|

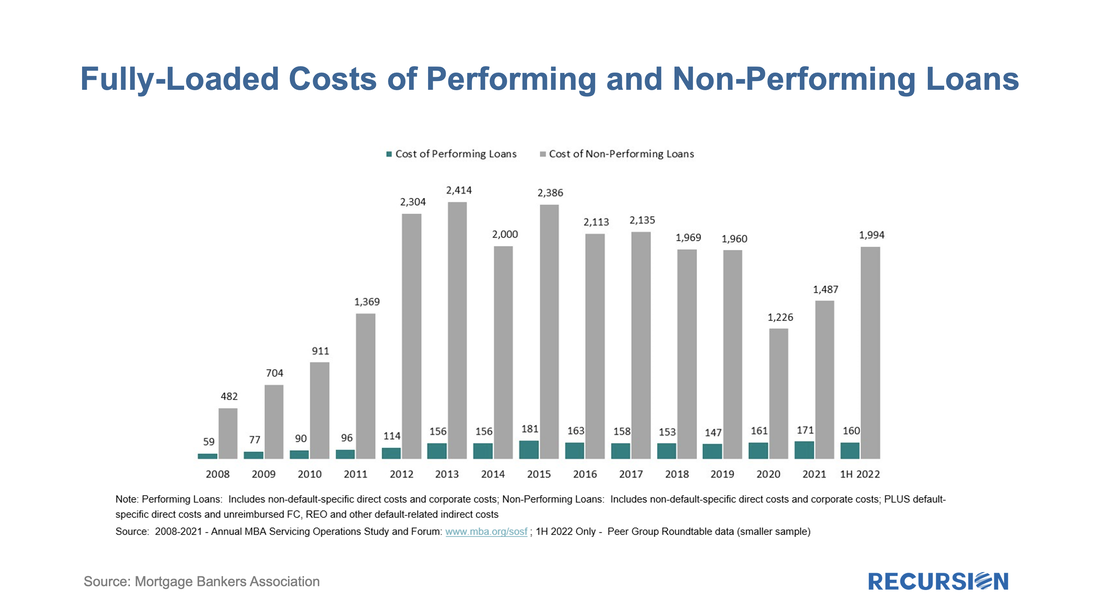

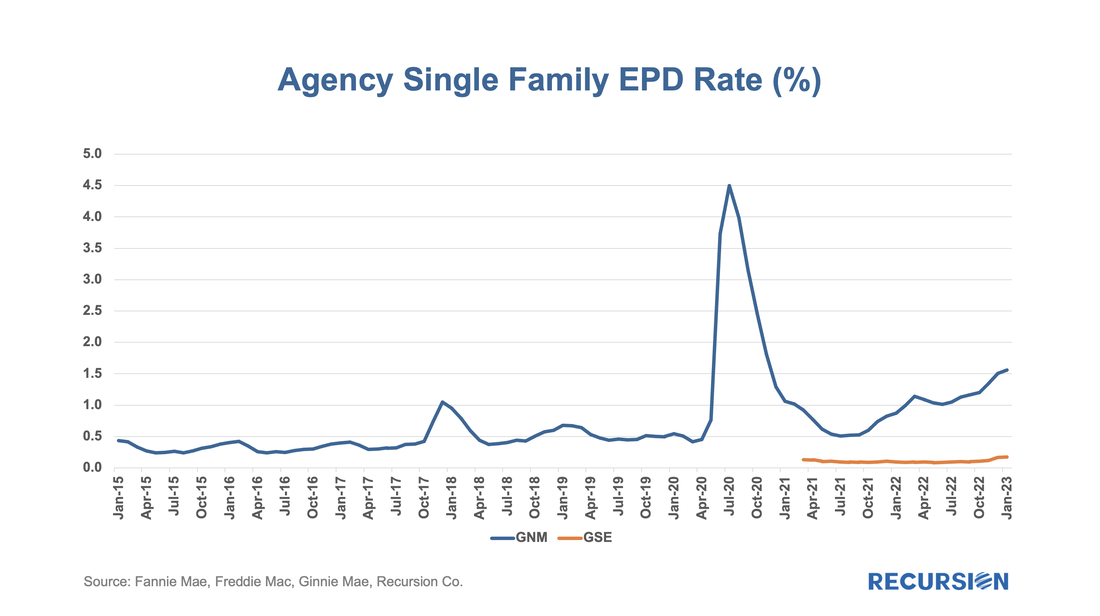

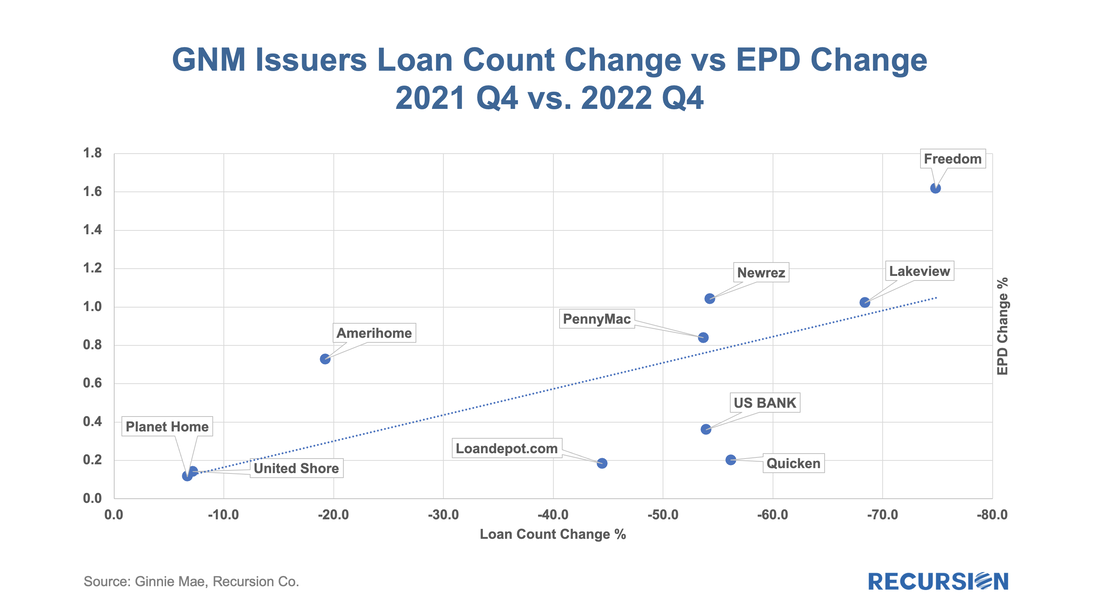

In recent posts, we introduced the phrase “Mortgage Winter” to describe the current environment where high-interest rates and elevated home prices lead to a severe drop in transaction volumes[1]. Subsequently, we looked at the impact of this situation on individual market participants[2]. The bulk of market participants across the mortgage ecosystem is experiencing year/year revenue declines of two-thirds or more. These entities are having to adjust their business models to this situation and develop strategies to navigate the uncertain environment ahead. Spring will come, but whether the ensuing rebound will be sufficient to return the sector to a state of financial health is a question that remains far from assured. There is also another factor to consider besides revenue, and that is the potential for increased servicing costs associated with delinquent borrowers. As we have noted previously[3], Ginnie Mae loans have exhibited growing signs of distress relative to the GSE’s despite the robust state of the housing market. There is a widespread understanding that these soar for delinquent borrowers, to levels far above the 44-basis point servicing fee[4]. An interesting question is whether there is any connection across issuers between revenue losses associated with reduced volumes and increased costs from distressed borrowers. While far from conclusive, it does appear that among larger financial firms, those with relatively fewer distressed borrowers tend to have smaller revenue losses. Looking forward, at the very least, it seems likely that further consolidation in the mortgage ecosystem will be a feature of the market for an extended period. The bigger risk is that a significant rise in the number of distressed borrowers on top of the revenue losses will push firms into insolvency. At this point, the distress risks in this sector become more systemic[5]. [1] https://www.recursionco.com/blog/mortgage-winter

[2] https://www.recursionco.com/blog/mortgage-winter-ii [3]https://www.recursionco.com/blog/a-quick-note-on-the-gnm-gse-early-delinquency-gap [4] See Cost of servicing delinquent mortgages is holding back credit access for many borrowers | Urban Institute [5]https://www.brookings.edu/blog/up-front/2018/09/10/mapping-the-boom-in-nonbank-mortgage-lending-and-understanding-the-risks/ |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed