|

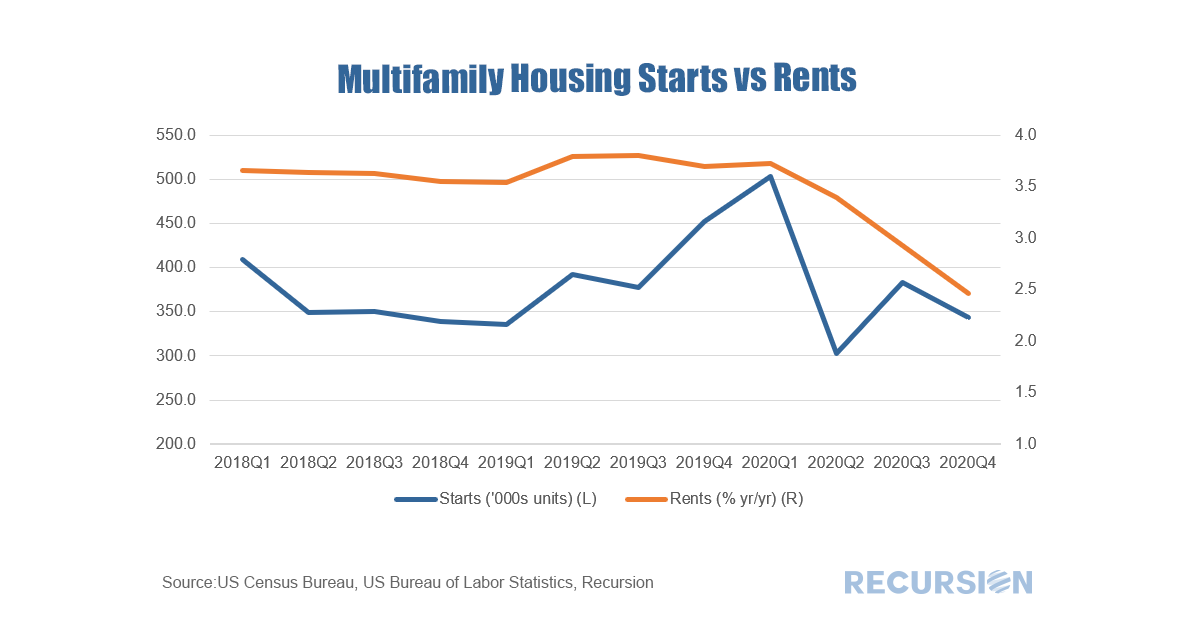

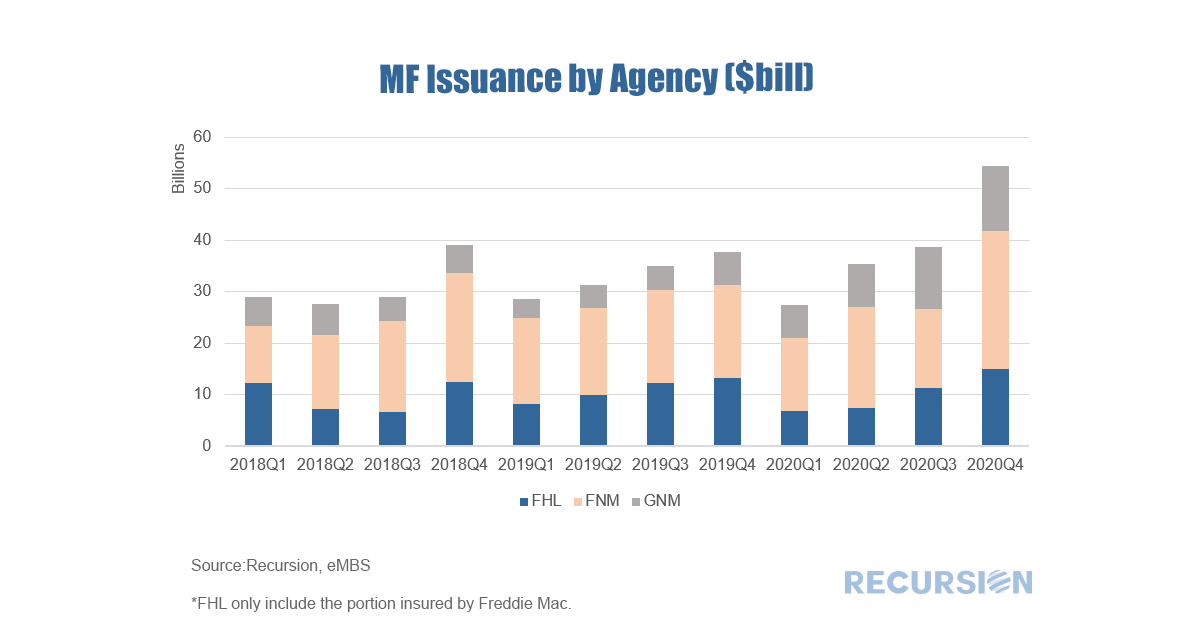

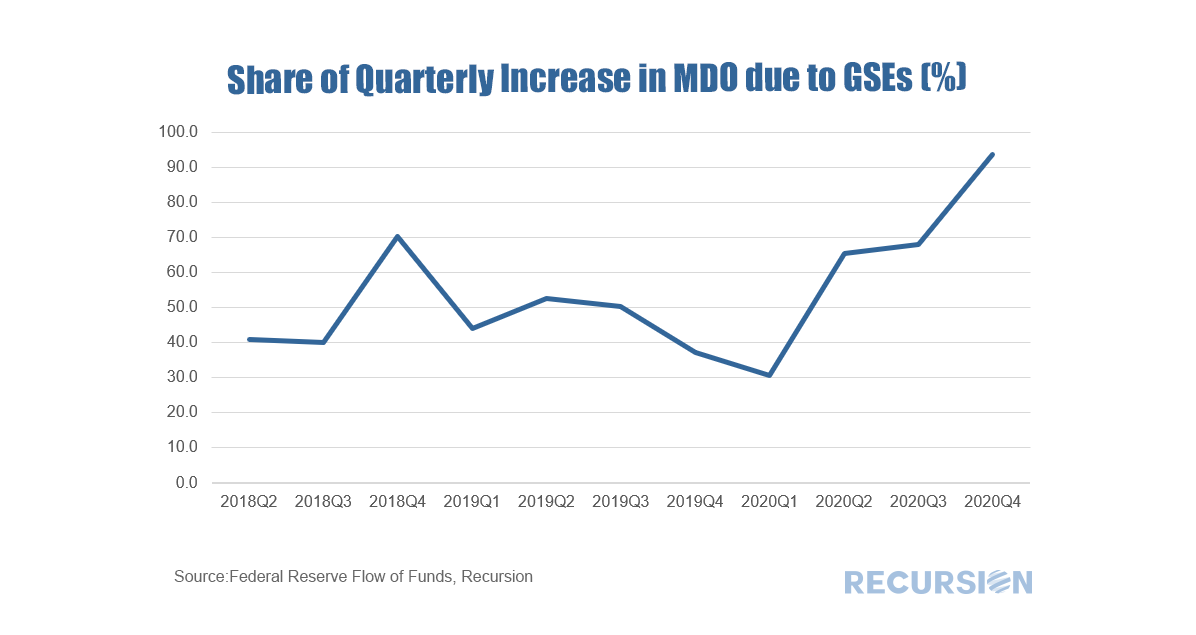

We have commented previously about housing and the “K-shaped Recovery”[1] in which home prices are booming but rent increases are decelerating. This dichotomy is highly unusual but reflects the flight of households out of dense urban environments due to the Covid-19 pandemic. With rents decelerating, it is not surprising that starts of new multifamily units have been in a trend decline over the past year. The situation for the MF debt market is more nuanced. The onset of the pandemic barely dented the growth rate of new Agency issuance last year, and in fact there was a substantial jump in GSE issuance at the end of the year. The Agency share of the MF market is not as dominant as is the case for single family securities, but its influence did increase sharply over the course of 2020. MF Mortgage Debt Outstanding (MDO) rose a record $42.3 billion in the fourth quarter, almost completely accounted for by the rise in volumes from Fannie Mae and Freddie Mac. This surge in GSE outstanding mf debt In Q4 2020 pushed the Agency share up by a single quarter record 1.2% to reach a record 47.8%. How will these trends evolve in 2021? The single biggest question is whether the recent sharp increase in the GSE share is the result of the Enterprises looking to front-run new limits on their 2021 business imposed last year[2], or whether private sector lenders have backed off due to the deteriorating environment for rents. This is a very complex calculation that depends on such factors as the outlook for the virus, and the degree to which the outflow of population from the most crowded cities may slow, or partially reverse. Finally, there is the potential for policy changes aimed at the multifamily market later in the year. While the surge in house prices grabs our attention, what happens in the lower arm of the “K” is of great importance. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed