|

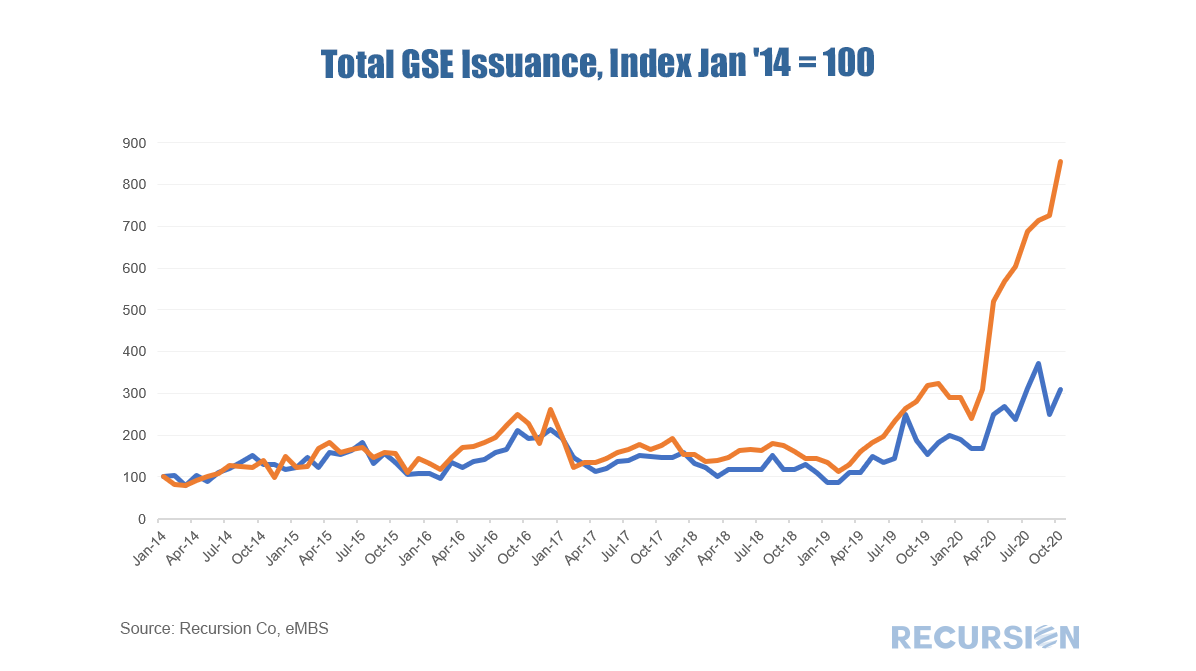

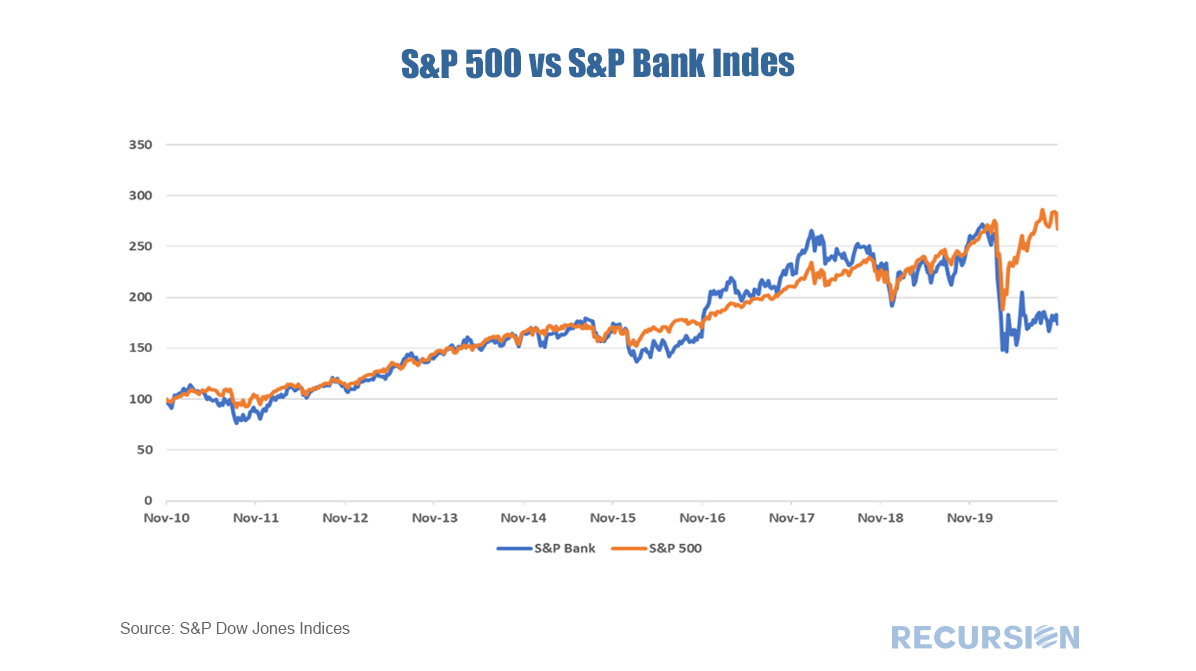

For some time, we have been writing about the surge in the share of nonbanks in mortgage underwriting and servicing[1]. We are just getting GSE data for October and the results are striking: Bank performance in this area is the result of many factors, but the heightened importance of technology in the midst of the Covid-19 crisis is clearly favoring nonbanks. It’s easy to imagine this spilling over into other consumer sectors such as car loans and wealth management, and also into a corporate activity such as payments and liquidity management. The strong branch networks supporting the banks have turned into liabilities in a pandemic. Excess supply of commercial real estate in many sectors implies sharp mark-downs in the values of these properties. Taken all together it’s natural to wonder how asset managers are viewing bank values vs the overall market: Someday, the housing boom will end and interest rates will no longer be conducive to large refinance volumes. When that happens, will the pendulum swing back towards visits to branch networks? Now that consumers are learning about the ease and security associated with getting mortgages online, that outcome is far from assured. Mean reversion, remember, is not part of the new normal. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed