|

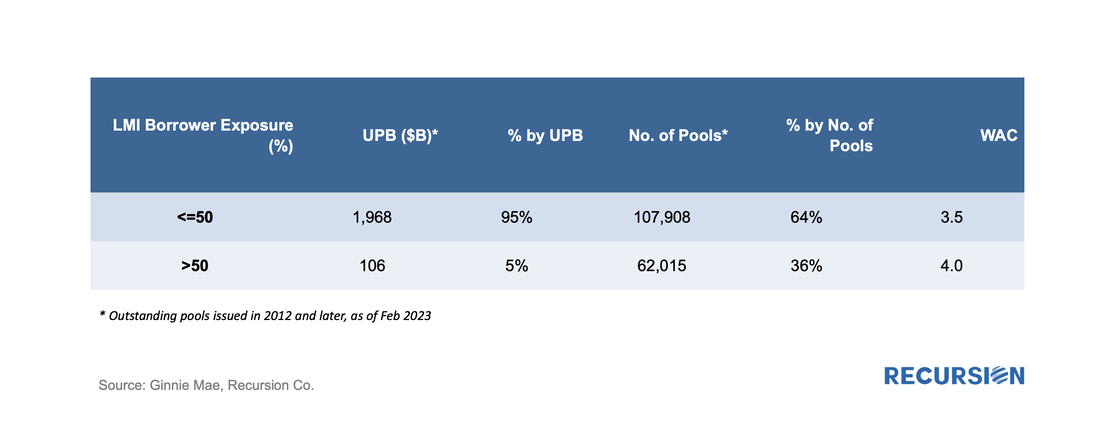

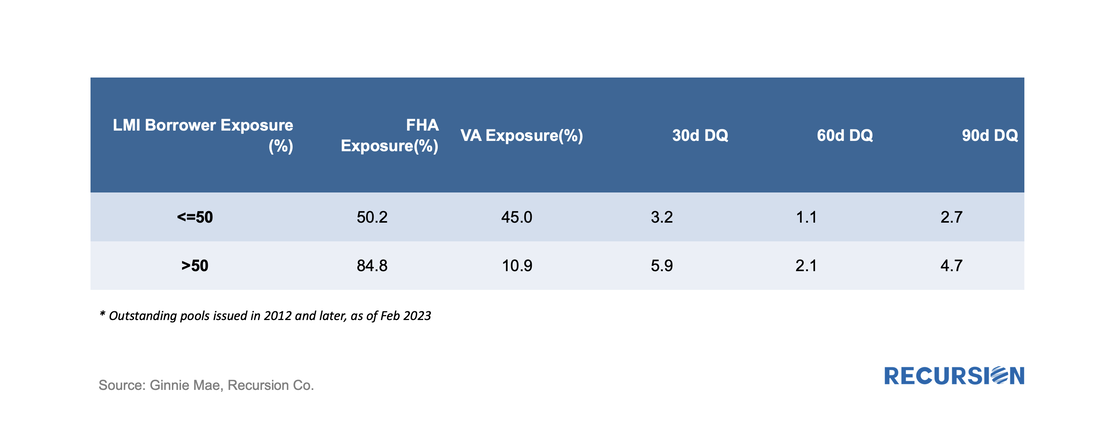

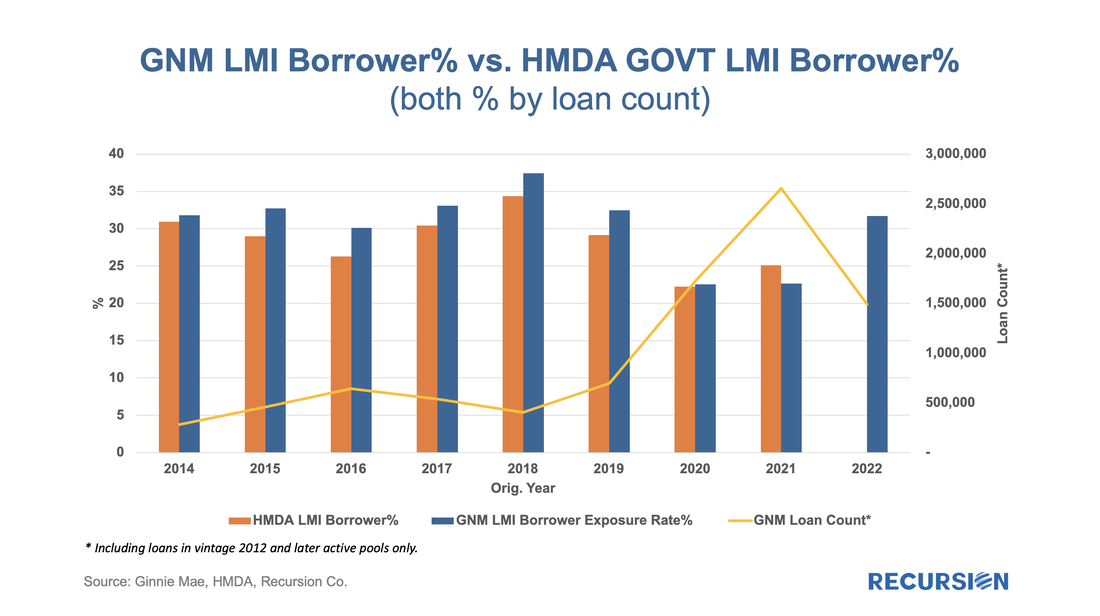

On February 9, Ginnie Mae announced a new Low-Moderate Income Borrower (LMBI) disclosure[1] “in response to investor interest in having greater transparency into Ginnie Mae mortgages in pools, in particular as part of meeting Environmental, Social, and Governance (ESG) investment mandates”. “The new disclosures capture the number of underlying loans made to LMI borrowers, the percentage of LMI loan count of total loan count, the unpaid principal balance (UPB) of LMI loans in the mortgage-backed security (MBS), and the percentage of LMI UPB of total MBS UPB.” “LMI households are classified according to the Federal Financial Institutions Examination Council (FFIEC) Median Family Income Report Tables[2] corresponding with the time of loan origination. These disclosures are being provided at the aggregate pool level for Federal Housing Administration (FHA) and U.S. Department of Veterans Affairs (VA) loans originated beginning in 2012.” In other words, grist for the Recursion mill. First, we look at the share of Ginnie vintage 2012 and later pools that consist of loans for which more than 50% are LMBI borrowers: Loans to LMBI borrowers consist of just 5% of loans by UPB, but 36% of pools have a majority of loans in this category. The WAC for these pools is higher at 4.0% than 3.5% for pools where lower-income borrowers make up less than half of the UPB of loans. Pools with a majority of loans made to LMBI borrowers consist of 85% FHA borrowers and 11% VA loans. The performance of these pools tends to be worse than pools where LMBI borrowers make up less than half the loans. In order to benchmark this data, we set out to compare it to a similar calculation based on HMDA data. There are some subtle points to be dealt with in performing this calculation. First, HMDA data are originations data, while the pool data are based on deliveries, which happen with a lag. We can adjust for this to some extent because we have the originations year for loans in the pool data. For HMDA, our calculation states that a loan is taken out by an LMBI borrower in a GNM program if their median income as a share of tract median income is less than 80%. A fairly remarkable correlation. It will be very interesting to see what the HMDA figure for 2022 is when the data is released in the coming months. A question that arises immediately is what drives the pattern of smaller shares in 2020 and 2021. We overlay the bars with a line tracking the number of GNM loans. There is a suggestive negative correlation, indicating that periods of booming mortgage growth tend to be led by higher-income households. But this is hardly conclusive, and a great more work stands to be done to explain these patterns. Another possibility is that % of LMI/LMBI is much higher for purchase loans and 2020/2021 volumes are driven by refi waves. |

Archives

July 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed