|

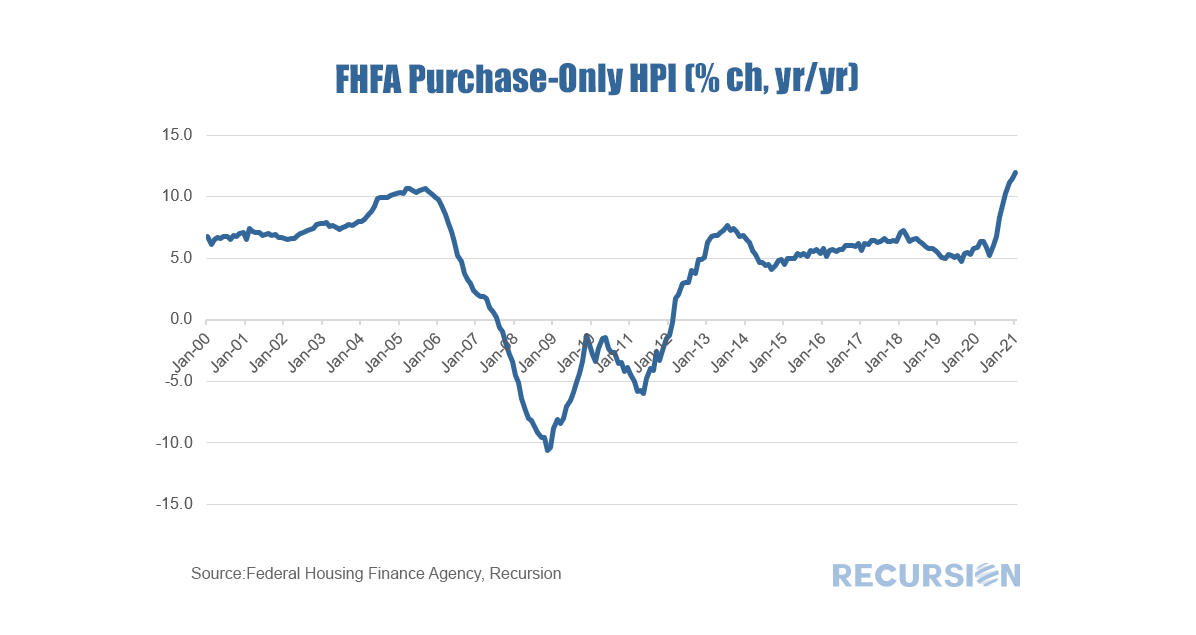

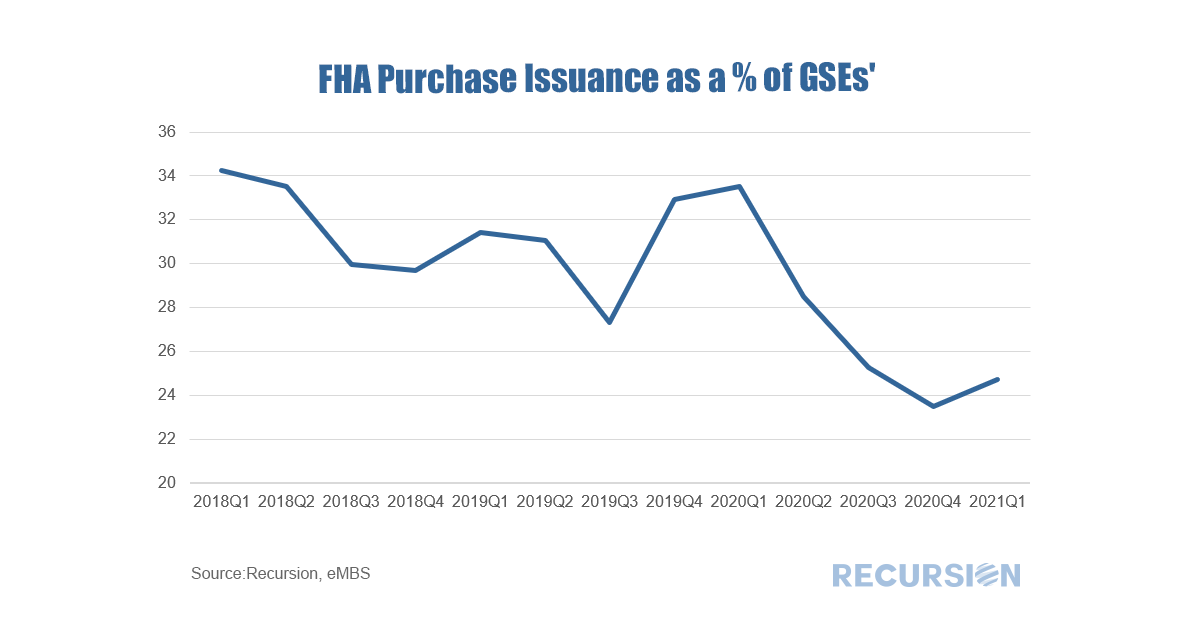

On March 30, FHA released its Quarterly Report to Congress on FHA Single-Family Mutual Mortgage Insurance Fund Programs for Q4 2020[1]. The report shows that the MMI fund grew to $82.3 billion from $79.9 billion the prior quarter. However, the year-to-date actual net loss rate on claim activity of 35.2% is higher than the projection of 30.1% percent, as the portfolio-level serious delinquency rate increased in the quarter to 11.9%, from 11.6% percent last quarter. Consequently, Secretary Fudge in a statement indicated stated that “Given the current FHA delinquency crisis and our duty to manage risks and the overall health of the fund, we have no near-term plans to change FHA’s mortgage insurance premium pricing.”[2] As we have noted previously, the Covid-19 crisis is very distinct from the Global Financial Crisis (GFC) insofar as while both periods experienced high delinquency rates, house prices now are soaring as opposed to collapsing in the earlier crisis. The surge in prices has made buying a house challenging for FHA borrowers, who tend to be lower income households than those of conventional borrowers ($77K vs $98K, from 2019 HMDA). Consequently, FHA has lost market share on trend over the past year. The following chart shows that the FHA issuance volume of purchase loans as a percentage of the GSEs’ dropped from 34% to 25% during the past 3 years from 2018Q1 to 2021Q1. HUD’s caution regarding public sector risk also may serve to protect borrowers. With the supply of homes for sale moving sharply lower[3], a MIP cut might have served to fuel an incipient bubble, and place those stretching to buy homes at record high prices at risk as well. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed