Recursion Data Cited in Commercial Mortgage Alert story on Fannie, Freddie Tighten Loan Terms1/19/2023

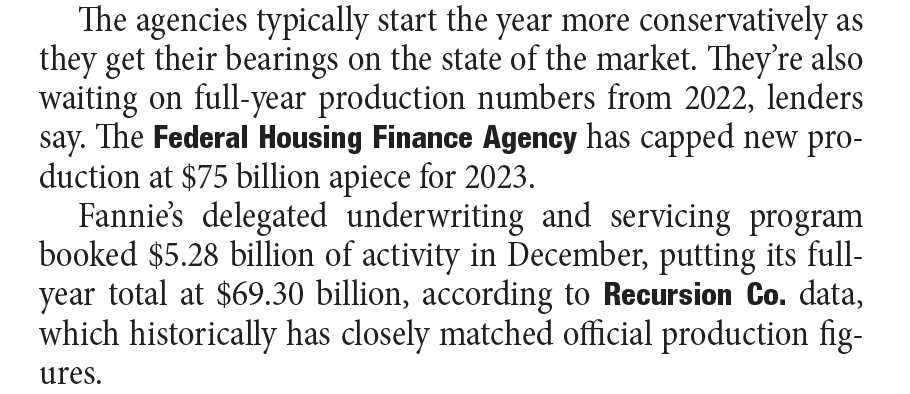

According to a recent Commercial Mortgage Alert article Fannie and Freddie have become more conservative with credit exceptions and maximum proceeds. Compared to the lower debt-service coverage ratios and longer amortization schedules observed in the previous year, “Fannie’s delegated underwriting and servicing program booked $5.28 billion of activity in December, putting its full-year total at $69.30 billion, according to Recursion Co. data”, below the $75 billion cap set by Federal Housing Finance Agency. In the article, Recursion Co. was described as a data source “which historically has closely matched official production figures.” We are proud to be cited as the leading provider of servicer data to the mortgage market. This data is used by investors, mortgage traders and the servicers themselves to obtain an accurate overview of the servicing landscape. Recursion data and analytics provide essential insights and productivity enhancements essential to thriving in a challenging environment.

The article can be found on the Commercial Mortgage Alert website (paywall). If you would like a copy of the article, please reach out to inquiry@recursionco.com. On November 15, FHA released its annual report to Congress regarding the status of its Mutual Mortgage Insurance (MMI) Fund[1]. The highlight was the increase in the capital reserve ratio by almost 3% last year to 11.11% in 2022. This was the fourth consecutive year of significant growth in this measure of performance. Recursion provided the analytics used to demonstrate successful fulfillment of FHA’s mission, as discussed in Chapter 2 - Access to Credit to Underserved Borrowers. Highlights include:

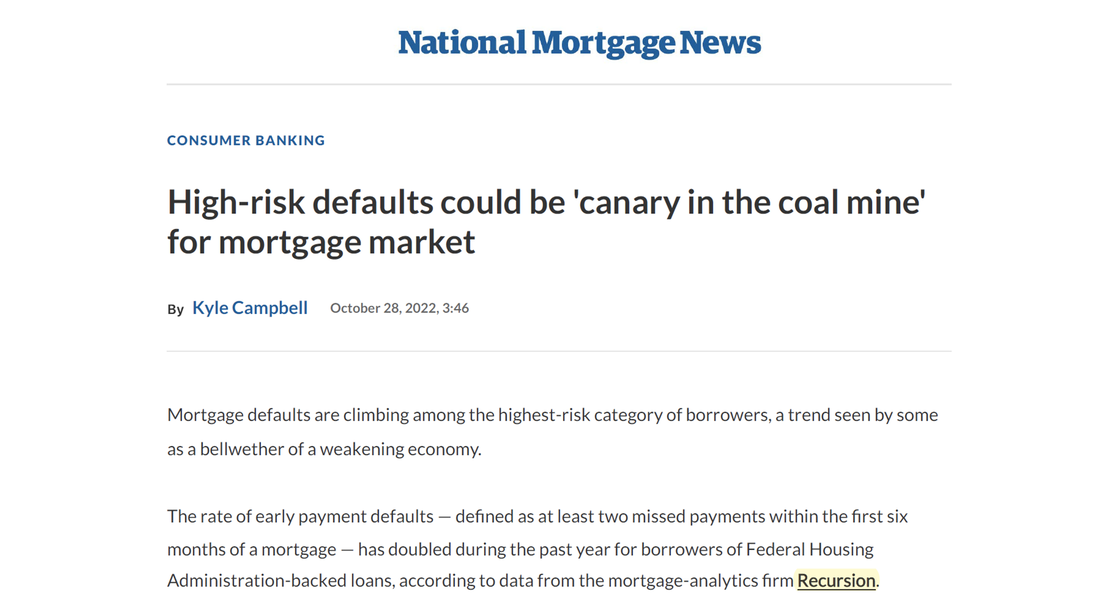

Recursion is proud to be the trusted provider of accurate and timely mortgage data to both public and private sector market participants. https://www.mba.org/news-and-research/research-and-economics/single-family-research/single-family-research-for-mba-members-onlyRecursion is proud to report that it has made an agreement with the Mortgage Bankers Association to make its monthly Top 25 Agency Servicer Report available to MBA members. This report contains data on the size of the serving book, issuance, prepayments, and MSR transfers for the top 25 servicers with 3 years of history., Recursion can provide industrywide data with bank/nonbank shares and reports at individual company level. MBA members can download the report by login to MBA website, and click the link in "Single Family Member Only Research" area: https://www.mba.org/news-and-research/research-and-economics/single-family-research/single-family-research-for-mba-members-only The data are very timely, available on the seventh business day of the month for data through the prior month. Members and nonmembers alike who are interested in the vast amount of underlying information available, including agency, loan purpose, loan size, note rate, underwriting characteristics, geography at the state level, and much more, should reach out to: inquiry@recursionco.com Recursion analysis of trends in short-term delinquencies of Ginnie Mae programs was highlighted in a recent article in National Mortgage News entitled "High-risk defaults could be 'canary in the coal mine' for mortgage market". "The rate of early payment defaults — defined as at least two missed payments within the first six months of a mortgage — has doubled during the past year for borrowers of Federal Housing Administration-backed loans, according to data from the mortgage-analytics firm Recursion." The article goes on to quote our analysis that this trend is notable for lower credit score articles in the FHA program. This has occurred in a period of robust job market, raising the issue that delinquencies may rise further if the recent hike in interest rates by the Federal Reserve results in stalled growth or a recession. Again, more market participants are turning to Recursion to obtain the most up-to-date insights into mortgage market trends. The article can be found here. (Subscription may be required)

For more information, please reach out to inquiry@recursionco.com. HousingWire cited Recursion data in a recent article discussing MSR risks. “Over the first nine months of this year, banks have far outstripped nonbanks in buying up MSR packages. Banks have been net purchasers of MSRs, to the tune of $107.8 billion — compared with $51.1 billion for all of 2021, according to a report by mortgage-data analytics firm Recursion.” Citing our analysis showing growing short term delinquencies picking up recently, Chief Research Officer Richard Koss is quoted: “It’s a source of concern I don’t think is broadly understood. The main mitigating factor is the still-huge amount of equity most buyers have in their homes.” Recursion is devoted to bringing the most up-to-date data and analysis to support the market’s assessment of key trends and policy issues. If you would like a copy of the article, please click here

A recent Housing Wire article entitled “Specter of the S&L crisis haunts today’s mortgage market” discusses the similarities of the current environment with the tumultuous period of the 1980’s. At that time 747 of these institutions were closed accounting for almost $500 billion in mortgages. At the present time similar pressures are building for independent mortgage banks (IMB’s, which are nonbanks). Many of these institutions failed to heed the historic example and Richard was quoted as saying “Many (IMBs) expanded operations during an unsustainable refi boom…” As the brewing economic storm becomes more apparent it’s essential that financial institutions have at their disposal both cutting edge data and analytic tools, as well as the expertise of experienced analysts. Recursion is uniquely situated to provide such services at affordable price points.

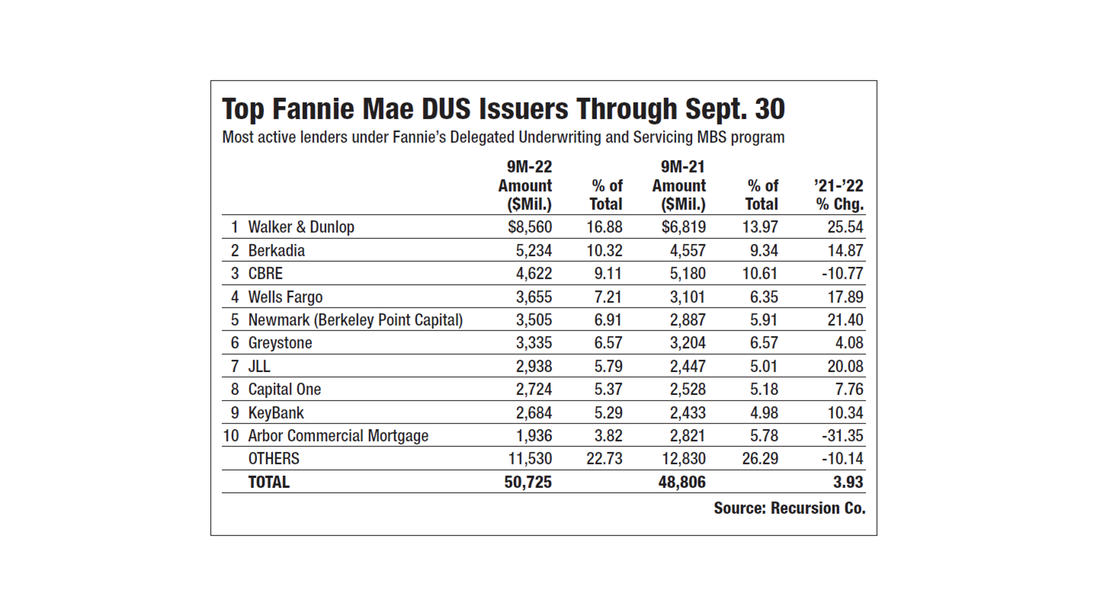

If you would like a copy of the article, please reach out to inquiry@recursionco.com. Commercial Mortgage Alert recently cited Recursion multifamily data in an article about issuance trends in this asset class. “Fannie purchased $6.5 billion of multifamily loans last month through its delegated underwriting and servicing, or DUS, model, according to data from Recursion Co. That compares with $4.93 billion of such purchases in August and $4.51 billion in July.” CMA also published a list of the top 10 issuers of Fannie Mae DUS loans YTD September. Recursion recognizes the importance of the rental market in an environment of extreme unaffordability and is the premier provider of Agency data and analytics in this sector.

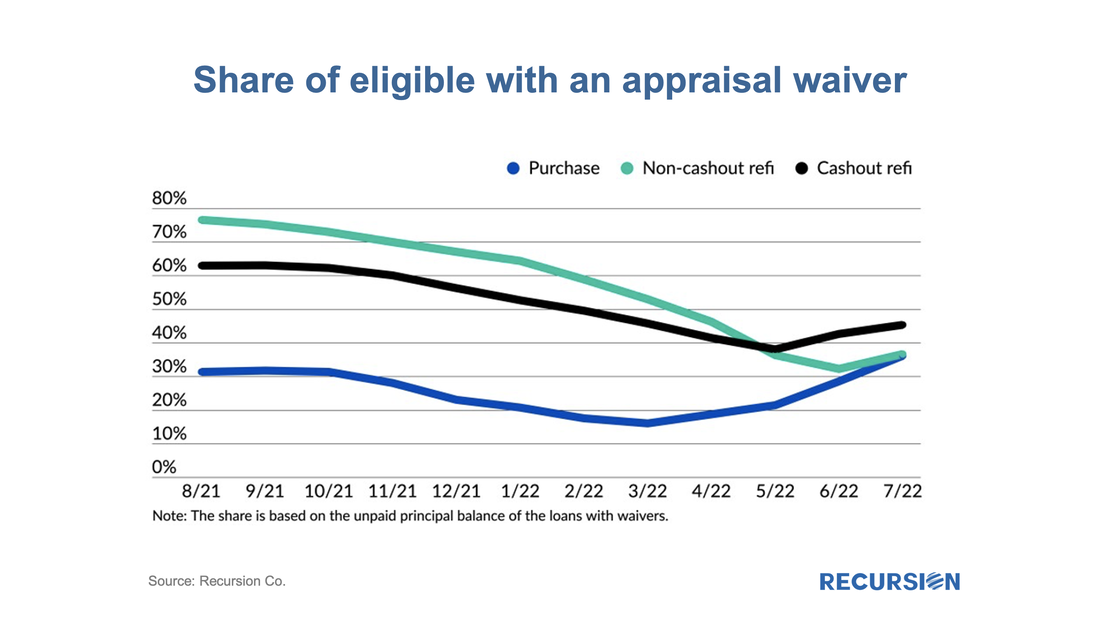

For more information, please reach out to inquiry@recursionco.com. Recursion data was cited in an article on how higher mortgage rates have resulted in higher shares of appraisal waiver usage in the last few months. The author notes that “An increasing share of originations are purchases, which have lower appraisal-waiver eligibility rates than refinances. But at the same time, there's increased willingness on the part of government sponsored enterprises to accept digital valuations….However, while waivers may be less available for purchase loans, lenders and borrowers seem no less eager to use them when they can, even with reductions in loan volume potentially reducing appraisal delays.”, citing Recursion data.

|

Archives

February 2024

Tags

All

|

RECURSION |

|

Copyright © 2022 Recursion, Co. All rights reserved.

RSS Feed

RSS Feed