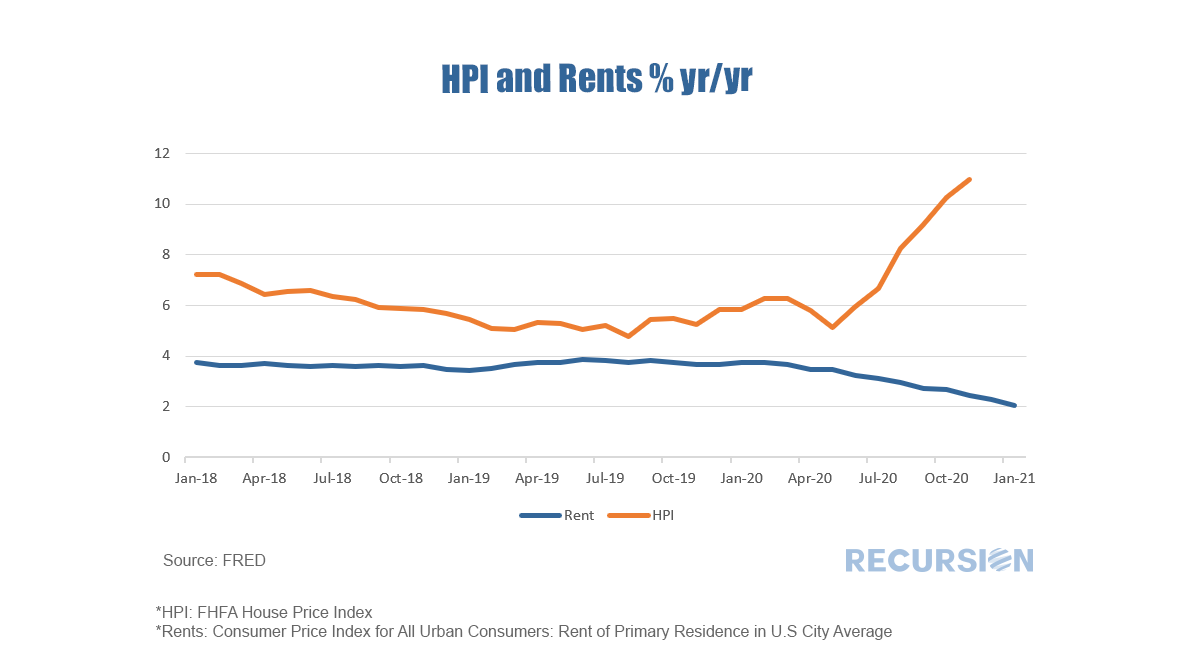

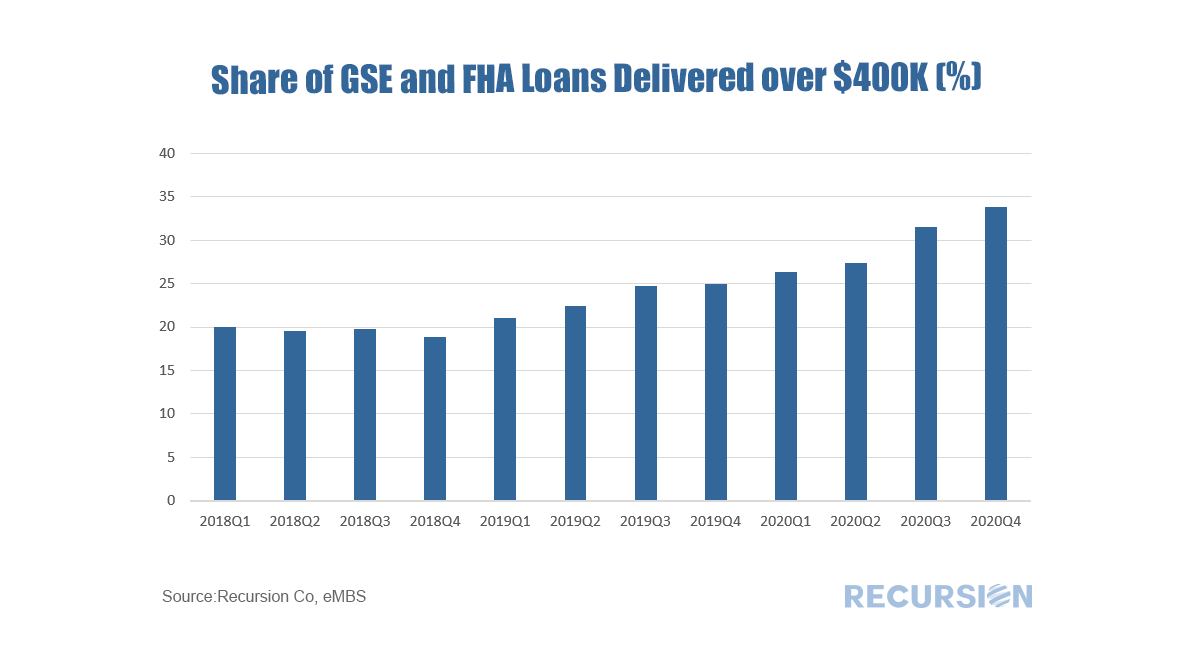

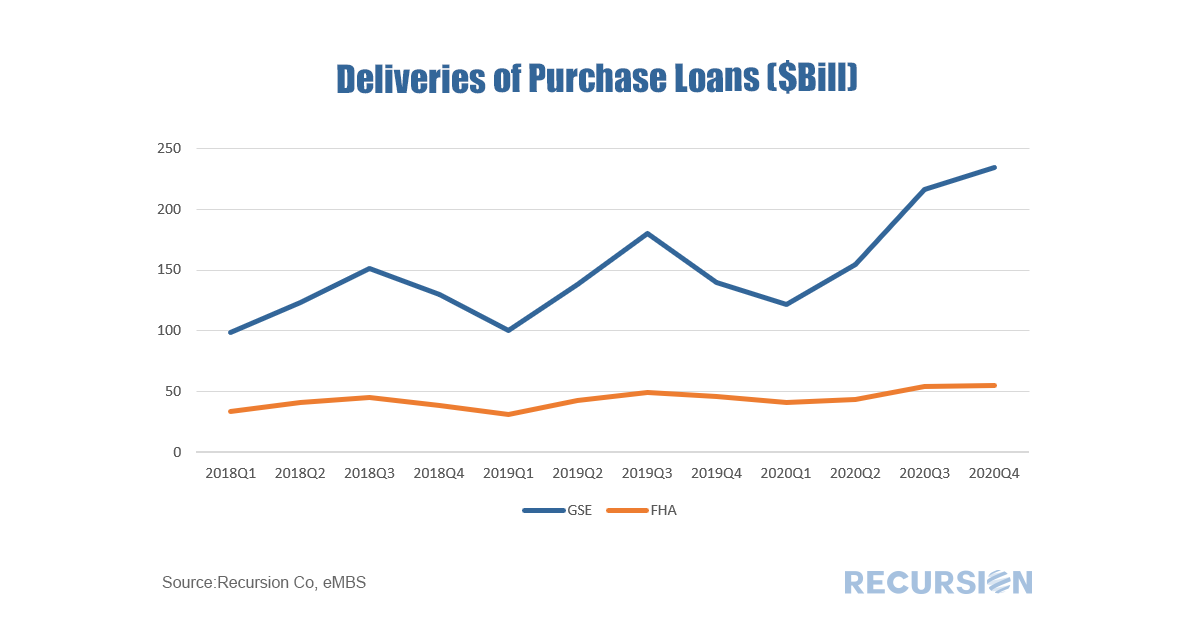

Assigning letters to economic recoveries (“V”, “L”, “U” etc.) has become a standard part of the economist’s toolkit for expressing a view on the nature of a particular forecast. The Covid-19 crisis has added a new letter to the lexicon, “K”. In a “K-shaped” recovery, some segment of the population experiences relatively strong growth, while others are left behind. Since housing tenure is an essential determinant of the distribution of household wealth, it is not surprising that we can clearly see this shape in the relative trends in house prices versus rents: As the burden of the Covid-19 pandemic has fallen on lower-income service sector employees, rent increases have decelerated, while record-low interest rates and a flight away from density are serving to boost house prices. The same dynamics are also expressed in changes in the share of FHA versus conventional purchase loans. According to HMDA, the median income of an FHA borrower for home purchase in 2019 was $66,000, considerably below that of conventional borrowers at $98,000. With surging house prices, the share of loans greater than $400,000 has risen considerably. Loans greater than $400,000 are out of reach of most FHA borrowers as they are 6x the median income of this cohort. Consequently, the booming housing market has been realized by higher-income conventional borrowers, while FHA loan production has essentially held steady. We won’t get income and demographic data for 2020 until the HMDA data are released this summer, but widening inequality from housing seems likely to be a key feature of the release.

|

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed