|

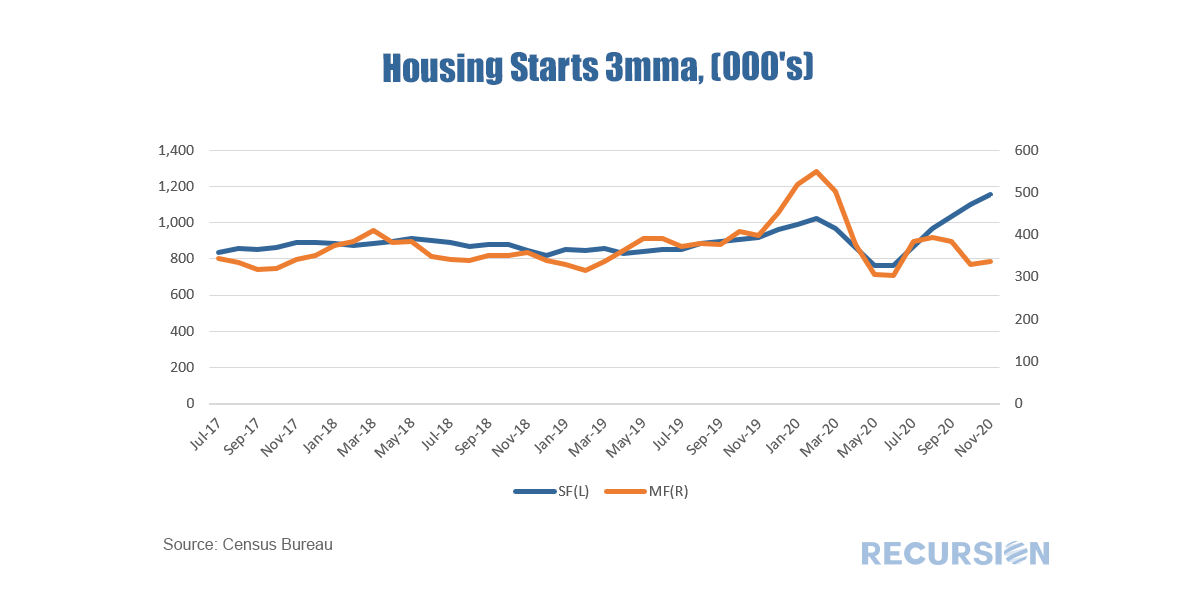

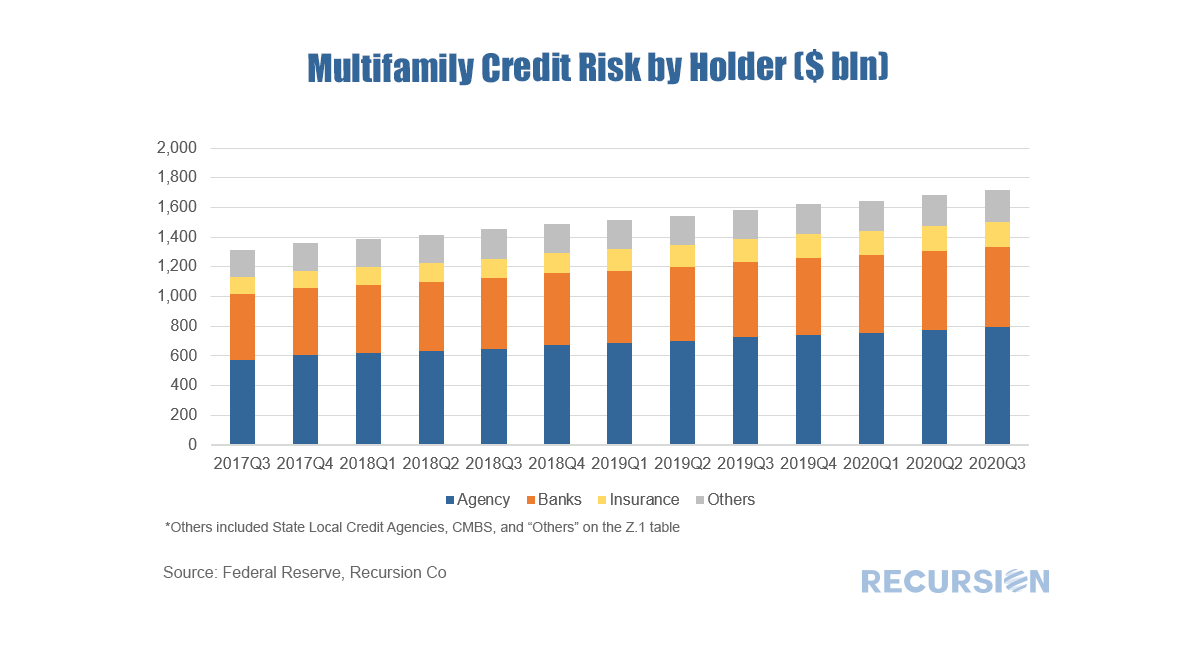

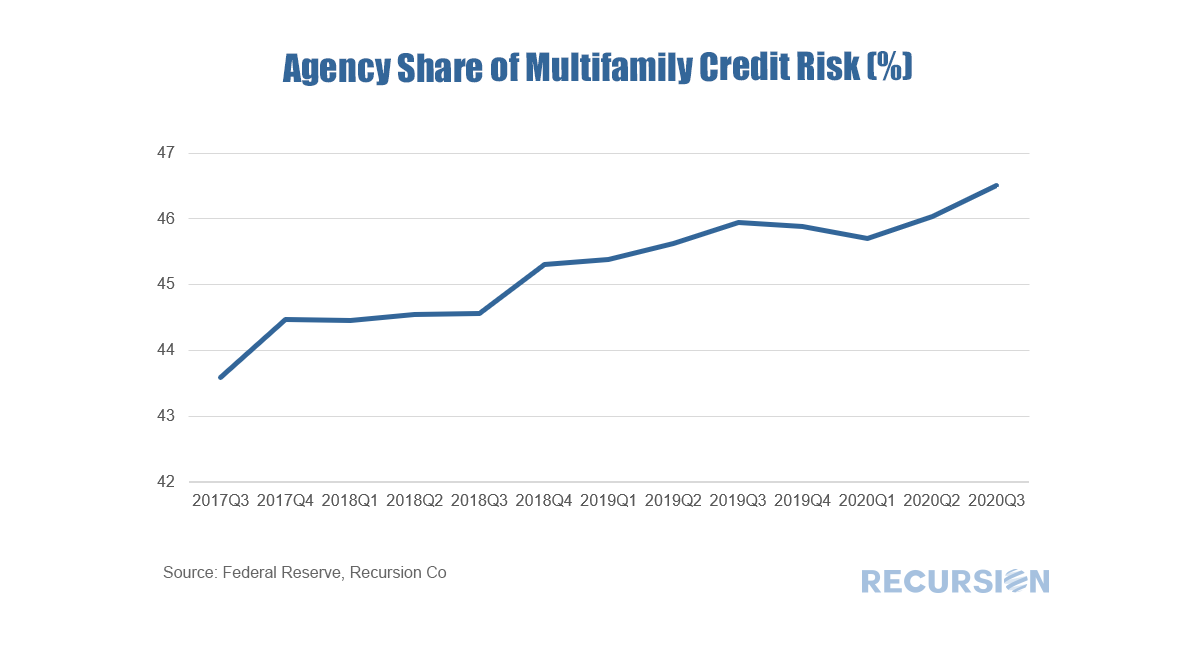

While the single-family housing market is booming, the trend in the multifamily market is much more nuanced. Over the 3 ½ year period from July 2017 to December 2020, new supply as measured by housing starts was in a steady-to-modestly rising trend. This changed with the onset of the Covid-19 pandemic: Both single and multifamily starts rose at the start of the year (the surge in multifamily likely reflecting warm weather) but plunged with the onset of the pandemic. However, the recovery in single-family has been remarkably more robust than for multifamily, reflecting both the low level of mortgage rates and the flight from density towards more sparsely populated locations. The outlook for multifamily is distinctly muddled. The pandemic and eviction moratorium together make reading the market situation difficult. Reflecting the still-damaged labor market, 20% or more of renters are behind on their payments. Even if their jobs return and they can begin to make payments, many households will not be able to catch up on arrears. The flip side of production, of course, is financing. The Federal Reserve just released Q3:2020 Financial Accounts data (Z.1) from which we can pull data on the holdings of multifamily credit risk. The outstanding stock of MF debt rose by $33 billion in Q3 to $1.716 trillion. This increase is in line with recent trends: A key characteristic of this market is the steady increase in the Agency share. The Agencies have gained about 3% in share in the past three years, of which 2.5% is due to a drop in the bank share. As we go into 2021, we are very aware of the major policy decisions concerning housing finance that loom over the next Administration, including the disposition of loans as they leave forbearance and the ultimate state of the GSE’s. In addition to these, the multifamily market faces an even wider array of decisions: eviction moratoriums that are set at the Federal, state, and local levels, and the GSE multifamily caps. Last month, FHFA announced new caps for the multifamily business of the GSE’s at $70 billion apiece for Fannie Mae and Freddie Mac for the calendar year 2021[1], down from $100 billion apiece for the five quarters Q42019 – Q4 2020. Moreover, 50% of the business of the GSE’s in multifamily must be in affordable housing in 2021, up from 37.5% in the prior period. Whether pinching the GSE’s in multifamily brings more private capital into this space remains to be seen, and adjustments are certainly possible, especially in a new Administration. More to watch in the new year. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed