|

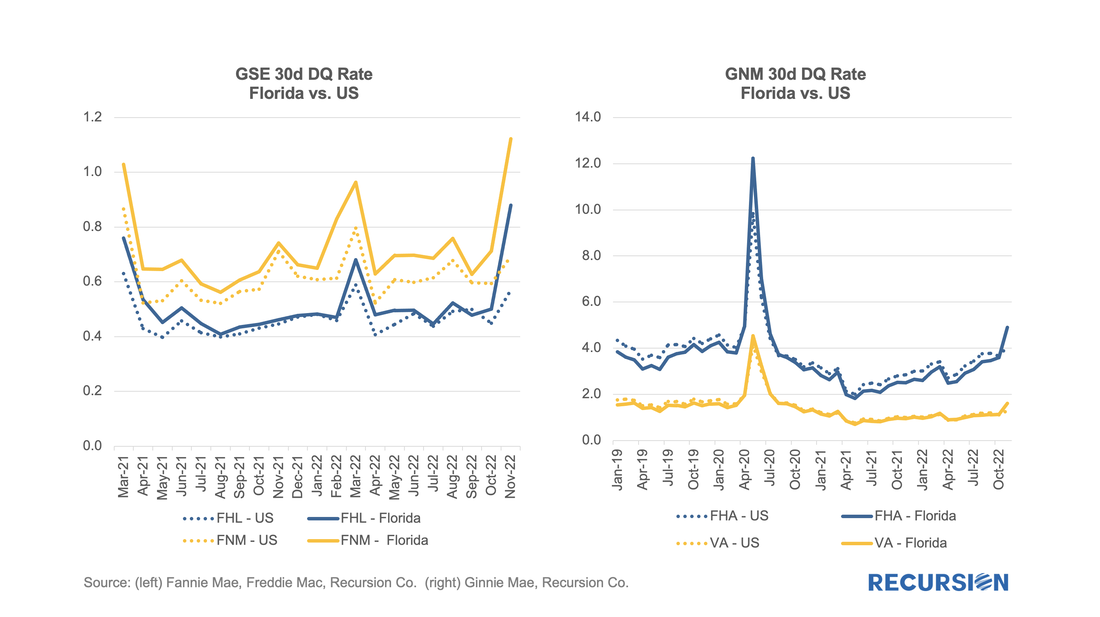

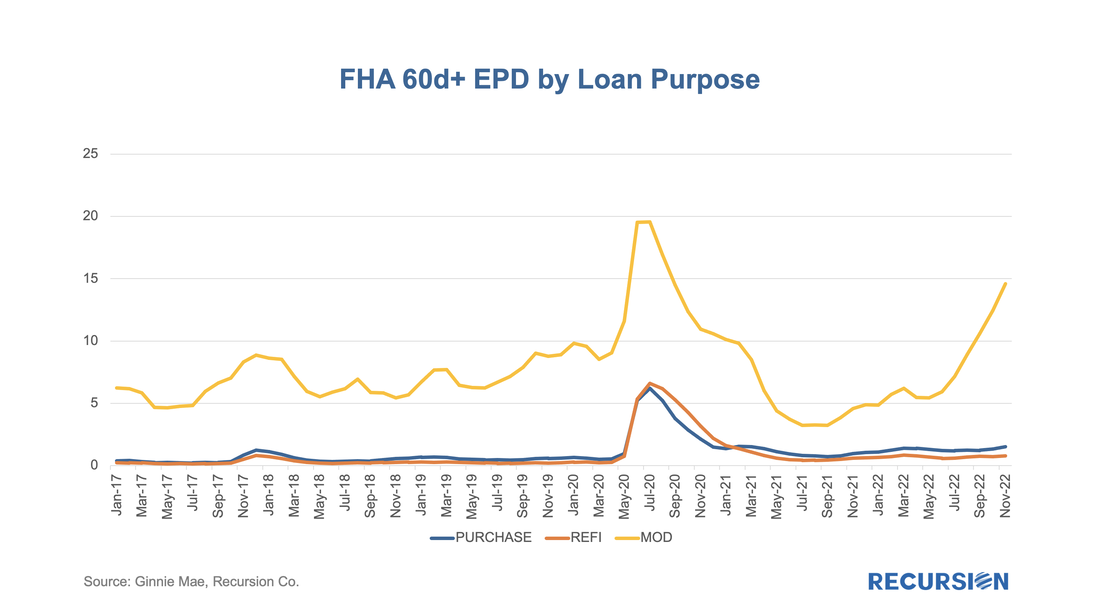

As policy interest rates continue to rise and economic activity begins to slow, attention in the mortgage market shifts towards concerns about the potential for borrower distress. We are early in this process as the labor market continues to add jobs, and there continue to be more job openings than people looking for work. Nonetheless, signs of strain begin to be seen, and it's worthwhile to point out early trends and consider implications. Notably, the impact of Hurricane Ian could be seen in the short-term delinquency data: For the loans in GSE pools, overall short-term delinquencies remained in a narrow range between 0.4% - 0.8%, while that for Florida entered a new range between 0.8%-1.2%. FHA loan delinquencies continued an upward trajectory[1], with short-term delinquencies reaching the highest level attained since August 2020. For Florida, the rate jumped by 1.3% to 1.9%. Next month we will be able to see the impact of Hurricane Ian, as this is a 60-day figure, while watching what happens when Hurricane Nicole comes on the scene. Besides geography, we can also start thinking about mortgage characteristics' role. One interesting category of buyers is those who have held their current mortgage for 6 months or less. Such mortgages that have missed two or more payments during this time are said to have experienced an early payment default (EPD). We can further break this down into categories of loan purpose: purchase, refinance, and modified loan. There are significant differences between loan purposes, especially modified loans: Modest increases can be seen in the refinance and purchase categories, while the figure for modified loans jumped by 2.1% to a 28-month high of 14.6%. This is a 70% retracement from the peak near 20% reached in July 2020 to the low of 3.2% reached in September 2021. As this occurred in an environment of solid job growth, any weakness in this area could lift the EPD figure closer to the pandemic peak. The intersection of climate change and borrower distress can be usefully examined by using big data techniques to examine cohorts in new and innovative ways. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed