|

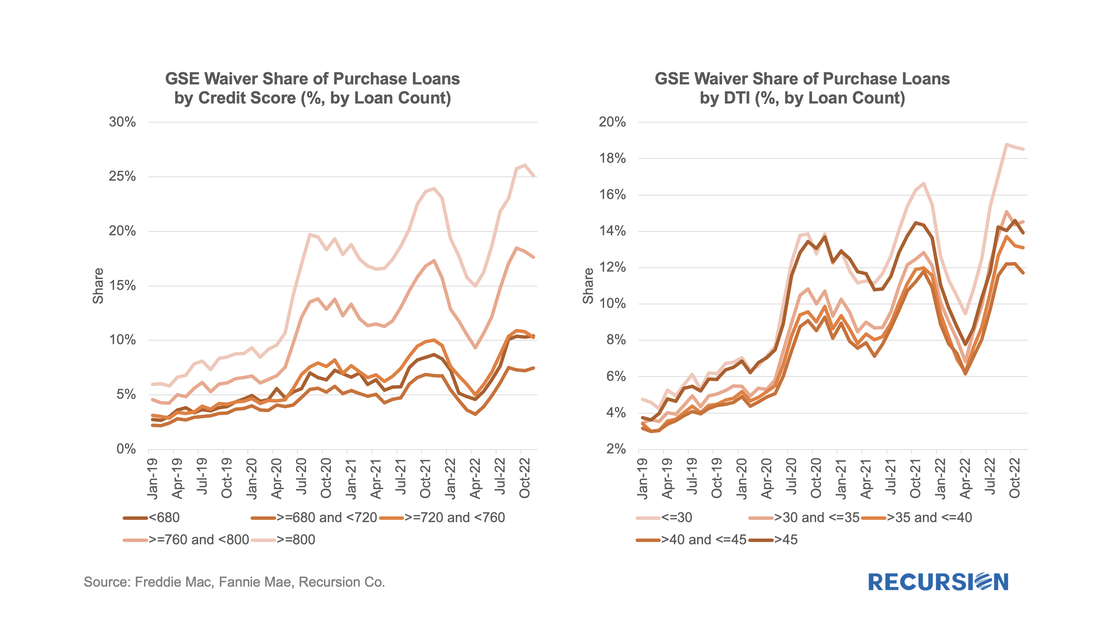

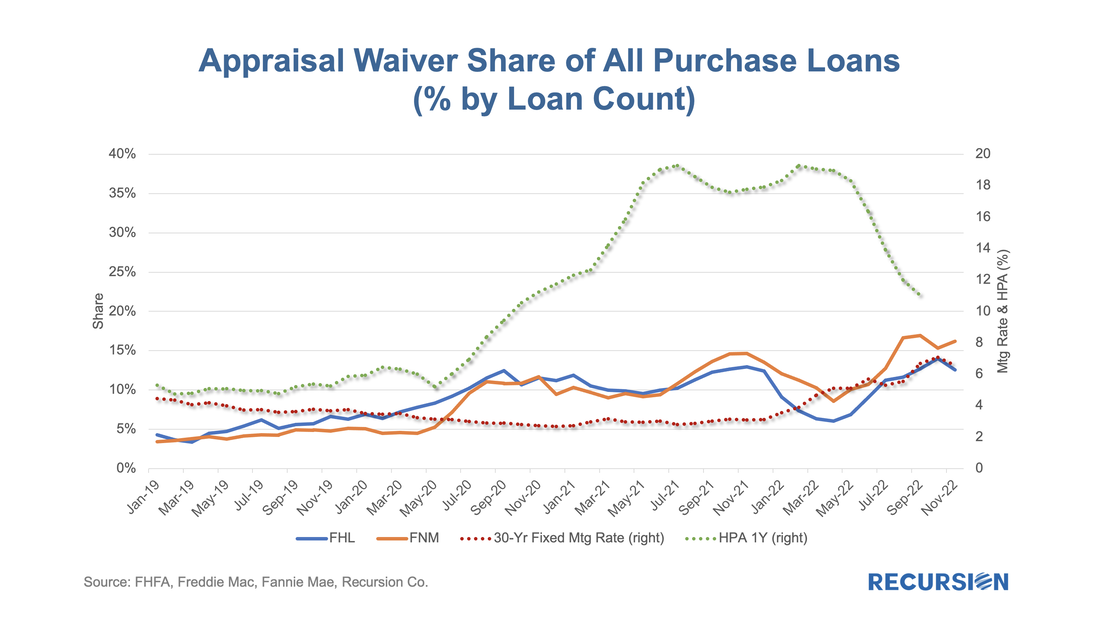

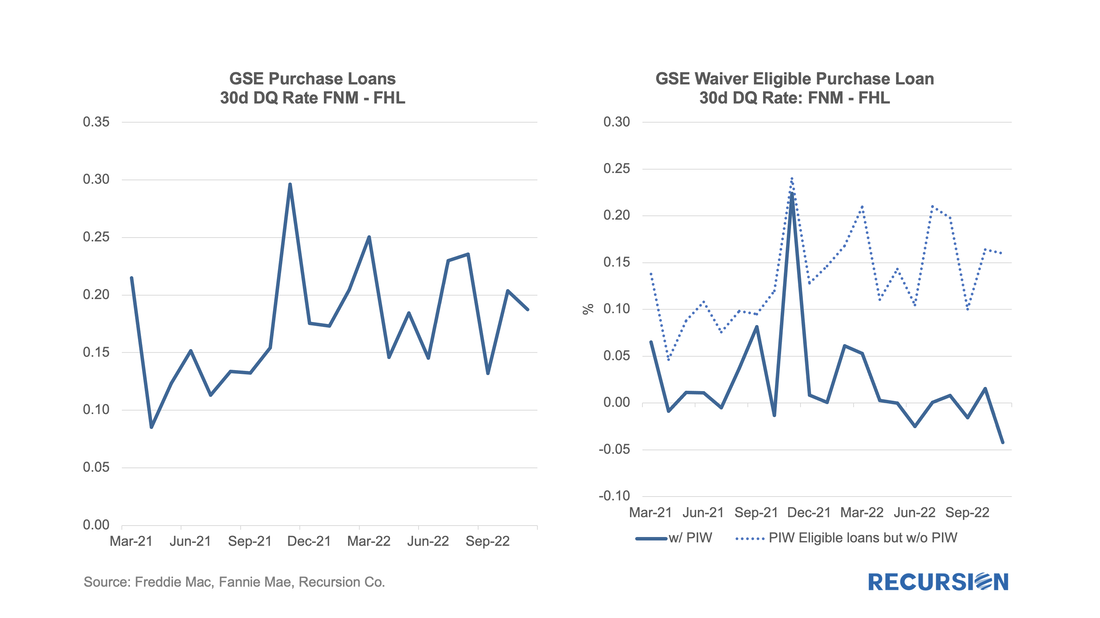

For some time, we have been following the trends in appraisal waiver usage for loans delivered to the GSEs[1]. Now it’s interesting to revisit these trends in the wake of the recent sharp volatility in economic and market conditions. Appraisal waiver usage by originators is one of a number of decisions that reflect the risk appetite of loan-producing firms. All else being equal, a waiver serves to reduce costs, and potentially volumes, at a cost of increased uncertainty about a property’s valuation. As the mortgage market is currently dominated by purchase mortgages in this high interest rate environment, we limit our analysis to this loan purpose. The risk aspect can be clearly seen by the tendency for waivers to be more widely available for borrowers with strong credit profiles: Of course, in the end, the decision to allow a waiver is the result of a myriad of factors: There is a positive correlation between the level of the mortgage rate and the utilization share of waivers as lenders seek to find ways to reduce cost pressures associated with higher interest rates. There is a less pronounced inverse (lagged) relationship between rising house prices and waiver utilization, as it appears that a firm’s confidence in valuations is highest in periods of accelerating price increases, while deceleration is associated with increased caution. At present, the need to support volumes in a very weak market appears to be the dominant factor in the decision. If house price declines accelerate, it will be interesting to see how long this behavior persists. Besides fundamental factors, recent important technological changes are impacting the usage of waivers and even the terminology used in the industry. When waivers began to be broadly adopted about five years ago, valuation was determined in a full property inspection, or this process was waived (through a Property Inspection Waiver or PIW), and the Enterprises utilized their own methodologies to measure value. More recently, a spate of innovative technologies has come onto the scene, leading to new categories of valuation methodologies. These include desktop and hybrid appraisals, which have only been available since March 2022. At the present time, the flag marked “appraisal” in the monthly disclosures can refer to a full onsite inspection, a hybrid appraisal, or a desktop appraisal. As the distinction between these categories is not made in the disclosures, we don’t know if a physical inspection was performed or not. The “waiver” flag implies that no physical inspection was performed, but it does not cover all such cases. We therefore drop the “PIW” distinction and refer to loans as having a waiver or not. We do not have enough information to tell if the trend rise in the waiver share this year, as seen in the chart above, for both Enterprises has more to do with institutional factors in terms of the introduction of these programs rather than fundamental factors. Insofar as that is the case, there is somewhat less risk involved than if there was no information available at all. A final point that is worthy of attention that can be made using this framework has to do with the difference in loans delivered to Fannie Mae and Freddie Mac. We’ve commented previously that there is a persistent modest performance gap between Fannie Mae and Freddie Mac MBS in favor of Freddie Mac. We notice here that over the past 15 months, during the period of higher interest rates, the use of waivers for loans delivered to Fannie Mae is somewhat higher than those sent to Freddie Mac, a sign of a somewhat higher risk appetite of the former versus the latter. This suggests that it might be useful to look at the performance gaps broken down into loans with waivers and those eligible for one but instead uses a regular appraisal: It appears that the performance difference is generally quite low for loans with waivers, and that the discrepancy in overall performance is associated to those with appraisals. More research is needed to explain this distinction, but it may be the case that loans with waivers are more carefully vetted than those without. Recursion is a preeminent provider of data and analytics in the mortgage industry. Please contact us if you have any questions about the underlying data referenced in this article. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed