|

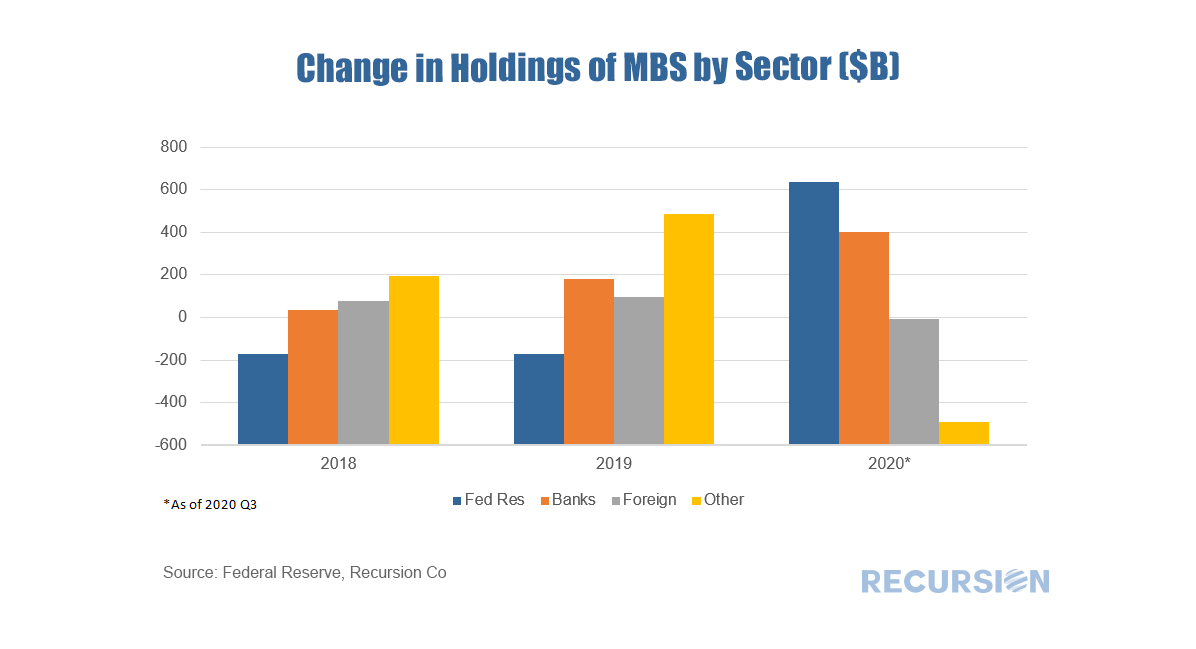

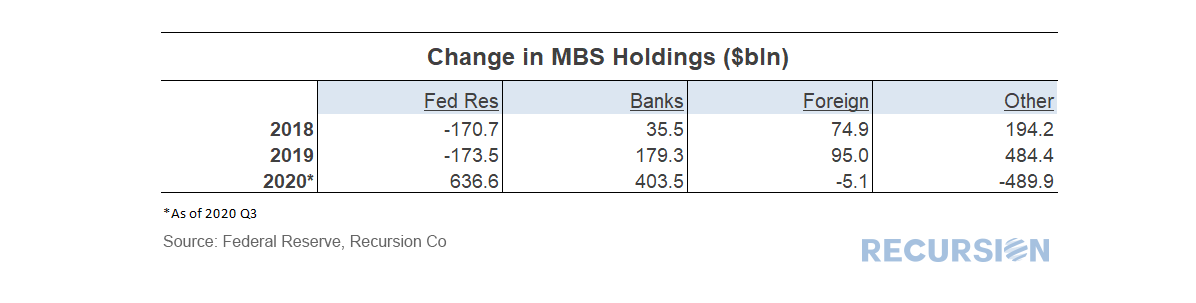

Updates of the Federal Reserve Financial Accounts (Z.1) data[1] always provide food for big-picture thoughts and the recent release of Q32020 data is no exception. Here is a look at the recent trend in holdings of MBS by sector: Over the period running up to the Covid-19 crisis, the Federal Reserve was allowing its holdings of Agency MBS to run off. This was easily accomplished without market disruption as the private sector stepped up to take the other side of the trade, from both the domestic (banks and “other”, largely private investors) and foreign sectors. Of course, the picture changed dramatically with the onset of the Covid-19 pandemic. In the first three quarters of 2020, the Federal Reserve purchased $637 billion of Agency MBS. What is interesting is that the only major sector selling has been private investors. Banks stepped up their purchases (from $179 bln in 2019 to $403 bln) during this period, while foreign holders held their positions steady (a moderate change of -$5 bln from the beginning of the year). The Federal Reserve’s switch from a seller to a massive buyer served to stabilize the MBS market[2] during the crisis. Except for a period of extreme volatility in late March with the onset of the crisis, mortgage spreads have been rather steady. What can be said about 2021 and beyond? Regarding the Central Bank, last week the Fed went out of its way to not provide any specific guidance as to when they would alter their current policy in this regard[3]. As a result, strong demand from the government sector can be expected well into 2021 and perhaps into 2022. Bank demand has been supported by a surge in deposits, which can be expected to fall once the health and associated economic crises pass by and households require less precautionary savings. Bank demand for MBS may also abate as confidence rises and they will want to hold new mortgage production on their balance sheets as whole loans rather than pay G-fees for credit protection. Other foreign and domestic investors have weathered this period without any broad sign of structural weakening in demand for the product. In the end, it is possible that a significant portion of the virus-induced share of public sector holdings of mortgage risk may not revert and instead remain an ongoing part of the New Normal. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed