|

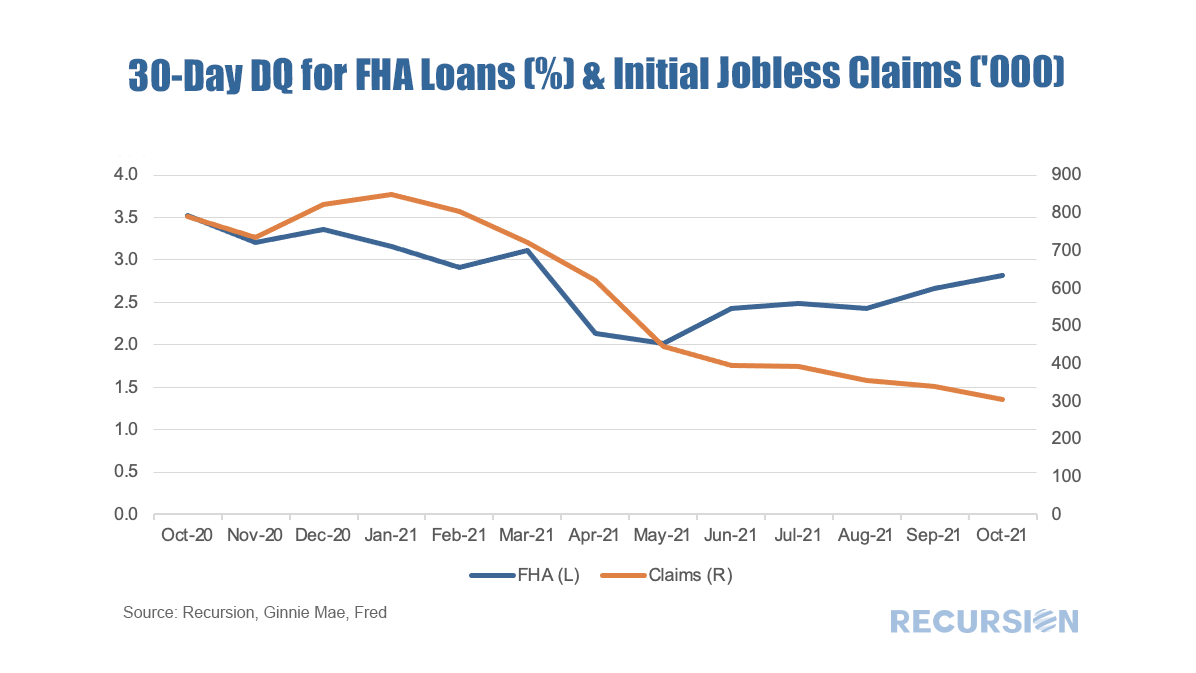

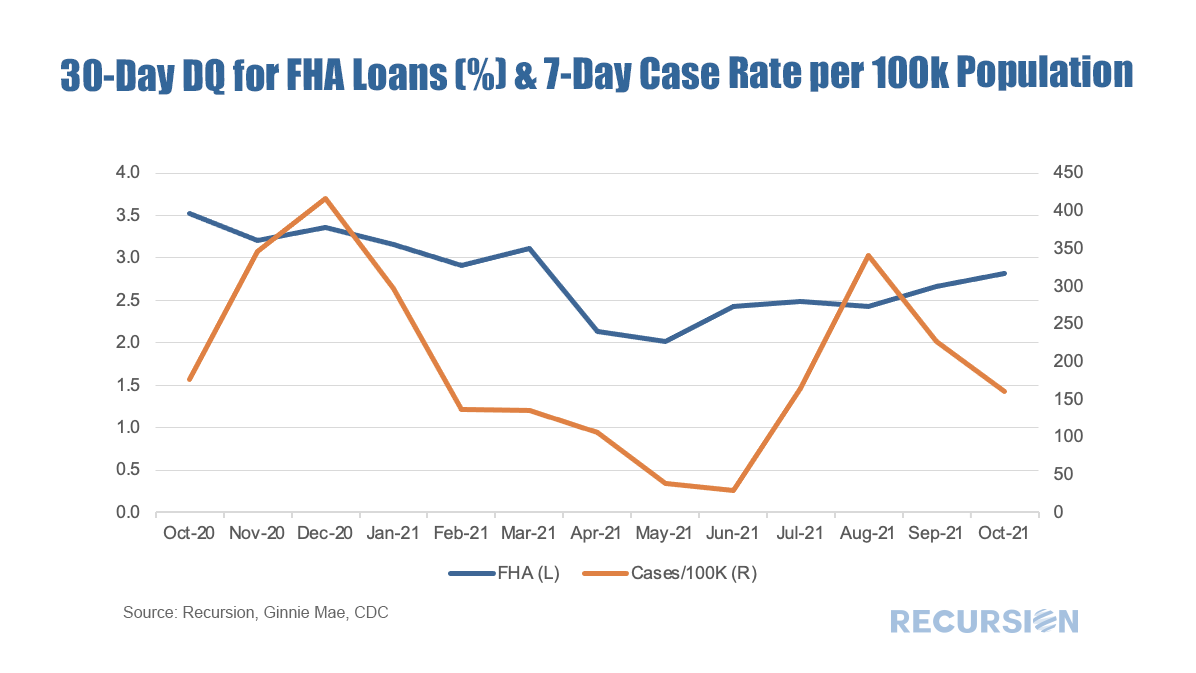

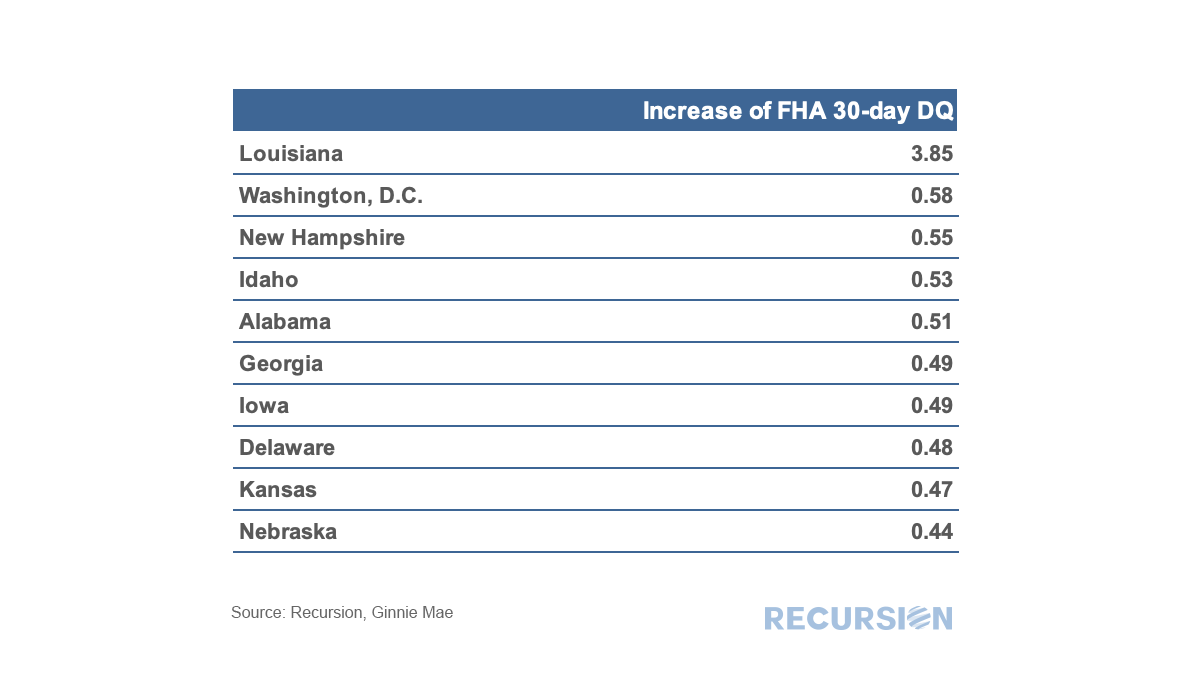

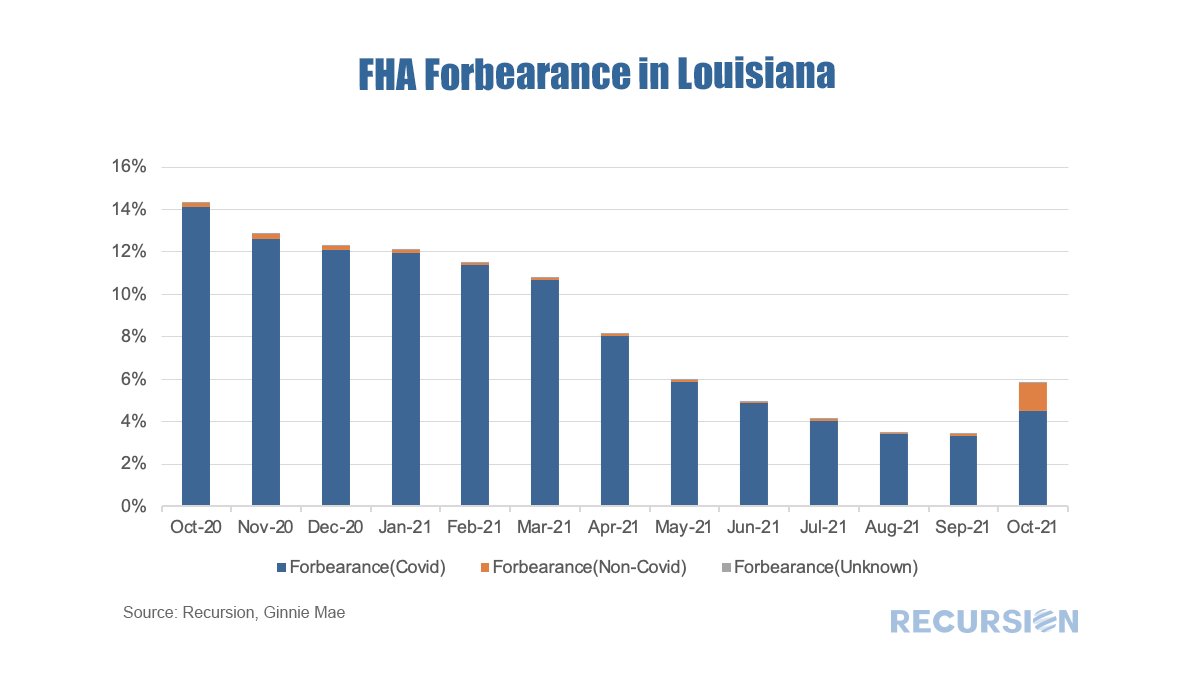

Received wisdom in the mortgage market holds that distress in the mortgage market eases as the labor market improves. While there is certainly some justification for this view, in fact there are many factors that drive performance so the direct correlation with the jobs market does not always hold. In particular, as the labor market returns to historic norms, measured here by jobless claims, other factors may rise in importance. Looking at this chart, one factor that comes to mind is the revival in the number of Covid-19 cases after the recent trough in the second quarter. This pattern doesn’t persist as there is there is no sign yet that the recent decline in cases has yet to be reflected in performance. Such improvement may just be a matter of time, but there is another possible explanation as Hurricane Ida smashed into Louisiana on August 28 this year, and then moved northeast towards New York and New Jersey. Below find a table of the top 10 increases in the FHA 30-day DQ rate for the period from August-October 2021. The rise in Louisiana is striking, while others on the hurricane’s path did not experience the same magnitude of impact. For example, New York and New Jersey’s DQ rate rose by 0.16% and 0.43% respectively. Only one state experienced a drop in the DQ rate during the prior two months: Vermont with a change of -0.02%. Interestingly, Vermont has the highest vaccination rate in the country of any state. Finally, how can we confirm that the rise in the delinquency rate was due to Hurricane Ida? It turns out that the Ginnie programs report a breakdown in forbearance between Covid and other (non-Covid) causes. Here is the chart for Louisiana on that basis: It’s interesting to note not only the rise in non-covid hurricane-related forbearance but also the increase in the Covid forbearance rate that month, indicating that other factors besides weather are at play. The likely culprit in this case is the October 1 deadline for FHA borrowers to apply for forbearance that had been in place. As it turns out, HUD extended this deadline at the very end of September[1]. Some indication of how borrowers will react to this extension in coming months. The main take-away from this exercise is the complex web of factors that drive loan performance. The economy (labor markets), weather (Hurricane Ida), the pandemic and policy all play a role. It is difficult to imagine producing a formal model that mimics these impacts with any accuracy. Instead, effective decision-making on the part of investors and policymakers needs to be founded on a deep understanding of market structure, supported by high-frequency big data in the cloud. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed